Deck 27: Consolidation: Wholly Owned Entities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 27: Consolidation: Wholly Owned Entities

1

Which of the following statements is incorrect with regards to the acquisition analysis?

A) It is considered the first step in the consolidation process.

B) It calculates and compares the fair value of the consideration transferred with the fair value of the net identifiable assets and liabilities acquired.

C) It calculates the fair value of the net identifiable assets and liabilities acquired based on the value of the post-acquisition equity in the subsidiary.

D) It determines whether there is a goodwill on acquisition or a gain on bargain purchase.

A) It is considered the first step in the consolidation process.

B) It calculates and compares the fair value of the consideration transferred with the fair value of the net identifiable assets and liabilities acquired.

C) It calculates the fair value of the net identifiable assets and liabilities acquired based on the value of the post-acquisition equity in the subsidiary.

D) It determines whether there is a goodwill on acquisition or a gain on bargain purchase.

C

2

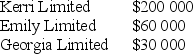

Kerri Limited has two subsidiary entities, Emily Limited and Georgia Limited. Kerri Limited owns 100% of the shares in both entities. Details of the issued share capital are:

The consolidated share capital amount of the Kerri - Emily - Georgia group is:

A) $230 000.

B) $90 000.

C) $200 000.

D) $290 000.

The consolidated share capital amount of the Kerri - Emily - Georgia group is:

A) $230 000.

B) $90 000.

C) $200 000.

D) $290 000.

C

3

Unity Limited acquired 100% of the share capital of Bellvista Limited. Bellvista had total shareholder's equity of $200 000. The book values of Bellvista Limited's assets were: buildings $100 000, machinery $120 000. The fair values of these assets were: buildings $180 000, machinery $140 000. The tax rate is 30%. The fair value of the identifiable net assets is:

A) $270 000.

B) $220 000.

C) $320 000.

D) $200 000.

A) $270 000.

B) $220 000.

C) $320 000.

D) $200 000.

A

4

The pre-acquisition entries are used to:

A) eliminate the pre-acquisition equity of the subsidiary.

B) eliminate the post-acquisition equity of the subsidiary.

C) eliminate the investment in the subsidiary and the pre-acquisition equity of the subsidiary.

D) eliminate the investment in the subsidiary and the post-acquisition equity of the subsidiary.

A) eliminate the pre-acquisition equity of the subsidiary.

B) eliminate the post-acquisition equity of the subsidiary.

C) eliminate the investment in the subsidiary and the pre-acquisition equity of the subsidiary.

D) eliminate the investment in the subsidiary and the post-acquisition equity of the subsidiary.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

Before undertaking the consolidation process, it may be necessary to make the following adjustments in relation to the individual statements if the parent and the subsidiary do not use the same accounting policies for like transactions in similar circumstances:

A) the subsidiary will prepare its own financial statements using the same accounting policies as the parent.

B) the parent will prepare its own financial statements using the same accounting policies as the subsidiary.

C) the subsidiary will prepare its own financial statements using accounting policies that are negotiated with the parent.

D) all of the options are incorrect.

A) the subsidiary will prepare its own financial statements using the same accounting policies as the parent.

B) the parent will prepare its own financial statements using the same accounting policies as the subsidiary.

C) the subsidiary will prepare its own financial statements using accounting policies that are negotiated with the parent.

D) all of the options are incorrect.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is incorrect?

A) The business combination valuation reserve is an account recorded in the subsidiary's records.

B) The acquisition analysis may include the recognition of assets and liabilities not recognised in the subsidiary's records.

C) The acquisition analysis will determine whether any goodwill or gain on bargain purchase has arisen as a part of the business combination.

D) An acquisition analysis is prepared at acquisition date to identify the identifiable assets and liabilities of the subsidiary at fair value.

A) The business combination valuation reserve is an account recorded in the subsidiary's records.

B) The acquisition analysis may include the recognition of assets and liabilities not recognised in the subsidiary's records.

C) The acquisition analysis will determine whether any goodwill or gain on bargain purchase has arisen as a part of the business combination.

D) An acquisition analysis is prepared at acquisition date to identify the identifiable assets and liabilities of the subsidiary at fair value.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

During the consolidation process, it may be necessary to make the following adjustments to the individual statements:

A) business combination valuation entries.

B) pre-acquisition entries.

C) business combination valuation entries and pre-acquisition entries in the individual journals of the parent and the subsidiaries.

D) business combination valuation entries and pre-acquisition entries in the consolidation worksheet.

A) business combination valuation entries.

B) pre-acquisition entries.

C) business combination valuation entries and pre-acquisition entries in the individual journals of the parent and the subsidiaries.

D) business combination valuation entries and pre-acquisition entries in the consolidation worksheet.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

In the case of a wholly owned subsidiary, if the fair value of the consideration transferred plus the fair value of the previously held interest is greater than the net fair value of the identifiable assets, liabilities and contingent liabilities of the subsidiary:

A) a gain on bargain purchase results.

B) goodwill has been purchased and must be recognised on consolidation.

C) the difference is treated as a special equity reserve in the acquirer's accounting records.

D) the difference is immediately charged to profit or loss in the period in which the business combination occurred.

A) a gain on bargain purchase results.

B) goodwill has been purchased and must be recognised on consolidation.

C) the difference is treated as a special equity reserve in the acquirer's accounting records.

D) the difference is immediately charged to profit or loss in the period in which the business combination occurred.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

Unity Limited acquired 100% of the share capital of Bellvista Limited for $300 000. Bellvista had total shareholder's equity of $200 000. The book values of Bellvista Limited's assets were: buildings $100 000, machinery $120 000. The fair values of these assets were: buildings $180 000, machinery $140 000. The tax rate is 30%. The acquisition analysis will determine:

A) a gain on bargain purchase of $100 000.

B) a goodwill of $30 000.

C) a goodwill of $80 000.

D) a gain on bargain purchase of $20 000.

A) a gain on bargain purchase of $100 000.

B) a goodwill of $30 000.

C) a goodwill of $80 000.

D) a gain on bargain purchase of $20 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is incorrect?

A) Where consolidated financial statements are prepared over a number of years, consolidation entries need to be made every time a consolidation worksheet is prepared.

B) Consolidation adjusting entries affect the ledger accounts of the parent and subsidiaries.

C) A consolidation worksheet is used to help the process of adding together the financial statements of the parent and its subsidiaries.

D) There are no consolidated ledger accounts.

A) Where consolidated financial statements are prepared over a number of years, consolidation entries need to be made every time a consolidation worksheet is prepared.

B) Consolidation adjusting entries affect the ledger accounts of the parent and subsidiaries.

C) A consolidation worksheet is used to help the process of adding together the financial statements of the parent and its subsidiaries.

D) There are no consolidated ledger accounts.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

If a subsidiary's reporting date does not coincide with the parent entity's reporting date, adjustments must be made for the effects of significant transactions that occur between the two reporting dates provided the reporting dates differ by no more than:

A) nine months.

B) three months.

C) one month.

D) six months.

A) nine months.

B) three months.

C) one month.

D) six months.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

The business combination valuation entries are used to recognise:

A) the fair value adjustments for assets and liabilities that were recorded in the subsidiary's accounts at acquisition date based on carrying amounts different from fair value.

B) the fair value of the assets not recorded in the subsidiary's accounts at acquisition date.

C) the fair value of the liabilities not recorded in the subsidiary's accounts at acquisition date.

D) all of the options are correct.

A) the fair value adjustments for assets and liabilities that were recorded in the subsidiary's accounts at acquisition date based on carrying amounts different from fair value.

B) the fair value of the assets not recorded in the subsidiary's accounts at acquisition date.

C) the fair value of the liabilities not recorded in the subsidiary's accounts at acquisition date.

D) all of the options are correct.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

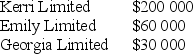

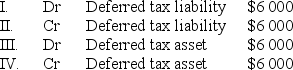

Water Limited acquired Boy Limited for a purchase consideration of $110 000. At acquisition date the fair value of the Boy Limited's land asset was $80 000 and the carrying amount was $60 000. If the company tax rate is 30%, which of the following is the appropriate adjustment to recognise the tax effect of the business combination revaluation of land at acquisition date?

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

The preparation of consolidated financial statements involves:

A) adding together the financial statements of the investor and the associate.

B) adjusting entries in the accounting records of the subsidiary.

C) adding together the financial statements of the parent and the subsidiaries.

D) adjusting entries in the accounting records of the parent.

A) adding together the financial statements of the investor and the associate.

B) adjusting entries in the accounting records of the subsidiary.

C) adding together the financial statements of the parent and the subsidiaries.

D) adjusting entries in the accounting records of the parent.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

The acquisition analysis calculates the fair value of the net identifiable assets and liabilities acquired based on the book value of the pre-acquisition equity of the subsidiary, adjusted for the following:

A) previously recorded goodwill in the subsidiary at acquisition date

B) fair value adjustments for the assets and liabilities that were recorded in the subsidiary's accounts at acquisition date based on carrying amounts different from fair value

C) the fair value of the assets and liabilities not recorded in the subsidiary's accounts at acquisition date

D) all of the options are correct

A) previously recorded goodwill in the subsidiary at acquisition date

B) fair value adjustments for the assets and liabilities that were recorded in the subsidiary's accounts at acquisition date based on carrying amounts different from fair value

C) the fair value of the assets and liabilities not recorded in the subsidiary's accounts at acquisition date

D) all of the options are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

The consolidation worksheet entries have an impact on:

A) the individual statement of the parent.

B) the individual statement of the subsidiaries.

C) the individual statements of the parent and its subsidiaries.

D) the consolidated financial statements.

A) the individual statement of the parent.

B) the individual statement of the subsidiaries.

C) the individual statements of the parent and its subsidiaries.

D) the consolidated financial statements.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

Sippy Ltd acquired 100% of the share capital of Downs Ltd when the carrying value of Downs Ltd's plant and machinery was $100 000. The fair value of the plant on acquisition date was $150 000. The company tax rate was 30%. What is the amount of the business combination valuation reserve that must be recognised on consolidation?

A) $15 000.

B) $35 000.

C) $50 000.

D) $150 000.

A) $15 000.

B) $35 000.

C) $50 000.

D) $150 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Before undertaking the consolidation process, it may be necessary to make the following adjustments in relation to the individual statements if the end of the subsidiary's financial period does not coincide with the:

A) the parent will prepare its own financial statements as at the end of the subsidiary's financial period.

B) the subsidiary will prepare its own financial statements as at the end of the parent's financial period.

C) the parent will prepare its own financial statements as at 30 June if the end of the parent's reporting period is not 30 June.

D) the subsidiary will prepare its own financial statements as at 30 June if the end of the parent's reporting period is not 30 June.

A) the parent will prepare its own financial statements as at the end of the subsidiary's financial period.

B) the subsidiary will prepare its own financial statements as at the end of the parent's financial period.

C) the parent will prepare its own financial statements as at 30 June if the end of the parent's reporting period is not 30 June.

D) the subsidiary will prepare its own financial statements as at 30 June if the end of the parent's reporting period is not 30 June.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

Unity Limited acquired 100% of the share capital of Bellvista Limited for $300 000. Bellvista had total shareholder's equity of $200 000. The book values of Bellvista Limited's assets were: buildings $100 000, machinery $120 000. The fair values of these assets were: buildings $180 000, machinery $140 000. Also, Bellvista Limited has not previously recorded an internally generated trademark with a fair value of $30 000 and a contingent liability related to a guarantee with a fair value of $20 000. The tax rate is 30%. The acquisition analysis will determine:

A) a gain on bargain purchase of $5 000.

B) a goodwill of $100 000.

C) a goodwill of $23 000.

D) a gain on bargain purchase of $10 000.

A) a gain on bargain purchase of $5 000.

B) a goodwill of $100 000.

C) a goodwill of $23 000.

D) a gain on bargain purchase of $10 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

Susan Limited has two subsidiary entities, Rachel Limited and Rebecca Limited. Susan Limited owns 100% of the shares in both entities. Details of the cash accounts of each company are: Susan Limited $200 000, Rachel Limited $60 000, Rebecca Limited $30 000. The balance of the consolidated cash account of the Susan Limited group is:

A) $290 000.

B) $200 000.

C) $260 000.

D) $230 000.

A) $290 000.

B) $200 000.

C) $260 000.

D) $230 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

There is no recognition of a deferred tax item in respect to goodwill because it is a residual amount and the recognition of a deferred tax item would:

A) decrease the carrying amount of goodwill.

B) increase the carrying amount of goodwill.

C) decrease the profit on consolidation.

D) increase the profit on consolidation.

A) decrease the carrying amount of goodwill.

B) increase the carrying amount of goodwill.

C) decrease the profit on consolidation.

D) increase the profit on consolidation.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

On 1 January 2012, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, the inventory of Tate Ltd had a fair value of $10 000 more than its carrying amount. By 30 June 2013, 75% of the inventory was sold to an entity outside of the group. The business combination valuation consolidation adjustment for inventories as at 30 June 2013 will include:

A) a debit to inventories of $10 000.

B) a debit to inventories of $2 500 and a debit to cost of sales of $7 500.

C) a credit to inventories of $2 500 and a credit to cost of sales of $7 500.

D) a debit to inventories of $7 500 and a debit to cost of sales $2 500.

A) a debit to inventories of $10 000.

B) a debit to inventories of $2 500 and a debit to cost of sales of $7 500.

C) a credit to inventories of $2 500 and a credit to cost of sales of $7 500.

D) a debit to inventories of $7 500 and a debit to cost of sales $2 500.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

On 1 January 2014, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, the plant of Tate Ltd had a fair value of $20 000 more than its carrying amount and an estimated useful life of 5 years. Tate Ltd depreciates the plant on a straight-line basis. The plant was sold to external parties on 31 December 2014. The business combination valuation entries in relation to the plant as at 30 June 2015 will include:

I) Adjustments to the plant account to recognise the fair value adjustment at acquisition date

II) Adjustments to the current depreciation expense

III) Adjustments to retained earnings (opening balance)

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) I, II and III only.

C) II, III and IV only.

D) I, II, III and IV.

I) Adjustments to the plant account to recognise the fair value adjustment at acquisition date

II) Adjustments to the current depreciation expense

III) Adjustments to retained earnings (opening balance)

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) I, II and III only.

C) II, III and IV only.

D) I, II, III and IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

When Wayne Ltd acquired 100% of the share capital of Carol Ltd, the carrying amount of Carol Ltd's machinery was $200 000. The fair value of the machinery on acquisition date was $160 000. The company tax rate was 30%. What is the amount of the business combination valuation reserve that will be recognised on consolidation?

A) $40 000.

B) $12 000.

C) $28 000.

D) $160 000.

A) $40 000.

B) $12 000.

C) $28 000.

D) $160 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

Where the consideration transferred is less than the fair value of the identifiable net assets and contingent liabilities acquired, the difference must be recognised in the consolidation worksheet as:

A) a transfer to the business combination valuation reserve.

B) goodwill.

C) an increase in the 'Shares in subsidiary' asset.

D) a gain on bargain purchase.

A) a transfer to the business combination valuation reserve.

B) goodwill.

C) an increase in the 'Shares in subsidiary' asset.

D) a gain on bargain purchase.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

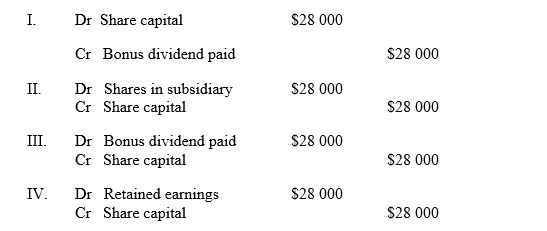

26

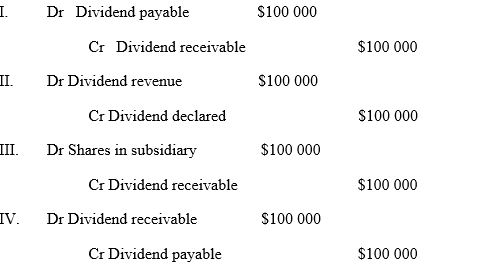

At the date of acquisition, a subsidiary had recorded a dividend payable of $100 000. Assuming that the shares were acquired on a cum div. basis, the consolidation adjustment needed at the date of acquisition to eliminate the dividend is:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

On 1 January 2014, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, Tate Ltd recognised in the notes to its financial statements a contingent liability with regards to a loan guarantee that had a fair value of $20 000. The contingent liability was settled at 31 December 2014 by Tate Ltd making a payment of $5 000. Ignoring the tax effect, the business combination valuation entries in relation to the contingent liability as at 30 June 2015 will include:

I) Adjustments to the liability account to recognise the fair value adjustment at acquisition date

II) Adjustments to expenses recognised on settlement

III) Adjustments to gains on settlement

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) I, II and III only.

C) II, III and IV only.

D) I, II, III and IV.

I) Adjustments to the liability account to recognise the fair value adjustment at acquisition date

II) Adjustments to expenses recognised on settlement

III) Adjustments to gains on settlement

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) I, II and III only.

C) II, III and IV only.

D) I, II, III and IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

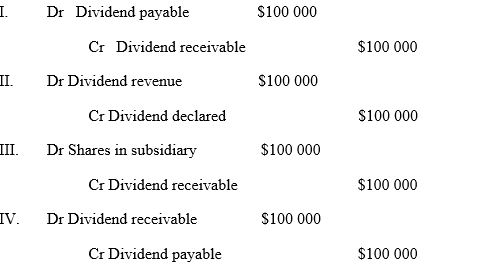

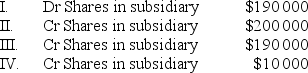

Easts Limited acquired 100% of the shares in Tigers Limited on a cum div. basis for $200 000. At acquisition date, the subsidiary had a declared dividend of $10 000. The pre-acquisition entry must include the following line:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

Salmon Ltd acquired on a cum div. basis all of shares in Trout Ltd for $520 000. At the date of acquisition, Trout Ltd had recorded a dividend payable of $100 000 and a total shareholders' equity of $400 000. Assuming that the all identifiable assets in Trout Ltd were recorded at fair value at acquisition date, the consolidation worksheet entries will have to recognise:

A) a goodwill of $220 000.

B) a goodwill of $120 000.

C) a goodwill of $20 000.

D) a gain on bargain purchase of $20 000.

A) a goodwill of $220 000.

B) a goodwill of $120 000.

C) a goodwill of $20 000.

D) a gain on bargain purchase of $20 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

The pre-acquisition entry is necessary to:

A) avoid overstating the equity and net assets of the parent.

B) record the 'shares in subsidiary' account in the parents records.

C) avoid overstating the equity and net assets of the group.

D) avoid understating the equity and net assets of the group.

A) avoid overstating the equity and net assets of the parent.

B) record the 'shares in subsidiary' account in the parents records.

C) avoid overstating the equity and net assets of the group.

D) avoid understating the equity and net assets of the group.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

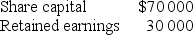

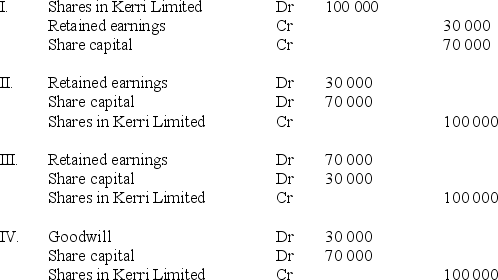

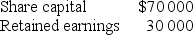

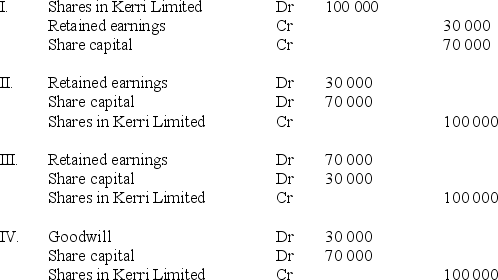

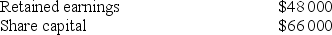

On 1 July 2014, Peter Limited acquired all the issued shares of Kerri Limited for $100 000 when the equity of Kerri Limited consisted of:

The pre-acquisition entry at 1 July 2014 is:

A) I.

B) II.

C) III.

D) IV.

The pre-acquisition entry at 1 July 2014 is:

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

On 1 July 2014 Good Ltd acquired a 100% interest in Life Ltd. At that time Life Ltd had goodwill of $10 000 recorded in its statement of financial position as a result of a previous business combination. The total goodwill arising on Good's acquisition of Life was $24 000. The goodwill to be recognised on consolidation as a result of Good's acquisition of Life is:

A) nil.

B) $10 000.

C) $14 000.

D) $24 000.

A) nil.

B) $10 000.

C) $14 000.

D) $24 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

On 1 January 2012, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, the inventory of Tate Ltd had a fair value of $10 000 more than its carrying amount. By 30 June 2013, 75% of the inventory was sold to an entity outside of the group. The business combination valuation consolidation adjustment against inventory as at 30 June 2013 will be:

A) a debit of $7 500.

B) a credit of $10 000.

C) a debit of $10 000.

D) a debit of $2 500.

A) a debit of $7 500.

B) a credit of $10 000.

C) a debit of $10 000.

D) a debit of $2 500.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

On 1 January 2014, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, the plant of Tate Ltd had a fair value of $20 000 more than its carrying amount and an estimated useful life of 5 years. Tate Ltd depreciates the plant on a straight-line basis. The plant was still in the business at 30 June 2015. The business combination valuation entries in relation to the plant as at 30 June 2015 will include:

I) Adjustments to the plant account to recognise the fair value adjustment at acquisition date

II) Adjustments to the current depreciation expense

III) Adjustments to retained earnings (opening balance)

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) II and III only.

C) I, II and III only.

D) I, II, III and IV.

I) Adjustments to the plant account to recognise the fair value adjustment at acquisition date

II) Adjustments to the current depreciation expense

III) Adjustments to retained earnings (opening balance)

IV) Transfers from business combination valuation reserve to retained earnings

A) I only.

B) II and III only.

C) I, II and III only.

D) I, II, III and IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

On 1 January 2014, Cowboys Ltd acquired all the issued shares in Tate Ltd. At that date, the plant of Tate Ltd had a fair value of $20 000 more than its carrying amount and an estimated useful life of 5 years. Tate Ltd depreciates the plant on a straight-line basis. The plant was sold during the year ended on 30 June 2015. The business combination valuation consolidation adjustment against plant in relation to the transaction as at 30 June 2015 will be:

A) a debit of $20 000.

B) a credit of $20 000.

C) a debit of $4 000.

D) there is no adjustment entry recorded against the plant account.

A) a debit of $20 000.

B) a credit of $20 000.

C) a debit of $4 000.

D) there is no adjustment entry recorded against the plant account.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

The effect of the pre-acquisition entry is to eliminate the 'Shares in subsidiary' asset and the:

A) equity of the subsidiary at the acquisition date.

B) equity of the parent at the acquisition date.

C) net assets of the subsidiary at the acquisition date.

D) net assets of the parent at the acquisition date.

A) equity of the subsidiary at the acquisition date.

B) equity of the parent at the acquisition date.

C) net assets of the subsidiary at the acquisition date.

D) net assets of the parent at the acquisition date.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements are incorrect with regards to pre-acquisition entries prepared after acquisition date?

A) are adjusted for transfers between post-acquisition equity accounts.

B) are adjusted for the changes in the investment account recognised by the parent in the subsidiary.

C) include the pre-acquisition entry prepared at acquisition date adjusted for the effects of all the transfers between pre-acquisition equity accounts and changes in the investment account up to the beginning of the current period.

D) reverse the transfers between pre-acquisition equity accounts and changes in the investment account that happen in the current period.

A) are adjusted for transfers between post-acquisition equity accounts.

B) are adjusted for the changes in the investment account recognised by the parent in the subsidiary.

C) include the pre-acquisition entry prepared at acquisition date adjusted for the effects of all the transfers between pre-acquisition equity accounts and changes in the investment account up to the beginning of the current period.

D) reverse the transfers between pre-acquisition equity accounts and changes in the investment account that happen in the current period.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

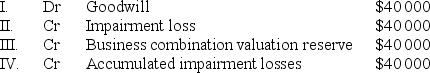

One year after acquisition date, the goodwill acquired was regarded as having become impaired by $40 000. The appropriate consolidation adjustment in relation to the impairment will include the following line:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

At the end of any period after acquisition, the business combination entries prepared for the assets and liabilities that were not recorded at fair value at acquisition date and that are sold, fully depreciated or settled during the current period include:

A) adjustments to the asset or liability account, recognising also the tax effects.

B) adjustments to the gains on sale or to expenses generated by depreciation, amortisation or impairment losses or settlement of liabilities, recognising also the tax effects.

C) adjustments to the asset and liability account and to the gains on sale or to expenses generated by depreciation, amortisation or impairment losses or settlement of liabilities, recognising also the tax effects.

D) no adjustments are required.

A) adjustments to the asset or liability account, recognising also the tax effects.

B) adjustments to the gains on sale or to expenses generated by depreciation, amortisation or impairment losses or settlement of liabilities, recognising also the tax effects.

C) adjustments to the asset and liability account and to the gains on sale or to expenses generated by depreciation, amortisation or impairment losses or settlement of liabilities, recognising also the tax effects.

D) no adjustments are required.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

Hungry Limited acquired 100% of the share capital of Jane Limited for a purchase consideration of $320 000. At acquisition date, the net fair value of Jane Limited's assets, liabilities and contingent liabilities was $250 000 including goodwill with a carrying amount of $20 000. The company tax rate is 30%. The unrecorded amount of goodwill that must be recognised on the consolidation worksheet is:

A) $50 000.

B) $70 000.

C) $90 000.

D) $15 000.

A) $50 000.

B) $70 000.

C) $90 000.

D) $15 000.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

If a revaluation of the subsidiary's assets is performed on consolidation, the subsidiary's assets are carried into the consolidated statement of financial position at:

A) net present value.

B) current replacement cost.

C) historical cost.

D) fair value.

A) net present value.

B) current replacement cost.

C) historical cost.

D) fair value.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

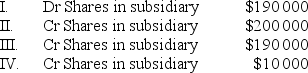

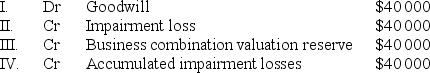

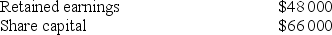

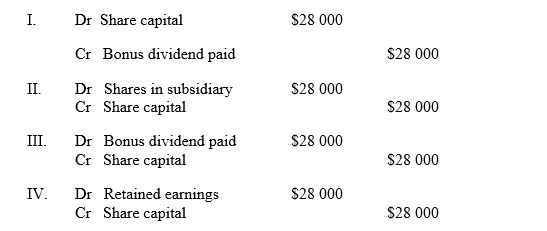

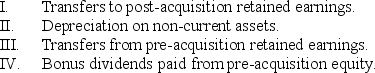

Titans Ltd acquired 100% of Taylor Ltd on 1 July 2014. At acquisition date, Taylor Ltd had the following equity items:

In the year following the acquisition, Taylor Ltd paid a bonus share dividend of $28 000 out of pre-acquisition retained earnings. Which of the following consolidation adjustments is needed in the consolidation worksheet for 30 June 2015?

A) I.

B) II.

C) III.

D) IV.

In the year following the acquisition, Taylor Ltd paid a bonus share dividend of $28 000 out of pre-acquisition retained earnings. Which of the following consolidation adjustments is needed in the consolidation worksheet for 30 June 2015?

A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

According to AASB 3 Business Combinations, the key principle relating to the disclosure of information about business combinations is to disclose information that:

A) enables financial statement users to evaluate the nature and financial effect of business combinations that occurred during the reporting period.

B) enables the preparation of the consolidated financial statements in the most cost-effective manner.

C) does not give an advantage to the competitors of a consolidated group.

D) provides financial statement users with information about the parent entity only.

A) enables financial statement users to evaluate the nature and financial effect of business combinations that occurred during the reporting period.

B) enables the preparation of the consolidated financial statements in the most cost-effective manner.

C) does not give an advantage to the competitors of a consolidated group.

D) provides financial statement users with information about the parent entity only.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following assets cannot be revalued above their cost in the accounting records of the subsidiary?

A) Inventories.

B) Plant and equipment.

C) Goodwill.

D) Inventories and goodwill.

A) Inventories.

B) Plant and equipment.

C) Goodwill.

D) Inventories and goodwill.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is correct?

A) AASB 3 Business Combinations requires that any revaluations of a subsidiary's assets at acquisition date must be done in the consolidation worksheet.

B) The revaluation of non-current assets in the subsidiary's records means that the subsidiary has adopted the cost model of accounting for those assets.

C) Revaluations of assets such as goodwill and inventory are not permitted in the accounting records of the subsidiary.

D) Inventories can be revalued to an amount greater than its cost in the records of the subsidiary.

A) AASB 3 Business Combinations requires that any revaluations of a subsidiary's assets at acquisition date must be done in the consolidation worksheet.

B) The revaluation of non-current assets in the subsidiary's records means that the subsidiary has adopted the cost model of accounting for those assets.

C) Revaluations of assets such as goodwill and inventory are not permitted in the accounting records of the subsidiary.

D) Inventories can be revalued to an amount greater than its cost in the records of the subsidiary.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

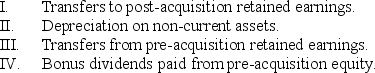

46

Which of the following events can cause a change in the pre-acquisition entry subsequent to acquisition date?

A) I, II, III and IV.

B) I, III and IV only.

C) II and III only.

D) III and IV only.

A) I, II, III and IV.

B) I, III and IV only.

C) II and III only.

D) III and IV only.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is incorrect?

A) The fair value adjustments may be made via the consolidation worksheet or in the actual records of the subsidiary.

B) All assets can be revalued in the subsidiary's accounts.

C) If the assets can be revalued in the subsidiary accounts, the increase in value will be recognised as part of the pre-acquisition equity in asset revaluation surplus.

D) If the assets are revalued in the consolidation worksheet, the increase in value will be recognised as part of the pre-acquisition equity in the business combination valuation reserve.

A) The fair value adjustments may be made via the consolidation worksheet or in the actual records of the subsidiary.

B) All assets can be revalued in the subsidiary's accounts.

C) If the assets can be revalued in the subsidiary accounts, the increase in value will be recognised as part of the pre-acquisition equity in asset revaluation surplus.

D) If the assets are revalued in the consolidation worksheet, the increase in value will be recognised as part of the pre-acquisition equity in the business combination valuation reserve.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

In the periods after acquisition, the gain on bargain purchase will be recognised in the pre-acquisition entries as:

A) a credit to gain for the current period.

B) a debit to retained earnings (closing balance).

C) a decrease in the amount of debit to retained earnings (opening balance).

D) no adjustment is necessary.

A) a credit to gain for the current period.

B) a debit to retained earnings (closing balance).

C) a decrease in the amount of debit to retained earnings (opening balance).

D) no adjustment is necessary.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck