Deck 6: Credit Policy and Collections

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/21

Play

Full screen (f)

Deck 6: Credit Policy and Collections

1

In using the net present value (NPV)approach to evaluating credit policy alternatives,all other things equal,

A)the alternative with the highest NPV should be selected

B)the alternative with the lowest NPV should be selected

C)the alternative with the NPV closest to zero should be selected

D)the alternative with the present value of cash inflows closest to zero should be selected

A)the alternative with the highest NPV should be selected

B)the alternative with the lowest NPV should be selected

C)the alternative with the NPV closest to zero should be selected

D)the alternative with the present value of cash inflows closest to zero should be selected

A

2

You are calculating the NPV of one day's sales associated with a given credit policy that does not offer a discount and has an average collection period of 45 days.You should discount variable costs _____ days and credit administration and collection expenses ______ days.

A)0,0

B)0,45

C)45,45

D)45,0

A)0,0

B)0,45

C)45,45

D)45,0

B

3

In calculating each of the last six months' uncollected balance percentages,the current accounts receivable balance is split into uncollected balances by month in which they originate.Then,each month's uncollected balance is divided by the __________________________________________.

A)current accounts receivable balance

B)sum of the accounts receivable balances from the last six months

C)credit sales for that month

D)the sum of the credit sales from the last six months

A)current accounts receivable balance

B)sum of the accounts receivable balances from the last six months

C)credit sales for that month

D)the sum of the credit sales from the last six months

C

4

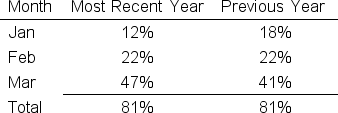

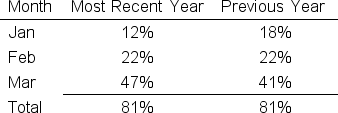

Milsonic Mfg.has been evaluating its short-term financial management practices recently.Below are its uncollected balance percentages for the most recent quarter as well as for the previous year's percentages.  Neither its credit policy nor its collection strategies have changed,and its sales mix is identical to last year's.Based on its numbers,one can conclude that Milsonic's collection experience is

Neither its credit policy nor its collection strategies have changed,and its sales mix is identical to last year's.Based on its numbers,one can conclude that Milsonic's collection experience is

A)the same as last year

B)worse than last year

C)better than last year

D)cannot be determined without further information

Neither its credit policy nor its collection strategies have changed,and its sales mix is identical to last year's.Based on its numbers,one can conclude that Milsonic's collection experience is

Neither its credit policy nor its collection strategies have changed,and its sales mix is identical to last year's.Based on its numbers,one can conclude that Milsonic's collection experience isA)the same as last year

B)worse than last year

C)better than last year

D)cannot be determined without further information

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

5

Evidence gathered by Smith & Belt indicates that managers consider marketing and ______________ considerations to be primary,rather than secondary,considerations for evaluating credit policy changes.

A)production capacity

B)bad debt loss

C)inventory requirement

D)degree of operating leverage

A)production capacity

B)bad debt loss

C)inventory requirement

D)degree of operating leverage

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

6

An heuristic approach to evaluating credit policy alternatives,which involves estimating profit effects of each alternative,is the

A)net present value (NPV)approach

B)financial statement approach

C)discounted cash flow approach

D)scenario-based approach

E)liquidity analysis approach

A)net present value (NPV)approach

B)financial statement approach

C)discounted cash flow approach

D)scenario-based approach

E)liquidity analysis approach

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following variable(s)did surveyed credit managers believe they could estimate adequately?

A)customer default probability

B)customer delinquency probability

C)the opportunity cost of funds invested in receivables

D)all of the above

A)customer default probability

B)customer delinquency probability

C)the opportunity cost of funds invested in receivables

D)all of the above

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

8

Additional complications related to extending credit internationally include each of the following except:

A)the foreign legal and economic environment

B)foreign customer payment habits

C)foreign currency volatility

D)the lack of banks in a number of countries

A)the foreign legal and economic environment

B)foreign customer payment habits

C)foreign currency volatility

D)the lack of banks in a number of countries

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

9

With an unchanging collection pattern but a trend of increasing sales,a calculated aging schedule would show proportionally _______ dollar sales as current or almost current,indicating a _______ favorable collection experience.

A)lower,more

B)higher,more

C)lower,less

D)higher,less

A)lower,more

B)higher,more

C)lower,less

D)higher,less

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

10

Late payments by customers may lead to all of the following EXCEPT:

A)An increase in the seller's working capital

B)Erode shareholder value

C)Lower interest payments for the seller

D)An increase in the length of trade credit from suppliers

A)An increase in the seller's working capital

B)Erode shareholder value

C)Lower interest payments for the seller

D)An increase in the length of trade credit from suppliers

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

11

The main weakness of the uncollected balance percentages method of monitoring collection experience is

A)it is biased by increasing or declining sales

B)it is biased by the whether percentages are computed for the last quarter or last year

C)it is not feasible to compare percentages to management targets

D)it is difficult to interpret them when credit sales make up a very large portion of total sales

E)none of the above

A)it is biased by increasing or declining sales

B)it is biased by the whether percentages are computed for the last quarter or last year

C)it is not feasible to compare percentages to management targets

D)it is difficult to interpret them when credit sales make up a very large portion of total sales

E)none of the above

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

12

The basic principle underlying collection philosophy is to collect the amount owed as close to the credit terms as possible while

A)minimizing the cost of capital

B)preserving customer goodwill

C)maximizing accounts receivable turnover

D)minimizing total collection costs

A)minimizing the cost of capital

B)preserving customer goodwill

C)maximizing accounts receivable turnover

D)minimizing total collection costs

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

13

The annual effective rate of interest for the Calgon Corp.is 12%.If the cash manager typically invests freed-up funds in overnight investments or uses funds to pay down a credit line on which the company pays daily compounded interest,the appropriate daily opportunity rate for short-term financial decisions would be:

A)0.12/365

B)(1+ 0.12)/ 365

C)[(1+ 0.12)1/365 - 1]

D)(0.12) 1/365

A)0.12/365

B)(1+ 0.12)/ 365

C)[(1+ 0.12)1/365 - 1]

D)(0.12) 1/365

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

14

Relative to minimizing inventory investment,minimizing bank balances,and slowing payment on payables,surveyed financial executives believed speeding collection of receivables to be ______________________ as a recommended short-term financial management strategy.

A)more important

B)equally important

C)less important

D)of almost no importance

A)more important

B)equally important

C)less important

D)of almost no importance

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

15

In addition to the bias introduced when sales are changing,DSO and accounts receivable turnover are sensitive to ________________,making them imperfect measures of changing collection experience (Assume they are calculated correctly based on a necessary information.)

A)how high or low the previously calculated figure was

B)the mix of cash and credit sales

C)the stringency of the company's collection effort

D)the length of the period over which they are calculated

A)how high or low the previously calculated figure was

B)the mix of cash and credit sales

C)the stringency of the company's collection effort

D)the length of the period over which they are calculated

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

16

Emily Cheney is evaluating a proposal to extend credit to a group of new customers.The new customers will generate an average of $40,000 per day in new sales.On average,they will pay in 68 days.The variable cost ratio is 80%,collection expenses are 2% of sales,and the cost of capital is 10%.What is the NPV of one day's sales if Emily grants credit? Assume that there is no bad debt loss.

A)$4,226.81

B)$5,190.78

C)$6,483.06

D)$7,200.00

A)$4,226.81

B)$5,190.78

C)$6,483.06

D)$7,200.00

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

17

Credit managers of U.S.-based multinational companies should be especially forceful in collecting past due receivables in foreign countries where

A)the currency is expected to appreciate relative to the U.S.dollar in the near term.

B)the value of the currency is pegged to the dollar.

C)the inflation rate is very low relative to the U.S.inflation rate.

D)the currency is expected to decline in value relative to the U.S.dollar.

A)the currency is expected to appreciate relative to the U.S.dollar in the near term.

B)the value of the currency is pegged to the dollar.

C)the inflation rate is very low relative to the U.S.inflation rate.

D)the currency is expected to decline in value relative to the U.S.dollar.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

18

The average collection period is also:

A)accounts receivable turnover

B)days sales outstanding

C)aging schedule

D)the sum of the credit sales from the last six months

A)accounts receivable turnover

B)days sales outstanding

C)aging schedule

D)the sum of the credit sales from the last six months

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

19

Traditional but flawed measures used to monitor receivables balances include each of the following except:

A)uncollected balance percentages

B)the aging schedule

C)accounts receivable turnover

D)days sales outstanding

A)uncollected balance percentages

B)the aging schedule

C)accounts receivable turnover

D)days sales outstanding

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

20

Evidence from recent studies indicates that creditors behave as if they _______ understand the goodwill tradeoff when selecting collection methods and that they are __________ aggressive in collecting receivables when their receivable investment grows relatively large.

A)do,less

B)do,more

C)do not,less

D)do not,more

A)do,less

B)do,more

C)do not,less

D)do not,more

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

21

Measures for monitoring receivables may be compared to:

A)A key competitor's values

B)Historical trends

C)Management targets

D)All of the above

E)None of the above

A)A key competitor's values

B)Historical trends

C)Management targets

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck