Deck 5: Business Deductions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/208

Play

Full screen (f)

Deck 5: Business Deductions

1

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount if the amount of the investigation expenses exceeds $5,000.

True

2

Fines and penalties paid for violations of the law (e.g., illegal dumping of hazardous waste) are deductible only if they relate to a trade or business.

False

3

Generally, a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

False

4

LD Partnership, a cash basis taxpayer, purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building. The gross receipts of the partnership are less than $100,000. LD must capitalize the $50,000 paid for the land, but can deduct the $150,000 paid for the building in the current tax year.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

5

Two-thirds of treble damage payments under the antitrust law are not deductible.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

6

If a taxpayer operates an illegal business, no deductions are permitted.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

7

Ordinary and necessary business expenses, other than cost of goods sold, of an illegal drug trafficking business do not reduce taxable income.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

8

Isabella owns two business entities. She may be able to use the cash method for one and the accrual method for the other.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

9

An expense need not be recurring in order to be "ordinary."

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

10

For a taxpayer who is engaged in a trade or business, the cost of investigating a business in the same field is deductible only if the taxpayer acquires the business.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

11

Aaron, a shareholder-employee of Pigeon, Inc., receives a $300,000 salary. The IRS classifies $100,000 of this amount as unreasonable compensation. The effect of this reclassification is to decrease Aaron's gross income by $100,000 and increase Pigeon's gross income by $100,000.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

12

The portion of a shareholder-employee's salary that is classified as unreasonable has no effect on the amount of a shareholder-employee's gross income, but results in an increase in the taxable income of the corporation.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

13

Jacques, who is not a U.S. citizen, makes a contribution to the campaign of a candidate for governor. Cassie, a U.S. citizen, also makes a contribution to the same campaign fund. If contributions by noncitizens are illegal under state law, the contribution by Cassie is deductible, while that by Jacques is not.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

14

None of the prepaid rent paid on September 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

15

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

16

The cash method can be used even if inventory and cost of goods sold are an income producing factor in the business.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

17

The amount of the addition to the reserve for bad debts for an accrual method taxpayer is allowed as a deduction for tax purposes, but is not allowed for a cash method taxpayer.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

18

Legal fees incurred in connection with a criminal defense are not deductible even if the crime is associated with a trade or business.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

19

A taxpayer's note or promise to pay satisfies the "actually paid" requirement for the cash basis method of accounting.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

20

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense. If the same amount is paid to the CEO of IBM, only $1 million is deductible.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

21

The key date for calculating cost recovery is the date the asset is placed in service.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

22

The limit for the domestic production activities deduction (DPAD) uses all W-2 wages paid to employees by the taxpayer during the tax year.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

23

All personal property placed in service in 2016 and used in a trade or business qualifies for additional first-year depreciation.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

24

For purposes of the § 267 loss disallowance provision, a taxpayer's aunt is a related party.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

25

The cost recovery period for 3-year class property is 4 years.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

26

Property which is classified as personalty may be depreciated.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

27

If qualified production activities income (QPAI) cannot be used in the calculation of the domestic production activities deduction because of the taxable income limitation, the product of the amount not allowed multiplied by the DPAD percentage rate (currently 9%) can be carried over for 5 years.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

28

The maximum cost recovery method for all personal property under MACRS is 150% declining balance.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

29

If an election is made to defer deduction of research expenditures, the amortization period is based on the expected life of the research project if less than 60 months.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

30

The cost recovery basis for property converted from personal use to business use may be the fair market value of the property at the time of the conversion.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

31

The basis of cost recovery property must be reduced by at least the cost recovery allowable.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

32

The domestic production activities deduction (DPAD) for a sole proprietor is calculated by multiplying a percentage rate (currently 9%) times adjusted gross income.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

33

Purchased goodwill must be capitalized, but can be amortized over a 60-month period.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

34

Land improvements are generally not eligible for cost recovery.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

35

Under MACRS, if the mid-quarter convention is applicable, all property sold is treated as being sold at the mid-point of the quarter in which it is placed in service.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

36

If more than 40% of the value of property, other than real property, is placed in service during the last quarter, all of the property placed in service in the second quarter will be allowed 7.5 months of cost recovery.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

37

Research and experimental expenditures do not include the cost of consumer surveys.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

38

Antiques may be eligible for cost recovery if they are used in a trade or business.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

39

The cost of depreciable property is not a research and experimental expenditure.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

40

Marge sells land to her adult son, Jason, for its $20,000 appraised value. Her adjusted basis for the land is $25,000. Marge's recognized loss is $5,000 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 recognized gain of Marge).

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

41

Taxpayers may elect to use the straight-line method under MACRS for personalty.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

42

A used $35,000 automobile that is used 100% for business is placed in service in 2016. If the automobile fails the 50% business usage test in the second year, no cost recovery will be recaptured.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

43

Property used for the production of income is not eligible for § 179 expensing.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

44

Under the MACRS straight-line election for personalty, only the half-year convention is applicable.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

45

The "luxury auto" cost recovery limits change if mid-quarter cost recovery is used.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

46

If an automobile is placed in service in 2016, the limitation for cost recovery in 2018 will be based on the cost recovery limits for the year 2016.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

47

The factor for determining the cost recovery for eligible real estate under MACRS, in the year of disposition, is taken from the month of the disposition.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

48

The luxury auto cost recovery limits applies to all automobiles.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

49

Any § 179 expense amount that is carried forward is subject to the business income limitation in the carryforward year.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

50

The § 179 limit for a sports utility vehicle with a GVW of 7,000 pounds will not apply if the sports utility vehicle is used as a taxi.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

51

Residential rental real estate includes property where 80% or more of the net rental revenues are from nontransient dwelling units.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

52

The inclusion amount for a leased automobile is adjusted by a business usage percentage.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

53

Once the more-than-50% business usage test is passed for listed property, it still matters if the business usage for the property drops to 50% or less during the recovery period.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

54

All listed property is subject to the substantiation requirements of § 274.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

55

Motel buildings have a cost recovery period of 27.5 years.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

56

For a new car that is used predominantly in business, the "luxury auto" limit depends on whether the taxpayer takes MACRS or straight-line depreciation.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

57

The basis of an asset on which $20,000 has been expensed under § 179 will be reduced by $20,000, even if $20,000 cannot be expensed in the current year because of the taxable income limitation.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

58

Taxable income for purposes of § 179 limited expensing is computed by including the MACRS deduction.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

59

For personal property placed in service in 2016, the § 179 maximum deduction is limited to $500,000.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

60

The § 179 deduction can exceed $500,000 in 2016 if the taxpayer had a § 179 amount which exceeded the taxable income limitation in the prior year.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

61

An election to use straight-line under ADS is made on an asset-by-asset basis for property other than eligible real estate.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

62

On December 16, 2016, the directors of Quail Corporation (an accrual basis, calendar year taxpayer) authorized a cash donation of $5,000 to the American Cancer Society, a qualified charity. The payment, which is made on April 11, 2017, may be claimed as a deduction for tax year 2016.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

63

Under the alternative depreciation system (ADS), the half-year convention must be used for personalty.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

64

The cost of a covenant not to complete for 10 years incurred in connection with the acquisition of a business is amortized over 10 years.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

65

Cost depletion is determined by multiplying the depletion cost per unit by the number of units sold.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

66

For real property, the ADS convention is the mid-month convention.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

67

Percentage depletion enables the taxpayer to recover more than the cost of an asset in the form of tax deductions.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

68

In the current year, Oriole Corporation donated a painting worth $30,000 to the Texas Art Museum, a qualified public charity. The museum included the painting in its permanent collection. Oriole Corporation purchased the painting 5 years ago for $10,000. Oriole's charitable contribution deduction is $30,000 (ignoring the taxable income limitation).

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

69

Petal, Inc. is an accrual basis taxpayer. Petal uses the aging approach to calculate the reserve for bad debts. During 2016, the following occur associated with bad debts.

The amount of the deduction for bad debt expense for Petal for 2016 is:

A)$10,000.

B)$12,000.

C)$22,000.

D)$140,000.

E)None of the above.

The amount of the deduction for bad debt expense for Petal for 2016 is:

A)$10,000.

B)$12,000.

C)$22,000.

D)$140,000.

E)None of the above.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

70

Intangible drilling costs must be capitalized and recovered through depletion.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

71

MACRS depreciation is used to compute earnings and profits.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

72

Payments by a cash basis taxpayer of capital expenditures:

A)Must be expensed at the time of payment.

B)Must be expensed by the end of the first year after the asset is acquired.

C)Must be deducted over the actual or statutory life of the asset.

D)Can be deducted in the year the taxpayer chooses.

E)None of the above.

A)Must be expensed at the time of payment.

B)Must be expensed by the end of the first year after the asset is acquired.

C)Must be deducted over the actual or statutory life of the asset.

D)Can be deducted in the year the taxpayer chooses.

E)None of the above.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

73

Crow Corporation, a C corporation, donated scientific property (basis of $30,000, fair market value of $50,000) to State University, a qualified charitable organization, to be used in research. Crow had held the property for four months as inventory. Crow Corporation may deduct $50,000 for the charitable contribution (ignoring the taxable income limitation).

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

74

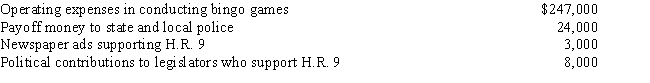

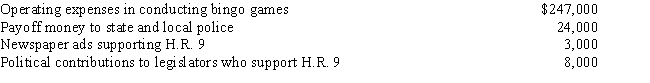

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2016, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2016, Rex had the following expenses:

Of these expenditures, Rex may deduct:

A)$247,000.

B)$250,000.

C)$258,000.

D)$282,000.

E)None of the above.

Of these expenditures, Rex may deduct:

A)$247,000.

B)$250,000.

C)$258,000.

D)$282,000.

E)None of the above.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following may be deductible?

A)Bribes that relate to a U.S. business.

B)Fines paid for violations of the law.

C)Interest on a loan used in a hobby.

D)All of the above.

E)None of the above.

A)Bribes that relate to a U.S. business.

B)Fines paid for violations of the law.

C)Interest on a loan used in a hobby.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

76

Goodwill associated with the acquisition of a business cannot be amortized.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

77

Heron Corporation, a calendar year C corporation, had an excess charitable contribution for 2015 of $5,000. In 2016, Heron made a further charitable contribution of $20,000. Heron's 2016 deduction is limited to $15,000 (10% of taxable income). The 2016 contribution must be applied first against the $15,000 limitation.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

78

A purchased trademark is a § 197 intangible.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

79

A taxpayer may elect to use the alternative depreciation system (ADS) to compute depreciation for earnings and profits.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck

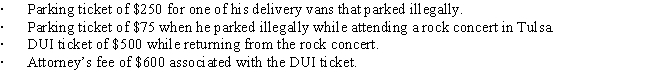

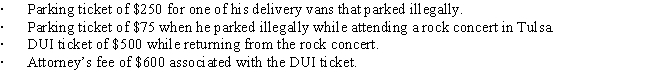

80

Andrew, who operates a laundry business, incurred the following expenses during the year.

What amount can Andrew deduct for these expenses?

A)$0.

B)$250.

C)$600.

D)$1,425.

E)None of the above.

What amount can Andrew deduct for these expenses?

A)$0.

B)$250.

C)$600.

D)$1,425.

E)None of the above.

Unlock Deck

Unlock for access to all 208 flashcards in this deck.

Unlock Deck

k this deck