Deck 5: Statement of Cash Flows and Articulation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/80

Play

Full screen (f)

Deck 5: Statement of Cash Flows and Articulation

1

A loss on the sale of machinery in the ordinary course of business should be presented in a statement of cash flows (indirect method)as

A) an addition to net income.

B) a deduction from net income.

C) an inflow and outflow of cash.

D) an outflow of cash.

A) an addition to net income.

B) a deduction from net income.

C) an inflow and outflow of cash.

D) an outflow of cash.

A

2

Using the indirect method,cash flows from operating activities would be increased by which of the following?

A) Gain on sale of investments

B) Decrease in accounts receivable

C) Decrease in accounts payable

D) Increase in prepaid expenses

A) Gain on sale of investments

B) Decrease in accounts receivable

C) Decrease in accounts payable

D) Increase in prepaid expenses

B

3

In preparing a statement of cash flows,which of the following transactions would be considered an investing activity?

A) Sale of a business segment

B) Issuance of bonds payable at a discount

C) Purchase of treasury stock

D) Sale of capital stock

A) Sale of a business segment

B) Issuance of bonds payable at a discount

C) Purchase of treasury stock

D) Sale of capital stock

A

4

In a statement of cash flows using the direct method,which of the following would increase reported cash flows from operating activities?

A) Dividends received from investments

B) Gain on sale of equipment

C) Gain on sale of a business segment

D) Sale of treasury stock

A) Dividends received from investments

B) Gain on sale of equipment

C) Gain on sale of a business segment

D) Sale of treasury stock

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

5

In a statement of cash flows,proceeds from issuing equity instruments should be classified as cash inflows from

A) brokerage activities.

B) financing activities.

C) investing activities.

D) operating activities.

A) brokerage activities.

B) financing activities.

C) investing activities.

D) operating activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

6

In preparing a statement of cash flows (indirect method),cash flows from operating activities

A) is calculated as the difference between revenues and expenses plus the beginning cash balance.

B) is always equal to the sum of cash flows from investing activities and cash flows from financing activities.

C) can be calculated by appropriately adding to or deducting from net income those items in the income statement that affect cash and accruals for current assets and current liabilities.

D) can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

A) is calculated as the difference between revenues and expenses plus the beginning cash balance.

B) is always equal to the sum of cash flows from investing activities and cash flows from financing activities.

C) can be calculated by appropriately adding to or deducting from net income those items in the income statement that affect cash and accruals for current assets and current liabilities.

D) can be calculated by appropriately adding to or deducting from net income those items in the income statement that do not affect cash.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

7

Cash equivalents would not include short-term investments in

A) money market funds.

B) available-for-sale securities.

C) commercial paper.

D) certificates of deposit.

A) money market funds.

B) available-for-sale securities.

C) commercial paper.

D) certificates of deposit.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

8

When preparing a statement of cash flows using the direct method,amortization of a patent is

A) shown as an increase in cash flows from operating activities.

B) shown as a reduction in cash flows from operating activities.

C) included with supplemental disclosures of noncash transactions.

D) not reported in the statement of cash flows or related disclosures.

A) shown as an increase in cash flows from operating activities.

B) shown as a reduction in cash flows from operating activities.

C) included with supplemental disclosures of noncash transactions.

D) not reported in the statement of cash flows or related disclosures.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

9

In a statement of cash flows,payments to acquire bonds or mortgages of other entities should be classified as cash outflows for

A) lending activities.

B) operating activities.

C) investing activities.

D) financing activities.

A) lending activities.

B) operating activities.

C) investing activities.

D) financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

10

In a statement of cash flows,payments to acquire debt instruments of other entities would typically be classified as cash outflows for

A) financing activities.

B) equity activities.

C) operating activities.

D) investing activities.

A) financing activities.

B) equity activities.

C) operating activities.

D) investing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

11

A decrease in accounts receivable should be presented in a statement of cash flows (indirect method)as

A) an inflow and outflow of cash.

B) an outflow of cash.

C) a deduction from net income.

D) an addition to net income.

A) an inflow and outflow of cash.

B) an outflow of cash.

C) a deduction from net income.

D) an addition to net income.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements regarding cash equivalents is correct?

A) A one-year Treasury note could not qualify as a cash equivalent.

B) All investments meeting the FASB's criteria for cash equivalents must be reported as such.

C) The date a security is purchased determines its "original maturity" for cash equivalent classification purposes.

D) Once established,management's policy for classifying items as cash equivalents cannot be changed.

A) A one-year Treasury note could not qualify as a cash equivalent.

B) All investments meeting the FASB's criteria for cash equivalents must be reported as such.

C) The date a security is purchased determines its "original maturity" for cash equivalent classification purposes.

D) Once established,management's policy for classifying items as cash equivalents cannot be changed.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

13

In a statement of cash flows,if equipment is sold at a gain,the amount shown as a cash inflow from investing activities equals the carrying amount of the equipment

A) with no addition or subtraction.

B) plus the gain and less the amount of tax attributable to the gain.

C) plus the gain only.

D) plus both the gain and the amount of tax attributable to the gain.

A) with no addition or subtraction.

B) plus the gain and less the amount of tax attributable to the gain.

C) plus the gain only.

D) plus both the gain and the amount of tax attributable to the gain.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

14

In preparing a statement of cash flows,sale of treasury stock at an amount greater than cost would be classified as a(n)

A) transfer activity.

B) operating activity.

C) investing activity.

D) financing activity.

A) transfer activity.

B) operating activity.

C) investing activity.

D) financing activity.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

15

In a statement of cash flows (indirect method),depreciation is treated as an adjustment to reported net income because depreciation

A) is an inflow of cash to a reserve account for asset replacement.

B) reduces the reported net income and involves an inflow of cash.

C) reduces the reported net income but does not involve an outflow of cash.

D) usually represents a significant portion of operating expenses.

A) is an inflow of cash to a reserve account for asset replacement.

B) reduces the reported net income and involves an inflow of cash.

C) reduces the reported net income but does not involve an outflow of cash.

D) usually represents a significant portion of operating expenses.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

16

In a statement of cash flows prepared using the direct method,if wages payable increased during the year,the cash paid for wages would be

A) the same as salary expense.

B) salary expense plus wages payable at the beginning of the year.

C) salary expense plus the increase in wages payable from the beginning to the end of the year.

D) salary expense less the increase in wages payable from the beginning to the end of the year.

A) the same as salary expense.

B) salary expense plus wages payable at the beginning of the year.

C) salary expense plus the increase in wages payable from the beginning to the end of the year.

D) salary expense less the increase in wages payable from the beginning to the end of the year.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

17

When preparing a statement of cash flows using the indirect method,the amortization of trademarks should be reported as a(n)

A) increase in cash flows from investing activities.

B) reduction in cash flows from investing activities.

C) increase in cash flows from operating activities.

D) reduction in cash flows from operating activities.

A) increase in cash flows from investing activities.

B) reduction in cash flows from investing activities.

C) increase in cash flows from operating activities.

D) reduction in cash flows from operating activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

18

In a statement of cash flows,receipts from sales of property,plant,and equipment would be classified as cash inflows from

A) liquidating activities.

B) operating activities.

C) investing activities.

D) financing activities.

A) liquidating activities.

B) operating activities.

C) investing activities.

D) financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

19

Cash inflows from investing result from

A) decreases in liabilities.

B) increases in liabilities.

C) decreases in noncash assets.

D) increases in noncash assets.

A) decreases in liabilities.

B) increases in liabilities.

C) decreases in noncash assets.

D) increases in noncash assets.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

20

A gain on the sale of a plant asset in the ordinary course of business should be presented in a statement of cash flows prepared using the indirect method as

A) a cash inflow from investing activities.

B) a cash inflow from financing activities.

C) a deduction from net income.

D) an addition to net income.

A) a cash inflow from investing activities.

B) a cash inflow from financing activities.

C) a deduction from net income.

D) an addition to net income.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

21

In a statement of cash flows,proceeds from the sale of a company's own bonds or mortgages should be classified as cash inflows from

A) leveraging activities.

B) operating activities.

C) investing activities.

D) financing activities.

A) leveraging activities.

B) operating activities.

C) investing activities.

D) financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following would not be classified as an operating activity?

A) Interest income

B) Income tax expense

C) Dividend income

D) Payment of dividends

A) Interest income

B) Income tax expense

C) Dividend income

D) Payment of dividends

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

23

The most likely situation in which reported earnings are positive but operations are consuming rather than generating cash would be a

A) rapidly growing company.

B) company reporting large noncash expenses.

C) company using very conservative accounting standards that lower earnings.

D) company paying large cash dividends to its shareholders.

A) rapidly growing company.

B) company reporting large noncash expenses.

C) company using very conservative accounting standards that lower earnings.

D) company paying large cash dividends to its shareholders.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would be an example of an investing activity?

A) Issuance of long-term bonds

B) Issuance of common stock

C) Payment of cash dividends

D) Sale of plant assets

A) Issuance of long-term bonds

B) Issuance of common stock

C) Payment of cash dividends

D) Sale of plant assets

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

25

Cash flows from financing activities would be reduced by which of the following?

A) Purchase of inventory

B) Repayment of long-term debt

C) Purchase of machinery

D) Payment of interest

A) Purchase of inventory

B) Repayment of long-term debt

C) Purchase of machinery

D) Payment of interest

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

26

Supplemental disclosures required only when the statement of cash flows is prepared using the indirect method include

A) a schedule reconciling net income with net cash provided by (used in)operating activities.

B) amounts paid for interest and taxes.

C) amounts deducted for depreciation and amortization.

D) significant noncash investing and financing activities.

A) a schedule reconciling net income with net cash provided by (used in)operating activities.

B) amounts paid for interest and taxes.

C) amounts deducted for depreciation and amortization.

D) significant noncash investing and financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

27

In a statement of cash flows,which of the following would increase reported cash flows from operating activities using the direct method?

A) Collection of a note receivable

B) Dividends received from investments

C) Gain on purchase of treasury stock

D) Gain on sale of equipment

A) Collection of a note receivable

B) Dividends received from investments

C) Gain on purchase of treasury stock

D) Gain on sale of equipment

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is true?

A) The FASB requires dividends paid to be classified as an operating activity.

B) The FASB requires interest paid to be classified as a financing activity.

C) The FASB allows dividends paid to be classified as an operating activity or as a financing activity.

D) The IASC allows dividends paid to be classified as an operating activity or as a financing activity.

A) The FASB requires dividends paid to be classified as an operating activity.

B) The FASB requires interest paid to be classified as a financing activity.

C) The FASB allows dividends paid to be classified as an operating activity or as a financing activity.

D) The IASC allows dividends paid to be classified as an operating activity or as a financing activity.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

29

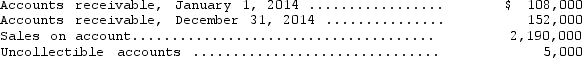

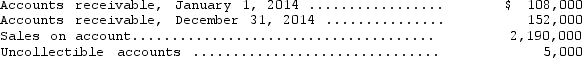

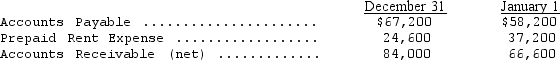

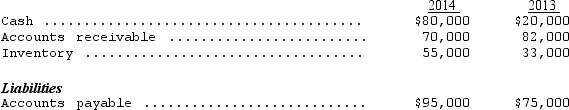

The following information was taken from the 2014 financial statements of Glocken Corporation:  No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?

No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?

A) $2,239,000

B) $2,234,000

C) $2,146,000

D) $2,141,000

No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?

No accounts receivable were written off or recovered during the year.If Glocken prepares a statement of cash flows using the direct method,what amount should be reported as collected from customers in 2014?A) $2,239,000

B) $2,234,000

C) $2,146,000

D) $2,141,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

30

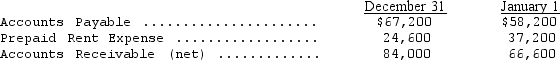

In its accrual basis income statement for the year ended December 31,2014,Braxton Company reported revenue of $3,500,000.Additional information is as follows:  Nelson should report cash collected from customers in its 2014 statement of cash flows (direct method)in the amount of

Nelson should report cash collected from customers in its 2014 statement of cash flows (direct method)in the amount of

A) $3,760,000.

B) $3,380,000.

C) $3,100,000.

D) $3,140,000.

Nelson should report cash collected from customers in its 2014 statement of cash flows (direct method)in the amount of

Nelson should report cash collected from customers in its 2014 statement of cash flows (direct method)in the amount ofA) $3,760,000.

B) $3,380,000.

C) $3,100,000.

D) $3,140,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

31

Cash flows from investing activities would be decreased by which of the following?

A) Issuance of bonds

B) Issuance of common stock

C) Purchase of long-term investments

D) Payment of dividends

A) Issuance of bonds

B) Issuance of common stock

C) Purchase of long-term investments

D) Payment of dividends

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

32

In a statement of cash flows,interest payments to lenders and other creditors should be classified as cash outflows for

A) borrowing activities.

B) operating activities.

C) investing activities.

D) financing activities.

A) borrowing activities.

B) operating activities.

C) investing activities.

D) financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

33

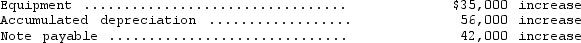

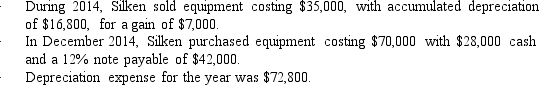

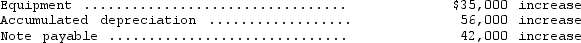

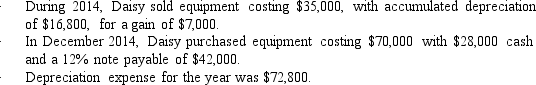

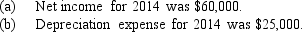

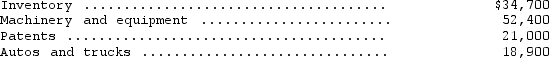

Silken Corp.reported net income of $420,000 for 2014.Changes occurred in several balance sheet accounts as follows:  Additional information:

Additional information:

In Silken's 2014 statement of cash flows,net cash used in investing activities should be

In Silken's 2014 statement of cash flows,net cash used in investing activities should be

A) $30,800.

B) $16,800.

C) $2,800.

D) $49,000.

Additional information:

Additional information: In Silken's 2014 statement of cash flows,net cash used in investing activities should be

In Silken's 2014 statement of cash flows,net cash used in investing activities should beA) $30,800.

B) $16,800.

C) $2,800.

D) $49,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is true?

A) The IASB requires eight cash flow categories.

B) The Statement of Cash Flows is classified according to three main categories.

C) The IASB does not specifically require a Statement of Cash Flows.

D) The provisions of IAS 7 are less flexible than the U.S.rules.

A) The IASB requires eight cash flow categories.

B) The Statement of Cash Flows is classified according to three main categories.

C) The IASB does not specifically require a Statement of Cash Flows.

D) The provisions of IAS 7 are less flexible than the U.S.rules.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

35

In a statement of cash flows (indirect method),an increase in inventories should be presented as

A) a deduction from net income from continuing operations.

B) an inflow and outflow of cash.

C) an addition to net income.

D) an inflow of cash.

A) a deduction from net income from continuing operations.

B) an inflow and outflow of cash.

C) an addition to net income.

D) an inflow of cash.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

36

American Corporation purchased a 3-month U.S.Treasury bill.In preparing American's statement of cash flows,this purchase would

A) be treated as an outflow from investing activities.

B) be treated as an outflow from operating activities.

C) have no effect.

D) be treated as an outflow from financing activities.

A) be treated as an outflow from investing activities.

B) be treated as an outflow from operating activities.

C) have no effect.

D) be treated as an outflow from financing activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would be an addition to net income when using the indirect method to derive net cash flows from operating activities?

A) Payment of cash dividends

B) Decrease in accounts payable

C) Increase in merchandise inventory

D) Loss on sale of machinery and equipment

A) Payment of cash dividends

B) Decrease in accounts payable

C) Increase in merchandise inventory

D) Loss on sale of machinery and equipment

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

38

Noncash investing and financing activities,if material,are

A) reported in the statement of cash flows under the "all-financial-resources concept."

B) reported in the statement of cash flows only if the indirect method is used.

C) disclosed in a note or separate schedule accompanying the statement of cash flows.

D) not reported or disclosed because they have no impact on cash.

A) reported in the statement of cash flows under the "all-financial-resources concept."

B) reported in the statement of cash flows only if the indirect method is used.

C) disclosed in a note or separate schedule accompanying the statement of cash flows.

D) not reported or disclosed because they have no impact on cash.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

39

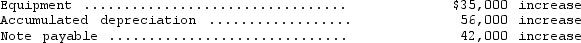

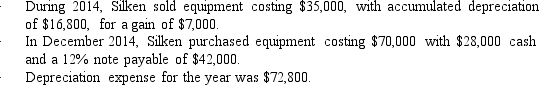

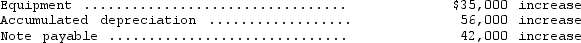

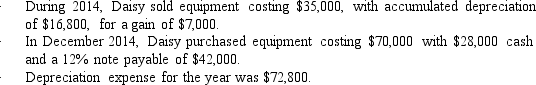

Daisy Corporation reported net income of $420,000 for 2014.Changes occurred in several balance sheet accounts as follows:  Additional information:

Additional information:

In Daisy's 2014 statement of cash flows,net cash provided by operating activities should be

In Daisy's 2014 statement of cash flows,net cash provided by operating activities should be

A) $476,000.

B) $485,800.

C) $492,800.

D) $499,800.

Additional information:

Additional information: In Daisy's 2014 statement of cash flows,net cash provided by operating activities should be

In Daisy's 2014 statement of cash flows,net cash provided by operating activities should beA) $476,000.

B) $485,800.

C) $492,800.

D) $499,800.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following would be subtracted from net income when using the indirect method to derive net cash flows from operating activities?

A) Decrease in net accounts receivable

B) Loss on sale of investments

C) Decrease in salaries and wages payable

D) Depreciation expense

A) Decrease in net accounts receivable

B) Loss on sale of investments

C) Decrease in salaries and wages payable

D) Depreciation expense

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

41

Stanner Company's 2014 income statement reported cost of goods sold as $135,000.Additional information is as follows:  If Stanner uses the direct method,what amount should Stanner report as cash paid to suppliers in its 2014 statement of cash flows?

If Stanner uses the direct method,what amount should Stanner report as cash paid to suppliers in its 2014 statement of cash flows?

A) $121,000

B) $134,000

C) $149,000

D) $136,000

If Stanner uses the direct method,what amount should Stanner report as cash paid to suppliers in its 2014 statement of cash flows?

If Stanner uses the direct method,what amount should Stanner report as cash paid to suppliers in its 2014 statement of cash flows?A) $121,000

B) $134,000

C) $149,000

D) $136,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

42

A gain on the sale of a plant asset should be included in which of the following sections of a statement of cash flows prepared using the direct method?

A) Investing activities

B) Operating activities

C) Financing activities

D) Any of these,if applied consistently from year to year

A) Investing activities

B) Operating activities

C) Financing activities

D) Any of these,if applied consistently from year to year

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

43

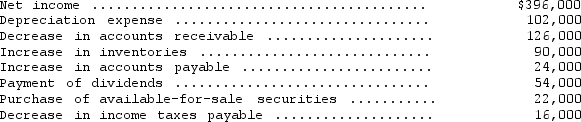

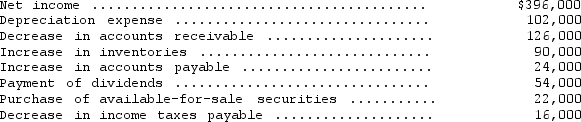

Thomson Company's income statement for the year ended December 31,2014,reported net income of $360,000.The financial statements also disclosed the following information:  Net cash provided by operating activities for 2014 should be reported as

Net cash provided by operating activities for 2014 should be reported as

A) $84,000.

B) $204,000.

C) $234,000.

D) $324,000.

Net cash provided by operating activities for 2014 should be reported as

Net cash provided by operating activities for 2014 should be reported asA) $84,000.

B) $204,000.

C) $234,000.

D) $324,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

44

A cash dividend that is declared during an accounting period,to be paid in the next accounting period,may be presented in the statement of cash flows in which of the following ways?

A) A use of cash from operating activities

B) A noncash transaction presented in a separate schedule

C) A use of cash from financing activities

D) A use of cash from investing activities

A) A use of cash from operating activities

B) A noncash transaction presented in a separate schedule

C) A use of cash from financing activities

D) A use of cash from investing activities

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

45

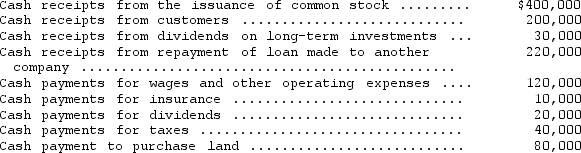

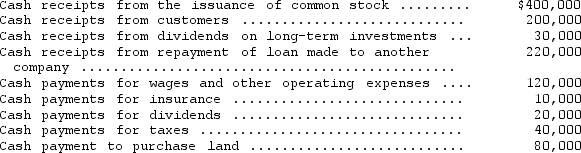

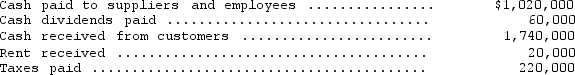

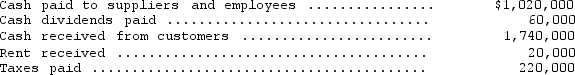

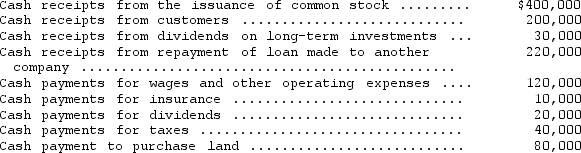

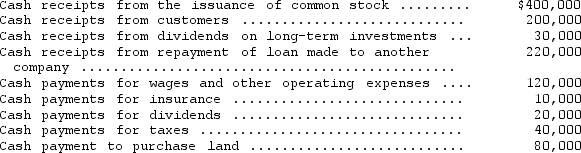

Dingo Boot Company uses the direct method to prepare its statement of cash flows.The company had the following cash flows during 2014:

See information regarding Ding Boot Company above.The net cash provided by (used in)investing activities is

A) $220,000.

B) $140,000.

C) $60,000.

D) $(80,000).

See information regarding Ding Boot Company above.The net cash provided by (used in)investing activities is

A) $220,000.

B) $140,000.

C) $60,000.

D) $(80,000).

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not a source of cash?

A) Sale of equipment below book value at a loss

B) Issuance of bonds payable below par value at a discount

C) Collection of a long-term note receivable from a customer

D) Declaration of a cash dividend to be paid in the next accounting period

A) Sale of equipment below book value at a loss

B) Issuance of bonds payable below par value at a discount

C) Collection of a long-term note receivable from a customer

D) Declaration of a cash dividend to be paid in the next accounting period

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is a noncash transaction that should be disclosed in a schedule accompanying the statement of cash flows?

A) Sale of an investment for cash

B) Purchase of a machine for cash

C) Issuance of common stock in exchange for land

D) Declaration and payment of a cash dividend on common stock

A) Sale of an investment for cash

B) Purchase of a machine for cash

C) Issuance of common stock in exchange for land

D) Declaration and payment of a cash dividend on common stock

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

48

Citrus Inc.declared and paid cash dividends of $100,000 on common stock and $75,000 on preferred stock.How would these dividends be presented in Citrus' statement of cash flows?

A) As a $100,000 reduction in cash flows from investing activities

B) As a $175,000 reduction in cash flows from investing activities

C) As a $100,000 reduction in cash flows from financing activities

D) As a $175,000 reduction in cash flows from financing activities

A) As a $100,000 reduction in cash flows from investing activities

B) As a $175,000 reduction in cash flows from investing activities

C) As a $100,000 reduction in cash flows from financing activities

D) As a $175,000 reduction in cash flows from financing activities

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is classified as a cash inflow from financing activities?

A) Cash received from re-issuance of treasury stock held by the company

B) Cash received from the sale of stock held as a long-term investment

C) Cash received as dividends on stock held as a long-term investment

D) Cash received from the sale of land

A) Cash received from re-issuance of treasury stock held by the company

B) Cash received from the sale of stock held as a long-term investment

C) Cash received as dividends on stock held as a long-term investment

D) Cash received from the sale of land

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

50

During 2014,Larson Corp.acquired buildings for $325,000,paying $75,000 cash and signing a 10% mortgage note payable in 10 years for the balance.How should the transaction be shown in the cash flow statement for Larson in 2014?

A) As a $325,000 reduction in cash flows from investing activities and a $250,000 increase in cash flows from financing activities

B) As a $325,000 reduction in cash flows from investing activities

C) As a $75,000 reduction in cash flows from investing activities

D) As a $250,000 increase in cash flows from financing activities

A) As a $325,000 reduction in cash flows from investing activities and a $250,000 increase in cash flows from financing activities

B) As a $325,000 reduction in cash flows from investing activities

C) As a $75,000 reduction in cash flows from investing activities

D) As a $250,000 increase in cash flows from financing activities

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

51

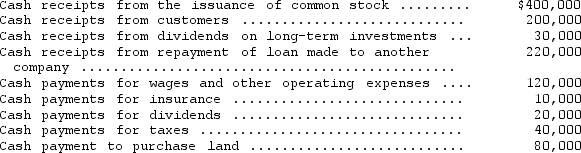

Dingo Boot Company uses the direct method to prepare its statement of cash flows.The company had the following cash flows during 2014:

See information regarding Dingo Boot Company above.The net cash provided by (used in)all activities is

A) $580,000.

B) $410,000.

C) $380,000.

D) $(60,000).

See information regarding Dingo Boot Company above.The net cash provided by (used in)all activities is

A) $580,000.

B) $410,000.

C) $380,000.

D) $(60,000).

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is not a cash inflow from investing activities?

A) Receipts from collections of sales of loans made by the enterprise

B) Receipts from sales of equity instruments of other entities

C) Receipts from issuance of equity instruments of the enterprise

D) Receipts from sales of productive assets

A) Receipts from collections of sales of loans made by the enterprise

B) Receipts from sales of equity instruments of other entities

C) Receipts from issuance of equity instruments of the enterprise

D) Receipts from sales of productive assets

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

53

The following information is available from Dodger Corporation's accounting records for the year ended December 31,2014:  Net cash flow provided by operating activities for 2014 was

Net cash flow provided by operating activities for 2014 was

A) $520,000.

B) $500,000.

C) $460,000.

D) $440,000.

Net cash flow provided by operating activities for 2014 was

Net cash flow provided by operating activities for 2014 wasA) $520,000.

B) $500,000.

C) $460,000.

D) $440,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

54

The following information is available from the financial statements of Barrington Corporation for the year ended December 31,2014:  What is Barrington Corporation's net cash flow from operating activities?

What is Barrington Corporation's net cash flow from operating activities?

A) $440,000

B) $466,000

C) $520,000

D) $542,000

What is Barrington Corporation's net cash flow from operating activities?

What is Barrington Corporation's net cash flow from operating activities?A) $440,000

B) $466,000

C) $520,000

D) $542,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

55

Almondine Company sold a computer for $50,000.The computer's original cost was $250,000,and the accumulated depreciation at the date of sale was $180,000.The sale of the computer should appear on Almondine's annual statement of cash flows (indirect method)as

A) a reduction in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000.

B) an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000.

C) a reduction in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $70,000.

D) an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $70,000.

A) a reduction in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000.

B) an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000.

C) a reduction in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $70,000.

D) an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $70,000.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not classified as a cash outflow from operating activities?

A) Cash payments to creditors for interest

B) Cash payments to stockholders for dividends

C) Cash payments to employees for services rendered

D) Cash payments on payables to material suppliers

A) Cash payments to creditors for interest

B) Cash payments to stockholders for dividends

C) Cash payments to employees for services rendered

D) Cash payments on payables to material suppliers

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

57

Waller Corporation had the following account balances for 2014:  Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?

Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?

A) $436,200

B) $445,200

C) $453,600

D) $454,200

Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?

Waller's 2014 net income is $450,000.What amount should Waller include as net cash provided by operating activities in its 2014 statement of cash flows?A) $436,200

B) $445,200

C) $453,600

D) $454,200

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

58

The amortization of a bond premium can correctly be presented in the statement of cash flows in which of the following ways?

A) A positive adjustment to net income in determining cash flows from operating activities

B) A use of cash in determining cash flows from investing activities

C) A source of cash in determining cash flows from financing activities

D) A negative adjustment to net income in determining cash flows from operating activities

A) A positive adjustment to net income in determining cash flows from operating activities

B) A use of cash in determining cash flows from investing activities

C) A source of cash in determining cash flows from financing activities

D) A negative adjustment to net income in determining cash flows from operating activities

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

59

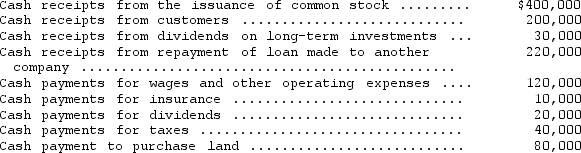

Dingo Boot Company uses the direct method to prepare its statement of cash flows.The company had the following cash flows during 2014:

See information regarding Dingo Boot Company above.The net cash provided by (used in)operating activities is

A) $60,000.

B) $40,000.

C) $30,000.

D) $(20,000).

See information regarding Dingo Boot Company above.The net cash provided by (used in)operating activities is

A) $60,000.

B) $40,000.

C) $30,000.

D) $(20,000).

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

60

Kirkland Company's prepaid rent was $40,000 at December 31,2014,and $15,000 at December 31,2013.Kirkland's income statement for 2014 reported rent expense as $10,000.What amount of cash disbursements for rent would be reported in Kirkland's net cash flows from operating activities for 2014 presented on a direct basis?

A) $10,000

B) $20,000

C) $35,000

D) $45,000

A) $10,000

B) $20,000

C) $35,000

D) $45,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

61

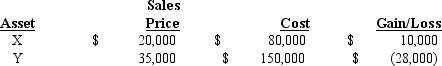

Net income for Parton Company for 2014 includes the effect of the following transactions involving the sale of fixed assets:  Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?

Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?

A) $175,000

B) $187,000

C) $197,000

D) $215,000

Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?

Purchases of fixed assets during 2014 amounted to $340,000.The Accumulated Depreciation account increased $40,000 during 2014.How much was depreciation expense for 2014?A) $175,000

B) $187,000

C) $197,000

D) $215,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

62

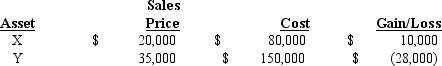

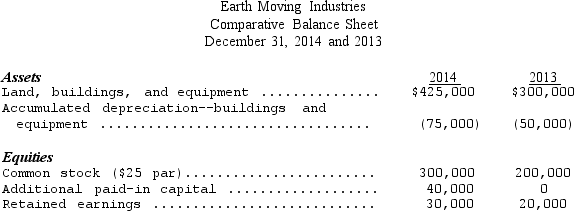

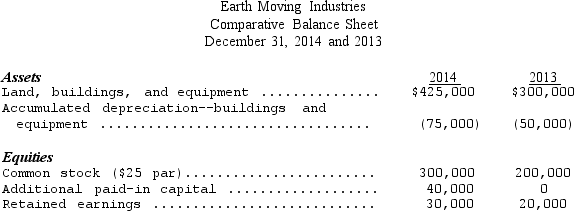

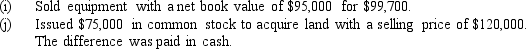

Partial balance sheet data and additional information for Earth Moving Industries are given below:

Additional information:

Additional information:

Prepare the investing and financing activities sections of the statement of cash flows for the year ending December 31,2014.

Prepare the investing and financing activities sections of the statement of cash flows for the year ending December 31,2014.

Additional information:

Additional information: Prepare the investing and financing activities sections of the statement of cash flows for the year ending December 31,2014.

Prepare the investing and financing activities sections of the statement of cash flows for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

63

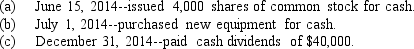

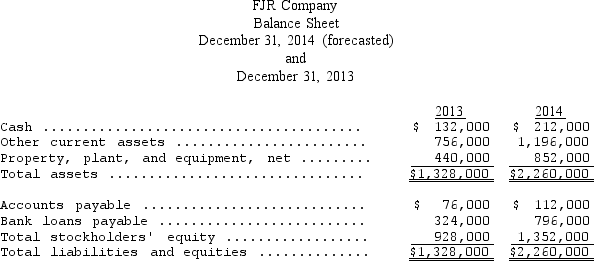

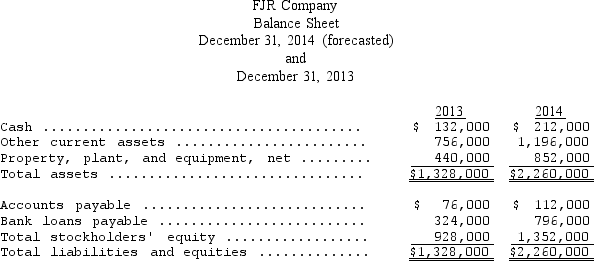

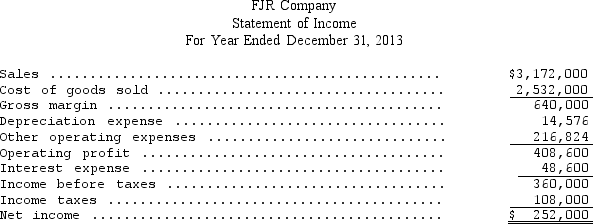

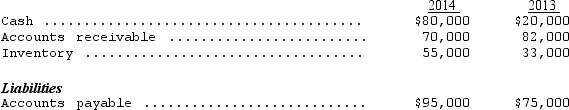

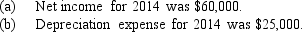

FJR Company is preparing a forecast of its net income for the year 2014.In addition,FJR plans to construct a forecasted statement of cash flows for 2014.The balance sheet and income statement data for 2013 are presented below,as well as a forecast of the balance sheet for 2014.Management expects sales in 2014 to rise to $6,000,000.In order to achieve this level of increase,management estimates that operating expenses (specifically sales commissions)will rise to $410,134.

Prepare a forecasted income statement and forecasted statement of cash flows (using the indirect method)for the year ended December 31,2014,for FJR Company.Calculate the cash flow to net income and cash flow adequacy ratios.There were no changes in stockholders' equity other than net income and cash dividends.

Prepare a forecasted income statement and forecasted statement of cash flows (using the indirect method)for the year ended December 31,2014,for FJR Company.Calculate the cash flow to net income and cash flow adequacy ratios.There were no changes in stockholders' equity other than net income and cash dividends.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

64

During the year,Samuels Company reported net income of $300,000,including amortization of intangible assets of $66,000,depreciation of plant assets of $132,000,and amortization of premium on investment in bonds of $20,000.Applying the indirect method,cash provided by operating activities is what amount?

A) $300,000

B) $518,000

C) $478,000

D) $498,000

A) $300,000

B) $518,000

C) $478,000

D) $498,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

65

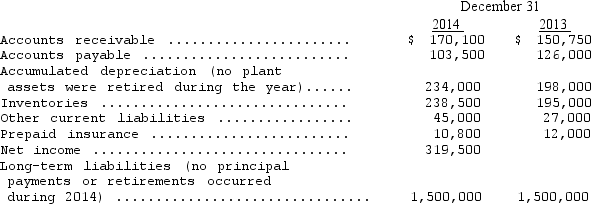

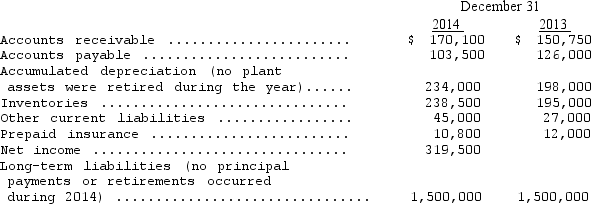

Partial balance sheet data and additional information for Bohemian Industries are given below:

Bohemian Industries

Partial Balance Sheet

December 31,2014 and 2013

Assets

Additional Information:

Additional Information:

Prepare the operating activities section of the statement of cash flows,using the indirect method,for the year ending December 31,2014.

Prepare the operating activities section of the statement of cash flows,using the indirect method,for the year ending December 31,2014.

Bohemian Industries

Partial Balance Sheet

December 31,2014 and 2013

Assets

Additional Information:

Additional Information: Prepare the operating activities section of the statement of cash flows,using the indirect method,for the year ending December 31,2014.

Prepare the operating activities section of the statement of cash flows,using the indirect method,for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

66

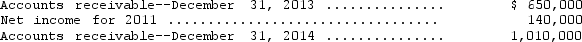

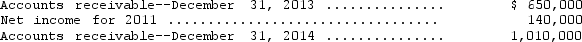

The following data were taken from the books of Golden Company.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.

Compute the net cash flow provided by (used in)operating activities during 2014 for Golden Company.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.

Cash dividends of $169,000 were declared and paid during 2011.Also,$56,000 of preferred stock was issued during the period.Compute the net cash flow provided by (used in)operating activities during 2014 for Golden Company.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

67

Robinson Company reported a net loss of $23,000 during the year.Comparing beginning and ending balances,you determine the following: (1)accounts receivable increased by $8,000;and (2)accrued expenses payable increased by $5,000.What was the amount of cash used in operating activities during the year?

A) $26,000

B) $36,000

C) $20,000

D) $10,000

A) $26,000

B) $36,000

C) $20,000

D) $10,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

68

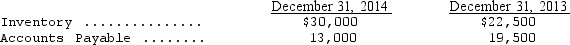

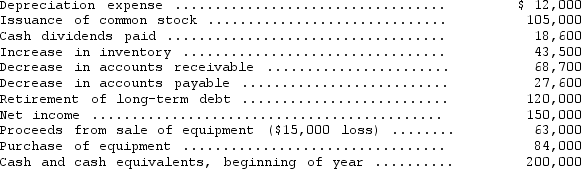

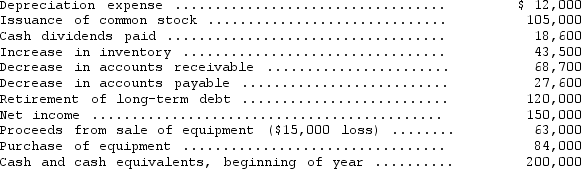

The following pertains to the Excelsior Corp.for the year ended December 31,2014.

Prepare a statement of cash flows in good form using the indirect method.Calculate the cash flow to net income and cash flow adequacy ratios for the company.

Prepare a statement of cash flows in good form using the indirect method.Calculate the cash flow to net income and cash flow adequacy ratios for the company.

Prepare a statement of cash flows in good form using the indirect method.Calculate the cash flow to net income and cash flow adequacy ratios for the company.

Prepare a statement of cash flows in good form using the indirect method.Calculate the cash flow to net income and cash flow adequacy ratios for the company.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

69

Sapphire Company reported the following information for the year 2014: Sales revenue of $280,000;cost of goods sold of $100,000;selling expenses of $40,000;administrative expenses of $35,000;depreciation of $25,000;interest expense of $8,000;and income tax expense of $28,000.All sales were made for cash and all expenses (other than depreciation and bond premium amortization of $2,000)were paid in cash.All current assets and current liabilities remained unchanged.How much cash was provided by operations for Sapphire Company during 2014?

A) $44,000

B) $69,000

C) $67,000

D) $71,000

A) $44,000

B) $69,000

C) $67,000

D) $71,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

70

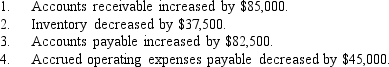

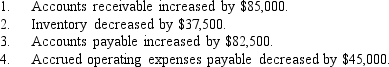

Net income for the Hot Springs Company for the most recent year was $150,000,consisting of $865,000 of revenues,$360,000 of cost of goods sold,and $365,000 of operating expenses.The following changes in current assets and current liabilities have been identified:

Required:

Required:

Calculate the cash flows from operating activities for the year,applying the direct method.Identify the individual amounts that would be disclosed in the statement of cash flows where possible.

Required:

Required:Calculate the cash flows from operating activities for the year,applying the direct method.Identify the individual amounts that would be disclosed in the statement of cash flows where possible.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

71

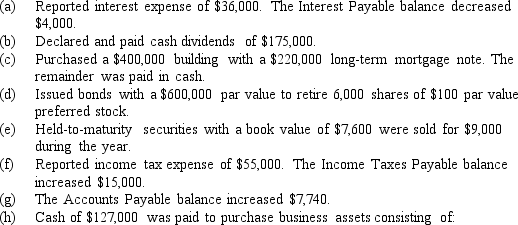

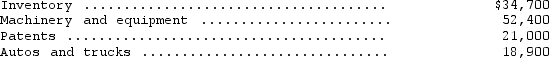

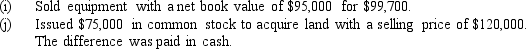

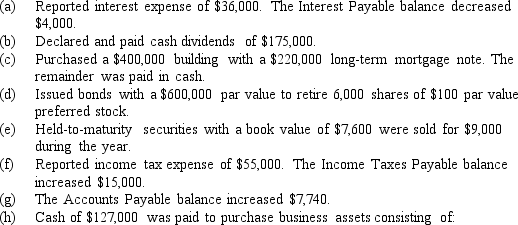

A review of the financial records of Stonehenge,Inc.for the current year revealed the following information:

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

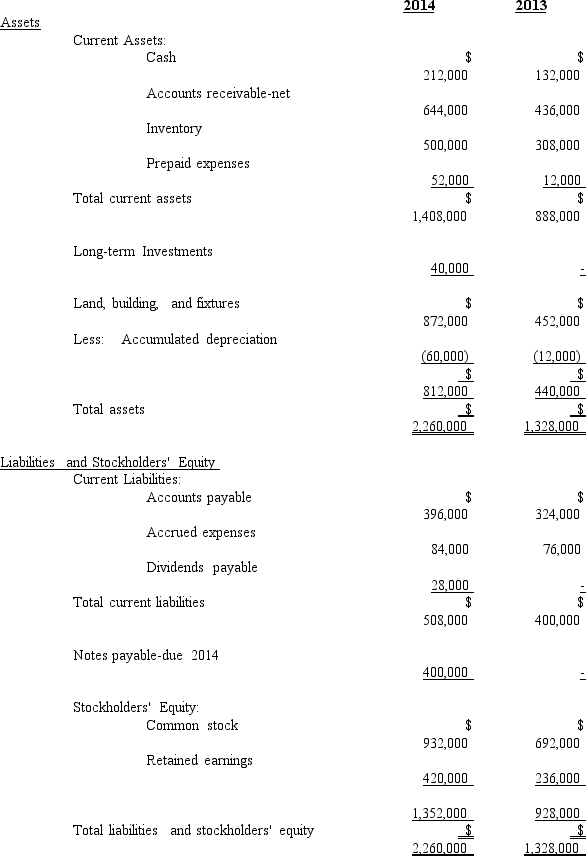

72

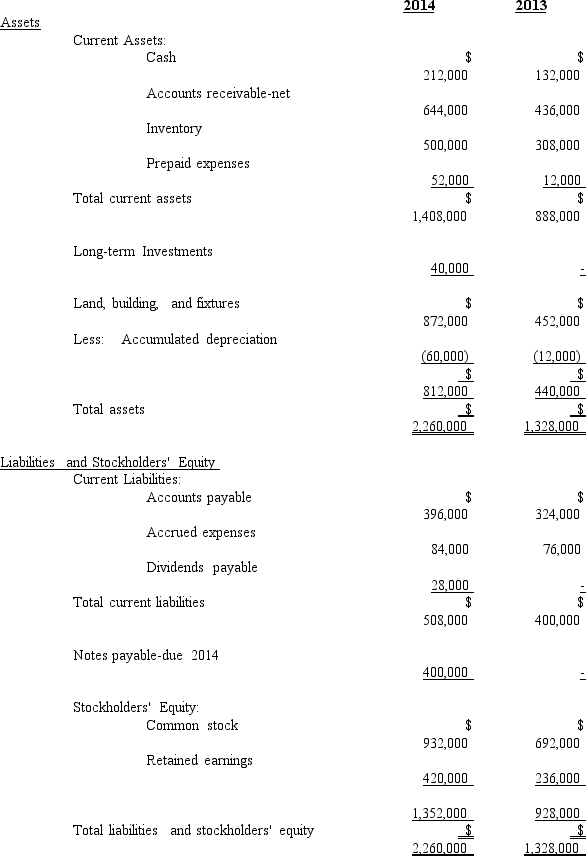

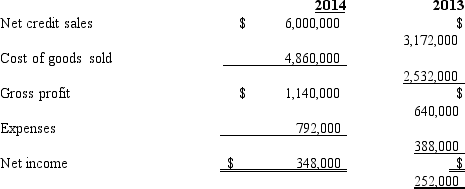

The following information is provided by Horizons Company:

Horizons Company

Balance Sheet

December 31,2014 and 2013

Horizons Company

Horizons Company

Income Statement

For the Years Ended December 31,2014 and 2013

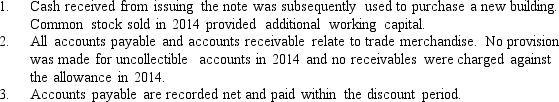

Additional information pertinent to this company is as follows:

Additional information pertinent to this company is as follows:

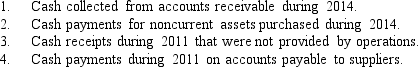

Required:

Required:

Determine the following amounts:

Horizons Company

Balance Sheet

December 31,2014 and 2013

Horizons Company

Horizons CompanyIncome Statement

For the Years Ended December 31,2014 and 2013

Additional information pertinent to this company is as follows:

Additional information pertinent to this company is as follows: Required:

Required:Determine the following amounts:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

73

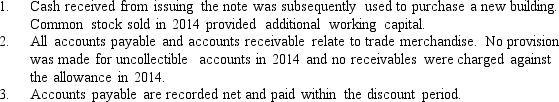

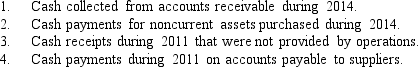

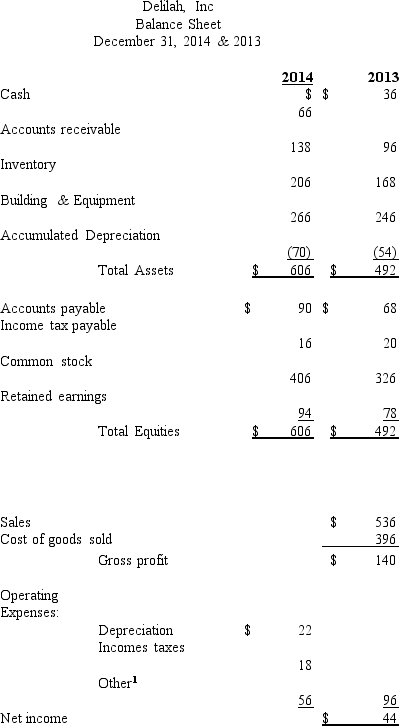

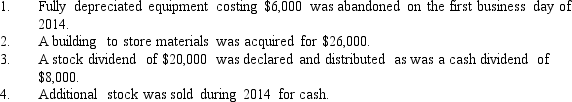

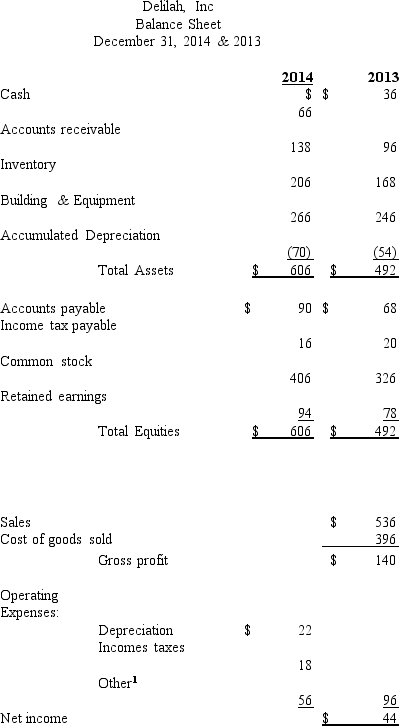

Delilah,Inc. ,presents the following comparative balance sheets and income statement (all amounts in thousands of dollars):

1Includes interest paid in cash of $23.

1Includes interest paid in cash of $23.

See information regarding Delilah,Inc.above.The following additional information is provided:

Required:

Required:

Compute the following:

1Includes interest paid in cash of $23.

1Includes interest paid in cash of $23.See information regarding Delilah,Inc.above.The following additional information is provided:

Required:

Required:Compute the following:

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

74

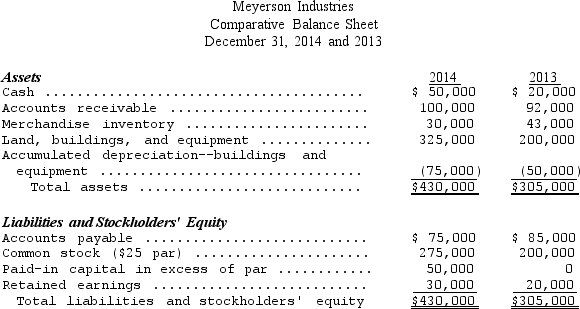

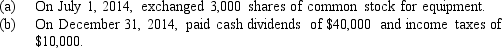

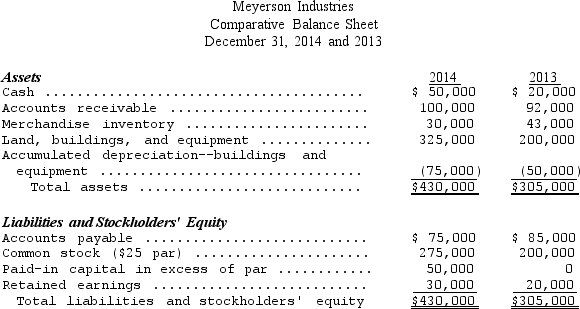

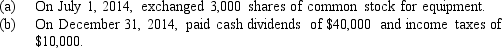

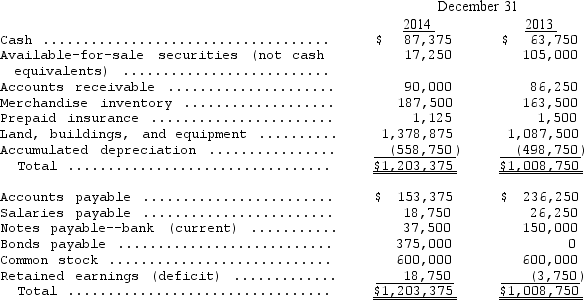

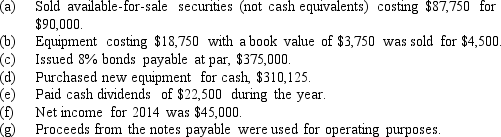

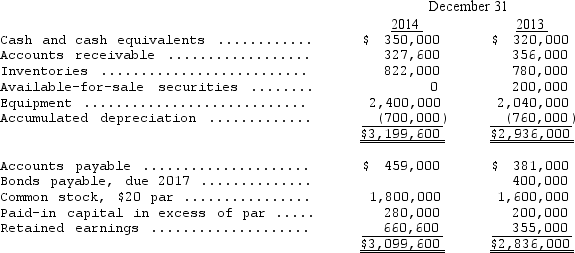

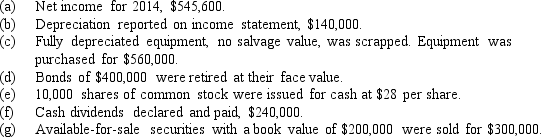

A comparative balance sheet for Meyerson Industries is given below:

Additional data from the company's records were:

Additional data from the company's records were:

Prepare a cash flow statement for Meyerson Industries for the year ended December 31,2014,using the indirect method.Include any necessary supplemental disclosures.

Prepare a cash flow statement for Meyerson Industries for the year ended December 31,2014,using the indirect method.Include any necessary supplemental disclosures.

Additional data from the company's records were:

Additional data from the company's records were: Prepare a cash flow statement for Meyerson Industries for the year ended December 31,2014,using the indirect method.Include any necessary supplemental disclosures.

Prepare a cash flow statement for Meyerson Industries for the year ended December 31,2014,using the indirect method.Include any necessary supplemental disclosures.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

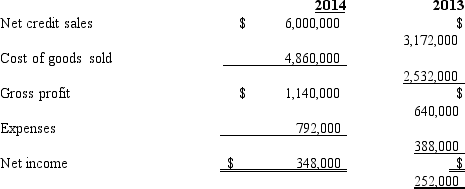

75

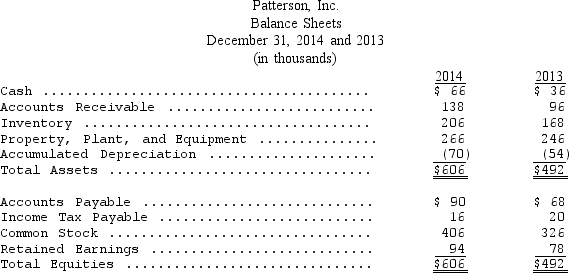

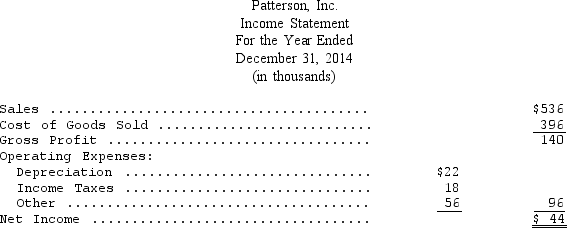

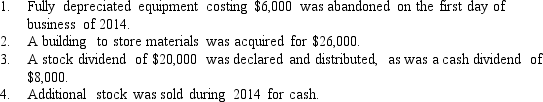

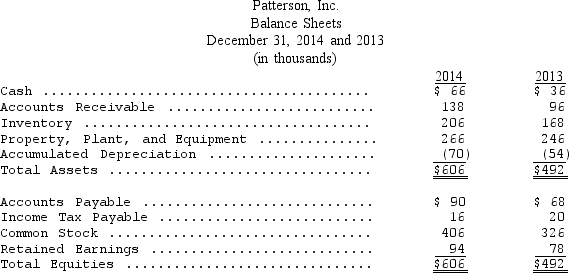

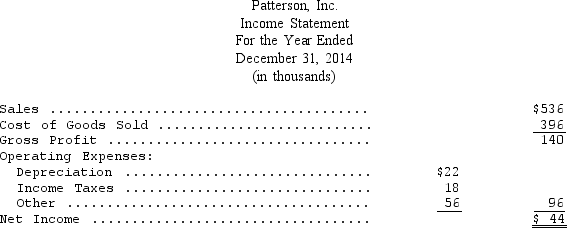

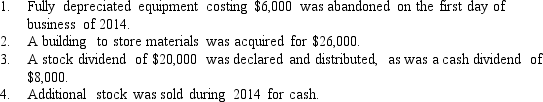

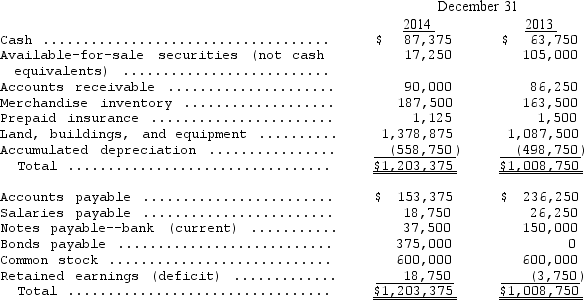

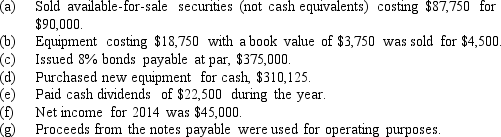

Patterson,Inc. ,has the following comparative balance sheets and income statement available for your examination:

Additional information:

Additional information:

Prepare a statement of cash flows for Patterson,Inc. ,for 2014 employing the indirect

Prepare a statement of cash flows for Patterson,Inc. ,for 2014 employing the indirect

method of identifying cash flows from operating activities.

Additional information:

Additional information: Prepare a statement of cash flows for Patterson,Inc. ,for 2014 employing the indirect

Prepare a statement of cash flows for Patterson,Inc. ,for 2014 employing the indirectmethod of identifying cash flows from operating activities.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

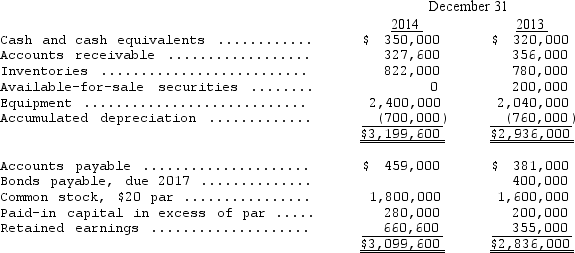

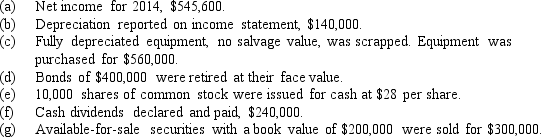

76

The Dakota Corporation prepared,for 2014 and 2013,the following balance sheet data:

Additional information:

Additional information:

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Additional information:

Additional information: Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

77

The following is a comparative balance sheet of Conumdrum Corporation for December 31,2014 and 2013:

Additional information:

Additional information:

Prepare a statement of cash flows for Conumdrum Corporation for 2014,using the indirect method.Compute the cash flow to net income and cash flow adequacy ratios.

Prepare a statement of cash flows for Conumdrum Corporation for 2014,using the indirect method.Compute the cash flow to net income and cash flow adequacy ratios.

Additional information:

Additional information: Prepare a statement of cash flows for Conumdrum Corporation for 2014,using the indirect method.Compute the cash flow to net income and cash flow adequacy ratios.

Prepare a statement of cash flows for Conumdrum Corporation for 2014,using the indirect method.Compute the cash flow to net income and cash flow adequacy ratios.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

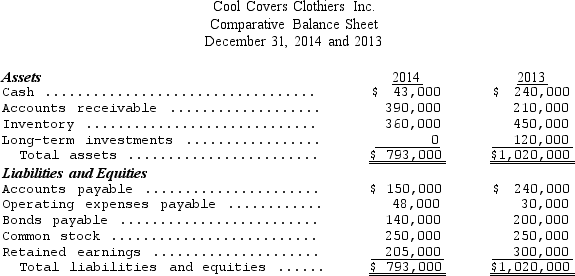

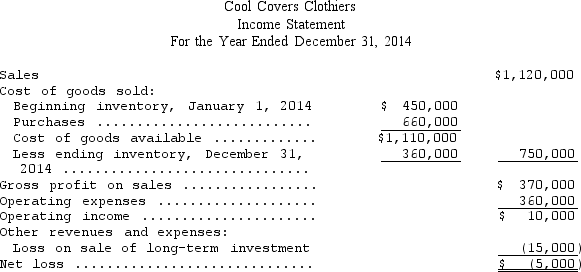

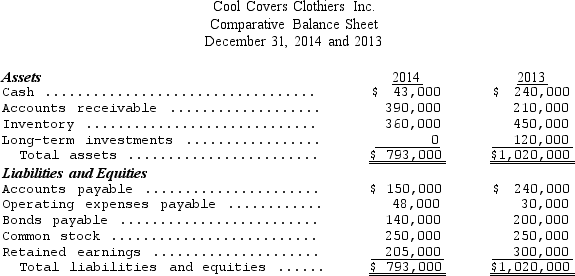

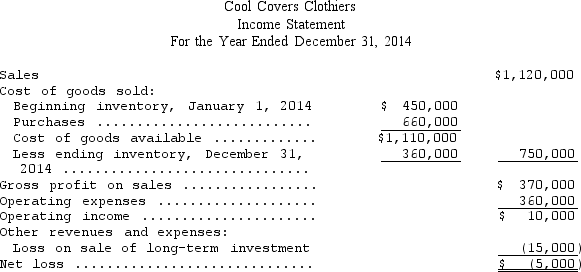

78

The following is a comparative balance sheet for Cool Covers Clothiers Inc.for the years 2014 and 2013:

The income statement for the year ended December 31,2014,follows:

The income statement for the year ended December 31,2014,follows:

After paying cash dividends,the decrease in retained earnings totaled $95,000.Management is alarmed by the shrinkage in the company's cash position during 2014.Prepare a statement of cash flows for 2014 using the direct method.

After paying cash dividends,the decrease in retained earnings totaled $95,000.Management is alarmed by the shrinkage in the company's cash position during 2014.Prepare a statement of cash flows for 2014 using the direct method.

The income statement for the year ended December 31,2014,follows:

The income statement for the year ended December 31,2014,follows: After paying cash dividends,the decrease in retained earnings totaled $95,000.Management is alarmed by the shrinkage in the company's cash position during 2014.Prepare a statement of cash flows for 2014 using the direct method.

After paying cash dividends,the decrease in retained earnings totaled $95,000.Management is alarmed by the shrinkage in the company's cash position during 2014.Prepare a statement of cash flows for 2014 using the direct method.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

79

During 2014,Stewart Company reported revenues on an accrual basis of $70,000.Accounts receivable decreased during the year from $35,000 at the beginning to $24,500 at the end.How much cash was provided by collections from customers during the year?

A) $45,500

B) $59,500

C) $70,000

D) $80,500

A) $45,500

B) $59,500

C) $70,000

D) $80,500

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

80

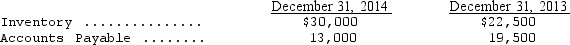

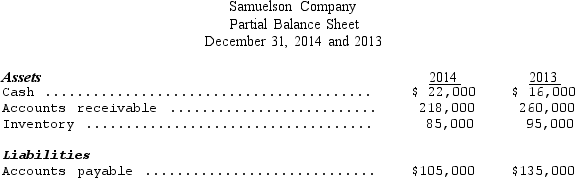

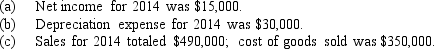

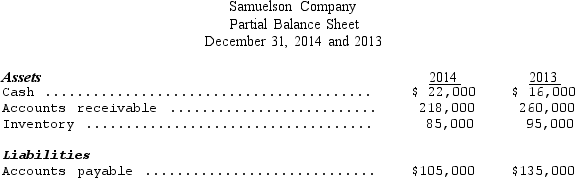

Partial balance sheet data and additional information for Samuelson Company are listed below:

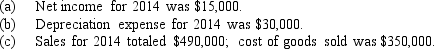

Additional Information:

Additional Information:

Compute the amount of cash paid in 2011 for inventory purchases.

Compute the amount of cash paid in 2011 for inventory purchases.

Additional Information:

Additional Information: Compute the amount of cash paid in 2011 for inventory purchases.

Compute the amount of cash paid in 2011 for inventory purchases.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck