Deck 10: Reporting and Interpreting Bond Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/128

Play

Full screen (f)

Deck 10: Reporting and Interpreting Bond Securities

1

The issuing company and the bond underwriter determine the selling price of a bond.

False

2

An advantage of issuing a bond relative to stock is that the bond interest payments are tax deductible.

True

3

Amortization of a discount on a bond payable will result in an increase in the book value of the bond liability on the balance sheet.

True

4

When the market rate of interest is greater than the coupon rate, the bond will sell at a discount.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

5

A bond will sell at a premium when the market rate of interest is greater than the coupon rate of interest.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

6

A bond issued at a discount will pay more cash for interest over the life of the bond than the total interest expense recognized over the life of the bond.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

7

The payment of bond interest on the interest payment date, for bonds issued at par value, reduces both the bond liability and assets, assuming that interest expense is recorded at the time of the cash payment.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

8

Either straight-line or effective-interest amortization may be used for bond premiums or discounts regardless of the amounts involved.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

9

A bond will sell at its par value when the market rate of interest equals the coupon rate of interest.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

10

Amortization of discount on bonds payable will make the amount of interest expense less than the cash owed for interest for that year.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

11

The journal entry for the cash payment of interest on a bond issued at a premium results in an increase in the book value of the bond liability.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

12

Issuing bonds dilutes the voting power of the common shareholders because bonds have preferential voting rights.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

13

The proceeds received from a bond issue will be greater than the bond maturity value when the coupon rate exceeds the market rate of interest.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

14

A company has a December 31 fiscal year-end. If the interest is paid annually on December 31, the bond interest expense on the income statement is the amount of the interest cash payment when the bond initially sells at par value.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

15

The major disadvantages of issuing a bond are the risk of bankruptcy and the negative impact on cash flow because debt must be repaid at a specified date in the future.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

16

A bond's interest payments are determined by multiplying the bond's principal amount by the coupon rate.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

17

The issuance price of a bond is the present value of both the principal, plus the cash interest to be received over the life of the bond, discounted at the coupon rate.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

18

The journal entry for the cash payment of interest on a bond issued at a discount will result in an increase in the book value of the bond liability.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

19

A convertible bond can be called for early retirement at the option of the issuing company.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

20

Increases in the market rate of interest subsequent to a bond issue increase the discount on the bond.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

21

A bond issued at a premium will pay periodic cash interest in excess of the amount of interest expense recognized for accounting purposes.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

22

When a company purchases and retires its outstanding bonds payable for an amount less than their book value, a decrease in stockholders' equity results.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

23

If a company calls bonds with a $1,000,000 maturity value for $1,020,000 when the book value is $950,000, a loss of $20,000 will be reported.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

24

The cash payment for interest on a bond payable is reported as a cash flow from financing activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

25

The debt-to-equity ratio is calculated by dividing total liabilities by total liabilities plus stockholders' equity.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

26

The debt-to-equity ratio assesses the amount of capital provided by creditors relative to stockholders' equity.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the title of a regulatory document with regard to a bond offering?

A)Certificate

B)Covenant

C)Indenture

D)Prospectus

A)Certificate

B)Covenant

C)Indenture

D)Prospectus

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

28

When a company prepares a bond indenture, certain provisions of the bonds are included. Which of the following is not specified in the indenture?

A)Date of each interest payment.

B)The coupon interest rate.

C)The maturity date.

D)The market rate of interest.

A)Date of each interest payment.

B)The coupon interest rate.

C)The maturity date.

D)The market rate of interest.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

29

When a company needs funds to finance the expansion of its operations, which of the following is not an advantage of issuing bonds rather than issuing stock?

A)Stockholders remain in control as bondholders cannot vote or share in the company's earnings.

B)Interest expense is tax deductible but dividends are not.

C)Bonds can usually be issued at a low interest rate and the proceeds can be invested to earn a higher rate.

D)The dates for the interest and maturity payments are fixeD.The fixed payment dates create inflexibility and therefore increase bankruptcy risk.

A)Stockholders remain in control as bondholders cannot vote or share in the company's earnings.

B)Interest expense is tax deductible but dividends are not.

C)Bonds can usually be issued at a low interest rate and the proceeds can be invested to earn a higher rate.

D)The dates for the interest and maturity payments are fixeD.The fixed payment dates create inflexibility and therefore increase bankruptcy risk.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

30

Interest expense increases over time when a bond is initially issued at a premium and the effective-interest method is used.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following types of bonds has specific assets pledged to guarantee repayment?

A)Debenture bond.

B)Callable bond.

C)Secured bond.

D)Convertible bonD.A secured bond has specific assets pledged as a guarantee of repayment at maturity.

A)Debenture bond.

B)Callable bond.

C)Secured bond.

D)Convertible bonD.A secured bond has specific assets pledged as a guarantee of repayment at maturity.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

32

Interest expense decreases over time when a bond is initially issued at a premium and the effective-interest method is used.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements best describes convertible bonds?

A)They can be turned in for early retirement at the option of the bondholder.

B)They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be converted to common stock at the option of the issuer.

A)They can be turned in for early retirement at the option of the bondholder.

B)They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be converted to common stock at the option of the issuer.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not a reason that a company would want to issue bonds instead of stock?

A)Interest payments can be deducted for income tax purposes.

B)Stockholders maintain control.

C)The impact on earnings from using borrowed money may be positive.

D)There is less risk associated with a bond issue.

A)Interest payments can be deducted for income tax purposes.

B)Stockholders maintain control.

C)The impact on earnings from using borrowed money may be positive.

D)There is less risk associated with a bond issue.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

35

The annual interest rate specified within a bond indenture is called which of the following?

A)The coupon rate of interest.

B)The market rate of interest.

C)The effective rate of interest.

D)The actual rate of interest.

A)The coupon rate of interest.

B)The market rate of interest.

C)The effective rate of interest.

D)The actual rate of interest.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

36

Issues of bonds in exchange for cash are reported as a cash flow from financing activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements best describes callable bonds?

A)They can be turned in for early retirement at the option of the bondholder.

B)They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be called for early retirement at the option of the lien holder.

A)They can be turned in for early retirement at the option of the bondholder.

B)They can be converted to common stock at the option of the bondholder.

C)They can be called for early retirement at the option of the issuer.

D)They can be called for early retirement at the option of the lien holder.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

38

The journal entry to record the issue of a bond when the coupon interest rate exceeds the market rate of interest debits premium on bonds payable.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

39

Issuing bonds rather than stock will result in an increase in the debt-to-equity ratio.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is not correct?

A)The bond principal is the amount due at the maturity date of the bond.

B)The coupon rate is used to determine the cash interest payments.

C)The bond principal is used to determine the cash interest payments.

D)The market rate of interest is used to determine the cash interest payments.

A)The bond principal is the amount due at the maturity date of the bond.

B)The coupon rate is used to determine the cash interest payments.

C)The bond principal is used to determine the cash interest payments.

D)The market rate of interest is used to determine the cash interest payments.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

41

Eaton Company issued $5 million of bonds with a 10% coupon rate of interest. When Eaton issued the bonds, the market rate of interest was 10%. Which of the following statements is incorrect?

A)The bonds were issued at par.

B)Annual interest expense will equal the company's annual cash payments for interest.

C)The book value of the bonds will decrease as cash interest payments are made.

D)Annual interest expense is the same regardless of whether the effective-interest or straight-line method of amortization is useD.Since the coupon and interest rates were the same at the date of issue, the bonds were issued at par.The payment of interest does not affect the book value of the bond liability because there is no discount or premium to amortize to interest expense.

A)The bonds were issued at par.

B)Annual interest expense will equal the company's annual cash payments for interest.

C)The book value of the bonds will decrease as cash interest payments are made.

D)Annual interest expense is the same regardless of whether the effective-interest or straight-line method of amortization is useD.Since the coupon and interest rates were the same at the date of issue, the bonds were issued at par.The payment of interest does not affect the book value of the bond liability because there is no discount or premium to amortize to interest expense.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

42

Zero coupon bonds are bonds that are issued:

A)With a zero effective interest rate.

B)At a rate that provides a large discount at issuance.

C)At a rate that has zero difference between the coupon rate and the market rate of interest.

D)As bonds that will have zero amortization recorded over the life of the bonD.Zero coupon bonds are issued at a large discount because they do not pay cash interest during the life of the bond.At maturity, the bonds will have earned the market rate of interest at the issue date.

A)With a zero effective interest rate.

B)At a rate that provides a large discount at issuance.

C)At a rate that has zero difference between the coupon rate and the market rate of interest.

D)As bonds that will have zero amortization recorded over the life of the bonD.Zero coupon bonds are issued at a large discount because they do not pay cash interest during the life of the bond.At maturity, the bonds will have earned the market rate of interest at the issue date.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

43

The journal entry to record the sale of bonds at their par value results in which of the following?

A)An increase in assets and liabilities equal to the par value of the bonds.

B)An increase in assets and liabilities equal to the par value of the bonds and their associated interest payments.

C)An increase in assets equal to the par value of the bonds and an increase in liabilities equal to the bonds' future cash flows.

D)An increase in assets and liabilities equal to the bonds' future cash flows.

A)An increase in assets and liabilities equal to the par value of the bonds.

B)An increase in assets and liabilities equal to the par value of the bonds and their associated interest payments.

C)An increase in assets equal to the par value of the bonds and an increase in liabilities equal to the bonds' future cash flows.

D)An increase in assets and liabilities equal to the bonds' future cash flows.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

44

During 2016, Patty's Pizza reported net income of $4,212 million, interest expense of $167 million and income tax expense of $1,372 million. During 2015, Patty's reported net income of $3,568 million, interest expense of $163 million and income tax expense of $1,424 million. The times interest earned ratios for 2016 and 2015, respectively, are closest to:

A)32.2 and 29.4 times.

B)28.4 and 23.8 times.

C)34.4 and 31.6 times.

D)34.1 and 26.6 times.

A)32.2 and 29.4 times.

B)28.4 and 23.8 times.

C)34.4 and 31.6 times.

D)34.1 and 26.6 times.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

45

Halverson's times interest earned ratio was 2.98 in 2016, 2.79 in 2015, and 2.31 in 2014. Which of the following statements about the ratio is possibly correct?

A)The increasing ratio indicates decreasing levels of debt on which interest is incurred.

B)The increasing ratio indicates the strategy of pursuing growth by investment in other companies, which has increased debt, but Halverson's profits have not yet increased from those investments.

C)The increasing ratio implies increased long-term debt financing.

D)The increasing ratio would be considered by creditors to be an indicator of higher risk.

A)The increasing ratio indicates decreasing levels of debt on which interest is incurred.

B)The increasing ratio indicates the strategy of pursuing growth by investment in other companies, which has increased debt, but Halverson's profits have not yet increased from those investments.

C)The increasing ratio implies increased long-term debt financing.

D)The increasing ratio would be considered by creditors to be an indicator of higher risk.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements does not correctly describe the accounting for bonds that were issued at their face (maturity) value?

A)The market rate of interest equals the coupon rate.

B)The interest expense over the life of the bonds will equal the total cash interest payments.

C)The present value of the bonds' future cash flows equals the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

A)The market rate of interest equals the coupon rate.

B)The interest expense over the life of the bonds will equal the total cash interest payments.

C)The present value of the bonds' future cash flows equals the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

47

Assuming no adjusting journal entries have been made, the journal entry to record the cash interest payment on the due date for bonds issued at their par value results in which of the following?

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and a decrease in assets.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and a decrease in assets.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

48

Skylar Company issued $50,000,000 of its 10% bonds at par on January 1, 2016. On December 31, 2016, the bonds were trading on the bond exchange at 102.5. Since the issue date, what has happened to the market rate of interest?

A)The market rate increased.

B)The market rate decreased.

C)The market rate stayed the same.

D)The change in the market rate can not be determineD.The bonds sold for par value on January 1, 2016, so the coupon rate equaled the market rate of interest.As of December 31, 2016, the bonds were selling at a premium, which means that the coupon rate was greater than the market rate on December 31, 2016.Therefore, the market rate of interest decreased.

A)The market rate increased.

B)The market rate decreased.

C)The market rate stayed the same.

D)The change in the market rate can not be determineD.The bonds sold for par value on January 1, 2016, so the coupon rate equaled the market rate of interest.As of December 31, 2016, the bonds were selling at a premium, which means that the coupon rate was greater than the market rate on December 31, 2016.Therefore, the market rate of interest decreased.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

49

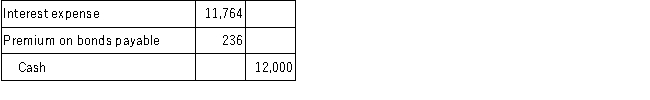

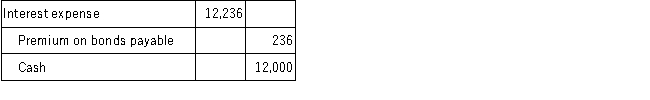

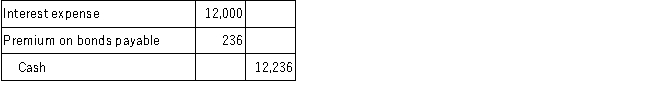

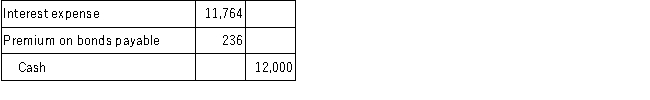

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. Rounding calculations to the nearest whole dollar, which of the following journal entries correctly records the 2016 interest expense?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

50

On November 1, 2015, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2015, and interest is payable each November 1 and May 1. Davis uses the straight-line method of amortization.

How much is the amount of discount amortization on each semi-annual interest date?

A)$90.

B)$45.

C)$900.

D)$450.

How much is the amount of discount amortization on each semi-annual interest date?

A)$90.

B)$45.

C)$900.

D)$450.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

51

Eaton Company issued $5 million of bonds with a 10% coupon rate of interest. When Eaton issued the bonds, the market rate of interest was 8%. Which of the following statements is incorrect?

A)The bonds were issued at a premium.

B)Annual interest expense will be less than the company's annual cash payments for interest.

C)The book value of the bonds will decrease as the bond matures.

D)The annual interest expense will increase if the effective-interest method of amortization was useD.Given that the market rate of interest was less than the coupon rate, the bonds sold at a premium.Therefore, the book value decreases as the premium on bond payable account is amortized, as a result interest expense decreases.

A)The bonds were issued at a premium.

B)Annual interest expense will be less than the company's annual cash payments for interest.

C)The book value of the bonds will decrease as the bond matures.

D)The annual interest expense will increase if the effective-interest method of amortization was useD.Given that the market rate of interest was less than the coupon rate, the bonds sold at a premium.Therefore, the book value decreases as the premium on bond payable account is amortized, as a result interest expense decreases.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is correct?

A)A secured bond has specific assets pledged as collateral to secure it.

B)An unsecured bond can be paid at the option of the issuer.

C)A bond trustee is appointed to represent the issuing company.

D)The bond indenture specifies the market rate of interest the investors will earn.

A)A secured bond has specific assets pledged as collateral to secure it.

B)An unsecured bond can be paid at the option of the issuer.

C)A bond trustee is appointed to represent the issuing company.

D)The bond indenture specifies the market rate of interest the investors will earn.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

53

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. The interest expense on the income statement for the year ended December 31, 2016 is closest to:

A)$677.

B)$883.

C)$773.

D)$700.

A)$677.

B)$883.

C)$773.

D)$700.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

54

On November 1, 2015, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2015, and interest is payable each November 1 and May 1. Davis uses the straight-line method of amortization.

Which of the following is incorrect with regard to the Davis bonds when the straight-line method of amortization is utilized?

A)The market rate of interest exceeded the coupon rate of interest when the bonds were issued.

B)The semi-annual interest expense is $1,095.

C)The book value of the bonds increases $45 every six months.

D)The semi-annual interest expense is less than the semi-annual cash interest payment.

Which of the following is incorrect with regard to the Davis bonds when the straight-line method of amortization is utilized?

A)The market rate of interest exceeded the coupon rate of interest when the bonds were issued.

B)The semi-annual interest expense is $1,095.

C)The book value of the bonds increases $45 every six months.

D)The semi-annual interest expense is less than the semi-annual cash interest payment.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

55

On November 1, 2015, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2015, and interest is payable each November 1 and May 1. Davis uses the straight-line method of amortization.

How much is the book value of the bonds after the November 1, 2016 interest payment was recorded using the straight-line method of amortization?

A)$29,010.

B)$29,100.

C)$29,190.

D)$29,280.

How much is the book value of the bonds after the November 1, 2016 interest payment was recorded using the straight-line method of amortization?

A)$29,010.

B)$29,100.

C)$29,190.

D)$29,280.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements correctly describes the accounting for bonds that were issued at a discount?

A)The market rate of interest is less than the coupon interest rate.

B)The interest expense over the life of the bonds will be less than the total cash interest payments.

C)The present value of the bonds' future cash flows is greater than the bonds' maturity value.

D)The book value of the bond liability increases when interest payments are made on the due dates.

A)The market rate of interest is less than the coupon interest rate.

B)The interest expense over the life of the bonds will be less than the total cash interest payments.

C)The present value of the bonds' future cash flows is greater than the bonds' maturity value.

D)The book value of the bond liability increases when interest payments are made on the due dates.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

57

On November 1, 2015, Davis Company issued $30,000, ten-year, 7% bonds for $29,100. The bonds were dated November 1, 2015, and interest is payable each November 1 and May 1. Davis uses the straight-line method of amortization.

How much is the semi-annual interest expense when the straight-line method of amortization is utilized?

A)$2,010.

B)$2,190.

C)$1,095.

D)$2,055.

How much is the semi-annual interest expense when the straight-line method of amortization is utilized?

A)$2,010.

B)$2,190.

C)$1,095.

D)$2,055.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

58

Eaton Company issued $5 million of bonds with a 10% coupon rate of interest. When Eaton issued the bonds, the market rate of interest was 11%. Which of the following statements is correct?

A)The bonds were issued at a premium.

B)Annual interest expense will exceed the company's actual cash payments for interest.

C)Annual interest expense will be $500,000.

D)The book value of the bond will decrease as the bond matures.

A)The bonds were issued at a premium.

B)Annual interest expense will exceed the company's actual cash payments for interest.

C)Annual interest expense will be $500,000.

D)The book value of the bond will decrease as the bond matures.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

59

Assuming no adjusting journal entries have been made, the journal entry to record the cash interest payment on the due date for bonds issued at a discount results in which of the following?

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements does not correctly describe the accounting for bonds that were issued at a discount?

A)The interest expense over the life of the bond exceeds the total cash interest payments.

B)The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the discount on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a discount, their book value increases over time and eventually reach the bonds' maturity value.Interest expense increases because the book value increases.The amortization of discount on bonds payable is the difference between the increasing interest expense and the constant cash interest payment.

A)The interest expense over the life of the bond exceeds the total cash interest payments.

B)The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the discount on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a discount, their book value increases over time and eventually reach the bonds' maturity value.Interest expense increases because the book value increases.The amortization of discount on bonds payable is the difference between the increasing interest expense and the constant cash interest payment.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

61

Gammell Company issued $50,000 of 9% bonds with annual interest payments. The bonds mature in ten years. The bonds were issued at $48,000. Gammell Company uses the straight-line method of amortization. What is the amount of the annual interest expense?

A)$4,700.

B)$4,300.

C)$4,500.

D)$4,680.

A)$4,700.

B)$4,300.

C)$4,500.

D)$4,680.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

62

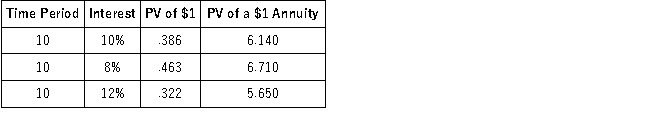

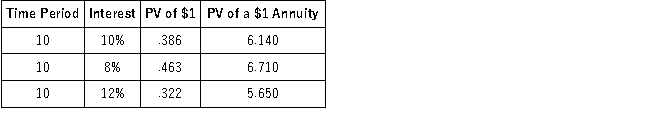

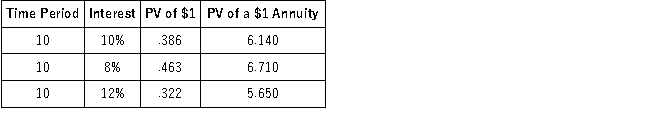

On January 1, 2016, Jason Company issued $5 million of 10-year bonds at a 10% coupon interest rate to be paid annually. The following present value factors have been provided:  Calculate the issuance price if the market rate of interest was 10%.

Calculate the issuance price if the market rate of interest was 10%.

A)$5,427,000.

B)$4,477,000.

C)$4,435,000.

D)$5,000,000.

Calculate the issuance price if the market rate of interest was 10%.

Calculate the issuance price if the market rate of interest was 10%.A)$5,427,000.

B)$4,477,000.

C)$4,435,000.

D)$5,000,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements incorrectly describes the accounting for bonds that were issued at a premium?

A)The market rate of interest is less than the coupon interest rate.

B)The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is less than the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

A)The market rate of interest is less than the coupon interest rate.

B)The interest expense over the life of the bonds will be less than the cash interest payments.

C)The present value of the bonds' future cash flows is less than the bonds' maturity value.

D)The book value of the bond liability decreases when interest payments are made on the due dates.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

64

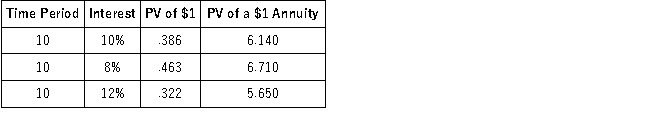

On January 1, 2016, Jason Company issued $5 million of 10-year bonds at a 10% coupon interest rate to be paid annually. The following present value factors have been provided:  Calculate the issuance price if the market rate of interest is 12%.

Calculate the issuance price if the market rate of interest is 12%.

A)$4,427,500.

B)$4,477,500.

C)$4,435,000.

D)$5,000,000.

Calculate the issuance price if the market rate of interest is 12%.

Calculate the issuance price if the market rate of interest is 12%.A)$4,427,500.

B)$4,477,500.

C)$4,435,000.

D)$5,000,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

65

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. The book value of the bonds as of December 31, 2016 is closest to:

A)$8,968.

B)$9,945.

C)$9,641.

D)$9,741.

A)$8,968.

B)$9,945.

C)$9,641.

D)$9,741.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

66

On January 1, 2016, a company issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% market interest rate. The effective-interest method of amortization is used. Which of the following statements is incorrect?

A)The market rate of interest on the sale date was less than the coupon rate of interest.

B)The book value of the bond will decrease as the bond reaches maturity.

C)The interest expense will decrease as the bond reaches maturity.

D)The amortization of the premium on bonds payable will decrease as the bond matures.

A)The market rate of interest on the sale date was less than the coupon rate of interest.

B)The book value of the bond will decrease as the bond reaches maturity.

C)The interest expense will decrease as the bond reaches maturity.

D)The amortization of the premium on bonds payable will decrease as the bond matures.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

67

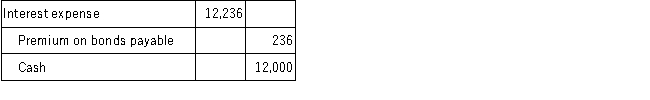

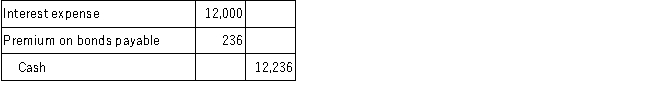

Mayberry, Inc., issued $100,000 of 10-year, 12% bonds dated April 1, 2016, for $102,360 on April 1, 2016. The bonds pay interest annually on April 1, beginning in 2017. Straight-line amortization is used by the company. What entry is required at April 1, 2017 for the first interest payment?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

68

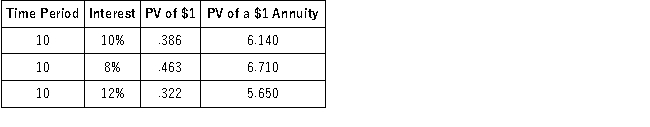

On January 1, 2016, Jason Company issued $5 million of 10-year bonds at a 10% coupon interest rate to be paid annually. The following present value factors have been provided:  What was the issuance price of the bonds if the market rate of interest was 8%?

What was the issuance price of the bonds if the market rate of interest was 8%?

A)$5,000,000.

B)$5,670,000.

C)$5,387,500.

D)$5,712,500.

What was the issuance price of the bonds if the market rate of interest was 8%?

What was the issuance price of the bonds if the market rate of interest was 8%?A)$5,000,000.

B)$5,670,000.

C)$5,387,500.

D)$5,712,500.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

69

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. The 2017 interest expense is closest to:

A)$779.

B)$796.

C)$677.

D)$700.

A)$779.

B)$796.

C)$677.

D)$700.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

70

On July 1, 2016, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2016, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses the straight-line method of amortization. What is the amount of the semi-annual interest expense?

A)$14,000.

B)$14,150.

C)$10,350.

D)$11,000.

A)$14,000.

B)$14,150.

C)$10,350.

D)$11,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

71

Assuming no adjusting journal entries have been made during the year, the journal entry on the due date of the cash interest payment for bonds issued at a premium has just been prepared. Which of the following is not an effect of the entry?

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

A)An increase in expenses and a decrease in liabilities.

B)An increase in expenses and an increase in liabilities.

C)A decrease in both liabilities and stockholders' equity.

D)A decrease in both assets and liabilities.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

72

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. The December 31, 2017 book value after the December 31, 2017 interest payment was made is closest to:

A)$9,662.

B)$9,820.

C)$9,668.

D)$9,723.

A)$9,662.

B)$9,820.

C)$9,668.

D)$9,723.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

73

Gammell Company issued $50,000 of 9% bonds with annual interest payments. The bonds mature in ten years. The bonds were issued at $48,000. Gammell Company uses the straight-line method of amortization. Which of the following statements is incorrect?

A)The market rate of interest exceeded the coupon rate of interest when the bonds were issued.

B)The annual interest expense exceeds the annual cash interest payment by $200.

C)The annual increase in the bond book value is $200.

D)The annual interest expense is $4,300.

A)The market rate of interest exceeded the coupon rate of interest when the bonds were issued.

B)The annual interest expense exceeds the annual cash interest payment by $200.

C)The annual increase in the bond book value is $200.

D)The annual interest expense is $4,300.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1, 2016, a company issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% market interest rate. The effective-interest method of amortization is used. Rounding all calculations to the nearest whole dollar, what is the interest expense for the six-month period ending June 30, 2016?

A)$24,000.

B)$24,789.

C)$20,000.

D)$20,658.

A)$24,000.

B)$24,789.

C)$20,000.

D)$20,658.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

75

On July 1, 2016, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2016, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses the straight-line method of amortization. What is the net amount of the bond liability to be reported on the December 31, 2016 balance sheet?

A)$300,000.

B)$302,850.

C)$302,700.

D)$303,000.

A)$300,000.

B)$302,850.

C)$302,700.

D)$303,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

76

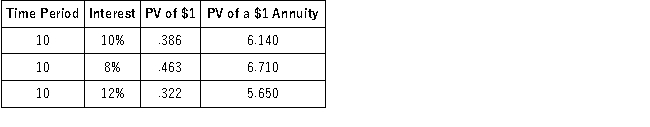

On January 1, 2016, Broker Corp. issued $3,000,000 par value 12%, 10-year bonds which pay interest each December 31. If the market rate of interest was 14%, what was the issue price of the bonds? (The present value factor for $1 in 10 periods at 12% is .3220 and at 14% is .2697. The present value of an annuity of $1 factor for 10 periods at 12% is 5.6502 and at 14% is 5.2161.)

A)$3,339,084.

B)$2,843,172.

C)$3,000,000.

D)$2,686,896.

A)$3,339,084.

B)$2,843,172.

C)$3,000,000.

D)$2,686,896.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

77

On July 1, 2016, Garden Works, Inc. issued $300,000 of ten-year, 7% bonds for $303,000. The bonds were dated July 1, 2016, and semi-annual interest will be paid each December 31 and June 30. Garden Works Inc. uses the straight-line method of amortization. What is the net amount of the bond liability to be reported on the December 31, 2017 balance sheet?

A)$300,000.

B)$302,550.

C)$302,700.

D)$303,000.

A)$300,000.

B)$302,550.

C)$302,700.

D)$303,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements correctly describes the accounting for bonds that were issued at a premium?

A)The interest expense over the life of the bond is less than the total cash interest payments.

B)The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the premium on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a premium, interest expense over the life of the bonds equals the total payments for interest minus the premium on bonds payable at the issue date.

A)The interest expense over the life of the bond is less than the total cash interest payments.

B)The interest expense over the life of the bonds increases as the bonds mature when the effective interest method is used.

C)The amortization of the premium on bonds payable account decreases as the bonds mature when the effective interest method is used.

D)The book value of the bond liability increases when interest payments are made on the due dates when the effective interest method of amortization is useD.When bonds are issued at a premium, interest expense over the life of the bonds equals the total payments for interest minus the premium on bonds payable at the issue date.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is incorrect?

A)The market rate of interest was less than the coupon rate of interest on July 1, 2016.

B)The interest expense during the life of the bonds is $3,000 less than the cash interest payments during the life of the bonds.

C)The book value of the bond liability decreases by $300 per year.

D)The semi-annual interest expense is $300 less than the semi-annual interest payment.

A)The market rate of interest was less than the coupon rate of interest on July 1, 2016.

B)The interest expense during the life of the bonds is $3,000 less than the cash interest payments during the life of the bonds.

C)The book value of the bond liability decreases by $300 per year.

D)The semi-annual interest expense is $300 less than the semi-annual interest payment.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

80

On January 1, 2016, a company issued $400,000 of 10-year, 12% bonds. The interest is payable semi-annually on June 30 and December 31. The issue price was $413,153 based on a 10% market interest rate. The effective-interest method of amortization is used. What is the book value of the bond liability as of June 30, 2016 (to the nearest dollar)?

A)$400,000.

B)$416,495.

C)$409,811.

D)$403,342.

A)$400,000.

B)$416,495.

C)$409,811.

D)$403,342.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck