Deck 26: Consolidation: Controlled Entities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 26: Consolidation: Controlled Entities

1

When one entity controls another entity, the business combination results in which of the following types of relationship?

A) Investor-investee.

B) Parent-subsidiary.

C) Investor-associate.

D) Parent-child.

A) Investor-investee.

B) Parent-subsidiary.

C) Investor-associate.

D) Parent-child.

B

2

A group may:

A) only have one parent.

B) have more than one parent.

C) have a few different sub-groups.

D) only have one parent, but it may have a few different sub-group.

A) only have one parent.

B) have more than one parent.

C) have a few different sub-groups.

D) only have one parent, but it may have a few different sub-group.

A

3

The key characteristic that determines when consolidated financial statements should be prepared is:

A) the existence of transactions between the entities.

B) control.

C) substance over form.

D) significant influence.

A) the existence of transactions between the entities.

B) control.

C) substance over form.

D) significant influence.

B

4

The reasons for the preparation of consolidated financial statements include which of the following?

A) Reporting of risks and benefits of the group as a single economic entity.

B) Allowing comparison of the group with similar entities.

C) Supply of relevant information to investors in the parent entity.

D) All of the options are correct.

A) Reporting of risks and benefits of the group as a single economic entity.

B) Allowing comparison of the group with similar entities.

C) Supply of relevant information to investors in the parent entity.

D) All of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

For the purposes of consolidated financial statements, a group is made out of:

A) an investor and its investees.

B) a parent entity and all its subsidiaries.

C) an entity that has one or more subsidiaries.

D) an entity that is controlled by a parent.

A) an investor and its investees.

B) a parent entity and all its subsidiaries.

C) an entity that has one or more subsidiaries.

D) an entity that is controlled by a parent.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

The entity that is represented by a single set of consolidated financial statements is:

A) a parent entity.

B) a subsidiary entity.

C) a legal entity.

D) an economic entity.

A) a parent entity.

B) a subsidiary entity.

C) a legal entity.

D) an economic entity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The consolidated financial statements reflect the effects of transactions:

A) between internal parties to the group only.

B) with external parties to the group only.

C) both between internal parties and with external parties to the group.

D) with some internal and external parties to the group.

A) between internal parties to the group only.

B) with external parties to the group only.

C) both between internal parties and with external parties to the group.

D) with some internal and external parties to the group.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

In the context of control, relevant activities are:

A) activities of the investor that significantly affect the investor's returns.

B) activities of the investee that significantly affect the investee's returns.

C) activities of the investor that significantly affect the investee's returns.

D) activities of the investor that are similar to the investee's activities.

A) activities of the investor that significantly affect the investor's returns.

B) activities of the investee that significantly affect the investee's returns.

C) activities of the investor that significantly affect the investee's returns.

D) activities of the investor that are similar to the investee's activities.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

In the context of control, examples of relevant activities include:

A) selling and purchasing goods and services.

B) managing financial assets.

C) determining a funding structure or obtaining funding.

D) all of the options are correct.

A) selling and purchasing goods and services.

B) managing financial assets.

C) determining a funding structure or obtaining funding.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Examples of rights that determine the existence of power include:

A) rights to appoint, reassign or remove members of an investee's key management personnel

B) rights to appoint or remove another entity that participates in management decisions.

C) rights to direct the investee to enter into, or veto any changes to, transactions that affect the investee's returns.

D) all of the options are correct.

A) rights to appoint, reassign or remove members of an investee's key management personnel

B) rights to appoint or remove another entity that participates in management decisions.

C) rights to direct the investee to enter into, or veto any changes to, transactions that affect the investee's returns.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

For the purpose of preparing consolidated financial statements, a group is made out of:

A) one parent entity and one subsidiary entity.

B) one or more parent entities and all their subsidiary entities.

C) one parent entity and all its subsidiary entities.

D) one or more parent entities and one subsidiary entity that they commonly control.

A) one parent entity and one subsidiary entity.

B) one or more parent entities and all their subsidiary entities.

C) one parent entity and all its subsidiary entities.

D) one or more parent entities and one subsidiary entity that they commonly control.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

A subsidiary is an entity that:

A) has significant influence over a parent entity.

B) exercises control over a parent entity.

C) has the power to control a parent entity.

D) is controlled by another entity.

A) has significant influence over a parent entity.

B) exercises control over a parent entity.

C) has the power to control a parent entity.

D) is controlled by another entity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

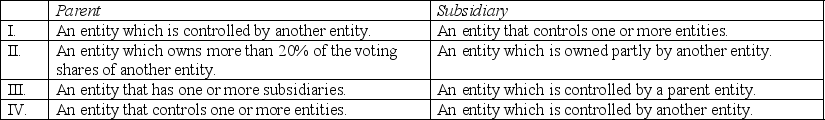

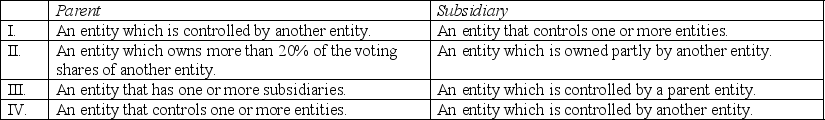

AASB 10/IFRS 10 Consolidated Financial Statements defines a 'parent' and a 'subsidiary' as which of the following?

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

At balance date, Company A has 40% of the voting rights in Company B. In addition Company A holds potential voting rights in Company B amounting to 6% that are currently exercisable, and a further 9% of voting rights in Company B that can be exercised in two years' time. Which of the following statements is correct?

A) Consolidated financial statements must be prepared for Company A and B in the current year.

B) Consolidated financial statements need not be prepared for Company A and B for the current year.

C) Consolidated financial statements must be prepared as Company A controls Company B at balance date.

D) Consolidated financial statements must be prepared as Company A has more than half of the voting rights in Company B at balance date.

A) Consolidated financial statements must be prepared for Company A and B in the current year.

B) Consolidated financial statements need not be prepared for Company A and B for the current year.

C) Consolidated financial statements must be prepared as Company A controls Company B at balance date.

D) Consolidated financial statements must be prepared as Company A has more than half of the voting rights in Company B at balance date.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

With regards to the concept on control, power over an investee:

A) is related to relevant activities of the investee.

B) arises from potential rights.

C) means actually directing the investee.

D) means the ability to significantly influence the investee.

A) is related to relevant activities of the investee.

B) arises from potential rights.

C) means actually directing the investee.

D) means the ability to significantly influence the investee.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

An additional set of financial statements that combines the separate sets of financial statements for all entities within an economic entity is known as:

A) a concise financial report.

B) a condensed financial report.

C) consolidated financial statements.

D) combined financial statements.

A) a concise financial report.

B) a condensed financial report.

C) consolidated financial statements.

D) combined financial statements.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not one of the three elements of control according to AASB 10/IFRS 10 Consolidated Financial Statements?

A) The ability to use power over the investee to affect the amount of the investor's returns.

B) Dominating the decision making of the investee.

C) Power over the investee.

D) Exposure, or rights, to variable returns from involvement with the investee.

A) The ability to use power over the investee to affect the amount of the investor's returns.

B) Dominating the decision making of the investee.

C) Power over the investee.

D) Exposure, or rights, to variable returns from involvement with the investee.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

In determining the existence of power, together with size of the investor's voting interest, the following factors need to be examined in relation to the holders of the other shares in the investee:

A) attendance at annual general meetings.

B) level of dilution and disorganization or apathy of the remaining shareholders.

C) the existence of contracts.

D) all of the options are correct.

A) attendance at annual general meetings.

B) level of dilution and disorganization or apathy of the remaining shareholders.

C) the existence of contracts.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

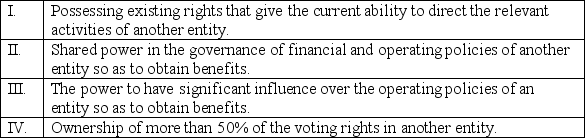

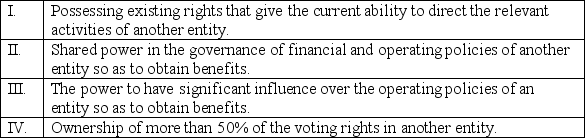

According to AASB 10/IFRS 10 Consolidated Financial Statements, which of the following factors indicate the existence of control?

A) I, II and III only.

B) I and IV only.

C) II and IV only.

D) IV only.

A) I, II and III only.

B) I and IV only.

C) II and IV only.

D) IV only.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

In a consolidated group of entities, control over the subsidiaries in the group:

A) may not be shared control.

B) can be shared with other entities.

C) requires 100% ownership of the subsidiaries' shares.

D) can exist where the rights are purely protective rights.

A) may not be shared control.

B) can be shared with other entities.

C) requires 100% ownership of the subsidiaries' shares.

D) can exist where the rights are purely protective rights.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Variable returns from an investee include:

A) dividends from ordinary shares that will change based on the profit performance of the investee

B) fixed interest payments from a bond, as they expose the investor to the credit risk of the issuer of the bond, namely the investee

C) fixed performance fees for management of the investee's assets, as they expose the investor to the performance risk of the investee.

D) all of the options are correct.

A) dividends from ordinary shares that will change based on the profit performance of the investee

B) fixed interest payments from a bond, as they expose the investor to the credit risk of the issuer of the bond, namely the investee

C) fixed performance fees for management of the investee's assets, as they expose the investor to the performance risk of the investee.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

In the context of control, which of the following is correct regarding rights?

A) They must be protective rights.

B) They must arise from a legal contract.

C) They must arise as a result of future events.

D) They must be substantive rights.

A) They must be protective rights.

B) They must arise from a legal contract.

C) They must arise as a result of future events.

D) They must be substantive rights.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

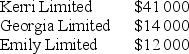

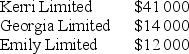

A group of entities comprised of Kerri Limited (parent entity), Georgia Limited (subsidiary entity) and Emily Limited (subsidiary entity) have the following inventories balances.

Which of the following amounts is shown as the consolidated inventories balance in the consolidated financial statements?

A) $12 000.

B) $14 000.

C) $26 000.

D) $67 000.

Which of the following amounts is shown as the consolidated inventories balance in the consolidated financial statements?

A) $12 000.

B) $14 000.

C) $26 000.

D) $67 000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Kowloon Limited is an entity listed in Hong Kong. Kowloon Limited holds a 100% investment in Aussie Pty Ltd, an Australian based company, who in turn holds a 90% interest in Skippy Pty Ltd. Aussie Pty Ltd and the Aussie group (comprising Aussie and Skippy) are both non-reporting entities. Which of the following statements is correct?

A) Aussie Pty Ltd will be required to prepare consolidated financial statements as the ultimate Australian parent.

B) Aussie Pty Ltd will not be required to prepare consolidated financial statements as they are a non-reporting entity.

C) Aussie Pty Ltd will be required to prepare consolidated financial statements only if directed to do so by ASIC.

D) Aussie Pty Ltd will not be required to prepare consolidated financial statements as Kowloon is a listed foreign entity.

A) Aussie Pty Ltd will be required to prepare consolidated financial statements as the ultimate Australian parent.

B) Aussie Pty Ltd will not be required to prepare consolidated financial statements as they are a non-reporting entity.

C) Aussie Pty Ltd will be required to prepare consolidated financial statements only if directed to do so by ASIC.

D) Aussie Pty Ltd will not be required to prepare consolidated financial statements as Kowloon is a listed foreign entity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Rights to variable returns from an investee include:

A) from economies of scale.

B) remuneration from provision of services.

C) returns from denying or regulating access to a subsidiary's assets.

D) all of the options are correct.

A) from economies of scale.

B) remuneration from provision of services.

C) returns from denying or regulating access to a subsidiary's assets.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Paragraph 9 of AASB 12/IFRS 12 Disclosure of Interests in Other Entities provides the following examples of situations where it is necessary to disclose significant judgements and assumptions in relation to subsidiaries

A) where an entity does not control another entity but it holds more than half of the voting rights in the other entity.

B) where an entity controls another entity but it holds less than half of the voting rights of the other entity.

C) where an entity is an agent or a principal.

D) all of the options are correct.

A) where an entity does not control another entity but it holds more than half of the voting rights in the other entity.

B) where an entity controls another entity but it holds less than half of the voting rights of the other entity.

C) where an entity is an agent or a principal.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

The disclosure requirements in consolidated financial statements are included in the following accounting standards:

A) AASB 10/IFRS 10 Consolidated Financial Statements.

B) AASB 12/IFRS 12 Disclosure of Interests in Other Entities.

C) AASB 127/IAS 127 Separate Financial Statements.

D) AASB 10/IFRS 10 Consolidated Financial Statements and AASB 12/IFRS 12 Disclosure of Interests in Other Entities.

A) AASB 10/IFRS 10 Consolidated Financial Statements.

B) AASB 12/IFRS 12 Disclosure of Interests in Other Entities.

C) AASB 127/IAS 127 Separate Financial Statements.

D) AASB 10/IFRS 10 Consolidated Financial Statements and AASB 12/IFRS 12 Disclosure of Interests in Other Entities.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

The process of preparing the combined financial statements of a group of entities is known as:

A) aggregation.

B) combination.

C) consolidation.

D) accumulation.

A) aggregation.

B) combination.

C) consolidation.

D) accumulation.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

According to AASB 10/IFRS 10 Consolidated Financial Statements, all parent entities are required to present consolidated statements unless which of the following conditions apply to them?

I The parent is a wholly owned subsidiary.

II The parent is a partly owned subsidiary and its other owners do not object to the non-presentation of consolidated financial statements.

III The parent's debt or equity securities are traded in a public market.

IV The parent is not in the process of applying to issue any securities in a public market.

A) I and II only.

B) I, II and III only.

C) I, II and IV only.

D) I, II, III and IV.

I The parent is a wholly owned subsidiary.

II The parent is a partly owned subsidiary and its other owners do not object to the non-presentation of consolidated financial statements.

III The parent's debt or equity securities are traded in a public market.

IV The parent is not in the process of applying to issue any securities in a public market.

A) I and II only.

B) I, II and III only.

C) I, II and IV only.

D) I, II, III and IV.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

The equity in a subsidiary not attributable to a parent is known as a/an:

A) non-controlling interest.

B) attributable interest.

C) non-parent interest.

D) external interest.

A) non-controlling interest.

B) attributable interest.

C) non-parent interest.

D) external interest.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Paragraph B23 of AASB 10/IFRS 10 Consolidated Financial Statements provides some factors to consider in assessing whether the rights over an investee are substantive:

A) whether there are any barriers that prevent the investor from exercising them.

B) whether the party or parties that hold the rights would benefit from the exercise of those rights.

C) where more than one party is involved, whether there is a mechanism in place to enable those parties to practically exercise them.

D) all of the options are correct.

A) whether there are any barriers that prevent the investor from exercising them.

B) whether the party or parties that hold the rights would benefit from the exercise of those rights.

C) where more than one party is involved, whether there is a mechanism in place to enable those parties to practically exercise them.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

The process of preparing consolidated financial statements requires that:

A) the individual financial statements of the parent and all its subsidiaries use uniform accounting policies for like transactions and other events in similar circumstances.

B) the individual financial statements of the parent and all its subsidiaries use uniform accounting practices for like transactions and other events in similar circumstances.

C) the subsidiaries must prepare, if practicable, financial information as of the same date and for the same period as the financial statements of the parent.

D) the individual financial statements of the parent and all its subsidiaries use uniform accounting policies for like transactions and other events in similar circumstances and that the subsidiaries must prepare, if practicable, financial information as of the same date and for the same period as the financial statements of the parent.

A) the individual financial statements of the parent and all its subsidiaries use uniform accounting policies for like transactions and other events in similar circumstances.

B) the individual financial statements of the parent and all its subsidiaries use uniform accounting practices for like transactions and other events in similar circumstances.

C) the subsidiaries must prepare, if practicable, financial information as of the same date and for the same period as the financial statements of the parent.

D) the individual financial statements of the parent and all its subsidiaries use uniform accounting policies for like transactions and other events in similar circumstances and that the subsidiaries must prepare, if practicable, financial information as of the same date and for the same period as the financial statements of the parent.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

When deciding whether or not one entity controls another entity:

A) the controlling entity must have exercised its power to control.

B) it is sufficient that the controlling entity has the capacity to control.

C) the controlling entity must be actively involved in the decision making of the other entity.

D) the controlling entity must have exerted its control over the financing policies of the other entity.

A) the controlling entity must have exercised its power to control.

B) it is sufficient that the controlling entity has the capacity to control.

C) the controlling entity must be actively involved in the decision making of the other entity.

D) the controlling entity must have exerted its control over the financing policies of the other entity.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Where the financial statements of a subsidiary are as of a date that differs from that of the parent, the group must disclose:

A) the date used by the subsidiary.

B) the reason for the subsidiary using a different date.

C) both the date used by the subsidiary as well as the reason for the subsidiary using a different date.

D) the reason for the parent using a different date.

A) the date used by the subsidiary.

B) the reason for the subsidiary using a different date.

C) both the date used by the subsidiary as well as the reason for the subsidiary using a different date.

D) the reason for the parent using a different date.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

According to paragraph 10 of AASB 12/IFRS 12 Disclosure of Interests in Other Entities, an entity shall disclose information that enables users of its consolidated financial statements to understand:

A) the composition of the group.

B) the interest that the subsidiaries have in the group's activities and cash flows.

C) the interest that non-controlling interests have in the group's activities and cash flows.

D) the composition of the group and the interest that non-controlling interests have in the group's activities and cash flows.

A) the composition of the group.

B) the interest that the subsidiaries have in the group's activities and cash flows.

C) the interest that non-controlling interests have in the group's activities and cash flows.

D) the composition of the group and the interest that non-controlling interests have in the group's activities and cash flows.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Eastpac Bank has lent Alexandra Ltd $500 000. Part of the loan contract prevents Alexandra from borrowing money in the future from other banks without the permission of Eastpac. As a result of this relationship:

A) Eastpac Bank is regarded as a parent entity of Alexandra Limited.

B) Alexandra Limited is regarded as a subsidiary of Eastpac Bank.

C) a parent-subsidiary relationship does not exist between these two parties.

D) a parent-subsidiary relationship is regarded as existing between these two parties as Eastpac Bank is able to direct the relevant activities of Alexandra Limited.

A) Eastpac Bank is regarded as a parent entity of Alexandra Limited.

B) Alexandra Limited is regarded as a subsidiary of Eastpac Bank.

C) a parent-subsidiary relationship does not exist between these two parties.

D) a parent-subsidiary relationship is regarded as existing between these two parties as Eastpac Bank is able to direct the relevant activities of Alexandra Limited.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Juliet Ltd is a listed public company and has an 60% controlling interest in Marley Pty Ltd. Marley Pty Ltd is the parent of Butterscotch Pty Ltd. In which of the following situations will Marley Pty Ltd not be required to prepare consolidated financial statements?

A) If Marley Pty Ltd prepares separate financial statements that comply with IFRS.

B) If the other owners of Marley Pty Ltd have consented to the non-preparation of consolidated financial statements.

C) Where it is likely that there are external users dependant on the information.

D) Marley Pty Ltd would never be required to prepare consolidated financial statements.

A) If Marley Pty Ltd prepares separate financial statements that comply with IFRS.

B) If the other owners of Marley Pty Ltd have consented to the non-preparation of consolidated financial statements.

C) Where it is likely that there are external users dependant on the information.

D) Marley Pty Ltd would never be required to prepare consolidated financial statements.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

An agent is:

A) a party primarly engaged to act for its own benefit.

B) a party primarly engaged to act for the benefit of another party.

C) a party primarly engaged to act for its own benefit and therefore controls the investee when it exercises its decision-making authority.

D) a party primarly engaged to act for the benefit of another party and therefore does not control the investee when it exercises its decision-making authority.

A) a party primarly engaged to act for its own benefit.

B) a party primarly engaged to act for the benefit of another party.

C) a party primarly engaged to act for its own benefit and therefore controls the investee when it exercises its decision-making authority.

D) a party primarly engaged to act for the benefit of another party and therefore does not control the investee when it exercises its decision-making authority.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

The process of preparing consolidated financial statements requires that:

A) no adjustments be made to the individual financial statements or ledger accounts of the entities in the group.

B) adjusting journal entries be recorded in the ledger accounts of the subsidiaries only.

C) accruals of expenses and revenues be recorded directly into the retained earnings account of the parent entity.

D) adjusting journal entries be recorded in the ledger accounts of the parent only.

A) no adjustments be made to the individual financial statements or ledger accounts of the entities in the group.

B) adjusting journal entries be recorded in the ledger accounts of the subsidiaries only.

C) accruals of expenses and revenues be recorded directly into the retained earnings account of the parent entity.

D) adjusting journal entries be recorded in the ledger accounts of the parent only.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Protective rights include:

A) a lender's right to restrict a borrower from undertaking activities that could significantly change the credit risk of the borrower to the detriment of the lender.

B) the right of a party holding a non-controlling interest in an investee to approve capital expenditure greater than that required in the ordinary course of business, or to approve the issue of equity or debt instruments.

C) the right of a lender to seize the assets of a borrower if the borrower fails to meet specified loan repayment conditions.

D) all of the options are correct.

A) a lender's right to restrict a borrower from undertaking activities that could significantly change the credit risk of the borrower to the detriment of the lender.

B) the right of a party holding a non-controlling interest in an investee to approve capital expenditure greater than that required in the ordinary course of business, or to approve the issue of equity or debt instruments.

C) the right of a lender to seize the assets of a borrower if the borrower fails to meet specified loan repayment conditions.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck