Deck 1: Introduction to Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 1: Introduction to Taxation

1

Two persons who live in the same state but in different counties may not be subject to the same general sales tax rate.

True

2

The Federal estate and gift taxes are examples of progressive taxes.

True

3

Not all of the states that impose a general sales tax also have a use tax.

False

4

The ad valorem tax on personal use personalty is more often avoided by taxpayers than the ad valorem tax on business use personalty.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

Currently, the Federal income tax is less progressive than it ever has been in the past.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

Like the Federal counterpart, the amount of the state excise taxes on gasoline varies from state to state.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

The Federal gas-guzzler tax applies only to automobiles manufactured overseas and imported into the U.S.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

The Federal excise tax on cigarettes is an example of a proportional tax.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

On transfers by death, the Federal government relies on an estate tax, while states impose an estate tax, an inheritance tax, both taxes, or neither tax.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

One of the major reasons for the enactment of the Federal estate tax was to prevent large amounts of wealth from being accumulated within the family unit.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

A safe and easy way for a taxpayer to avoid local and state sales taxes is to make the purchase in a state that levies no such taxes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

A Federal excise tax is no longer imposed on admission to theaters.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

An inheritance tax is a tax on a decedent's right to pass property at death.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

States impose either a state income tax or a general sales tax, but not both types of taxes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

The FICA tax (Medicare component) on wages is progressive since the tax due increases as wages increase.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

Sales made by mail order are not exempt from the application of a general sales (or use) tax.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

There is a Federal excise tax on hotel occupancy.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

A fixture will be subject to the ad valorem tax on personalty rather than the ad valorem tax on realty.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

Mona inherits her mother's personal residence, which she converts to a furnished rental house. These changes should affect the amount of ad valorem property taxes levied on the properties.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

Even if property tax rates are not changed, the amount of ad valorem taxes imposed on realty may not remain the same.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

Julius, a married taxpayer, makes gifts to each of his six children. A maximum of twelve annual exclusions could be allowed as to these gifts.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

A parent employs his twin daughters, age 17, in his sole proprietorship. The daughters are not subject to FICA coverage.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

The tax law provides various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education. These provisions can be justified on both economic and equity grounds.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

The annual exclusion, currently $14,000, is available for gift and estate tax purposes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

Currently, the tax base for the Social Security component of the FICA is not limited to a dollar amount.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

One of the motivations for making a gift is to save on income taxes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

The principal objective of the FUTA tax is to provide some measure of retirement security.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

To lessen, or eliminate, the effect of multiple taxation, a taxpayer who is subject to both foreign and U.S. income taxes on the same income is allowed either a deduction or a credit for the foreign tax paid.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Unlike FICA, FUTA requires that employers comply with state as well as Federal rules.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

Various tax provisions encourage the creation of certain types of retirement plans. Such provisions can be justified on both economic and social grounds.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

Under the usual state inheritance tax, two heirs, a cousin and a son of the deceased, would not be taxed at the same rate.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

A provision in the law that compels accrual basis taxpayers to pay a tax on prepaid income in the year received and not when earned is consistent with generally accepted accounting principles.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

The formula for the Federal income tax on corporations is the same as that applicable to individuals.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

As it is consistent with the wherewithal to pay concept, the tax law requires a seller to recognize gain in the year the installment sale occurs.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

Under Clint's will, all of his property passes to either the Lutheran Church or to his wife. No Federal estate tax will be due on Clint's death in 2016.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

To mitigate the effect of the annual accounting period concept, the tax law permits the carryforward to other years of the excess charitable contributions of a particular year.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

Jason's business warehouse is destroyed by fire. As the insurance proceeds exceed the basis of the property, a gain results. If Jason shortly reinvests the proceeds in a new warehouse, no gain is recognized due to the application of the wherewithal to pay concept.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

When Congress enacts a tax cut that is phased in over a period of years, revenue neutrality is achieved.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

A tax cut enacted by Congress that contains a sunset provision will make the tax cut temporary.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

In 2016, José, a widower, sells land (fair market value of $100,000) to his daughter, Linda, for $50,000. José has not made a taxable gift.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

A landlord leases property upon which the tenant makes improvements. The improvements are significant and are not made in lieu of rent. At the end of the lease, the value of the improvements are not income to the landlord. This rule is an example of:

A)A clear reflection of income result.

B)The tax benefit rule.

C)The arm's length concept.

D)The wherewithal to pay concept.

E)None of these.

A)A clear reflection of income result.

B)The tax benefit rule.

C)The arm's length concept.

D)The wherewithal to pay concept.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

Which, if any, of the following transactions will decrease a taxing jurisdiction's ad valorem tax revenue imposed on real estate?

A)A tax holiday is granted to an out-of-state business that is searching for a new factory site.

B)An abandoned church is converted to a restaurant.

C)A public school is razed and turned into a city park.

D)A local university sells a dormitory that will be converted for use as an apartment building.

E)None of these.

A)A tax holiday is granted to an out-of-state business that is searching for a new factory site.

B)An abandoned church is converted to a restaurant.

C)A public school is razed and turned into a city park.

D)A local university sells a dormitory that will be converted for use as an apartment building.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

Indicate which, if any, statement is incorrect. State income taxes:

A)Can piggyback to the Federal version.

B)Cannot apply to visiting nonresidents.

C)Can decouple from the Federal version.

D)Can provide occasional amnesty programs.

E)None of these.

A)Can piggyback to the Federal version.

B)Cannot apply to visiting nonresidents.

C)Can decouple from the Federal version.

D)Can provide occasional amnesty programs.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

Provisions in the tax law that promote energy conservation and more use of alternative (non-fossil) fuels can be justified by:

A)Political considerations.

B)Economic and social considerations.

C)Promoting administrative feasibility.

D)Encouragement of small business.

E)None of these.

A)Political considerations.

B)Economic and social considerations.

C)Promoting administrative feasibility.

D)Encouragement of small business.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

Allowing a domestic production activities deduction for certain manufacturing income can be justified:

A)As mitigating the effect of the annual accounting period concept.

B)As promoting administrative feasibility.

C)By economic considerations.

D)Based on the wherewithal to pay concept.

E)None of these.

A)As mitigating the effect of the annual accounting period concept.

B)As promoting administrative feasibility.

C)By economic considerations.

D)Based on the wherewithal to pay concept.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

State income taxes generally can be characterized by:

A)The same date for filing as the Federal income tax.

B)No provision for withholding procedures.

C)Allowance of a deduction for Federal income taxes paid.

D)Applying only to individuals and not applying to corporations.

E)None of these.

A)The same date for filing as the Federal income tax.

B)No provision for withholding procedures.

C)Allowance of a deduction for Federal income taxes paid.

D)Applying only to individuals and not applying to corporations.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

Which, if any, of the following transactions will increase a taxing jurisdiction's revenue from the ad valorem tax imposed on real estate?

A)A resident dies and leaves his farm to his church.

B)A large property owner issues a conservation easement as to some of her land.

C)A tax holiday issued 10 years ago has expired.

D)A bankrupt motel is acquired by the Red Cross and is to be used to provide housing for homeless persons.

E)None of these.

A)A resident dies and leaves his farm to his church.

B)A large property owner issues a conservation easement as to some of her land.

C)A tax holiday issued 10 years ago has expired.

D)A bankrupt motel is acquired by the Red Cross and is to be used to provide housing for homeless persons.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

Property can be transferred within the family group by gift or at death. One motivation for preferring the gift approach is:

A)To take advantage of the higher unified transfer tax credit available under the gift tax.

B)To avoid a future decline in value of the property transferred.

C)To take advantage of the per donee annual exclusion.

D)To shift income to higher bracket donees.

E)None of these.

A)To take advantage of the higher unified transfer tax credit available under the gift tax.

B)To avoid a future decline in value of the property transferred.

C)To take advantage of the per donee annual exclusion.

D)To shift income to higher bracket donees.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

Taxes levied by all states include:

A)Tobacco excise tax.

B)Individual income tax.

C)Inheritance tax.

D)General sales tax.

E)None of these.

A)Tobacco excise tax.

B)Individual income tax.

C)Inheritance tax.

D)General sales tax.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

A use tax is imposed by:

A)The Federal government and all states.

B)The Federal government and a majority of the states.

C)All states and not the Federal government.

D)Most of the states and not the Federal government.

E)None of these.

A)The Federal government and all states.

B)The Federal government and a majority of the states.

C)All states and not the Federal government.

D)Most of the states and not the Federal government.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

As a matter of administrative convenience, the IRS would prefer to have Congress decrease (rather than increase) the amount of the standard deduction allowed to individual taxpayers.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

Federal excise taxes that are no longer imposed include:

A)Tax on air travel.

B)Tax on wagering.

C)Tax on the manufacture of sporting equipment.

D)Tax on alcohol.

E)None of these.

A)Tax on air travel.

B)Tax on wagering.

C)Tax on the manufacture of sporting equipment.

D)Tax on alcohol.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

Which, if any, of the following provisions of the tax law cannot be justified as promoting administrative feasibility (simplifying the task of the IRS)?

A)Penalties are imposed for failure to file a return or pay a tax on time.

B)Prepaid income is taxed in the year received and not in the year earned.

C)Annual adjustments for indexation increases the amount of the standard deduction allowed.

D)Casualty losses must exceed 10% of AGI to be deductible.

E)A deduction is allowed for charitable contributions.

A)Penalties are imposed for failure to file a return or pay a tax on time.

B)Prepaid income is taxed in the year received and not in the year earned.

C)Annual adjustments for indexation increases the amount of the standard deduction allowed.

D)Casualty losses must exceed 10% of AGI to be deductible.

E)A deduction is allowed for charitable contributions.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

Taxes levied by both states and the Federal government include:

A)General sales tax.

B)Custom duties.

C)Hotel occupancy tax.

D)Franchise tax.

E)None of these.

A)General sales tax.

B)Custom duties.

C)Hotel occupancy tax.

D)Franchise tax.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

Which, if any, of the following is a typical characteristic of an ad valorem tax on personalty?

A)Taxpayer compliance is greater for personal use property than for business use property.

B)The tax on automobiles sometimes considers the age of the vehicle.

C)Most states impose a tax on intangibles.

D)The tax on intangibles generates considerable revenue since it is difficult for taxpayers to avoid.

E)None of these.

A)Taxpayer compliance is greater for personal use property than for business use property.

B)The tax on automobiles sometimes considers the age of the vehicle.

C)Most states impose a tax on intangibles.

D)The tax on intangibles generates considerable revenue since it is difficult for taxpayers to avoid.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

Taxes not imposed by the Federal government include:

A)Tobacco excise tax.

B)Customs duties (tariffs on imports).

C)Tax on rental cars.

D)Gas guzzler tax.

E)None of these.

A)Tobacco excise tax.

B)Customs duties (tariffs on imports).

C)Tax on rental cars.

D)Gas guzzler tax.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Social considerations can be used to justify:

A)Allowance of a credit for child care expenses.

B)Allowing excess capital losses to be carried over to other years.

C)Allowing accelerated amortization for the cost of installing pollution control facilities.

D)Allowing a Federal income tax deduction for state and local sales taxes.

E)None of these.

A)Allowance of a credit for child care expenses.

B)Allowing excess capital losses to be carried over to other years.

C)Allowing accelerated amortization for the cost of installing pollution control facilities.

D)Allowing a Federal income tax deduction for state and local sales taxes.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

Both economic and social considerations can be used to justify:

A)Favorable tax treatment for accident and health plans provided for employees and financed by employers.

B)Disallowance of any deduction for expenditures deemed to be contrary to public policy (e.g., fines, penalties, illegal kickbacks, bribes to government officials).

C)Various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education.

D)Allowance of a deduction for state and local income taxes paid.

E)None of these.

A)Favorable tax treatment for accident and health plans provided for employees and financed by employers.

B)Disallowance of any deduction for expenditures deemed to be contrary to public policy (e.g., fines, penalties, illegal kickbacks, bribes to government officials).

C)Various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education.

D)Allowance of a deduction for state and local income taxes paid.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Which, if any, of the following provisions cannot be justified as mitigating the effect of the annual accounting period concept?

A)Nonrecognition of gain allowed for involuntary conversions.

B)Net operating loss carryback and carryover provisions.

C)Carry over of excess charitable contributions.

D)Use of the installment method to recognize gain.

E)Carry over of excess capital losses.

A)Nonrecognition of gain allowed for involuntary conversions.

B)Net operating loss carryback and carryover provisions.

C)Carry over of excess charitable contributions.

D)Use of the installment method to recognize gain.

E)Carry over of excess capital losses.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Burt and Lisa are married and live in a common law state. Burt wants to make gifts to their four children in 2016. What is the maximum amount of the annual exclusion they will be allowed for these gifts?

A)$14,000.

B)$28,000.

C)$56,000.

D)$112,000.

E)None of these.

A)$14,000.

B)$28,000.

C)$56,000.

D)$112,000.

E)None of these.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

The tax law allows, under certain conditions, deferral of gain recognition for involuntary conversions.

a.What is the justification for this relief measure?

b.What happens if the proceeds are not entirely reinvested?

a.What is the justification for this relief measure?

b.What happens if the proceeds are not entirely reinvested?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

A small business corporation can elect to avoid the corporate income tax.

a. Economic considerations

b. Social considerations

c. Equity considerations

A small business corporation can elect to avoid the corporate income tax.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

Tax brackets are increased for inflation.

a. Economic considerations

b. Social considerations

c. Equity considerations

Tax brackets are increased for inflation.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

In terms of revenue neutrality, comment on a tax cut enacted by Congress that:

a.contains revenue offsets.

b.includes a sunset provision.

a.contains revenue offsets.

b.includes a sunset provision.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

A deduction for qualified tuition paid to obtain higher education.

a. Economic considerations

b. Social considerations

c. Equity considerations

A deduction for qualified tuition paid to obtain higher education.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

State and local governments are sometimes forced to find ways to generate additional revenue. Comment on the pros and cons of the following procedures:

a.Decouple what would be part of the piggyback format of the state income tax.

b.Tax amnesty provisions.

c.Internet shaming.

a.Decouple what would be part of the piggyback format of the state income tax.

b.Tax amnesty provisions.

c.Internet shaming.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

Taylor, a widow, makes cash gifts to her five married children (including their spouses) and to her seven grandchildren. What is the maximum amount Taylor can give for calendar year 2016 without using her unified transfer tax credit?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

A lack of compliance in the payment of use taxes can be resolved by several means. In this regard, comment on the following:

a.Registration of automobiles.

b.Reporting of Internet purchases on state income tax returns.

a.Registration of automobiles.

b.Reporting of Internet purchases on state income tax returns.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

The tax law contains various provisions that encourage home ownership.

a.On what basis can this objective be justified?

b.Are there any negative considerations? Explain.

a.On what basis can this objective be justified?

b.Are there any negative considerations? Explain.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

A tax credit for amounts spent to furnish care for children while the parent is at work.

a. Economic considerations

b. Social considerations

c. Equity considerations

A tax credit for amounts spent to furnish care for children while the parent is at work.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

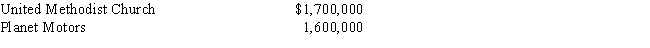

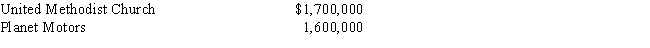

Due to the population change, the Goose Creek School District has decided to close one of its high schools. Since it has no further need of the property, the school is listed for sale. The two bids it receives are as follows:

The United Methodist Church would use the property to establish a sectarian middle school. Planet, a well-known car dealership, would revamp the property and operate it as a branch location.

If you were a member of the School District board, what factors would you consider in evaluating the two bids?

The United Methodist Church would use the property to establish a sectarian middle school. Planet, a well-known car dealership, would revamp the property and operate it as a branch location.

If you were a member of the School District board, what factors would you consider in evaluating the two bids?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

In 2014, Deborah became 65 years old. In 2015 she added a swimming pool, and in 2016 she converted the residence to rental property and moved into an assisted living facility. Since 2013, Deborah's ad valorem property taxes have decreased once and increased twice. Explain.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

Morgan inherits her father's personal residence including all of the furnishings. She plans to add a swimming pool and sauna to the property and rent it as a furnished house. What are some of the ad valorem property tax problems Morgan can anticipate?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

In 1985, Roy leased real estate to Drab Corporation for 20 years. Drab Corporation made significant capital improvements to the property. In 2005, Drab decides not to renew the lease and vacates the property. At that time, the value of the improvements is $800,000. Roy sells the real estate in 2016 for $1,200,000 of which $900,000 is attributable to the improvements. When is Roy taxed on the improvements made by Drab Corporation?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

The tax law contains various tax credits, deductions, and exclusions that are designed to encourage taxpayers to obtain additional education. On what grounds can these provisions be justified?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

The tax law allows an income tax deduction (or a credit) for foreign income taxes. Explain why.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

Several years ago, Logan purchased extra grazing land for his ranch at a cost of $240,000. In 2016, the land is condemned by the state for development as a highway maintenance depot. Under the condemnation award, Logan receives $600,000 for the land. Within the same year, he replaces the property with other grazing land. What is Logan's tax situation if the replacement land cost:

a.$210,000?

b.$360,000?

c.$630,000?

d.Why?

a.$210,000?

b.$360,000?

c.$630,000?

d.Why?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

Paige is the sole shareholder of Citron Corporation. During the year, Paige leases a building to Citron for a monthly rental of $80,000. If the fair rental value of the building is $60,000, what are the income tax consequences to the parties involved?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

A deduction for contributions by an employee to certain retirement plans.

a. Economic considerations

b. Social considerations

c. Equity considerations

A deduction for contributions by an employee to certain retirement plans.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

Using the choices provided below, show the justification for each provision of the tax law listed.

a. Economic considerations

b. Social considerations

c. Equity considerations

Additional depreciation deduction allowed for the year the asset is acquired.

a. Economic considerations

b. Social considerations

c. Equity considerations

Additional depreciation deduction allowed for the year the asset is acquired.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck