Deck 12: Corporations: Organization, Capital Structure, and Operating Rules

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/141

Play

Full screen (f)

Deck 12: Corporations: Organization, Capital Structure, and Operating Rules

1

Employment taxes apply to all entity forms of operating a business. As a result, employment taxes are a neutral factor in selecting the most tax effective form of operating a business.

False

2

Hornbill Corporation, a cash basis and calendar year C corporation, was formed and began operations on May 1, 2016. Hornbill incurred the following expenses during its first year of operations (May 1 - December 31, 2016): temporary directors meeting expenses of $10,500, state of incorporation fee of $5,000, stock certificate printing expenses of $1,200, and legal fees for drafting corporate charter and bylaws of $7,500. Hornbill Corporation's current year deduction for organizational expenditures is $5,800.

True

3

Ed, an individual, incorporates two separate businesses that he owns by establishing two new C corporations. Each corporation generates taxable income of $50,000. As a general rule, each corporation will have a tax liability of $11,125.

True

4

A personal service corporation with taxable income of $100,000 will have a tax liability of $22,250.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

5

Lilac Corporation incurred $4,700 of legal and accounting fees associated with its incorporation. The $4,700 is deductible as startup expenditures on Lilac's tax return for the year in which it begins business.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

6

Carol and Candace are equal partners in Peach Partnership. In the current year, Peach had a net profit of $75,000 ($250,000 gross income - $175,000 operating expenses) and distributed $25,000 to each partner. Peach must pay tax on $75,000 of income.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

7

Because of the taxable income limitation, no dividends received deduction is allowed if a corporation has an NOL for the current taxable year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

8

Quail Corporation is a C corporation with net income of $125,000 during the current year. If Quail paid dividends of $25,000 to its shareholders, the corporation must pay tax on $100,000 of net income. Shareholders must report the $25,000 of dividends as income.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

9

Jake, the sole shareholder of Peach Corporation, a C corporation, has the corporation pay him $100,000. For income tax purposes, Jake would prefer to have the payment treated as dividend instead of salary.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

10

Tomas owns a sole proprietorship, and Lucy is the sole shareholder of a C corporation. In the current year both businesses make a net profit of $60,000. Neither business distributes any funds to the owners in the year. For the current year, Tomas must report $60,000 of income on his individual tax return, but Lucy is not required to report any income from the corporation on her individual tax return.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

11

No dividends received deduction is allowed unless the corporation has held the stock for more than 90 days.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

12

Double taxation of corporate income results because dividend distributions are included in a shareholder's gross income but are not deductible by the corporation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

13

Donald owns a 45% interest in a partnership that earned $130,000 in the current year. He also owns 45% of the stock in a C corporation that earned $130,000 during the year. Donald received $20,000 in distributions from each of the two entities during the year. With respect to this information, Donald must report $78,500 of income on his individual income tax return for the year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

14

Thrush Corporation files Form 1120, which reports taxable income of $200,000. The corporation's tax is $56,250.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

15

Azul Corporation, a calendar year C corporation, received a dividend of $30,000 from Naranja Corporation. Azul owns 25% of the Naranja Corporation stock. Assuming it is not subject to the taxable income limitation, Azul's dividends received deduction is $21,000.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

16

Eagle Company, a partnership, had a short-term capital loss of $10,000 during the year. Aaron, who owns 25% of Eagle, will report $2,500 of Eagle's short-term capital loss on his individual tax return.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

17

Don, the sole shareholder of Pastel Corporation (a C corporation), has the corporation pay him a salary of $600,000 in the current year. The Tax Court has held that $200,000 represents unreasonable compensation. Don must report a salary of $400,000 and a dividend of $200,000 on his individual tax return.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

18

Under the "check-the-box" Regulations, a two-owner LLC that fails to elect to be to treated as a corporation will be taxed as a sole proprietorship.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

19

Rajib is the sole shareholder of Robin Corporation, a calendar year S corporation. Robin earned net profit of $350,000 ($520,000 gross income - $170,000 operating expenses) and distributed $80,000 to Rajib. Rajib must report Robin Corporation profit of $350,000 on his Federal income tax return.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

20

The corporate marginal income tax rates range from 15% to 39%, while the individual marginal income tax rates range from 10% to 39.6%.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

21

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

22

A corporation must file a Federal income tax return even if it has no taxable income for the year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

23

Elk, a C corporation, has $370,000 operating income and $290,000 operating expenses during the year. In addition, Elk has a $10,000 long-term capital gain and a $17,000 short-term capital loss. Elk's taxable income is:

A)$63,000.

B)$73,000.

C)$80,000.

D)$90,000.

E)None of the above.

A)$63,000.

B)$73,000.

C)$80,000.

D)$90,000.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

24

Norma formed Hyacinth Enterprises, a proprietorship, in 2016. In its first year, Hyacinth had operating income of $400,000 and operating expenses of $240,000. In addition, Hyacinth had a long-term capital loss of $10,000. Norma, the proprietor of Hyacinth Enterprises, withdrew $75,000 from Hyacinth during the year. Assuming Norma has no other capital gains or losses , and ignoring any self-employment taxes, how does this information affect her adjusted gross income for 2016?

A)Increases Norma's adjusted gross income by $157,000 ($160,000 ordinary business income - $3,000 long-term capital loss).

B)Increases Norma's adjusted gross income by $150,000 ($160,000 ordinary business income - $10,000 long-term capital loss).

C)Increases Norma's adjusted gross income by $75,000.

D)Increases Norma's adjusted gross income by $160,000.

E)None of the above.

A)Increases Norma's adjusted gross income by $157,000 ($160,000 ordinary business income - $3,000 long-term capital loss).

B)Increases Norma's adjusted gross income by $150,000 ($160,000 ordinary business income - $10,000 long-term capital loss).

C)Increases Norma's adjusted gross income by $75,000.

D)Increases Norma's adjusted gross income by $160,000.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

25

On December 31, 2016, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president (a cash basis taxpayer), who owns 75% of the corporation's outstanding stock. The $50,000 bonus is paid to the president on February 2, 2017. For Flamingo's 2016 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

26

An expense that is deducted in computing net income per books but not deductible in computing taxable income is a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

27

Bjorn owns a 60% interest in an S corporation that earned $150,000 in 2016. He also owns 60% of the stock in a C corporation that earned $150,000 during the year. The S corporation distributed $30,000 to Bjorn and the C corporation paid dividends of $30,000 to Bjorn. How much income must Bjorn report from these businesses?

A)$0 income from the S corporation and $30,000 income from the C corporation.

B)$30,000 income from the S corporation and $30,000 of dividend income from the C corporation.

C)$90,000 income from the S corporation and $0 income from the C corporation.

D)$90,000 income from the S corporation and $30,000 income from the C corporation.

E)None of the above.

A)$0 income from the S corporation and $30,000 income from the C corporation.

B)$30,000 income from the S corporation and $30,000 of dividend income from the C corporation.

C)$90,000 income from the S corporation and $0 income from the C corporation.

D)$90,000 income from the S corporation and $30,000 income from the C corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements is incorrect about LLCs and the check-the-box Regulations?

A)If a limited liability company with more than one owner does not make an election, the entity is taxed as a corporation.

B)All 50 states have passed laws that allow LLCs.

C)An entity with more than one owner and formed as a corporation cannot elect to be taxed as a partnership.

D)If a limited liability company with one owner does not make an election, the entity is taxed as a sole proprietorship.

E)A limited liability company with one owner can elect to be taxed as a corporation.

A)If a limited liability company with more than one owner does not make an election, the entity is taxed as a corporation.

B)All 50 states have passed laws that allow LLCs.

C)An entity with more than one owner and formed as a corporation cannot elect to be taxed as a partnership.

D)If a limited liability company with one owner does not make an election, the entity is taxed as a sole proprietorship.

E)A limited liability company with one owner can elect to be taxed as a corporation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

29

Juanita owns 60% of the stock in a C corporation that had a profit of $200,000 in 2016. Carlos owns a 60% interest in a partnership that had a profit of $200,000 during the year. The corporation distributed $45,000 to Juanita, and the partnership distributed $45,000 to Carlos. Which of the following statements relating to 2016 is incorrect?

A)Juanita must report $120,000 of income from the corporation.

B)The corporation must pay corporate tax on $200,000 of income.

C)Carlos must report $120,000 of income from the partnership.

D)The partnership is not subject to a Federal entity-level income tax.

E)None of the above.

A)Juanita must report $120,000 of income from the corporation.

B)The corporation must pay corporate tax on $200,000 of income.

C)Carlos must report $120,000 of income from the partnership.

D)The partnership is not subject to a Federal entity-level income tax.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

30

Rachel is the sole member of an LLC, and Jordan is the sole shareholder of a C corporation. Both businesses were started in the current year, and each business has a long-term capital gain of $10,000 for the year. Neither business made any distributions during the year. With respect to this information, which of the following statements is correct?

A)The C corporation receives a preferential tax rate on the LTCG of $10,000.

B)The LLC must pay corporate tax on taxable income of $10,000.

C)Jordan must report $10,000 of LTCG on his tax return.

D)Rachel must report $10,000 of LTCG on her tax return.

E)None of the above.

A)The C corporation receives a preferential tax rate on the LTCG of $10,000.

B)The LLC must pay corporate tax on taxable income of $10,000.

C)Jordan must report $10,000 of LTCG on his tax return.

D)Rachel must report $10,000 of LTCG on her tax return.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

31

A calendar year C corporation can receive an automatic 9-month extension to file its corporate return (Form 1120) by timely filing a Form 7004 for the tax year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

32

Schedule M-1 is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

33

Lucinda is a 60% shareholder in Rhea Corporation, a calendar year S corporation. During the year, Rhea Corporation had gross income of $550,000 and operating expenses of $380,000. In addition, the corporation sold land that had been held for investment purposes for a short-term capital gain of $30,000. During the year, Rhea Corporation distributed $50,000 to Lucinda. With respect to this information, which of the following statements is correct?

A)Rhea Corporation will pay tax on taxable income of $200,000.

B)Lucinda reports ordinary income of $50,000.

C)Lucinda reports ordinary income of $120,000.

D)Lucinda reports ordinary income of $102,000 and a short-term capital gain of $18,000.

E)None of the above.

A)Rhea Corporation will pay tax on taxable income of $200,000.

B)Lucinda reports ordinary income of $50,000.

C)Lucinda reports ordinary income of $120,000.

D)Lucinda reports ordinary income of $102,000 and a short-term capital gain of $18,000.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

34

Schedule M-3 is similar to Schedule M-1 in that the form is designed to reconcile net income per books with taxable income. However, an objective of Schedule M-3 is more transparency between financial statements and tax returns than that provided by Schedule M-1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

35

Income that is included in net income per books but not included in taxable income is a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

36

For purposes of the estimated tax payment rules, a "large corporation" is defined as a corporation that had taxable income of $1 million or more in any of the three preceding years.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

37

Pablo, a sole proprietor, sold stock held as an investment for a $40,000 long-term capital gain. Pablo's marginal tax rate is 33%. Loon Corporation, a C corporation, sold stock held as an investment for a $40,000 long-term capital gain. Loon's marginal tax rate is 35%. What tax rates are applicable to these capital gains?

A)15% rate applies to Pablo and 35% rate applies to Loon.

B)15% rate applies to Loon and 33% rate applies to Pablo.

C)35% rate applies to Loon and 33% rate applies to Pablo.

D)15% rate applies to both Pablo and Loon.

E)None of the above.

A)15% rate applies to Pablo and 35% rate applies to Loon.

B)15% rate applies to Loon and 33% rate applies to Pablo.

C)35% rate applies to Loon and 33% rate applies to Pablo.

D)15% rate applies to both Pablo and Loon.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

38

A corporation with $5 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

39

Red Corporation, which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of $40,000. Red takes a dividends received deduction of $28,000. Which of the following statements is correct?

A)Red owns 80% of Blue Corporation.

B)Red owns 20% or more, but less than 80% of Blue Corporation.

C)Red owns 80% or more of Blue Corporation.

D)Red owns less than 20% of Blue Corporation.

E)None of the above.

A)Red owns 80% of Blue Corporation.

B)Red owns 20% or more, but less than 80% of Blue Corporation.

C)Red owns 80% or more of Blue Corporation.

D)Red owns less than 20% of Blue Corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

40

Flycatcher Corporation, a C corporation, has two equal individual shareholders, Nancy and Pasqual. In the current year, Flycatcher earned $100,000 net profit and paid a dividend of $10,000 to each shareholder. Regardless of any tax consequences resulting from their interests in Flycatcher, Nancy is in the 33% marginal tax bracket and Pasqual is in the 15% marginal tax bracket. With respect to the current year, which of the following statements is incorrect?

A)Flycatcher cannot avoid the corporate tax altogether by distributing all $100,000 of net profit as dividends to the shareholders.

B)Nancy incurs income tax of $1,500 on her dividend income.

C)Pasqual incurs income tax of $1,500 on his dividend income.

D)Flycatcher pays corporate tax of $22,250.

E)None of the above.

A)Flycatcher cannot avoid the corporate tax altogether by distributing all $100,000 of net profit as dividends to the shareholders.

B)Nancy incurs income tax of $1,500 on her dividend income.

C)Pasqual incurs income tax of $1,500 on his dividend income.

D)Flycatcher pays corporate tax of $22,250.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

41

Nancy Smith is the sole shareholder and employee of White Corporation, a C corporation that is engaged exclusively in accounting services. During the current year, White has operating income of $320,000 and operating expenses (excluding salary) of $150,000. Further, White Corporation pays Nancy a salary of $100,000. The salary is reasonable in amount and Nancy is in the 33% marginal tax bracket irrespective of any income from White. Assuming that White Corporation distributes all after-tax income as dividends, how much total combined income tax do White and Nancy pay in the current year? (Ignore any employment tax considerations.)

A)$56,125

B)$64,325

C)$67,625

D)$84,000

E)None of the above

A)$56,125

B)$64,325

C)$67,625

D)$84,000

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

42

Amber Company has $100,000 in net income in the current year before deducting any compensation or other payment to its sole owner, Alfredo. Assume that Alfredo is in the 33% marginal tax bracket. Discuss the tax aspects of each of the following independent situations. (Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

a.Alfredo operates Amber Company as a proprietorship.

b.Alfredo incorporates Amber Company and pays himself no salary and no dividend.

c.Alfredo incorporates Amber Company and pays himself a $50,000 salary and a dividend of $42,500 ($50,000 - $7,500 corporate income tax).

a.Alfredo operates Amber Company as a proprietorship.

b.Alfredo incorporates Amber Company and pays himself no salary and no dividend.

c.Alfredo incorporates Amber Company and pays himself a $50,000 salary and a dividend of $42,500 ($50,000 - $7,500 corporate income tax).

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements is incorrect regarding the taxation of C corporations?

A)Similar to those applicable to individuals, the marginal tax rate brackets for corporations are adjusted for inflation.

B)Taxable income of a personal service corporation is taxed at a flat rate of 35%.

C)A tax return must be filed whether or not the corporation has taxable income.

D)The highest corporate marginal tax rate is 39%.

E)None of the above.

A)Similar to those applicable to individuals, the marginal tax rate brackets for corporations are adjusted for inflation.

B)Taxable income of a personal service corporation is taxed at a flat rate of 35%.

C)A tax return must be filed whether or not the corporation has taxable income.

D)The highest corporate marginal tax rate is 39%.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

44

During the current year, Skylark Company had operating income of $420,000 and operating expenses of $250,000. In addition, Skylark had a long-term capital loss of $20,000, and a charitable contribution of $5,000. How does Toby, the sole owner of Skylark Company, report this information on his individual income tax return under following assumptions?

a.Skylark is an LLC, and Toby does not withdraw any funds from the company during the year.

b.Skylark is an S corporation, and Toby does not withdraw any funds from the company during the year.

c.Skylark is a regular (C) corporation, and Toby does not withdraw any funds from the company during the year.

a.Skylark is an LLC, and Toby does not withdraw any funds from the company during the year.

b.Skylark is an S corporation, and Toby does not withdraw any funds from the company during the year.

c.Skylark is a regular (C) corporation, and Toby does not withdraw any funds from the company during the year.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

45

Copper Corporation owns stock in Bronze Corporation and has net operating income of $900,000 for the year. Bronze Corporation pays Copper a dividend of $150,000. What amount of dividends received deduction may Copper claim if it owns 85% of Bronze stock (assuming Copper's dividends received deduction is not limited by its taxable income)?

A)$97,500

B)$105,000

C)$120,000

D)$150,000

E)None of the above

A)$97,500

B)$105,000

C)$120,000

D)$150,000

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

46

In a § 351 transfer, a shareholder receives boot of $10,000 but ends up with a realized loss of $3,000. Only $7,000 of the boot will be taxed to the shareholder.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

47

Orange Corporation owns stock in White Corporation and has net operating income of $400,000 for the year. White Corporation pays Orange a dividend of $60,000. What amount of dividends received deduction may Orange claim if it owns 45% of White stock (assuming Orange's dividends received deduction is not limited by its taxable income)?

A)$27,000

B)$42,000

C)$48,000

D)$60,000

E)None of the above

A)$27,000

B)$42,000

C)$48,000

D)$60,000

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

48

Similar to like-kind exchanges, the receipt of "boot" under § 351 can cause loss to be recognized.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

49

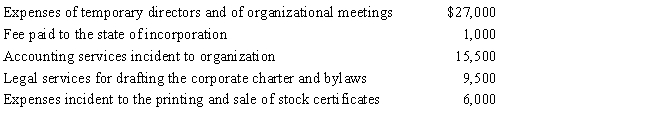

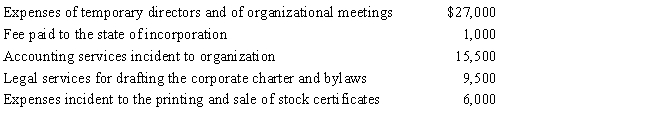

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2016. The following expenses were incurred during the first tax year (April 1 through December 31, 2016) of operations.

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2016?

A)$0

B)$4,550

C)$5,000

D)$7,400

E)None of the above

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2016?

A)$0

B)$4,550

C)$5,000

D)$7,400

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

50

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income. Which of the following items is an addition on Schedule M-1?

A)Domestic production activities deduction.

B)Proceeds of life insurance paid on death of key employee.

C)Excess of capital losses over capital gains.

D)Tax-exempt interest.

E)None of the above.

A)Domestic production activities deduction.

B)Proceeds of life insurance paid on death of key employee.

C)Excess of capital losses over capital gains.

D)Tax-exempt interest.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

51

Eagle Corporation owns stock in Hawk Corporation and has taxable income of $100,000 for the year before considering the dividends received deduction. Hawk Corporation pays Eagle a dividend of $130,000, which was considered in calculating the $100,000. What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock?

A)$0

B)$70,000

C)$91,000

D)$104,000

E)None of the above

A)$0

B)$70,000

C)$91,000

D)$104,000

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

52

Similar to the like-kind exchange provision, § 351 can be partly justified under the wherewithal to pay concept.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is correct regarding the taxation of C corporations?

A)Schedule M-2 is used to reconcile net income computed for financial accounting purposes with taxable income reported on the corporation's tax return.

B)The corporate return is filed on Form 1120S.

C)Corporations can receive an automatic extension of nine months for filing the corporate return by filing Form 7004 by the due date for the return.

D)A corporation with total assets of $7.5 million or more is required to file Schedule M-3.

E)None of the above.

A)Schedule M-2 is used to reconcile net income computed for financial accounting purposes with taxable income reported on the corporation's tax return.

B)The corporate return is filed on Form 1120S.

C)Corporations can receive an automatic extension of nine months for filing the corporate return by filing Form 7004 by the due date for the return.

D)A corporation with total assets of $7.5 million or more is required to file Schedule M-3.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

54

Tina incorporates her sole proprietorship with assets having a fair market value of $100,000 and an adjusted basis of $110,000. Even though § 351 applies, Tina may recognize her realized loss of $10,000.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

55

Robin Corporation, a calendar year C corporation, had taxable income of $1.9 million, $1.2 million, and $900,000 for 2013, 2014, and 2015, respectively. Robin has taxable income of $1.5 million for 2016. The minimum 2016 estimated tax installment payments for Robin are:

A)April 15, 2016, $76,500; June 15, 2016, $76,500; September 15, 2016, $76,500; December 15, 2016, $76,500.

B)April 15, 2016, $110,500; June 15, 2016, $127,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

C)April 15, 2016, $127,500; June 15, 2016, $127,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

D)April 15, 2016, $76,500; June 15, 2016, $178,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

E)None of the above.

A)April 15, 2016, $76,500; June 15, 2016, $76,500; September 15, 2016, $76,500; December 15, 2016, $76,500.

B)April 15, 2016, $110,500; June 15, 2016, $127,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

C)April 15, 2016, $127,500; June 15, 2016, $127,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

D)April 15, 2016, $76,500; June 15, 2016, $178,500; September 15, 2016, $127,500; December 15, 2016, $127,500.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

56

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income. Which of the following items is a subtraction on Schedule M-1?

A)Book depreciation in excess of tax depreciation.

B)Excess of capital losses over capital gains.

C)Proceeds on key employee life insurance.

D)Income subject to tax but not recorded on the books.

E)None of the above.

A)Book depreciation in excess of tax depreciation.

B)Excess of capital losses over capital gains.

C)Proceeds on key employee life insurance.

D)Income subject to tax but not recorded on the books.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

57

During the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000. How much is Sparrow's tax liability for the year?

A)$42,650

B)$42,800

C)$45,650

D)$62,400

E)None of the above

A)$42,650

B)$42,800

C)$45,650

D)$62,400

E)None of the above

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

58

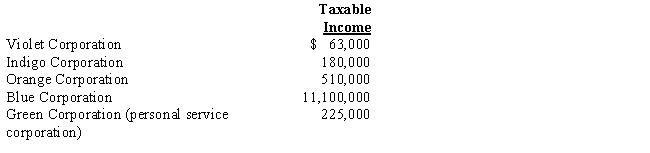

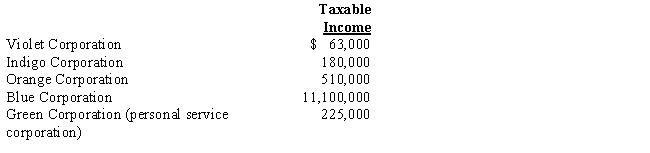

In each of the following independent situations, determine the corporation's income tax liability. Assume that all corporations use a calendar year 2016.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

59

During the current year, Coyote Corporation (a calendar year C corporation) has the following transactions:

a.Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b.Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

a.Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b.Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is incorrect regarding the dividends received deduction?

A)A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B)The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C)If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D)The taxable income limitation does not apply if the normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation.

E)None of the above.

A)A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B)The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C)If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D)The taxable income limitation does not apply if the normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

61

Allen transfers marketable securities with an adjusted basis of $120,000, fair market value of $300,000, for 85% of the stock of Heron Corporation. In addition, he receives cash of $40,000. Allen recognizes a capital gain of $40,000 on the transfer.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

62

A taxpayer may never recognize a loss on the transfer of property in a transaction subject to § 351.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

63

In a § 351 transaction, if a transferor receives consideration other than stock, the transaction can be taxable.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

64

A person who performs services for a corporation in exchange for stock cannot be treated as a member of the transferring group even if that person also transfers some property to the corporation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

65

Because services are not considered property under § 351, a taxpayer must report as income the fair market value of stock received for such services.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

66

In determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

67

Beth forms Lark Corporation with a transfer of appreciated property in exchange for all of its shares. Shortly thereafter, she transfers half her shares to her son, Ted. The later transfer to Ted could cause the original transfer to be taxable.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

68

The use of § 351 is not limited to the initial formation of a corporation, and it can apply to later transfers as well.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

69

Gabriella and Maria form Luster Corporation with each receiving 50 shares of its stock. Gabriella transfers cash of $50,000, while Maria transfers a proprietary formula (basis of $0; fair market value of $50,000). Neither Gabriella nor Maria will recognize gain on the transfer.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

70

A taxpayer transfers assets and liabilities to a corporation in return for its stock. If the liabilities exceed the basis of the assets transferred, the taxpayer will have a negative basis in the stock.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

71

The receipt of nonqualified preferred stock in exchange for the transfer of appreciated property to a controlled corporation results in recognition of gain to the transferor.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

72

The control requirement under § 351 requires that the person or persons transferring property to the corporation, immediately after the transfer, own stock possessing at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock of the corporation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

73

In order to retain the services of Eve, a key employee in Ted's sole proprietorship, Ted contracts with Eve to make her a 30% owner. Ted incorporates the business receiving in return 100% of the stock. Three days later, Ted transfers 30% of the stock to Eve. Under these circumstances, § 351 will not apply to the incorporation of Ted's business.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

74

For § 351 purposes, stock rights and stock warrants are included in the definition of "stock."

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

75

When consideration is transferred to a corporation in return for stock, the definition of "property" is important because tax deferral treatment of § 351 is available only to taxpayers who transfer property.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

76

If a transaction qualifies under § 351, any recognized gain is equal to the value of the boot received.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

77

When incorporating her sole proprietorship, Samantha transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

78

Because boot is generated under § 357(b) (i.e., the liability is not supported by a bona fide business purpose), the transferor shareholder will always have to recognize gain.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

79

The transfer of an installment obligation in a transaction qualifying under § 351 is a disposition of the obligation that causes gain to be recognized by the transferor.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

80

Ruth transfers property worth $200,000 (basis of $60,000) to Goldfinch Corporation. In return, she receives 80% of its stock (worth $180,000) and a long-term note, executed by Goldfinch and made payable to Ruth (worth $20,000). Ruth will recognize no gain on the transfer.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck