Deck 13: Equity Financing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 13: Equity Financing

1

Which of the following is NOT one of the basic shareholders rights?

A) The right to participate in earnings

B) The right to maintain one's proportional interest in the corporation

C) The right to participate in the proceeds of the sale of corporate assets upon liquidation of the corporation

D) The right to inspect the accounting records of the corporation

A) The right to participate in earnings

B) The right to maintain one's proportional interest in the corporation

C) The right to participate in the proceeds of the sale of corporate assets upon liquidation of the corporation

D) The right to inspect the accounting records of the corporation

D

2

Which of the following is an appropriate presentation of treasury stock?

A) As a marketable security

B) As a deduction at cost from total stockholders' equity

C) As a deduction at cost from total contingent liabilities

D) As a deduction at par from total stockholders' equity

A) As a marketable security

B) As a deduction at cost from total stockholders' equity

C) As a deduction at cost from total contingent liabilities

D) As a deduction at par from total stockholders' equity

B

3

How would a stock split affect each of the following? Total

Stockholders' Additional

Assets Equity Paid-In Capital

A) Increase Increase No effect

B) No effect No effect No effect

C) No effect No effect Increase

D) Decrease Decrease Decrease

Stockholders' Additional

Assets Equity Paid-In Capital

A) Increase Increase No effect

B) No effect No effect No effect

C) No effect No effect Increase

D) Decrease Decrease Decrease

B

4

At the date of the financial statements,common stock shares issued would exceed common stock shares outstanding as a result of the

A) declaration of a stock split.

B) purchase of treasury stock.

C) declaration of a stock dividend.

D) payment in full of subscribed stock.

A) declaration of a stock split.

B) purchase of treasury stock.

C) declaration of a stock dividend.

D) payment in full of subscribed stock.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

The par value of common stock represents the

A) liquidation value of the stock.

B) book value of the stock.

C) amount received by the corporation when the stock was originally issued.

D) legal nominal value assigned to the stock.

A) liquidation value of the stock.

B) book value of the stock.

C) amount received by the corporation when the stock was originally issued.

D) legal nominal value assigned to the stock.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

A company issued rights to its existing shareholders to acquire,at $15 per share,5,000 unissued shares of common stock with a par value of $10 per share.Common Stock will be credited at

A) $15 per share when the rights are exercised.

B) $15 per share when the rights are issued.

C) $10 per share when the rights are exercised.

D) $10 per share when the rights are issued.

A) $15 per share when the rights are exercised.

B) $15 per share when the rights are issued.

C) $10 per share when the rights are exercised.

D) $10 per share when the rights are issued.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following features of preferred stock would most likely be opposed by common shareholders?

A) Par or stated value

B) Participating

C) Redeemable

D) Callable

A) Par or stated value

B) Participating

C) Redeemable

D) Callable

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

The entry to record the issuance of common stock for fully paid stock subscriptions is

A) a memorandum entry.

B) Common Stock Subscribed,Common Stock Additional Paid-In Capital.

C) Common Stock Subscribed,Subscriptions Receivable.

D) Common Stock Subscribed,Common Stock.

A) a memorandum entry.

B) Common Stock Subscribed,Common Stock Additional Paid-In Capital.

C) Common Stock Subscribed,Subscriptions Receivable.

D) Common Stock Subscribed,Common Stock.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is least likely to affect the retained earnings balance?

A) Conversion of preferred stock into common stock

B) Stock splits

C) Treasury stock transactions

D) Stock dividends

A) Conversion of preferred stock into common stock

B) Stock splits

C) Treasury stock transactions

D) Stock dividends

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

A company issued rights to its existing shareholders to purchase for par unissued shares of common stock with a par value of $10 per share.When the market value of the common stock was $12 per share,the rights were exercised.Common Stock should be credited at $10 per share and

A) Paid-In Capital from Stock Rights credited at $2 per share.

B) Additional Paid-In Capital credited at $2 per share.

C) Retained Earnings credited at $2 per share.

D) no credit made to Additional Paid-In Capital or Retained Earnings.

A) Paid-In Capital from Stock Rights credited at $2 per share.

B) Additional Paid-In Capital credited at $2 per share.

C) Retained Earnings credited at $2 per share.

D) no credit made to Additional Paid-In Capital or Retained Earnings.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

The issuance of shares of preferred stock to shareholders

A) increases preferred stock outstanding.

B) has no effect on preferred stock outstanding.

C) increases preferred stock authorized.

D) decreases preferred stock authorized.

A) increases preferred stock outstanding.

B) has no effect on preferred stock outstanding.

C) increases preferred stock authorized.

D) decreases preferred stock authorized.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

The exercise price and market price of stock under a fixed compensatory stock option plan are equal on the grant date.The fair value of the options is greater than the option price.Under the fair value method,

A) compensation expense will be recognized in connection with the option plan.

B) no compensation expense will be recognized in connection with the option plan.

C) deferred compensation will be recognized.

D) no paid-in capital from stock options will be recognized.

A) compensation expense will be recognized in connection with the option plan.

B) no compensation expense will be recognized in connection with the option plan.

C) deferred compensation will be recognized.

D) no paid-in capital from stock options will be recognized.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

The use of equity reserves under international accounting standards

A) is strictly voluntary on the part of the management of a company.

B) is based on whether a reserve is part of distributable or nondistributable equity.

C) is primarily for the benefit of shareholders rather than creditors.

D) results in the elimination of the retained earnings category from the total equity of a company.

A) is strictly voluntary on the part of the management of a company.

B) is based on whether a reserve is part of distributable or nondistributable equity.

C) is primarily for the benefit of shareholders rather than creditors.

D) results in the elimination of the retained earnings category from the total equity of a company.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is most likely to be found in state laws regarding payment of dividends?

A) Dividends may be paid from legal capital.

B) Retained earnings are available for dividends unless restricted by contract or by statute.

C) Unrealized capital is available for any type of dividend.

D) Capital from donated assets is available for dividends.

A) Dividends may be paid from legal capital.

B) Retained earnings are available for dividends unless restricted by contract or by statute.

C) Unrealized capital is available for any type of dividend.

D) Capital from donated assets is available for dividends.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

Current financial accounting standards require

A) the use of the fair value method,but not the intrinsic value method.

B) the use of the fair value method and the intrinsic value method to account for each plan.

C) disclosure in the notes to the financial statements of compensation expense under the fair value method if the intrinsic value method is used.

D) disclosure in the notes to the financial statements of compensation expense under the intrinsic value method if the fair value method is used.

A) the use of the fair value method,but not the intrinsic value method.

B) the use of the fair value method and the intrinsic value method to account for each plan.

C) disclosure in the notes to the financial statements of compensation expense under the fair value method if the intrinsic value method is used.

D) disclosure in the notes to the financial statements of compensation expense under the intrinsic value method if the fair value method is used.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following shareholder rights is most commonly enhanced in an issue of preferred stock?

A) The right to vote for the board of directors

B) The right to maintain one's proportional interest in the corporation

C) The right to receive a full cash dividend before dividends are paid to other classes of stock

D) The right to vote on major corporate issues

A) The right to vote for the board of directors

B) The right to maintain one's proportional interest in the corporation

C) The right to receive a full cash dividend before dividends are paid to other classes of stock

D) The right to vote on major corporate issues

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is NOT a component of comprehensive income?

A) Asset revaluation reserve

B) Net income

C) Foreign currency translation adjustment

D) Minimum pension liability adjustment

A) Asset revaluation reserve

B) Net income

C) Foreign currency translation adjustment

D) Minimum pension liability adjustment

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

Gains and losses on the purchase and resale of treasury stock may be reflected only in

A) paid-in capital and retained earnings accounts.

B) paid-in capital accounts.

C) income,paid-in capital,and retaining earnings accounts.

D) income and paid-in capital accounts.

A) paid-in capital and retained earnings accounts.

B) paid-in capital accounts.

C) income,paid-in capital,and retaining earnings accounts.

D) income and paid-in capital accounts.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

An adjustment to retained earnings as a result of a conversion of preferred stock to common stock most likely would occur when

A) par value of the preferred stock is high relative to fair value of the common stock.

B) par value of the common stock is less than the book value of the preferred stock.

C) par value of the common stock exceeds the book value of the preferred stock.

D) par value of the preferred stock is low relative to fair value of the common.

A) par value of the preferred stock is high relative to fair value of the common stock.

B) par value of the common stock is less than the book value of the preferred stock.

C) par value of the common stock exceeds the book value of the preferred stock.

D) par value of the preferred stock is low relative to fair value of the common.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

Farnon Company has not declared or paid dividends on its cumulative preferred stock in the last three years.These dividends should be reported

A) as a current liability.

B) as a reduction in stockholders' equity.

C) in a note to the financial statements.

D) as a noncurrent liability.

A) as a current liability.

B) as a reduction in stockholders' equity.

C) in a note to the financial statements.

D) as a noncurrent liability.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

When a dividend is declared and paid in stock,

A) total stockholders' equity does not change.

B) total stockholders' equity decreases.

C) the current ratio increases.

D) the amount of working capital decreases.

A) total stockholders' equity does not change.

B) total stockholders' equity decreases.

C) the current ratio increases.

D) the amount of working capital decreases.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

How would the declaration of a 20 percent stock dividend by Astros Corporation affect each of the following on Astros' balance sheet? Retained Total Stock-

Earnings holders' Equity

A) Decrease Decrease

B) Decrease No effect

C) No effect Decrease

D) No effect No effect

Earnings holders' Equity

A) Decrease Decrease

B) Decrease No effect

C) No effect Decrease

D) No effect No effect

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

6,000 shares of common stock with a par value of $10 per share were issued initially at $12 per share.Subsequently,2,000 of these shares were acquired as treasury stock at $15 per share.Assuming that the par value method of accounting for treasury stock transactions is used,what is the effect of the acquisition of the treasury stock on each of the following? Additional Retained

Paid-In Capital Earnings

A) Increase No effect

B) Increase Decrease

C) Decrease Increase

D) Decrease Decrease

Paid-In Capital Earnings

A) Increase No effect

B) Increase Decrease

C) Decrease Increase

D) Decrease Decrease

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

When treasury stock is purchased for cash at more than its par value,what is the effect on total stockholders' equity under each of the following methods? Cost Method Par Value Method

A) No effect Decrease

B) Decrease No effect

C) Increase Increase

D) Decrease Decrease

A) No effect Decrease

B) Decrease No effect

C) Increase Increase

D) Decrease Decrease

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

When a property dividend is declared and the market value of the property exceeds its book value,the excess is credited to

A) Gain on Distribution of Property Dividends.

B) Retained Earnings.

C) Additional Paid-In Capital.

D) the related asset account.

A) Gain on Distribution of Property Dividends.

B) Retained Earnings.

C) Additional Paid-In Capital.

D) the related asset account.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

A restriction of retained earnings is most likely to be required by

A) incurring a net loss in the current year.

B) incurring a net loss in the prior year.

C) purchasing treasury stock.

D) reissuing treasury stock.

A) incurring a net loss in the current year.

B) incurring a net loss in the prior year.

C) purchasing treasury stock.

D) reissuing treasury stock.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

Under international accounting requirements,which of the following equity reserves is part of distributable equity?

A) Retained earnings

B) Capital redemption reserve

C) Asset revaluation reserve

D) Par value of shares

A) Retained earnings

B) Capital redemption reserve

C) Asset revaluation reserve

D) Par value of shares

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

Select the statement that is incorrect concerning the appropriations of retained earnings.

A) Appropriations of retained earnings reflect funds set aside for a designated purpose,such as plant expansion.

B) Appropriations of retained earnings do not change the total amount of stockholders' equity.

C) Appropriations of retained earnings can be made as a result of contractual requirements.

D) Appropriations of retained earnings can be made at the discretion of the board of directors.

A) Appropriations of retained earnings reflect funds set aside for a designated purpose,such as plant expansion.

B) Appropriations of retained earnings do not change the total amount of stockholders' equity.

C) Appropriations of retained earnings can be made as a result of contractual requirements.

D) Appropriations of retained earnings can be made at the discretion of the board of directors.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

Stock warrants outstanding should be classified as

A) liabilities.

B) reductions of capital contributed in excess of par value.

C) capital stock.

D) additions to contributed capital.

A) liabilities.

B) reductions of capital contributed in excess of par value.

C) capital stock.

D) additions to contributed capital.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

On July 31,2013,Rangers Corporation purchased 500,000 shares of Tigers Corporation.On December 31,2014,Rangers distributed 250,000 shares of Tigers stock as a dividend to Rangers' stockholders.This is an example of a

A) liquidating dividend.

B) investment dividend.

C) property dividend.

D) stock dividend.

A) liquidating dividend.

B) investment dividend.

C) property dividend.

D) stock dividend.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

Treasury stock was acquired for cash at a price in excess of its par value.The treasury stock was subsequently reissued for cash at a price in excess of its acquisition price.Assuming that the cost method of accounting for treasury stock transactions is used,what is the effect on retained earnings? Acquisition of Reissuance of

Treasury Stock Treasury Stock

A) No effect Increase

B) Increase No effect

C) No effect No effect

D) Increase Decrease

Treasury Stock Treasury Stock

A) No effect Increase

B) Increase No effect

C) No effect No effect

D) Increase Decrease

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

A company issued rights to its existing shareholders to purchase,for $30 per share,unissued shares of $15 par value common stock.When the rights lapse,

A) Additional Paid-In Capital will be credited.

B) Stock Rights Outstanding will be debited.

C) Gain on Lapse of Stock Rights will be credited.

D) no entry will be made.

A) Additional Paid-In Capital will be credited.

B) Stock Rights Outstanding will be debited.

C) Gain on Lapse of Stock Rights will be credited.

D) no entry will be made.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Unlike a stock split,a stock dividend requires a formal journal entry in the financial accounting records because stock dividends

A) represent a transfer from Retained Earnings to Capital Stock.

B) increase the stockholders' equity in the issuing firm.

C) are payable on the date they are declared.

D) increase the relative book value of an individual's stock holdings.

A) represent a transfer from Retained Earnings to Capital Stock.

B) increase the stockholders' equity in the issuing firm.

C) are payable on the date they are declared.

D) increase the relative book value of an individual's stock holdings.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

If 35 percent of the recent dividend paid by Yankees Corporation was correctly considered to be a liquidating dividend,how would this distribution affect each of the following accounts? Additional Retained

Paid-In Capital Earnings

A) No effect Decrease

B) No effect No effect

C) Decrease No effect

D) Decrease Decrease

Paid-In Capital Earnings

A) No effect Decrease

B) No effect No effect

C) Decrease No effect

D) Decrease Decrease

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

When a portion of stockholders' original investment is returned in the form of a dividend,it is called a

A) compensating dividend.

B) liquidating dividend.

C) property dividend.

D) equity dividend.

A) compensating dividend.

B) liquidating dividend.

C) property dividend.

D) equity dividend.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

Undistributed stock dividends should be reported as

A) a current liability.

B) an addition to capital stock outstanding.

C) a reduction in total stockholders' equity.

D) a note to the financial statements.

A) a current liability.

B) an addition to capital stock outstanding.

C) a reduction in total stockholders' equity.

D) a note to the financial statements.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is issued to shareholders by a corporation as evidence of the ownership of rights to acquire its unissued or treasury stock?

A) Stock options

B) Stock rights

C) Stock dividends

D) Stock subscriptions

A) Stock options

B) Stock rights

C) Stock dividends

D) Stock subscriptions

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

When treasury stock is purchased for more than its par value,Treasury Stock is debited for the purchase price under which of the following methods? Cost Method Par Value Method

A) No No

B) No Yes

C) Yes No

D) Yes Yes

A) No No

B) No Yes

C) Yes No

D) Yes Yes

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

On February 1,authorized common stock was sold on a subscription basis at a price in excess of par value,and 20 percent of the subscription price was collected.On May 1,the remaining 80 percent of the subscription price was collected.Additional Paid-In Capital would increase on February 1 May 1

A) No Yes

B) No No

C) Yes No

D) Yes Yes

A) No Yes

B) No No

C) Yes No

D) Yes Yes

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

When a property dividend is declared and the book value of the property exceeds its market value,the dividend is recorded at the

A) market value of the property at the date of distribution.

B) book value of the property at the date of declaration.

C) book value of the property at the date of distribution if it still exceeds the market value of the property at the date of declaration.

D) market value of the property at the date of declaration.

A) market value of the property at the date of distribution.

B) book value of the property at the date of declaration.

C) book value of the property at the date of distribution if it still exceeds the market value of the property at the date of declaration.

D) market value of the property at the date of declaration.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

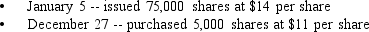

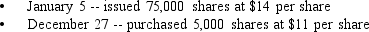

41

Waltham Corporation was organized on January 2 with 100,000 authorized shares of $10 par value common stock.During the year,Waltham had the following capital transactions:  Waltham used the par value method to record the purchase of the treasury shares.

Waltham used the par value method to record the purchase of the treasury shares.

What would be the balance in the paid-in capital from treasury stock account at December 31?

A) $0

B) $5,000

C) $15,000

D) $20,000

Waltham used the par value method to record the purchase of the treasury shares.

Waltham used the par value method to record the purchase of the treasury shares.What would be the balance in the paid-in capital from treasury stock account at December 31?

A) $0

B) $5,000

C) $15,000

D) $20,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

How would retained earnings be affected by the declaration of each of the following? Stock Dividend Stock Split

A) Decrease Decrease

B) No effect Decrease

C) Decrease No effect

D) No effect No effect

A) Decrease Decrease

B) No effect Decrease

C) Decrease No effect

D) No effect No effect

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

A company declared a cash dividend on its common stock in December 2013,payable in January 2014.Retained Earnings would

A) increase on the date of declaration.

B) not be affected on the date of declaration.

C) not be affected on the date of payment.

D) decrease on the date of payment.

A) increase on the date of declaration.

B) not be affected on the date of declaration.

C) not be affected on the date of payment.

D) decrease on the date of payment.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

On November 10,Linden Co.split its stock 5-for-2 when the market value was $55 per share.Prior to the split,Linden had 300,000 shares of $15 par value stock.After the split,the par value of the stock was

A) $3.

B) $6.

C) $15.

D) $26.

A) $3.

B) $6.

C) $15.

D) $26.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

How would the declaration of a liquidating dividend by a corporation affect each of the following? Contributed Total Stock-

Capital holders' Equity

A) No effect Decrease

B) Decrease No effect

C) No effect No effect

D) Decrease Decrease

Capital holders' Equity

A) No effect Decrease

B) Decrease No effect

C) No effect No effect

D) Decrease Decrease

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

On March 2,2014,Burton Corporation issued 4,000 shares of 6 percent cumulative $100 par value preferred stock for $434,000.Each preferred share carried one nondetachable stock warrant which entitled the holder to acquire,at $17,one share of Burton $10 par common stock.On March 2,2014,the market price of the preferred stock (without warrants)was $90 per share and the market price of the stock warrants was $15 per warrant.The amount credited to Paid-In Capital in Excess of Par-Preferred by Burton on the issuance of the stock was

A) $0.

B) $8,000.

C) $34,000.

D) $62,000.

A) $0.

B) $8,000.

C) $34,000.

D) $62,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

On December 10,Vandalia Co.split its stock 5-for-2 when the market value was $49 per share.Prior to the split,Vandalia had 250,000 shares of $15 par value stock.After the split,Vandalia's outstanding shares would be

A) 250,000

B) 225,000

C) 375,000

D) 625,000

A) 250,000

B) 225,000

C) 375,000

D) 625,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

In 2014,Climber Corporation issued for $110 per share,18,000 shares of $100 par value convertible preferred stock.One share of preferred stock may be converted into three shares of Climber's $30 par value common stock at the option of the preferred shareholder.On December 31,2015,all of the preferred stock was converted into common stock.The market value of the common stock at the conversion date was $40 per share.What amount should be credited to the common stock account on December 31,2015?

A) $1,620,000

B) $1,800,000

C) $1,318,000

D) $1,960,000

A) $1,620,000

B) $1,800,000

C) $1,318,000

D) $1,960,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

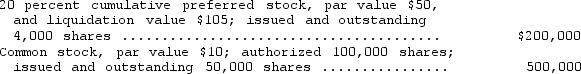

The Erhardt Corporation was incorporated on January 1,2014,with the following authorized capitalization:  During 2014,Erhardt issued 34,000 shares of common stock for a total of $1,700,000 and 6,000 shares of preferred stock at $16 per share.In addition,on December 20,2014,subscriptions for 2,000 shares of preferred stock were taken at a purchase price of $17.These subscribed shares were paid for on January 2,2015.What should Erhardt report as total contributed capital on its December 31,2014,balance sheet?

During 2014,Erhardt issued 34,000 shares of common stock for a total of $1,700,000 and 6,000 shares of preferred stock at $16 per share.In addition,on December 20,2014,subscriptions for 2,000 shares of preferred stock were taken at a purchase price of $17.These subscribed shares were paid for on January 2,2015.What should Erhardt report as total contributed capital on its December 31,2014,balance sheet?

A) $1,540,000

B) $1,762,000

C) $1,796,000

D) $1,830,000

During 2014,Erhardt issued 34,000 shares of common stock for a total of $1,700,000 and 6,000 shares of preferred stock at $16 per share.In addition,on December 20,2014,subscriptions for 2,000 shares of preferred stock were taken at a purchase price of $17.These subscribed shares were paid for on January 2,2015.What should Erhardt report as total contributed capital on its December 31,2014,balance sheet?

During 2014,Erhardt issued 34,000 shares of common stock for a total of $1,700,000 and 6,000 shares of preferred stock at $16 per share.In addition,on December 20,2014,subscriptions for 2,000 shares of preferred stock were taken at a purchase price of $17.These subscribed shares were paid for on January 2,2015.What should Erhardt report as total contributed capital on its December 31,2014,balance sheet?A) $1,540,000

B) $1,762,000

C) $1,796,000

D) $1,830,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

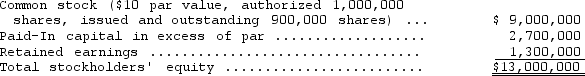

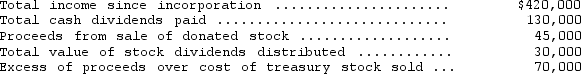

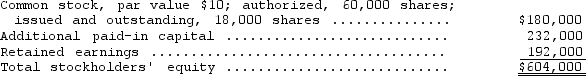

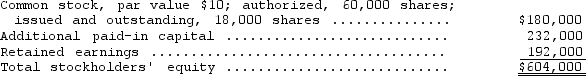

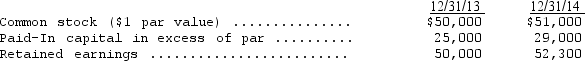

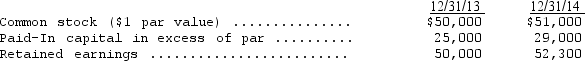

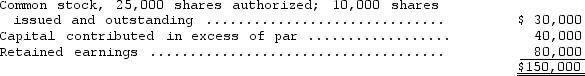

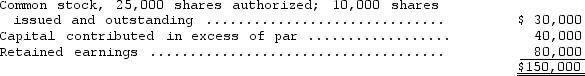

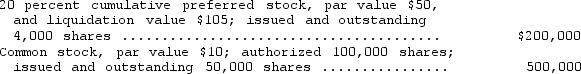

The stockholders' equity section of Sliver Corporation's balance sheet at December 31,2014,was as follows:  On January 2,2015,Sliver purchased and retired 100,000 shares of its stock for $1,800,000.Sliver records treasury stock using the par value method.Immediately after retirement of these 100,000 shares,the balances in the additional paid-in capital and retained earnings accounts should be

On January 2,2015,Sliver purchased and retired 100,000 shares of its stock for $1,800,000.Sliver records treasury stock using the par value method.Immediately after retirement of these 100,000 shares,the balances in the additional paid-in capital and retained earnings accounts should be

Paid-In Capital Retained

In Excess of Par Earnings

A) $900,000 $1,300,000

B) $1,400,000 $800,000

C) $1,900,000 $1,300,000

D) $2,400,000 $800,000

On January 2,2015,Sliver purchased and retired 100,000 shares of its stock for $1,800,000.Sliver records treasury stock using the par value method.Immediately after retirement of these 100,000 shares,the balances in the additional paid-in capital and retained earnings accounts should be

On January 2,2015,Sliver purchased and retired 100,000 shares of its stock for $1,800,000.Sliver records treasury stock using the par value method.Immediately after retirement of these 100,000 shares,the balances in the additional paid-in capital and retained earnings accounts should bePaid-In Capital Retained

In Excess of Par Earnings

A) $900,000 $1,300,000

B) $1,400,000 $800,000

C) $1,900,000 $1,300,000

D) $2,400,000 $800,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

How would the declaration of a 20 percent stock dividend by a corporation affect each of the following on its books? Retained Total Stock-

Earnings holders' Equity

A) Decrease No effect

B) Decrease Decrease

C) No effect Decrease

D) No effect No effect

Earnings holders' Equity

A) Decrease No effect

B) Decrease Decrease

C) No effect Decrease

D) No effect No effect

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

Oleander Corporation was organized on January 3,2014,with authorized capital of 100,000 shares of $10 par common stock.During 2014,Oleander had the following transactions affecting stockholders' equity:  The cost method was used to record the treasury stock transaction.Oleander's net income for 2014 is $300,000.What is the amount of stockholders' equity at December 31,2014?

The cost method was used to record the treasury stock transaction.Oleander's net income for 2014 is $300,000.What is the amount of stockholders' equity at December 31,2014?

A) $640,000

B) $702,000

C) $708,000

D) $720,000

The cost method was used to record the treasury stock transaction.Oleander's net income for 2014 is $300,000.What is the amount of stockholders' equity at December 31,2014?

The cost method was used to record the treasury stock transaction.Oleander's net income for 2014 is $300,000.What is the amount of stockholders' equity at December 31,2014?A) $640,000

B) $702,000

C) $708,000

D) $720,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

Porter Corporation holds 10,000 shares of its $10 par common stock as treasury stock,which was purchased in 2013 at a cost of $140,000.On December 10,2014,Porter sold all 10,000 shares for $260,000.Assuming that Porter used the cost method of accounting for treasury stock,this sale would result in a credit to

A) Paid-In Capital from Treasury Stock of $120,000.

B) Paid-In Capital from Treasury Stock of $110,000.

C) Gain on Sale of Treasury Stock of $120,000.

D) Retained Earnings of $120,000.

A) Paid-In Capital from Treasury Stock of $120,000.

B) Paid-In Capital from Treasury Stock of $110,000.

C) Gain on Sale of Treasury Stock of $120,000.

D) Retained Earnings of $120,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

On July 1,Riverwalk Corporation issued 2,000 shares of its $10 par common and 4,000 shares of its $10 par preferred stock for a lump sum of $80,000.At this date,Riverwalk's common stock was selling for $18 per share and the preferred stock for $13.50 per share.The amount of proceeds allocated to Riverwalk's preferred stock should be

A) $40,000.

B) $48,000.

C) $54,000.

D) $60,000.

A) $40,000.

B) $48,000.

C) $54,000.

D) $60,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Weaver Corporation was organized on January 1,2013,at which date it issued 100,000 shares of $10 par common stock at $15 per share.During the period January 1,2013,through December 31,2015,Weaver reported net income of $450,000 and paid cash dividends of $230,000.On January 10,2015,Weaver purchased 6,000 shares of its common stock at $12 per share.On December 31,2015,Weaver sold 4,000 treasury shares at $8 per share.Weaver uses the cost method of accounting for treasury shares.What is Weaver's total stockholders' equity on December 31,2015?

A) $1,720,000

B) $1,704,000

C) $1,688,000

D) $1,680,000

A) $1,720,000

B) $1,704,000

C) $1,688,000

D) $1,680,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

On July 1,Crimson Corporation had 200,000 shares of $10 par common stock outstanding.The market price of the stock was $12 per share.On the same date,Crimson declared a 1-for-2 reverse stock split.The par value of the stock was increased from $10 to $20,and one new $20 par share was issued for each two $10 par shares outstanding.Immediately before the 1-for-2 reverse stock split,Crimson's additional paid-in capital was $650,000.What should be the balance in Crimson's additional paid-in capital account immediately after the reverse stock split?

A) $450,000

B) $650,000

C) $850,000

D) $1,050,000

A) $450,000

B) $650,000

C) $850,000

D) $1,050,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

On January 2,2014,Sanders Corporation granted stock options to key employees for the purchase of 60,000 shares of the company's common stock at $25 per share.The options are intended to compensate employees for the next two years.The options are exercisable within a four-year period beginning January 1,2016,by grantees still in the employ of the company.The fair value of the option determined by an option pricing model is $7 at the grant date.Sanders plans to distribute up to 60,000 shares of treasury stock when options are exercised.The treasury stock was acquired by Sanders at a cost of $28 per share and was recorded under the cost method.Assume that no stock options were terminated during the year.How much should Sanders charge to Compensation Expense for the year ended December 31,2014?

A) $420,000

B) $210,000

C) $180,000

D) $90,000

A) $420,000

B) $210,000

C) $180,000

D) $90,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

On June 1,Continental Company issued 8,000 shares of its $10 par common stock to Divide for a tract of land.The stock had a fair market value of $18 per share on this date.On Divide's last property tax bill,the land was assessed at $96,000.Continental should record an increase in Additional Paid-In Capital of

A) $96,000.

B) $64,000.

C) $40,000.

D) $16,000.

A) $96,000.

B) $64,000.

C) $40,000.

D) $16,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

On February 24,Bramlett Company purchased 4,000 shares of Delaney Corp.'s newly issued 6 percent cumulative $75 par preferred stock for $304,000.Each share carried one detachable stock warrant entitling the holder to acquire at $10 one share of Delaney no-par common stock.On February 25,the market price of the preferred stock was $72 per share,and the market price of the stock warrants was $8 per warrant.On December 29,Bramlett sold all the stock warrants for $41,000.The gain on the sale of the stock warrants was

A) $0.

B) $1,000.

C) $9,000.

D) $10,600.

A) $0.

B) $1,000.

C) $9,000.

D) $10,600.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

On August 1,2014,B.Amherst Company reacquired 4,000 shares of its $15 par value common stock for $18 per share.Amherst uses the cost method to account for treasury stock.What journal entry should Amherst make to record the acquisition of treasury stock?

A) Treasury Stock .......................60,000

Additional Paid-In Capital ...........12,000

Cash ...............................72,000

B) Treasury Stock .......................60,000

Retained Earnings ....................12,000

Cash ...............................72,000

C) Retained Earnings ....................72,000

Cash ...............................72,000

D) Treasury Stock .......................72,000

Cash ...............................72,000

A) Treasury Stock .......................60,000

Additional Paid-In Capital ...........12,000

Cash ...............................72,000

B) Treasury Stock .......................60,000

Retained Earnings ....................12,000

Cash ...............................72,000

C) Retained Earnings ....................72,000

Cash ...............................72,000

D) Treasury Stock .......................72,000

Cash ...............................72,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

Island Company has 1,000,000 shares of common stock authorized with a par value of $3 per share of which 600,000 shares are outstanding.Island authorized a stock dividend when the market value was $8 per share,entitling its stockholders to one additional share for each share held.The par value of the stock was not changed.Assuming the declaration is not recorded separately,what entry,if any,should Island make to record distribution of the stock dividend?

A) Retained Earnings...........4,800,000

Common Stock..............1,800,000

Gain on Stock Dividends...3,000,000

B) Retained Earnings...........1,800,000

Common Stock..............1,800,000

C) Retained Earnings...........4,800,000

Common Stock..............1,800,000

Paid-In Capital from Stock Dividends 3,000,000

D) Memorandum entry noting the number of additional shares issued as a dividend

A) Retained Earnings...........4,800,000

Common Stock..............1,800,000

Gain on Stock Dividends...3,000,000

B) Retained Earnings...........1,800,000

Common Stock..............1,800,000

C) Retained Earnings...........4,800,000

Common Stock..............1,800,000

Paid-In Capital from Stock Dividends 3,000,000

D) Memorandum entry noting the number of additional shares issued as a dividend

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

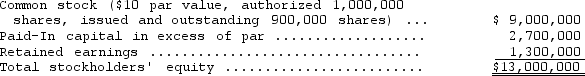

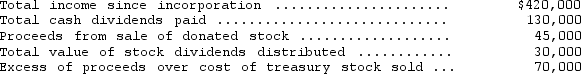

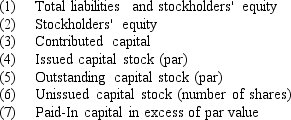

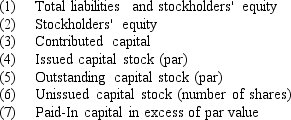

The following was abstracted from the accounts of the Aspen Corp.at year-end:  What should be the current balance of Retained Earnings?

What should be the current balance of Retained Earnings?

A) $260,000

B) $290,000

C) $305,000

D) $335,000

What should be the current balance of Retained Earnings?

What should be the current balance of Retained Earnings?A) $260,000

B) $290,000

C) $305,000

D) $335,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

Statement of Financial Accounting Standards No.160,"Noncontrolling Interests in Consolidated Financial Statements: An Amendment of ARB No.51",requires that the amount of equity interest provided by outside shareholders of subsidiaries that are not 100 %-owned by the parent company requires this amount be shown as

A) noncontrolling interest in the liabilities section of the balance sheet.

B) minority interest in the "mezzanine" section of the balance sheet between liabilities and owners' equity.

C) noncontrolling interest in the equity section of the balance sheet.

D) minority interest in the equity section of the balance sheet.

A) noncontrolling interest in the liabilities section of the balance sheet.

B) minority interest in the "mezzanine" section of the balance sheet between liabilities and owners' equity.

C) noncontrolling interest in the equity section of the balance sheet.

D) minority interest in the equity section of the balance sheet.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

On December 31,2014,the stockholders' equity section of Pierce Co.was as follows:  On March 31,2015,Pierce declared a 10 percent stock dividend,and accordingly 1,800 additional shares were issued,when the fair market value of the stock was $16 per share.For the three months ended March 31,2015,Pierce sustained a net loss of $64,000.The balance of Pierce's Retained Earnings as of March 31,2015,should be

On March 31,2015,Pierce declared a 10 percent stock dividend,and accordingly 1,800 additional shares were issued,when the fair market value of the stock was $16 per share.For the three months ended March 31,2015,Pierce sustained a net loss of $64,000.The balance of Pierce's Retained Earnings as of March 31,2015,should be

A) $99,200.

B) $110,000.

C) $112,000.

D) $128,000.

On March 31,2015,Pierce declared a 10 percent stock dividend,and accordingly 1,800 additional shares were issued,when the fair market value of the stock was $16 per share.For the three months ended March 31,2015,Pierce sustained a net loss of $64,000.The balance of Pierce's Retained Earnings as of March 31,2015,should be

On March 31,2015,Pierce declared a 10 percent stock dividend,and accordingly 1,800 additional shares were issued,when the fair market value of the stock was $16 per share.For the three months ended March 31,2015,Pierce sustained a net loss of $64,000.The balance of Pierce's Retained Earnings as of March 31,2015,should beA) $99,200.

B) $110,000.

C) $112,000.

D) $128,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

Adam Corporation owns 1,000 shares of common stock of Rosen,Inc. ,a large publicly traded company listed on a major stock exchange.If Rosen issues a 20 percent stock dividend when the par value is $10 per share and the market value is $70 per share,how much and what type of income should Adam report?

A) $0

B) $2,000 ordinary income

C) $14,000 ordinary income

D) $2,000 ordinary income and $12,000 extraordinary income

A) $0

B) $2,000 ordinary income

C) $14,000 ordinary income

D) $2,000 ordinary income and $12,000 extraordinary income

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

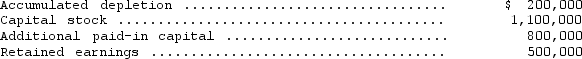

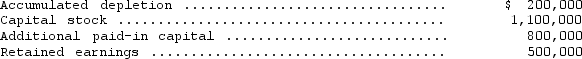

On January 2,2014 the board of directors of Moorehaven Mining Corporation declared a cash dividend of $1,200,000 to stockholders of record on January 18,2014,and payable on February 10,2014.The dividend is permissible by law in Moorehaven's state of incorporation.Selected data from Moorehaven's December 31,2013,balance sheet follow:  The $1,200,000 dividend includes a liquidating dividend of

The $1,200,000 dividend includes a liquidating dividend of

A) $800,000.

B) $700,000.

C) $600,000.

D) $200,000.

The $1,200,000 dividend includes a liquidating dividend of

The $1,200,000 dividend includes a liquidating dividend ofA) $800,000.

B) $700,000.

C) $600,000.

D) $200,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

On September 1,2014,Clownfish Corporation declared and issued a 15 percent common stock dividend.Prior to this date,Clownfish had 25,000 shares of $2 par value common stock that were both issued and outstanding.The market value of Clownfish' stock was $20 per share at the time the dividend was issued.As a result of this stock dividend,Clownfish' total stockholders' equity

A) decreased by $37,5000.

B) decreased by $375,000.

C) increased by $375,000.

D) did not change.

A) decreased by $37,5000.

B) decreased by $375,000.

C) increased by $375,000.

D) did not change.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

The following data are extracted from the stockholders' equity section of the balance sheet of Guthrie Corporation:  During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 was

During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 was

A) $2,300.

B) $9,800.

C) $10,800.

D) $14,800.

During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 was

During 2014,the corporation declared and paid cash dividends of $7,500 and also declared and issued a stock dividend.There were no other changes in stock issued and outstanding during 2014.Net income for 2014 wasA) $2,300.

B) $9,800.

C) $10,800.

D) $14,800.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

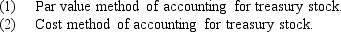

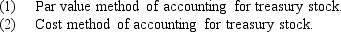

On August 10,Bushmills Corporation reacquired 8,000 shares of its $100 par value common stock at $134.The stock was originally issued at $110.The shares were resold on November 21 at $145.

Provide the entries required to record the reacquisition and the subsequent resale of the stock using the:

Provide the entries required to record the reacquisition and the subsequent resale of the stock using the:

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

The stockholders' equity section of Angus Corporation as of December 31,2014,contained the following accounts:  Angus's board of directors declared a 10 percent stock dividend on April 1,2015,when the market value of the stock was $7 per share.Accordingly,1,000 new shares were issued.All of Angus's stock has a par value of $3 per share.Assuming Angus sustained a net loss of $12,000 for the quarter ended March 31,2015,what amount should Angus report as retained earnings as of April 1,2015?

Angus's board of directors declared a 10 percent stock dividend on April 1,2015,when the market value of the stock was $7 per share.Accordingly,1,000 new shares were issued.All of Angus's stock has a par value of $3 per share.Assuming Angus sustained a net loss of $12,000 for the quarter ended March 31,2015,what amount should Angus report as retained earnings as of April 1,2015?

A) $61,000

B) $64,000

C) $68,000

D) $73,000

Angus's board of directors declared a 10 percent stock dividend on April 1,2015,when the market value of the stock was $7 per share.Accordingly,1,000 new shares were issued.All of Angus's stock has a par value of $3 per share.Assuming Angus sustained a net loss of $12,000 for the quarter ended March 31,2015,what amount should Angus report as retained earnings as of April 1,2015?

Angus's board of directors declared a 10 percent stock dividend on April 1,2015,when the market value of the stock was $7 per share.Accordingly,1,000 new shares were issued.All of Angus's stock has a par value of $3 per share.Assuming Angus sustained a net loss of $12,000 for the quarter ended March 31,2015,what amount should Angus report as retained earnings as of April 1,2015?A) $61,000

B) $64,000

C) $68,000

D) $73,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

Meower Corp.received a charter authorizing 120,000 shares of common stock at $15 par value per share.During the first year of operations,40,000 shares were sold at $28 per share.600 shares were issued in payment of a current operating debt of $18,600.In the first year,the net income was $142,000.

During the year,dividends of $46,000 were paid to stockholders.At the end of the year,total liabilities were $82,000.Use the given data to compute the following items at the end of the first year (show all computations):

During the year,dividends of $46,000 were paid to stockholders.At the end of the year,total liabilities were $82,000.Use the given data to compute the following items at the end of the first year (show all computations):

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

The Mailer Corporation had the following classes of stock outstanding as of December 31,2014: Common stock,$20 par value,20,000 shares outstanding

Preferred stock,6 percent,$100 par value,cumulative,2,000 shares outstanding

No dividends were paid on preferred stock for 2012 and 2013.On December 31,2014,a total cash dividend of $200,000 was declared.What are the amounts of dividends payable on both the common and preferred stock,respectively?

A) $0 and $200,000

B) $164,000 and $36,000

C) $176,000 and $24,000

D) $188,000 and $12,000

Preferred stock,6 percent,$100 par value,cumulative,2,000 shares outstanding

No dividends were paid on preferred stock for 2012 and 2013.On December 31,2014,a total cash dividend of $200,000 was declared.What are the amounts of dividends payable on both the common and preferred stock,respectively?

A) $0 and $200,000

B) $164,000 and $36,000

C) $176,000 and $24,000

D) $188,000 and $12,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

On June 1,2014,Revere Corporation declared a stock dividend entitling its stockholders to one additional share for each share held.At the time the dividend was declared,the market value of the stock was $10 per share and the par value was $5 per share.On this date Revere had 1,000,000 shares of common stock authorized of which 500,000 shares were outstanding.Assuming the par value of the stock was NOT changed,what entry should Revere make to record this transaction?

A) Retained Earnings .............5,000,000

Common Stock Dividend Distributable 2,500,000

Capital in Excess of Par.....2,500,000

B) Stock Dividend Payable ........5,000,000

Common Stock Dividend Distributable.2,500,000

Capital in Excess of Par.....2,500,000

C) Retained Earnings..............2,500,000

Common Stock Dividend Distributable 2,500,000

D) No entry

A) Retained Earnings .............5,000,000

Common Stock Dividend Distributable 2,500,000

Capital in Excess of Par.....2,500,000

B) Stock Dividend Payable ........5,000,000

Common Stock Dividend Distributable.2,500,000

Capital in Excess of Par.....2,500,000

C) Retained Earnings..............2,500,000

Common Stock Dividend Distributable 2,500,000

D) No entry

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

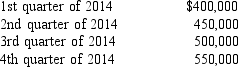

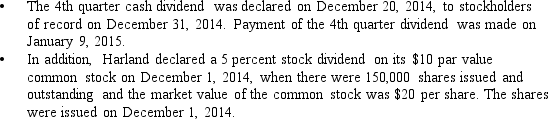

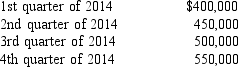

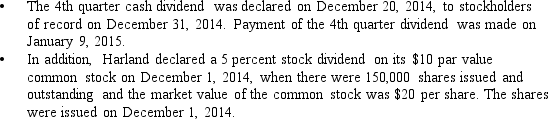

Cash dividends on the $10 par value common stock of Harland Company were as follows:

What was the effect on Harland's stockholders' equity accounts as a result of the 2014 dividend transactions?

What was the effect on Harland's stockholders' equity accounts as a result of the 2014 dividend transactions?

Additional

Common Stock Paid-In Capital Retained Earnings

A) $75,000 credit $0 $1,975,000 debit

B) $75,000 credit $75,000 credit $2,050,000 debit

C) $150,000 credit $150,000 credit $1,900,000 debit

D) $150,000 credit $75,000 credit $2,050,000 debit

What was the effect on Harland's stockholders' equity accounts as a result of the 2014 dividend transactions?

What was the effect on Harland's stockholders' equity accounts as a result of the 2014 dividend transactions?Additional

Common Stock Paid-In Capital Retained Earnings

A) $75,000 credit $0 $1,975,000 debit

B) $75,000 credit $75,000 credit $2,050,000 debit

C) $150,000 credit $150,000 credit $1,900,000 debit

D) $150,000 credit $75,000 credit $2,050,000 debit

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

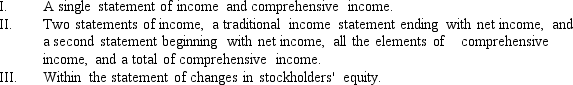

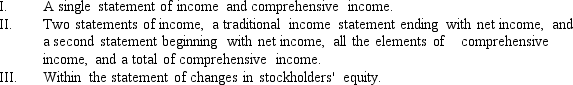

Which of the following presentation formats is permitted by Statement of Financial Accounting Standards No.130,"Reporting Comprehensive Income"?

A) Only I

B) I and III

C) I and II

D) I,II,and III

A) Only I

B) I and III

C) I and II

D) I,II,and III

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

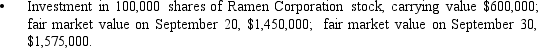

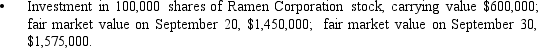

On September 20,2014,Shunt Corporation declared the distribution of the following dividend to its stockholders of record as of September 30,2014:  The entry to record the declaration of the property dividend would include a debit to Retained Earnings of

The entry to record the declaration of the property dividend would include a debit to Retained Earnings of

A) $1,575,000.

B) $1,450,000.

C) $850,000.

D) $600,000.

The entry to record the declaration of the property dividend would include a debit to Retained Earnings of

The entry to record the declaration of the property dividend would include a debit to Retained Earnings ofA) $1,575,000.

B) $1,450,000.

C) $850,000.

D) $600,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

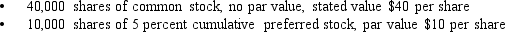

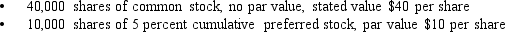

77

Indigo Co.was organized on January 2,2014,with the following capital structure:  Indigo's net income for the year ended December 31,2014,was $750,000,but no dividends were declared.Indigo's balance sheet would report Dividends Payable at December 31,2014,of

Indigo's net income for the year ended December 31,2014,was $750,000,but no dividends were declared.Indigo's balance sheet would report Dividends Payable at December 31,2014,of

A) $90,000.

B) $20,000.

C) $2,000.

D) $0.

Indigo's net income for the year ended December 31,2014,was $750,000,but no dividends were declared.Indigo's balance sheet would report Dividends Payable at December 31,2014,of

Indigo's net income for the year ended December 31,2014,was $750,000,but no dividends were declared.Indigo's balance sheet would report Dividends Payable at December 31,2014,ofA) $90,000.

B) $20,000.

C) $2,000.

D) $0.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

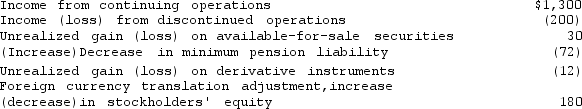

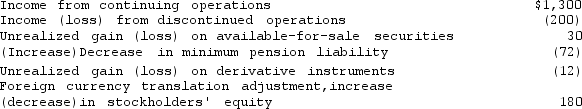

Lexan Company reported the following for the year ended December 31,2014 (all items are net of income taxes):  Comprehensive income (loss)for the year ended December 31,2014,would be

Comprehensive income (loss)for the year ended December 31,2014,would be

A) ($74).

B) $1,226.

C) $1,426.

D) $126.

Comprehensive income (loss)for the year ended December 31,2014,would be

Comprehensive income (loss)for the year ended December 31,2014,would beA) ($74).

B) $1,226.

C) $1,426.

D) $126.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

Chase Co.owned 30,000 common shares of Sanborn Corporation purchased in 2008 for $540,000.On September 20,2014,Chase declared a property dividend of 1 share of Sanborn for every 5 shares of Chase stock held by a stockholder.On that date,there were 50,000 common shares of Chase outstanding,and the market value of Sanborn shares was $30 per share.The entry to record the declaration of the property dividend would include a debit to Retained Earnings of

A) $0.

B) $300,000.

C) $360,000.

D) $540,000.

A) $0.

B) $300,000.

C) $360,000.

D) $540,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

On June 30,2014,Lynch Co.declared and issued a 15 percent stock dividend.Prior to this dividend,Lynch had 50,000 shares of $10 par value common stock issued and outstanding.The market value of Lynch Co.'s common stock on June 30,2014,was $24 per share.As a result of this stock dividend,by what amount would Lynch's total stockholders' equity increase (decrease)?

A) $0

B) $75,000

C) $70,000

D) $(70,000)

A) $0

B) $75,000

C) $70,000

D) $(70,000)

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck