Deck 12: Mutual Funds and Exchange-Traded Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 12: Mutual Funds and Exchange-Traded Funds

1

Mutual fund investors delegate all of the following decisions to the fund's managers EXCEPT

A) which companies and industries to invest in.

B) when to buy and sell individual stocks.

C) how many securities to hold in the portfolio.

D) how to allocate investments among different classes of assets such as stocks, bonds, cash and real estate.

A) which companies and industries to invest in.

B) when to buy and sell individual stocks.

C) how many securities to hold in the portfolio.

D) how to allocate investments among different classes of assets such as stocks, bonds, cash and real estate.

D

2

Which of the following are advantages offered by mutual funds?

I) professional portfolio management

II) dividend reinvestment

III) consistent returns in excess of the overall market rate of return

IV) modest capital outlay for investors

A) I and II only

B) I and IV only

C) II, III and IV only

D) I, II and IV only

I) professional portfolio management

II) dividend reinvestment

III) consistent returns in excess of the overall market rate of return

IV) modest capital outlay for investors

A) I and II only

B) I and IV only

C) II, III and IV only

D) I, II and IV only

D

3

Which of the following statements best describes the legal organization of mutual funds?

A) Funds are organized as a single entity that handles all functions such as custody and investment decisions.

B) Funds split their basic functions such as record keeping and investment decisions among two or more companies.

C) Funds are owned by the company that manages them.

D) A distributor keeps track of investment and redemption requests from shareholders and maintains other shareholder records.

A) Funds are organized as a single entity that handles all functions such as custody and investment decisions.

B) Funds split their basic functions such as record keeping and investment decisions among two or more companies.

C) Funds are owned by the company that manages them.

D) A distributor keeps track of investment and redemption requests from shareholders and maintains other shareholder records.

B

4

One drawback of investing in mutual funds is the

A) annual management fee.

B) lack of liquidity of fund shares.

C) amount required for the initial investment.

D) lack of information on the performance of the fund.

A) annual management fee.

B) lack of liquidity of fund shares.

C) amount required for the initial investment.

D) lack of information on the performance of the fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

The discount or premium on a closed-end mutual fund can be as much as 25 percent.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

Mutual funds rank second only to banks as being the largest financial intermediary in the United States.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

Nearly all mutual funds operate as regulated investment companies. This means that

A) they are no-load funds.

B) portfolio decisions are mandated by government authorities.

C) they do not pay taxes on their income.

D) their investments are guaranteed by the FDIC.

A) they are no-load funds.

B) portfolio decisions are mandated by government authorities.

C) they do not pay taxes on their income.

D) their investments are guaranteed by the FDIC.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

The mutual fund market is dominated by funds that invest in diversified bond portfolios.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

To operate as a regulated investment company and enjoy the related tax benefits, a mutual fund must annually distribute to its shareholders

A) half of its realized capital gains, and interest and dividend income.

B) none of its realized capital gains, but all of its interest and dividend income.

C) all of its realized capital gains, and at least 90 percent of its interest and dividend income.

D) all of its realized capital gains and interest and dividend income.

A) half of its realized capital gains, and interest and dividend income.

B) none of its realized capital gains, but all of its interest and dividend income.

C) all of its realized capital gains, and at least 90 percent of its interest and dividend income.

D) all of its realized capital gains and interest and dividend income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

During the 7 year market cycle of 2006-2012, in which category of funds did a majority of funds outperform the market average?

A) large cap funds

B) small cap funds

C) asset allocation funds

D) In no category did a majority of funds outperform the market average.

A) large cap funds

B) small cap funds

C) asset allocation funds

D) In no category did a majority of funds outperform the market average.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

Investors purchase shares in an open end mutual fund directly from the fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

Mutual funds provide a simplified means of diversifying a portfolio.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

Mutual funds tend to outperform the market.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

When an investor buys shares in a mutual fund, he or she becomes a part owner of a portfolio of securities.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

Which one of the following statements concerning mutual funds is correct?

A) The selection of individual securities remains with the mutual fund investor.

B) Mutual funds were first created in the 1980s.

C) The mutual fund industry is the largest financial intermediary in the United States.

D) Mutual funds are generally highly concentrated portfolios.

A) The selection of individual securities remains with the mutual fund investor.

B) Mutual funds were first created in the 1980s.

C) The mutual fund industry is the largest financial intermediary in the United States.

D) Mutual funds are generally highly concentrated portfolios.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

The purchase price of a closed-end mutual fund is equivalent to the net asset value of the fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

What are some of the advantages of investing through mutual funds? Name at least three.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following statements is correct concerning players in the mutual fund industry?

A) Security analysts and traders work for the management company.

B) Normally a bank serves as the custodian.

C) The management company maintains the shareholder records.

D) The mutual fund shareholders are the owners of the management company.

A) Security analysts and traders work for the management company.

B) Normally a bank serves as the custodian.

C) The management company maintains the shareholder records.

D) The mutual fund shareholders are the owners of the management company.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

The transfer agent for a mutual fund physically safeguards the securities being bought and sold by that firm.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

The mutual fund, and not the investor, is responsible for all income taxes on capital gains and dividends earned by the fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

Like ordinary stocks, exchange traded funds (ETFs) can be sold short.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

A closed-end fund with an NAV of $9.60 and a market price of $10.25 is selling at a premium of 6.8%.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

Closed-end funds are required to provide a prospectus to all new shareholders as long as the fund is trading at a premium.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

Mutual fund fees are disclosed in the fund prospectus.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

Which one of the following statements concerning ETFs is correct?

A) ETFs are based solely on U.S. indexes.

B) The ETF based on the Standard & Poor's 500 Index is priced at 1/10 the value of that index.

C) Spiders are based on the DJIA.

D) The ETF based on the Dow is priced at 1/10 of the value of the DJIA.

A) ETFs are based solely on U.S. indexes.

B) The ETF based on the Standard & Poor's 500 Index is priced at 1/10 the value of that index.

C) Spiders are based on the DJIA.

D) The ETF based on the Dow is priced at 1/10 of the value of the DJIA.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

An open-end investment company

A) is involved in all trades of its shares.

B) sells shares at a discounted NAV price.

C) trades like a stock on the exchanges.

D) has a set number of shares.

A) is involved in all trades of its shares.

B) sells shares at a discounted NAV price.

C) trades like a stock on the exchanges.

D) has a set number of shares.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

Hedge funds are subject to the same regulations and disclosure requirements as mutual funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

The net asset value is the price per share an investor will pay to acquire shares in a no-load, open-end fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following characteristics apply to exchange traded funds (ETFs)?

I) unlimited number of outstanding shares

II) typically track the performance of some index

III) Market prices may be higher or lower than NAV.

IV) May invest in the whole index or use a sample of securities to track the index as closely as possible.

A) I and II only

B) II and III only

C) I, II and III only

D) I, II and IV only

I) unlimited number of outstanding shares

II) typically track the performance of some index

III) Market prices may be higher or lower than NAV.

IV) May invest in the whole index or use a sample of securities to track the index as closely as possible.

A) I and II only

B) II and III only

C) I, II and III only

D) I, II and IV only

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

As a general rule, the time to buy a closed-end mutual fund is when the fund's premium is approximately 5 percent higher than its past average.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Closed-end funds are

A) less liquid than open-end funds.

B) best purchased when they are selling at a premium.

C) purchased directly from the funds' manager.

D) traded at NAV.

A) less liquid than open-end funds.

B) best purchased when they are selling at a premium.

C) purchased directly from the funds' manager.

D) traded at NAV.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is(are) correct concerning exchange-traded funds (ETFs)?

I) You can buy and sell ETFs any time during trading hours.

II) ETFs are actively managed.

III) ETFs have high portfolio turnover rates.

IV) ETFs rarely distribute any capital gains.

A) I, II and IV only

B) I and IV only

C) II and III only

D) I, III and IV only

I) You can buy and sell ETFs any time during trading hours.

II) ETFs are actively managed.

III) ETFs have high portfolio turnover rates.

IV) ETFs rarely distribute any capital gains.

A) I, II and IV only

B) I and IV only

C) II and III only

D) I, III and IV only

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following characteristics apply to closed-end mutual funds?

I) unlimited number of outstanding shares

II) transactions between shareholders

III) Market prices may be higher or lower than NAV.

IV) Fund will repurchase shares at any time.

A) I and IV only

B) II and III only

C) I, II and III only

D) II, III and IV only

I) unlimited number of outstanding shares

II) transactions between shareholders

III) Market prices may be higher or lower than NAV.

IV) Fund will repurchase shares at any time.

A) I and IV only

B) II and III only

C) I, II and III only

D) II, III and IV only

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

Investors who buy or sell exchange-traded funds will do so at a price based on the closing price for the day.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

Most exchange-traded funds are index funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

A closed end fund is selling at a premium when the NAV exceeds the market price.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

Trading in closed-end investment companies takes place between investors in the open market.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

The longer you intend to hold a fund, the more willing you should be to accept a front-end load charge in exchange for lower annual management and 12(b)-1 fees.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

The commission charged when shares of an open-end mutual fund are purchased is called a

A) management fee.

B) back-end load.

C) front-end load.

D) 12(b)-1 fee.

A) management fee.

B) back-end load.

C) front-end load.

D) 12(b)-1 fee.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

The net asset value of a mutual fund increased from $12.03 to $13.53, but its price per share increased by only $1.26. This information indicates that the fund

A) paid out $1 in capital gains.

B) paid out $1 in dividends.

C) is a closed-end fund.

D) is an open-end fund.

A) paid out $1 in capital gains.

B) paid out $1 in dividends.

C) is a closed-end fund.

D) is an open-end fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

The maximum average maturity of the holdings within a money market account must be 6 months or less.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

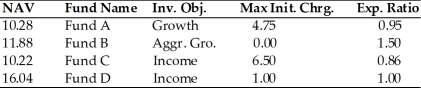

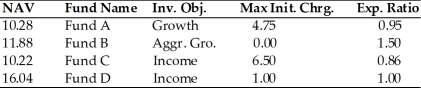

Use this information to answer the following questions.

(a) Which fund does NOT charge a front-end load?

(b) Which fund can best be described as a low-load fund?

(c) What can you say about Fund B with respect to the type of investments it most likely holds?

(d) If you want to buy a fund and hold it for five years, which one of these funds should you purchase based on fund costs? Assume the funds earn a positive rate of return each year.

(a) Which fund does NOT charge a front-end load?

(b) Which fund can best be described as a low-load fund?

(c) What can you say about Fund B with respect to the type of investments it most likely holds?

(d) If you want to buy a fund and hold it for five years, which one of these funds should you purchase based on fund costs? Assume the funds earn a positive rate of return each year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

An aggressive growth mutual fund is least likely to purchase a stock

A) with a high P/E ratio.

B) with a high anticipated rate of growth.

C) of an unseasoned firm.

D) with a high dividend yield.

A) with a high P/E ratio.

B) with a high anticipated rate of growth.

C) of an unseasoned firm.

D) with a high dividend yield.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

A unit investment trust

A) engages in short-term trading within a particular sector.

B) offers a low-cost, diversified portfolio.

C) is an unmanaged portfolio of securities.

D) is used only for fixed-income securities.

A) engages in short-term trading within a particular sector.

B) offers a low-cost, diversified portfolio.

C) is an unmanaged portfolio of securities.

D) is used only for fixed-income securities.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

The primary objective of growth mutual funds is capital appreciation with a high level of current income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

Mutual funds can carry a number of different types of sales charges and fees. Briefly explain the following such expenses.

(a) a front-end load

(b) a back-end load

(c) a 12(b)-1 fee

(a) a front-end load

(b) a back-end load

(c) a 12(b)-1 fee

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

Index funds merely attempt to match the performance of some benchmark, not to outperform it.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

Morningstar, a leading. mutual fund industry publication, classifies funds by the number of shareholders and the total amount of money invested in the fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

One characteristic of 12(b)-1 charges is that they are payable

A) only in years that the mutual fund shows an increase in net asset value.

B) each year regardless of the performance of the mutual fund.

C) only during the first year the fund is owned.

D) only when shares in the fund are sold.

A) only in years that the mutual fund shows an increase in net asset value.

B) each year regardless of the performance of the mutual fund.

C) only during the first year the fund is owned.

D) only when shares in the fund are sold.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is(are) correct concerning hedge funds?

I) They are highly regulated.

II) They hedge all positions to limit risks.

III) Management and other fees are extremely low compared to other types of funds.

IV) Access is limited to institutions and high net worth or high income individuals.

A) I, II and III only

B) II and IV only

C) IV only

D) I, II, III and, IV

I) They are highly regulated.

II) They hedge all positions to limit risks.

III) Management and other fees are extremely low compared to other types of funds.

IV) Access is limited to institutions and high net worth or high income individuals.

A) I, II and III only

B) II and IV only

C) IV only

D) I, II, III and, IV

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

Back-end loads

A) are charged when an investor buys their mutual fund shares.

B) are charged if an investor sells his or her shares within the first few years.

C) were designed to help no-load funds cover their marketing expenses.

D) encourage short-term trading.

A) are charged when an investor buys their mutual fund shares.

B) are charged if an investor sells his or her shares within the first few years.

C) were designed to help no-load funds cover their marketing expenses.

D) encourage short-term trading.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

What are the primary disadvantages of owning mutual fund shares?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

Investors in hedge funds have the legal status of

A) shareholders.

B) limited partners.

C) general partners.

D) trustees.

A) shareholders.

B) limited partners.

C) general partners.

D) trustees.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

Explain why closed-end funds can sell at prices other than the fund's NAV.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Risk-seeking investors seeking maximum capital appreciation with little, if any current income, should invest in

A) value funds.

B) growth funds.

C) aggressive growth funds.

D) equity-income funds.

A) value funds.

B) growth funds.

C) aggressive growth funds.

D) equity-income funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

A type of fund that invests in real estate and/or mortgages is known as a

A) REIT.

B) ETF.

C) sector fund.

D) hedge fund.

A) REIT.

B) ETF.

C) sector fund.

D) hedge fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

Which type of fund is always passively managed?

A) a closed-end fund

B) a growth fund

C) a value fund

D) an index fund

A) a closed-end fund

B) a growth fund

C) a value fund

D) an index fund

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

Performance fees based on profits earned by the fund are typical of

A) hedge funds.

B) exchange traded funds.

C) closed-end investment companies.

D) open end mutual funds.

A) hedge funds.

B) exchange traded funds.

C) closed-end investment companies.

D) open end mutual funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

Socially responsible funds only hold stocks of companies that meet the fund's ethical guidelines.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

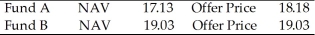

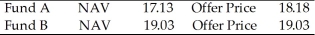

Two mutual funds are quoted as follows.  Given these quotes, which one of the following is true?

Given these quotes, which one of the following is true?

A) Both funds are load funds.

B) Fund A is a no-load fund.

C) Fund B is a no-load fund.

D) Both funds are no-load funds.

Given these quotes, which one of the following is true?

Given these quotes, which one of the following is true?A) Both funds are load funds.

B) Fund A is a no-load fund.

C) Fund B is a no-load fund.

D) Both funds are no-load funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

Automatic investment plans makes it easier for investors to save money.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

The primary objective of an equity-income fund is

A) capital gains.

B) current income with capital preservation.

C) potentially high capital gains with limited income.

D) high risk-return trade-offs.

A) capital gains.

B) current income with capital preservation.

C) potentially high capital gains with limited income.

D) high risk-return trade-offs.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

Which type of mutual fund consists of both stocks and bonds with a combined objective of current income and long-term capital gains?

A) equity-income

B) balanced

C) value

D) bond

A) equity-income

B) balanced

C) value

D) bond

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

Which one of the following statements is correct concerning international funds?

A) A devaluation of the dollar causes returns on foreign investments to improve from a U.S. perspective.

B) International funds are considered low-risk investments.

C) Balance-of-trade positions do NOT affect the rate of return from a U.S. perspective.

D) Technically, global funds can only invest in foreign securities.

A) A devaluation of the dollar causes returns on foreign investments to improve from a U.S. perspective.

B) International funds are considered low-risk investments.

C) Balance-of-trade positions do NOT affect the rate of return from a U.S. perspective.

D) Technically, global funds can only invest in foreign securities.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

Aggressive mutual funds often employ investing strategies such as

I) short selling.

II) margin trading.

III) option trading.

IV) hedging.

A) I and III only

B) II and III only

C) I, II and IV only

D) I, II, III and IV

I) short selling.

II) margin trading.

III) option trading.

IV) hedging.

A) I and III only

B) II and III only

C) I, II and IV only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

Compared to yields on general purpose money funds, the yields on tax-exempt money funds are

A) about the same.

B) 5 to 10 percent higher.

C) 5 to 10 percent lower.

D) 20 to 30 percent lower.

A) about the same.

B) 5 to 10 percent higher.

C) 5 to 10 percent lower.

D) 20 to 30 percent lower.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

A fund that is designed to match the performance of a measure such as the S & P 500 or the Russell 2000 is called a(n)

A) index fund.

B) targeted fund.

C) sector fund.

D) block fund.

A) index fund.

B) targeted fund.

C) sector fund.

D) block fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

One characteristic of most index funds is that such funds typically

A) produce a large dollar amount of realized capital gains every year.

B) have a very low-cost structure with respect to management fees and transaction fees.

C) charge high front-end loads.

D) are designed to "beat the market."

A) produce a large dollar amount of realized capital gains every year.

B) have a very low-cost structure with respect to management fees and transaction fees.

C) charge high front-end loads.

D) are designed to "beat the market."

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

One advantage gained by investing in a bond fund rather than in individual bonds is the

A) diversification among issuers.

B) most bond funds outperform their benchmarks.

C) immunity from interest rate changes.

D) guarantee that the bonds will be held to maturity to avoid market fluctuations.

A) diversification among issuers.

B) most bond funds outperform their benchmarks.

C) immunity from interest rate changes.

D) guarantee that the bonds will be held to maturity to avoid market fluctuations.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

Socially responsible funds are distinguished from other mutual funds because they

A) invest only in over-the-counter stocks.

B) do not charge any sales commission or management fees.

C) invest only in companies that meet specified moral, ethical, or environmental standards.

D) will sell their shares only to investors who sign a statement saying they do not smoke tobacco or use alcohol.

A) invest only in over-the-counter stocks.

B) do not charge any sales commission or management fees.

C) invest only in companies that meet specified moral, ethical, or environmental standards.

D) will sell their shares only to investors who sign a statement saying they do not smoke tobacco or use alcohol.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

Investors who seek triple (federal, state, and local) tax-free income should invest in ________ bond funds.

A) convertible

B) indexed

C) mortgage-backed

D) single-state municipal

A) convertible

B) indexed

C) mortgage-backed

D) single-state municipal

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

Every mutual fund has a stated investment objective. Disclosure of the investment objective is required by the SEC, and is used to classify a mutual fund into one of several categories. Briefly explain the investment objective of each of the following categories.

(a) growth funds

(b) aggressive growth funds

(c) equity-income funds

(d) balanced funds

(a) growth funds

(b) aggressive growth funds

(c) equity-income funds

(d) balanced funds

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

Funds that invest in a portfolio of companies from the same or closely related industries are known as

A) aggressive growth funds.

B) sector funds.

C) emerging market funds.

D) asset allocation funds.

A) aggressive growth funds.

B) sector funds.

C) emerging market funds.

D) asset allocation funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

Value funds seek stocks

I) with low dividend yields.

II) with potential for growth.

III) with low P/E ratios.

IV) of newly discovered firms.

A) I and III only

B) II and III only

C) II, III and IV only

D) I, II, III and IV

I) with low dividend yields.

II) with potential for growth.

III) with low P/E ratios.

IV) of newly discovered firms.

A) I and III only

B) II and III only

C) II, III and IV only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

To participate in an automatic investment plan, investors must allow the investment company to have access to a bank account or their paycheck.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

Ashley believes that the price of gas and oil is about to rise and energy company profits will follow. She should invest in

A) an asset allocation fund.

B) an emerging market fund.

C) a sector fund.

D) an aggressive growth fund.

A) an asset allocation fund.

B) an emerging market fund.

C) a sector fund.

D) an aggressive growth fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

One type of mutual fund spreads investors' money across equity markets, bond markets, and money markets. Moreover, as market conditions change, the amount of money invested in each market sector will change. This type of mutual fund is known as a(n)

A) socially responsible fund.

B) fiscally responsible fund.

C) growth-and-income fund.

D) asset allocation fund.

A) socially responsible fund.

B) fiscally responsible fund.

C) growth-and-income fund.

D) asset allocation fund.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

Government securities money funds are structured to eliminate

A) interest rate risk.

B) inflation risk.

C) default risk.

D) market risk.

A) interest rate risk.

B) inflation risk.

C) default risk.

D) market risk.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

One characteristic of bond funds is the

A) requirement of a minimum initial investment of $5,000 or more.

B) high anticipated short-term growth potential.

C) fluctuation in value in response to changing interest rates.

D) extremely aggressive trading approach.

A) requirement of a minimum initial investment of $5,000 or more.

B) high anticipated short-term growth potential.

C) fluctuation in value in response to changing interest rates.

D) extremely aggressive trading approach.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following are advantages of bond funds over individual bonds?

I) greater liquidity

II) maturities matched to the investor's time horizon

III) automatic reinvestment of interest payments

IV) diversification

A) I and III only

B) I, III and IV only

C) I, II and IV only

D) II, III and IV only

I) greater liquidity

II) maturities matched to the investor's time horizon

III) automatic reinvestment of interest payments

IV) diversification

A) I and III only

B) I, III and IV only

C) I, II and IV only

D) II, III and IV only

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck