Deck 10: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/169

Play

Full screen (f)

Deck 10: Capital Budgeting Decisions

1

When considering a number of investment projects, the project that has the shortest payback period does not necessarily have the highest net present value.

True

2

For capital budgeting decisions, the simple rate of return method is superior to the net present value method.

False

3

In the payback method, depreciation is deducted from net operating income when computing the annual net cash flow.

False

4

Preference decisions follow screening decisions and seek to rank investment proposals in order of their desirability.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

5

If the internal rate of return exceeds the required rate of return for a project, then the net present value of that project is negative.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

6

The simple rate of return in any one year may be less than or greater than the internal rate of return of a project.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

7

When discounted cash flow methods of capital budgeting are used, the working capital required for a project is ordinarily counted as a cash inflow at the beginning of the project and as a cash outflow at the end of the project.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

8

The salvage value of new equipment should be considered when using the internal rate of return method to evaluate a project.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

9

In preference decision situations, a project with a lower net present value may be preferable to a project with a higher net present value.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

10

An investment project with a project profitability index of -0.05 has an internal rate of return that is less than the discount rate.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

11

The payback method of making capital budgeting decisions does not give full consideration to the time value of money.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

12

When cash flows are uneven and vary from year to year, the net present value method is easier to use than the internal rate of return method.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

13

The required rate of return is the minimum rate of return that an investment project must yield to the acceptable.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

14

When using internal rate of return to evaluate investment projects, if the internal rate of return is greater than the required rate of return, the project should be accepted.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

15

The internal rate of return method assumes that the cash flows generated by the project are immediately reinvested elsewhere at a rate of return that equals the internal rate of return.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

16

The internal rate of return is computed by finding the discount rate that maximizes the difference between the present value of a project's cash outflows and the present value of its cash inflows.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

17

Discounted cash flow techniques do not take into account recovery of initial investment.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

18

In calculating the payback period where new equipment is replacing old equipment, any salvage value to be received on disposal of the old equipment should be added to the cost of the new equipment.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

19

The basic premise of the payback method is that the more quickly the cost of an investment is recovered the more desirable is the investment.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

20

One criticism of the payback method is that it ignores cash flows that occur after the payback point has been reached.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

21

The investment required for the project profitability index should:

A)be reduced by the amount of any salvage recovered from the sale of old equipment.

B)be reduced by the amount of any salvage recovered from the sale of the new equipment at the end of its useful life.

C)be reduced by the amount of any salvage recovered from the sale of both the old and new equipment.

D)not be adjusted for the salvage value of old or new equipment.

A)be reduced by the amount of any salvage recovered from the sale of old equipment.

B)be reduced by the amount of any salvage recovered from the sale of the new equipment at the end of its useful life.

C)be reduced by the amount of any salvage recovered from the sale of both the old and new equipment.

D)not be adjusted for the salvage value of old or new equipment.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

22

If taxes are ignored, all of the following items are included in a discounted cash flow analysis except:

A)future operating cash savings.

B)depreciation expense.

C)future salvage value.

D)investment in working capital.

A)future operating cash savings.

B)depreciation expense.

C)future salvage value.

D)investment in working capital.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

23

The internal rate of return for a project can be determined:

A)only if the project's cash flows are constant.

B)by finding the discount rate that yields a zero net present value for the project.

C)by subtracting the company's cost of capital from the project's profitability index.

D)only if the project profitability index is greater than zero.

A)only if the project's cash flows are constant.

B)by finding the discount rate that yields a zero net present value for the project.

C)by subtracting the company's cost of capital from the project's profitability index.

D)only if the project profitability index is greater than zero.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

24

(Ignore income taxes in this problem.) A company with $600,000 in operating assets is considering the purchase of a machine that costs $72,000 and which is expected to reduce operating costs by $18,000 each year. These reductions in cost occur evenly throughout the year. The payback period for this machine in years is closest to:

A)4 years

B)8.3 years

C)0.25 years

D)33.3 years

A)4 years

B)8.3 years

C)0.25 years

D)33.3 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

25

The best capital budgeting method for ranking investment projects of different dollar amounts is the:

A)project profitability index.

B)net present value method.

C)simple rate of return method.

D)payback period.

A)project profitability index.

B)net present value method.

C)simple rate of return method.

D)payback period.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

26

An investment project with a project profitability index of less than one should ordinarily be rejected.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

27

If a company has computed a project profitability index of -0.015 for an investment project, then:

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relationship of the internal rate of return and the discount rate is impossible to determine from the data given.

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relationship of the internal rate of return and the discount rate is impossible to determine from the data given.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

28

The project profitability index is computed by dividing the present value of the cash inflows of the project by present value of the cash outflows of the project.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following will have the largest dollar effect on the net present value of a 10 year investment project?

A)a decrease of $20,000 in the initial investment required with no effect on the expected salvage value in 10 years.

B)an increase of $20,000 in the expected salvage value in 10 years with no effect on the initial investment.

C)a decrease of $20,000 in both the working capital needed to start the project and the amount being released at the end of the 10 years.

D)an increase of $2,000 in the annual cash inflows from this project.

A)a decrease of $20,000 in the initial investment required with no effect on the expected salvage value in 10 years.

B)an increase of $20,000 in the expected salvage value in 10 years with no effect on the initial investment.

C)a decrease of $20,000 in both the working capital needed to start the project and the amount being released at the end of the 10 years.

D)an increase of $2,000 in the annual cash inflows from this project.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

30

In capital budgeting computations, discounted cash flow methods:

A)automatically provide for recovery of initial investment.

B)can't be used unless cash flows are uniform from year to year.

C)assume that all cash flows occur at the beginning of a period.

D)ignore all cash flows after the payback period.

A)automatically provide for recovery of initial investment.

B)can't be used unless cash flows are uniform from year to year.

C)assume that all cash flows occur at the beginning of a period.

D)ignore all cash flows after the payback period.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

31

(Ignore income taxes in this problem.) Buy-Rite Pharmacy has purchased a small auto for delivering prescriptions. The auto was purchased for $28,000 and will have a 6-year useful life and a $4,000 salvage value. Delivering prescriptions (which the pharmacy has never done before) should increase gross revenues by at least $32,000 per year. The cost of these prescriptions to the pharmacy will be about $25,000 per year. The pharmacy depreciates all assets using the straight-line method. The payback period for the auto is closest to:

A)4 years

B)1.8 years

C)2 years

D)1.2 years

A)4 years

B)1.8 years

C)2 years

D)1.2 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

32

When making preference decisions about competing investment proposals, the internal rate of return is superior to the project profitability index.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

33

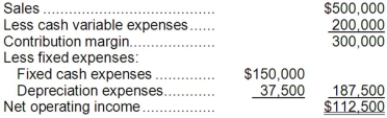

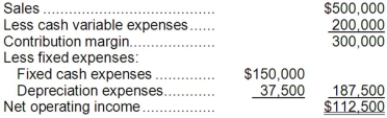

(Ignore income taxes in this problem.) Harrison Corporation is studying a project that would have an eight-year life and would require a $300,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 10%. The payback period for this project is closest to:

The company's required rate of return is 10%. The payback period for this project is closest to:

A)3 years

B)2 years

C)2.5 years

D)2.67 years

The company's required rate of return is 10%. The payback period for this project is closest to:

The company's required rate of return is 10%. The payback period for this project is closest to:A)3 years

B)2 years

C)2.5 years

D)2.67 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

34

The simple rate of return method does not take into account the time value of money.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

35

The net present value of a proposed investment is negative. Therefore, the discount rate used must be:

A)greater than the project's internal rate of return.

B)less than the project's internal rate of return.

C)greater than the minimum required rate of return.

D)less than the minimum required rate of return.

A)greater than the project's internal rate of return.

B)less than the project's internal rate of return.

C)greater than the minimum required rate of return.

D)less than the minimum required rate of return.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

36

If a project does not have constant incremental revenues and expenses over its useful life, the simple rate of return will fluctuate from year to year.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

37

The net present value and internal rate of return methods of capital budgeting are superior to the payback method because they:

A)are easier to implement.

B)consider the time value of money.

C)require less data.

D)reflect the effects of depreciation and income taxes.

A)are easier to implement.

B)consider the time value of money.

C)require less data.

D)reflect the effects of depreciation and income taxes.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

38

If the project profitability index of an investment project is zero, then:

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relationship of the rate of return and the discount rate is impossible to determine from the data given.

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relationship of the rate of return and the discount rate is impossible to determine from the data given.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

39

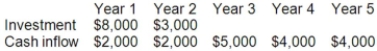

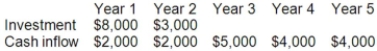

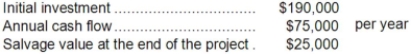

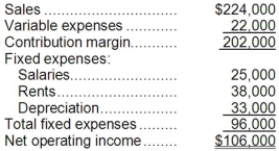

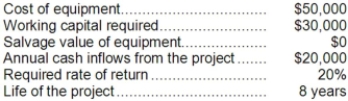

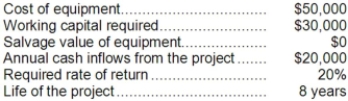

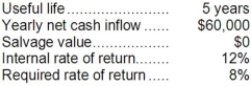

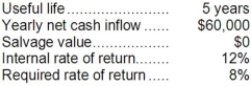

(Ignore income taxes in this problem.) The Zinger Corporation is considering an investment that has the following data:  Cash inflows occur evenly throughout the year. The payback period for this investment is:

Cash inflows occur evenly throughout the year. The payback period for this investment is:

A)3.0 years

B)3.5 years

C)4.0 years

D)4.5 years

Cash inflows occur evenly throughout the year. The payback period for this investment is:

Cash inflows occur evenly throughout the year. The payback period for this investment is:A)3.0 years

B)3.5 years

C)4.0 years

D)4.5 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

40

The project profitability index is used to compare the net present values of two investments that require different amounts of investment funds.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

41

(Ignore income taxes in this problem.) Avanca Fitness Center is considering an investment in some additional weight training equipment. The equipment has an estimated useful life of 10 years with no salvage value at the end of the 10 years. Ataxia's internal rate of return on this equipment is 12%. Ataxia's discount rate is also 12%. The payback period on this equipment is closest to:

A)10 years

B)5 years

C)5.65 years

D)4.26 years

A)10 years

B)5 years

C)5.65 years

D)4.26 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

42

Mujalli Corporation is considering a capital budgeting project that would require an initial investment of $200,000. The investment would generate annual cash inflows of $64,000 for the life of the project, which is 4 years. At the end of the project, equipment that had been used in the project could be sold for $10,000. The company's discount rate is 9%. The net present value of the project is closest to:

A)$14,376

B)$66,000

C)$214,376

D)$7,296

A)$14,376

B)$66,000

C)$214,376

D)$7,296

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

43

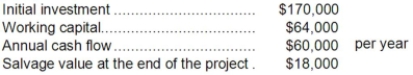

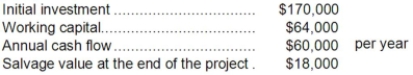

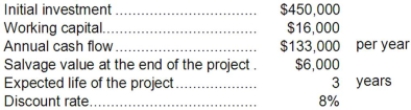

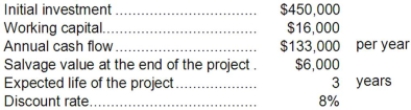

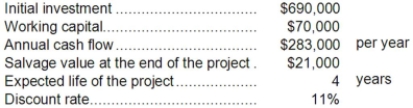

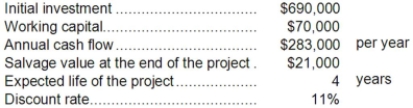

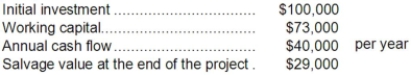

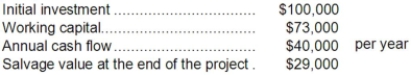

Dul Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:

A)$(61,872)

B)$(9,648)

C)$10,000

D)$54,352

The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:A)$(61,872)

B)$(9,648)

C)$10,000

D)$54,352

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

44

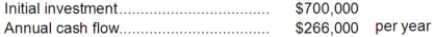

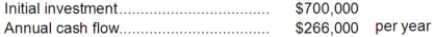

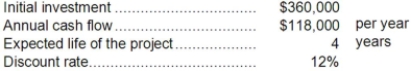

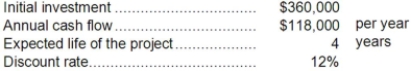

Schoultz Corporation has provided the following data concerning an investment project that it is considering:  The life of the project is 4 years. The company's discount rate is 12%. The net present value of the project is closest to:

The life of the project is 4 years. The company's discount rate is 12%. The net present value of the project is closest to:

A)$700,000

B)$364,000

C)$108,108

D)$808,108

The life of the project is 4 years. The company's discount rate is 12%. The net present value of the project is closest to:

The life of the project is 4 years. The company's discount rate is 12%. The net present value of the project is closest to:A)$700,000

B)$364,000

C)$108,108

D)$808,108

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

45

(Ignore income taxes in this problem.) Riveros, Inc., is considering the purchase of a machine that would cost $120,000 and would last for 8 years. At the end of 8 years, the machine would have a salvage value of $29,000. The machine would reduce labor and other costs by $25,000 per year. Additional working capital of $9,000 would be needed immediately. All of this working capital would be recovered at the end of the life of the machine. The company requires a minimum pretax return of 18% on all investment projects. The net present value of the proposed project is closest to:

A)$(18,050)

B)$(63,683)

C)$(10,336)

D)$(16,942)

A)$(18,050)

B)$(63,683)

C)$(10,336)

D)$(16,942)

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

46

Kingsolver Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

A)$(118,495)

B)$(51,000)

C)$(89,791)

D)$(105,791)

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:A)$(118,495)

B)$(51,000)

C)$(89,791)

D)$(105,791)

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

47

(Ignore income taxes in this problem.) The management of Helberg Corporation is considering a project that would require an investment of $203,000 and would last for 6 years. The annual net operating income from the project would be $103,000, which includes depreciation of $30,000. The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A)1.5 years

B)2.0 years

C)1.4 years

D)1.7 years

A)1.5 years

B)2.0 years

C)1.4 years

D)1.7 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

48

(Ignore income taxes in this problem.) Beaver Corporation is investigating the purchase of a new threading machine that costs $18,000. The machine would save about $4,000 per year over the present method of threading component parts, and would have a salvage value of about $3,000 in 6 years when the machine would be replaced. The company's required rate of return is 12%. The machine's net present value is closest to:

A)$1,556

B)$(35)

C)$11,000

D)$8,000

A)$1,556

B)$(35)

C)$11,000

D)$8,000

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

49

Fimbrez Corporation has provided the following data concerning an investment project that it is considering:  The net present value of the project is closest to:

The net present value of the project is closest to:

A)$358,484

B)$360,000

C)$(1,516)

D)$112,000

The net present value of the project is closest to:

The net present value of the project is closest to:A)$358,484

B)$360,000

C)$(1,516)

D)$112,000

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

50

(Ignore income taxes in this problem.) Sturn Corporation purchased a machine with an estimated useful life of seven years. The machine will generate cash inflows of $9,000 each year over the next seven years. If the machine has no salvage value at the end of seven years, if Stutz's discount rate is 10%, and if the net present value of this investment is $17,000 then the purchase price of the machine was closest to:

A)$43,812

B)$26,812

C)$17,000

D)$22,195

A)$43,812

B)$26,812

C)$17,000

D)$22,195

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

51

Czlapinski Corporation is considering a capital budgeting project that would require an initial investment of $440,000 and working capital of $32,000. The working capital would be released for use elsewhere at the end of the project in 4 years. The investment would generate annual cash inflows of $147,000 for the life of the project. At the end of the project, equipment that had been used in the project could be sold for $11,000. The company's discount rate is 7%. The net present value of the project is closest to:

A)$66,282

B)$34,282

C)$159,000

D)$58,698

A)$66,282

B)$34,282

C)$159,000

D)$58,698

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

52

Correl Corporation has provided the following data concerning an investment project that it is considering:  The life of the project is 4 years. The company's discount rate is 15%. The net present value of the project is closest to:

The life of the project is 4 years. The company's discount rate is 15%. The net present value of the project is closest to:

A)$38,500

B)$228,500

C)$135,000

D)$24,200

The life of the project is 4 years. The company's discount rate is 15%. The net present value of the project is closest to:

The life of the project is 4 years. The company's discount rate is 15%. The net present value of the project is closest to:A)$38,500

B)$228,500

C)$135,000

D)$24,200

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

53

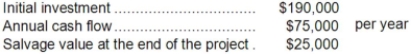

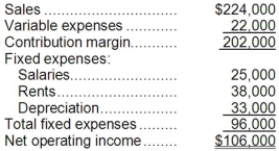

(Ignore income taxes in this problem.) Neighbors Corporation is considering a project that would require an investment of $279,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows:  The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A)2.0 years

B)2.6 years

C)2.5 years

D)1.9 years

The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:A)2.0 years

B)2.6 years

C)2.5 years

D)1.9 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

54

Zabarkes Corporation is considering a capital budgeting project that would require an initial investment of $640,000 and working capital of $79,000. The working capital would be released for use elsewhere at the end of the project in 3 years. The investment would generate annual cash inflows of $205,000 for the life of the project. At the end of the project, equipment that had been used in the project could be sold for $29,000. The company's discount rate is 7%. The net present value of the project is closest to:

A)$(13,952)

B)$(92,952)

C)$(157,416)

D)$(25,000)

A)$(13,952)

B)$(92,952)

C)$(157,416)

D)$(25,000)

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

55

(Ignore income taxes in this problem.) Naomi Corporation has a capital budgeting project that has a negative net present value of $36,000. The life of this project is 6 years. Naomi's discount rate is 20%. By how much would the annual cash inflows from this project have to increase in order to have a positive net present value?

A)$1,200 or more

B)$2,412 or more

C)$6,000 or more

D)$10,824 or more

A)$1,200 or more

B)$2,412 or more

C)$6,000 or more

D)$10,824 or more

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

56

(Ignore income taxes in this problem.) The following data on a proposed investment project have been provided:  The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

A)$3,730

B)$0

C)$32,450

D)$88,370

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:A)$3,730

B)$0

C)$32,450

D)$88,370

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

57

(Ignore income taxes in this problem.) Peter wants to buy a computer which he expects to save him $4,000 each year in bookkeeping costs. The computer will last for five years, and at the end of five years it will have no salvage value. If Peter's required rate of return is 12%, what is the maximum price Peter should be willing to pay for the computer now?

A)$20,000

B)$14,420

C)$11,340

D)$10,830

A)$20,000

B)$14,420

C)$11,340

D)$10,830

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

58

Bullinger Corporation has provided the following data concerning an investment project that it is considering:  The net present value of the project is closest to:

The net present value of the project is closest to:

A)$93,000

B)$406,326

C)$(63,674)

D)$(79,658)

The net present value of the project is closest to:

The net present value of the project is closest to:A)$93,000

B)$406,326

C)$(63,674)

D)$(79,658)

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

59

(Ignore income taxes in this problem.) Jason Corporation has invested in a machine that cost $80,000, that has a useful life of eight years, and that has no salvage value at the end of its useful life. The machine is being depreciated by the straight-line method, based on its useful life. It will have a payback period of five years. Given these data, the simple rate of return on the machine is closest to:

A)6.8%

B)7.5%

C)9%

D)12%

A)6.8%

B)7.5%

C)9%

D)12%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

60

(Ignore income taxes in this problem.) Frick Road Paving Corporation is considering an investment in a curb-forming machine. The machine will cost $180,000, will last 10 years, and will have a $30,000 salvage value at the end of 10 years. The machine is expected to generate net cash inflows of $40,000 per year in each of the 10 years. Frick's discount rate is 10%. The net present value of the proposed investment is closest to:

A)$250,000

B)$65,800

C)$245,800

D)$77,380

A)$250,000

B)$65,800

C)$245,800

D)$77,380

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

61

(Ignore income taxes in this problem.) Galindo Long-Haul, Inc., is considering the purchase of a tractor-trailer that would cost $178,848, would have a useful life of 8 years, and would have no salvage value. The tractor-trailer would be used in the company's hauling business, resulting in additional net cash inflows of $36,000 per year. The internal rate of return on the investment in the tractor-trailer is closest to:

A)10%

B)15%

C)12%

D)13%

A)10%

B)15%

C)12%

D)13%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

62

(Ignore income taxes in this problem.) Henscheid Roofing is considering the purchase of a crane that would cost $104,972, would have a useful life of 7 years, and would have no salvage value. The use of the crane would result in labor savings of $23,000 per year. The internal rate of return on the investment in the crane is closest to:

A)13%

B)10%

C)12%

D)15%

A)13%

B)10%

C)12%

D)15%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

63

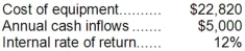

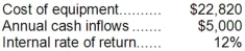

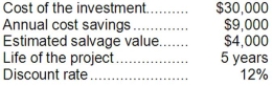

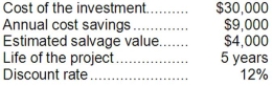

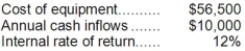

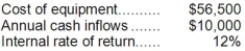

(Ignore income taxes in this problem.) Baber Corporation is planning an investment with the following characteristics:  The initial cost of the equipment is closest to:

The initial cost of the equipment is closest to:

A)$300,000

B)$216,300

C)$2,500,000

D)Cannot be determined from the given information.

The initial cost of the equipment is closest to:

The initial cost of the equipment is closest to:A)$300,000

B)$216,300

C)$2,500,000

D)Cannot be determined from the given information.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

64

(Ignore income taxes in this problem.) An investment project has the following characteristics:  The life of the equipment is closest to:

The life of the equipment is closest to:

A)It is impossible to determine from the data given.

B)7 years

C)12 years

D)4.56 years.

The life of the equipment is closest to:

The life of the equipment is closest to:A)It is impossible to determine from the data given.

B)7 years

C)12 years

D)4.56 years.

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

65

Valotta Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

A)$178,118

B)$201,988

C)$463,000

D)$131,988

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project. The net present value of the project is closest to:A)$178,118

B)$201,988

C)$463,000

D)$131,988

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

66

(Ignore income taxes in this problem) The management of Favreau Corporation is considering the purchase of a machine that would cost $310,464 and would have a useful life of 5 years. The machine would have no salvage value. The machine would reduce labor and other operating costs by $84,000 per year. The internal rate of return on the investment in the new machine is closest to:

A)12%

B)14%

C)11%

D)13%

A)12%

B)14%

C)11%

D)13%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

67

(Ignore income taxes in this problem.) Boyson, Inc., is investigating an investment in equipment that would have a useful life of 9 years. The company uses a discount rate of 16% in its capital budgeting. The net present value of the investment, excluding the salvage value, is -$315,027. To the nearest whole dollar how large would the salvage value of the equipment have to be to make the investment in the equipment financially attractive?

A)$1,197,821

B)$50,404

C)$1,968,919

D)$315,027

A)$1,197,821

B)$50,404

C)$1,968,919

D)$315,027

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

68

(Ignore income taxes in this problem) Buse Corporation is investigating buying a small used aircraft for the use of its executives. The aircraft would have a useful life of 8 years. The company uses a discount rate of 14% in its capital budgeting. The net present value of the investment, excluding the salvage value of the aircraft, is -$488,487. Management is having difficulty estimating the salvage value of the aircraft. To the nearest whole dollar how large would the salvage value of the aircraft have to be to make the investment in the aircraft financially attractive?

A)$1,391,701

B)$3,489,193

C)$68,388

D)$488,487

A)$1,391,701

B)$3,489,193

C)$68,388

D)$488,487

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

69

(Ignore income taxes in this problem.) Tidwell Corporation is considering the purchase of a machine costing $18,000. Tidwell estimates that this machine will save $5,000 per year in cash operating expenses for the next five years. If the machine has no salvage value at the end of five years and the discount rate used by Tidwell is 8%, then the machine's internal rate of return is closest to:

A)8%

B)10%

C)12%

D)14%

A)8%

B)10%

C)12%

D)14%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

70

(Ignore income taxes in this problem.) Tangen Corporation is considering the purchase of a machine that would cost $380,000 and would last for 6 years. At the end of 6 years, the machine would have a salvage value of $80,000. By reducing labor and other operating costs, the machine would provide annual cost savings of $104,000. The company requires a minimum pretax return of 14% on all investment projects. The net present value of the proposed project is closest to:

A)$104,456

B)$24,456

C)$133,753

D)$60,936

A)$104,456

B)$24,456

C)$133,753

D)$60,936

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

71

(Ignore income taxes in this problem.) The following data pertain to an investment proposal:  The net present value of the proposed investment is closest to:

The net present value of the proposed investment is closest to:

A)$4,713

B)$2,445

C)$2,268

D)$19,000

The net present value of the proposed investment is closest to:

The net present value of the proposed investment is closest to:A)$4,713

B)$2,445

C)$2,268

D)$19,000

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

72

(Ignore income taxes in this problem.) Baker Corporation is considering buying a new donut maker. This machine will replace an old donut maker that still has a useful life of 4 years. The new machine will cost $3,500 a year to operate, as opposed to the old machine, which costs $3,900 per year to operate. Also, because of increased capacity, an additional 10,000 donuts a year can be produced. The company makes a contribution margin of $0.15 per donut. The old machine can be sold for $6,000 and the new machine costs $28,000. The incremental annual net cash inflows provided by the new machine would be:

A)$1,500

B)$400

C)$1,900

D)$7,000

A)$1,500

B)$400

C)$1,900

D)$7,000

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

73

(Ignore income taxes in this problem.) Crockin Corporation is considering a machine that will save $8,000 a year in cash operating costs each year for the next six years. At the end of six years it would have no salvage value. If this machine costs $33,848 now, the machine's internal rate of return is closest to:

A)9%

B)10%

C)11%

D)12%

A)9%

B)10%

C)11%

D)12%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

74

(Ignore income taxes in this problem) The management of Kiefert Corporation is investigating an investment in equipment that would have a useful life of 9 years. The company uses a discount rate of 18% in its capital budgeting. The net present value of the investment, excluding the annual cash inflow, is -$290,453. To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive?

A)$32,273

B)$67,500

C)$52,282

D)$290,453

A)$32,273

B)$67,500

C)$52,282

D)$290,453

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

75

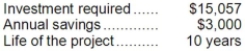

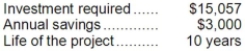

(Ignore income taxes in this problem.) Given the following data:  The life of the equipment must be:

The life of the equipment must be:

A)it is impossible to determine from the data given

B)5 years

C)10 years

D)15 years

The life of the equipment must be:

The life of the equipment must be:A)it is impossible to determine from the data given

B)5 years

C)10 years

D)15 years

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

76

Bevans Corporation is considering a capital budgeting project that would require an initial investment of $190,000. The investment would generate annual cash inflows of $58,000 for the life of the project, which is 4 years. The company's discount rate is 7%. The net present value of the project is closest to:

A)$190,000

B)$6,446

C)$196,446

D)$42,000

A)$190,000

B)$6,446

C)$196,446

D)$42,000

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

77

(Ignore income taxes in this problem) The management of Urbine Corporation is considering the purchase of a machine that would cost $350,000, would last for 6 years, and would have no salvage value. The machine would reduce labor and other costs by $79,000 per year. The company requires a minimum pretax return of 14% on all investment projects. The net present value of the proposed project is closest to:

A)$(42,769)

B)$124,000

C)$(93,877)

D)$56,493

A)$(42,769)

B)$124,000

C)$(93,877)

D)$56,493

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

78

(Ignore income taxes in this problem) The management of Enamorado Corporation is investigating buying a small used aircraft to use in making airborne inspections of its above-ground pipelines. The aircraft would have a useful life of 5 years. The company uses a discount rate of 17% in its capital budgeting. The net present value of the investment, excluding the intangible benefits, is -$160,462. To the nearest whole dollar how large would the annual intangible benefit have to be to make the investment in the aircraft financially attractive?

A)$160,462

B)$50,160

C)$32,092

D)$27,279

A)$160,462

B)$50,160

C)$32,092

D)$27,279

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

79

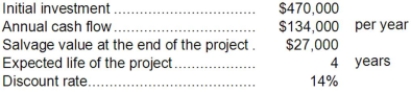

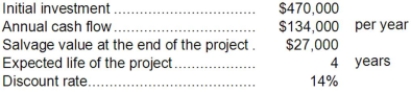

(Ignore income taxes in this problem.) The following data pertain to an investment project:  The internal rate of return is closest to:

The internal rate of return is closest to:

A)13%

B)14%

C)15%

D)16%

The internal rate of return is closest to:

The internal rate of return is closest to:A)13%

B)14%

C)15%

D)16%

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck

80

Vinup Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project in 4 years. The company's discount rate is 13%. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 4 years. The company's discount rate is 13%. The net present value of the project is closest to:

A)$8,486

B)$36,737

C)$89,000

D)$(36,263)

The working capital would be released for use elsewhere at the end of the project in 4 years. The company's discount rate is 13%. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 4 years. The company's discount rate is 13%. The net present value of the project is closest to:A)$8,486

B)$36,737

C)$89,000

D)$(36,263)

Unlock Deck

Unlock for access to all 169 flashcards in this deck.

Unlock Deck

k this deck