Deck 11: Individuals As Employees and Proprietors

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/197

Play

Full screen (f)

Deck 11: Individuals As Employees and Proprietors

1

One indicia of independent contractor (rather than employee) status is when the individual performing the services is paid based on time spent (rather than on tasks performed).

False

2

Jake performs services for Maude. If Maude provides a helper and tools, this is indicative of independent contractor (rather than employee) status.

False

3

If an individual is subject to the direction or control of another only to the extent of the end result but not as to the means of accomplishment, an employer-employee relationship does not exist.

True

4

Zork Corporation was very profitable and had accumulated excess cash. The company decided to repurchase some of its bonds that had been issued for $1,000,000. Because of an increase in market interest rates, Zork was able to retire the bonds for $900,000. The company is not required to recognize $100,000 of income from the discharge of its indebtedness but must reduce the basis in its assets.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

5

Nicole's employer pays her $150 per month towards the cost of parking near a railway station where Nicole catches the train to work. The employer also pays the cost of the rail pass, $75 per month. Nicole can exclude both of these payments from her gross income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

6

In some cases it may be appropriate for a taxpayer to report work-related expenses by using both Form 2106 and Schedule C.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

7

Mauve Company permits employees to occasionally use the copying machine for personal purposes. The copying machine is located in the office where the higher paid executives work, so they occasionally use the machine. However, the machine is not convenient for use by the lower paid warehouse employees and, thus, they never use the copier. The use of the copy machine may not be excluded from gross income because the benefit is discriminatory.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

8

Fresh Bakery often has unsold donuts at the end of the day. The bakery allows employees to take the leftovers home. The employees are not required to recognize gross income because the bakery does not incur any additional cost.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

9

Carla is a deputy sheriff. Her employer requires that she live in the county where she is employed. Housing is very expensive; so the county agreed to pay her $4,800 per year to cover the higher cost of housing. Carla must include the housing supplement in her gross income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

10

For a person who is in the 35% marginal tax bracket, $1,000 of tax-exempt income is equivalent to $1,350 of income that is subject to tax.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

11

Sarah's employer pays the hospitalization insurance premiums for a policy that covers all employees and retired former employees. After Sarah retires, the hospital insurance premiums paid for her by her employer can be excluded from her gross income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

12

Meg's employer carries insurance on its employees that will pay an employee his or her regular salary while the employee is away from work due to illness. The premiums for Meg's coverage were $1,800. Meg was absent from work for two months as a result of a kidney infection. Meg's employer's insurance company paid Meg's regular salary of $8,000 while she was away from work. Meg also collected $2,000 on a wage continuation policy she had purchased. Meg must include $11,800 in her gross income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

13

Employees of a CPA firm located in Maryland may exclude from gross income the meals and lodging provided by the employer while they were on an audit in Delaware.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

14

If an employer pays for the employee's long-term care insurance premiums, the employee can exclude from gross income the premiums but all of the benefits collected must be included in gross income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

15

A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of tolls and parking.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

16

Roger is in the 35% marginal tax bracket. Roger's employer has created a flexible spending account for medical and dental expenses that are not covered by the company's health insurance plan. Roger had his salary reduced by $1,200 during the year for contributions to the flexible spending plan. However, Roger incurred only $1,100 in actual expenses for which he was reimbursed. Under the plan, he must forfeit the $100 unused amount. His after-tax cost of overfunding the plan is $65.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

17

The work-related expenses of an independent contractor will be subject to the 2%-of-AGI floor.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

18

A U.S. citizen who works in France from February 1, 2016 until January 31, 2017 is eligible for the foreign earned income exclusion in 2016 and 2017.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

19

In choosing between the actual expense method and the automatic mileage method, a taxpayer should consider the cost of insurance on the automobile.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

20

Generally, a U.S. citizen is required to include in gross income the salary and wages earned while working in a foreign country even if the foreign country taxes the income.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

21

In November 2016, Katie incurs unreimbursed moving expenses to accept a new job. Katie cannot deduct any of these expenses when she timely files her 2016 income tax return since she has not yet satisfied the 39-week time test.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

22

Alexis (a CPA) sold her public accounting practice in Des Moines and accepted a job with the Seattle office of a national accounting firm. Her moving expenses are not deductible because she has changed employment status (i.e., went from self-employed to employee).

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

23

Liam just graduated from college. Because it is his first job, the cost of moving his personal belongings from his parents' home to the job site does not qualify for the moving expense deduction.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

24

Lloyd, a practicing CPA, pays tuition to attend law school. Since a law degree involves education leading to a new trade or business, the tuition is not deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

25

Qualified moving expenses include the cost of lodging but not meals during the move.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

26

A moving expense deduction is allowed even if at the time of the move the taxpayer did not have a job at the new location.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

27

Bob lives and works in Newark, NJ. He travels to London for a three-day business meeting, after which he spends three days touring Scotland. All of his air fare is deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

28

An education expense deduction may be allowed even if the education results in a promotion or pay raise for the employee.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

29

In May 2016, after 11 months on a new job, Ken is fired after he assaults a customer. Ken must include in his gross income for 2016 any deduction for moving expenses he may have claimed on his 2015 tax return.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

30

Amy lives and works in St. Louis. In the morning she flies to Boston, has a three-hour business meeting, and returns to St. Louis that evening. For tax purposes, Amy was away from home.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

31

James has a job that compels him to go to many different states during the year. It is possible that James was never away from his tax home during the year.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

32

Once the actual cost method is used, a taxpayer cannot change to the automatic mileage method in a later year.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

33

Kelly, an unemployed architect, moves from Boston to Phoenix to accept a job as a chef at a restaurant. Kelly's moving expenses are not deductible because her new job is in a different trade or business.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

34

Eileen lives and works in Mobile. She travels to Rome for an eight-day business meeting, after which she spends two days touring Italy. All of Eileen's airfare is deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

35

A taxpayer who lives and works in Kansas City is sent to Chicago on an eight-day business trip. While in Chicago, taxpayer uses the hotel valet service to have some laundry done. The valet charge is a nondeductible personal travel expense.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

36

The tax law specifically provides that a taxpayer cannot be temporarily away from home for any period of employment that exceeds one year.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

37

For tax purposes, "travel" is a broader classification than "transportation."

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

38

A taxpayer who uses the automatic mileage method for the business use of an automobile can change to the actual cost method in a later year.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

39

Sick of her 65 mile daily commute, Edna purchases a condo that is only four miles from her job. Edna's moving expenses to her new condo are not allowed and cannot be claimed by her as a deduction.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

40

A taxpayer who lives and works in Tulsa travels to Buffalo for five days. If three days are spent on business and two days are spent on visiting relatives, only 60% of the airfare is deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

41

Under the simplified method, the maximum office in the home deduction allowed is the greater of $1,500 or the office square feet × $5.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

42

Tired of renting, Dr. Smith buys the academic robes she will wear at her college's graduation procession. The cost of this attire does not qualify as a uniform expense.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

43

On their birthdays, Lily sends gift certificates (each valued at $25) to Caden (a key client) and to each of Caden's two minor children. Lily can deduct only $25 as to these gifts.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

44

Frank, a recently retired FBI agent, pays job search expenses to obtain a position with a city police department. Frank's job search expenses do qualify as deductions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

45

If the cost of uniforms is deductible, their maintenance cost (e.g., laundry, dry cleaning, alterations) also is deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

46

Only self-employed individuals are required to make estimated tax payments.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

47

For tax year 2015, Taylor used the simplified method of determining her office in the home deduction. For 2016, Taylor must continue to use the simplified method and cannot switch to the regular (actual expense) method.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

48

Qualifying job search expenses are deductible even if the taxpayer does not change jobs.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

49

Under the right circumstances, a taxpayer's meals and lodging expense can qualify as a deductible education expense.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

50

The base amount for the Social Security portion (old age, survivors, and disability insurance) is different from that for the Medicare portion of FICA.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

51

By itself, credit card receipts will not constitute adequate substantiation for travel expenses.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

52

If a taxpayer does not own a home but rents an apartment, the office in the home deduction is not available.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

53

Both traditional and Roth IRAs possess the advantage of tax-free accumulation of income within the plan.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

54

A taxpayer who claims the standard deduction will not be able to claim an office in the home deduction.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

55

After graduating from college with a degree in chemistry, Alberto obtains a job as a chemist with DuPont. Alberto's job search expenses qualify as deductions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

56

Ethan, a bachelor with no immediate family, uses the Pine Shadows Country Club exclusively for his business entertaining. All of Ethan's annual dues for his club membership are deductible.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

57

Madison is an instructor of fine arts at a local community college. If she spends $600 (not reimbursed) on art supplies for her classes, $250 of this amount can be claimed as a deduction for AGI.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

58

Jackson gives his supervisor and her husband each a $30 box of chocolates at Christmas. Jackson may claim only $25 as a deduction.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

59

Travis holds rights to a skybox (containing 10 seats) at Memorial Stadium which he uses to entertain key clients. At one sporting event, he took only six clients since three were ill. Even so, Travis may still deduct the appropriate cost of all ten seats.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

60

Under the regular (actual expense) method, the portion of the office in the home deduction that exceeds the income from the business can be carried over to future years.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

61

A participant has an adjusted basis of $0 in any nondeductible contributions to a traditional IRA.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

62

If a married taxpayer is an active participant in another qualified retirement plan, the traditional IRA deduction phaseout begins at $98,000 of AGI for a joint return in 2016.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

63

An individual, age 40, who is not subject to the phase-out provision may contribute a nondeductible amount to a Roth IRA up to $5,500 per year in 2016.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

64

A worker may prefer to be treated as an independent contractor (rather than an employee) for which of the following reasons:

A)Avoids the cutback adjustment as to business meals.

B)All of the self-employment tax is deductible for income tax purposes.

C)Work-related expenses are not subject to the 2%-of-AGI floor.

D)A Schedule C does not have to be filed.

E)None of these.

A)Avoids the cutback adjustment as to business meals.

B)All of the self-employment tax is deductible for income tax purposes.

C)Work-related expenses are not subject to the 2%-of-AGI floor.

D)A Schedule C does not have to be filed.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

65

Which, if any, of the following factors is not a characteristic of independent contractor status?

A)Work-related expenses are reported on Form 2106.

B)Receipt of a Form 1099 reporting payments received.

C)Workplace fringe benefits are not available.

D)Services are performed for more than one party.

E)None of these.

A)Work-related expenses are reported on Form 2106.

B)Receipt of a Form 1099 reporting payments received.

C)Workplace fringe benefits are not available.

D)Services are performed for more than one party.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

66

A participant who is at least age 59 1/2 can make a tax-free qualified withdrawal from a Roth IRA after a five-year holding period.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

67

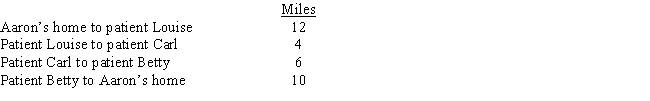

Aaron is a self-employed practical nurse who works out of his home. He provides nursing care for disabled persons living in their residences. During the day he drives his car as follows.

Aaron's deductible mileage for each workday is:

A)10 miles.

B)12 miles.

C)20 miles.

D)22 miles.

E)32 miles.

Aaron's deductible mileage for each workday is:

A)10 miles.

B)12 miles.

C)20 miles.

D)22 miles.

E)32 miles.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

68

If an individual is ineligible to make a deductible contribution to a traditional IRA, nondeductible contributions of any amount can be made to a traditional IRA.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

69

Distributions from a Roth IRA that are subject to taxation are treated first as from earnings and last as from contributions.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

70

Jordan performs services for Ryan. Which, if any, of the following factors indicate that Jordan is an independent contractor, rather than an employee?

A)Ryan sets the work schedule.

B)Ryan provides the tools used.

C)Jordan files a Form 2106 with his Form 1040.

D)Jordan is paid based on tasks performed.

E)None of these.

A)Ryan sets the work schedule.

B)Ryan provides the tools used.

C)Jordan files a Form 2106 with his Form 1040.

D)Jordan is paid based on tasks performed.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

71

A worker may prefer to be classified as an employee (rather than an independent contractor) for which of the following reasons:

A)To claim unreimbursed work-related expenses as a deduction for AGI.

B)To avoid the self-employment tax.

C)To avoid the cutback adjustment on unreimbursed business entertainment expenses.

D)To avoid the 2%-of-AGI floor on unreimbursed work-related expenses.

E)None of these.

A)To claim unreimbursed work-related expenses as a deduction for AGI.

B)To avoid the self-employment tax.

C)To avoid the cutback adjustment on unreimbursed business entertainment expenses.

D)To avoid the 2%-of-AGI floor on unreimbursed work-related expenses.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

72

Under the actual cost method, which, if any, of the following expenses will not be allowed?

A)Car registration fees.

B)Auto insurance.

C)Interest expense on a car loan (taxpayer is an employee).

D)Dues to auto clubs.

E)All of these will be allowed.

A)Car registration fees.

B)Auto insurance.

C)Interest expense on a car loan (taxpayer is an employee).

D)Dues to auto clubs.

E)All of these will be allowed.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

73

An individual is considered an active participant in an employer-sponsored retirement plan merely because an individual's spouse is an active participant for any part of a plan year in applying the IRA phase-out provision.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

74

When using the automatic mileage method, which, if any, of the following expenses also can be claimed?

A)Engine tune-up.

B)Parking.

C)Interest on automobile loan.

D)MACRS depreciation.

E)None of these.

A)Engine tune-up.

B)Parking.

C)Interest on automobile loan.

D)MACRS depreciation.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

75

Aiden performs services for Lucas. Which, if any, of the following factors indicate that Aiden is an employee, rather than an independent contractor?

A)Aiden provides his own support services (e.g., work assistants).

B)Aiden obtained his training (i.e., job skills) from his father.

C)Aiden is paid based on hours worked.

D)Aiden makes his services available to others.

E)None of these.

A)Aiden provides his own support services (e.g., work assistants).

B)Aiden obtained his training (i.e., job skills) from his father.

C)Aiden is paid based on hours worked.

D)Aiden makes his services available to others.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

76

Contributions to a Roth IRA can be made up to the due date (excluding extensions) of the taxpayer's income tax return.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

77

In which, if any, of the following situations is the automatic mileage available?

A)A limousine to be rented by the owner for special occasions (e.g., weddings, high school proms).

B)The auto belongs to taxpayer's mother.

C)One of seven cars used to deliver pizzas.

D)MACRS statutory percentage method has been claimed on the automobile.

E)None of these.

A)A limousine to be rented by the owner for special occasions (e.g., weddings, high school proms).

B)The auto belongs to taxpayer's mother.

C)One of seven cars used to deliver pizzas.

D)MACRS statutory percentage method has been claimed on the automobile.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

78

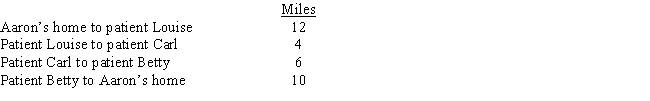

Corey is the city sales manager for "RIBS," a national fast food franchise. Every working day, Corey drives his car as follows:

Corey's deductible mileage is:

A)0 miles.

B)50 miles.

C)66 miles.

D)76 miles.

E)None of these.

Corey's deductible mileage is:

A)0 miles.

B)50 miles.

C)66 miles.

D)76 miles.

E)None of these.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

79

The maximum annual contribution to a Roth IRA for an unmarried taxpayer who is age 35 is the smaller of $5,500 or the individual's compensation for the year.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck

80

On February 1, 2016, Tuan withdrew $15,000 from his IRA #1. He deposited the funds back into IRA #1 within 60 days (a"rollover"). Tuan may do one more nontaxable rollover distribution from either IRA #1 or IRA #2 starting in April 2016.

Unlock Deck

Unlock for access to all 197 flashcards in this deck.

Unlock Deck

k this deck