Deck 9: Property Acquisition and Cost Recovery

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 9: Property Acquisition and Cost Recovery

1

If a taxpayer places only one asset (a building) in service during the fourth quarter of the year,the mid-quarter convention must be used.All real property is depreciated using the mid-month convention.

False

2

Taxpayers may use historical data to determine the recovery period for tax depreciation.Taxpayers use the recovery periods outlined in Revenue Procedure 87-56.

False

3

Property expensed under the §179 immediate expensing election is not included in the 40 percent test to determine whether the mid-quarter convention must be used.

True

4

The §179 immediate expensing election phases out based upon a taxpayer's taxable income.The §179 phase out is based upon the amount of property placed in service during the year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

An asset's capitalized cost basis includes only the actual purchase price;whereas the other expenses associated with the asset are immediately expensed.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

Real property is always depreciated using the straight-line method.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

The §179 immediate expensing election phases out based upon the amount of tangible personal property a taxpayer places in service during the year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

Tax cost recovery methods include depreciation,amortization,and depletion.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

The MACRS depreciation tables automatically switch to the straight-line method when it exceeds the declining balance method.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

The basis for a personal use asset converted to business use is the lesser of the asset's cost basis or fair market value on the date of the transfer or conversion.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

Depreciation is currently computed under the Modified Accelerated Cost Recovery System (MACRS) .

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

The 200 percent or double declining balance method is allowable for five and seven year property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

All taxpayers may use the §179 immediate expensing election on certain property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

Taxpayers use the half-year convention for all assets.For personal property,taxpayers must use either the half-year or mid-quarter convention.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

If tangible personal property is depreciated using the half-year convention and is disposed of during the first quarter of a subsequent year,the taxpayer must use the mid-quarter convention for the year of disposition.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

If a business mistakenly claims too little depreciation,the business must only reduce the asset's basis by the depreciation actually taken rather than the amount of the allowable depreciation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

In general,a taxpayer should select longer-lived property for the §179 immediate expensing election.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

If a machine (seven-year property) being depreciated using the half-year convention is disposed of during the seventh year,a taxpayer must multiply the appropriate depreciation percentage from the MACRS table percentage by 50 percent to calculate the depreciation expense properly.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

Like financial accounting,most business property must be capitalized for tax purposes.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

The mid-month convention applies to real property in the year of acquisition and disposition.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

Goodwill and customer lists are examples of §197 amortizable assets.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

Cost depletion is available to all natural resource producers.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

The alternative depreciation system requires both a slower method of recovery and longer recovery periods.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

Businesses deduct percentage depletion when they sell the natural resource and they deduct cost depletion in the year they produce or extract the natural resource.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

Businesses may immediately expense research and experimentation expenditures or they may elect to capitalize these costs and amortize them using the straight-line method over a period of not less than 60 months.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

Significant limits are placed on the depreciation of luxury automobiles.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

Tax depreciation is currently calculated under what system?

A)Sum of the years digits

B)Accelerated cost recovery system

C)Modified accelerated cost recovery system

D)Straight line system

E)None of these

A)Sum of the years digits

B)Accelerated cost recovery system

C)Modified accelerated cost recovery system

D)Straight line system

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

Business assets that tend to be used for both business and personal purposes are referred to as listed property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not depreciated?

A)Automobile

B)Building

C)Patent

D)Machinery

E)All of these are depreciated

A)Automobile

B)Building

C)Patent

D)Machinery

E)All of these are depreciated

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

In general,major integrated oil and gas producers may take the greater of cost or percentage depletion.Depletion of timber and major integrated oil companies must be calculated using only the cost depletion method (no percentage depletion is available) .

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

Tax cost recovery methods do not include:

A)Amortization

B)Capitalization

C)Depletion

D)Depreciation

E)All of these are tax cost recovery methods

A)Amortization

B)Capitalization

C)Depletion

D)Depreciation

E)All of these are tax cost recovery methods

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

All assets subject to amortization have the same recovery period.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

The manner in which a business amortizes a patent or copyright is the same whether the business directly purchases the patent or copyright or whether it self-creates the intangible.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

Which is not an allowable method under MACRS?

A)150 percent declining balance

B)200 percent declining balance

C)Straight line

D)Sum of the years digits

E)All of these are allowable methods under MACRS

A)150 percent declining balance

B)200 percent declining balance

C)Straight line

D)Sum of the years digits

E)All of these are allowable methods under MACRS

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

If the business use percentage for listed property falls below 50 percent,the only adjustment is all future depreciation must be calculated under the straight-line method.The property is subject to depreciation recapture for any excess depreciation over the straight line method using the ADS recovery period over the entire time.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

Depletion is the method taxpayers use to recover their capital investment in natural resources.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not usually included in an asset's tax basis?

A)Purchase price

B)Sales tax

C)Shipping

D)Installation costs

E)All of these are included in an asset's tax basis

A)Purchase price

B)Sales tax

C)Shipping

D)Installation costs

E)All of these are included in an asset's tax basis

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

Occasionally bonus depreciation is used as a stimulus tool by tax policy makers.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

Taxpayers may always expense a portion of start-up costs and organizational expenditures.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

The method for tax amortization is always the straight-line method.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

Deirdre's business purchased two assets during the current year.It placed in service computer equipment (5-year property) on January 20 with a basis of $15,000 and machinery (7-year property) on October 1 with a basis of $15,000.Calculate the maximum depreciation expense,rounded to a whole number (ignoring §179 and bonus depreciation) :

A)$1,286

B)$5,144

C)$5,786

D)$6,000

E)None of these

A)$1,286

B)$5,144

C)$5,786

D)$6,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

Anne LLC purchased computer equipment (5-year property) on August 29 with a basis of $30,000 and used the half-year convention.During the current year,which is the fourth year Anne LLC owned the property,the property was disposed of on January 15.Calculate the maximum depreciation expense:

A)$432

B)$1,728

C)$1,874

D)$3,456

E)None of these

A)$432

B)$1,728

C)$1,874

D)$3,456

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

The MACRS recovery period for automobiles and computers is:

A)3 years

B)5 years

C)7 years

D)10 years

E)None of these

A)3 years

B)5 years

C)7 years

D)10 years

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

Clay LLC placed in service machinery and equipment (7-year property) with a basis of $2,450,000 on June 6,2013.Assume that Clay has sufficient income to avoid any limitations.Calculate the maximum depreciation expense including §179 expensing (ignoring any possible bonus expensing) ,rounded to a whole number:

A)$350,105

B)$392,960

C)$778,070

D)$864,395

E)None of these

A)$350,105

B)$392,960

C)$778,070

D)$864,395

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the allowable methods allows the most accelerated depreciation?

A)150 percent declining balance

B)200 percent declining balance

C)Straight line

D)Sum of the years digits

E)None of these allow accelerated depreciation

A)150 percent declining balance

B)200 percent declining balance

C)Straight line

D)Sum of the years digits

E)None of these allow accelerated depreciation

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

Bonnie Jo purchased a used computer (5-year property) for use in her sole proprietorship.The basis of the computer was $2,400.Bonnie Jo used the computer in her business 60 percent of the time and used it for personal purposes the rest of the time during the first year.Calculate Bonnie Jo's depreciation expense during the first year assuming the sole proprietorship had a loss during the year (Bonnie did not place the property in service in the last quarter) :

A)$240

B)$288

C)$480

D)$2,400

E)None of these

A)$240

B)$288

C)$480

D)$2,400

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

Suvi,Inc.purchased two assets during the current year.It placed in service computer equipment (5-year property) on August 10 with a basis of $20,000 and machinery (7-year property) on November 18 with a basis of $10,000.Calculate the maximum depreciation expense,rounded to a whole number (ignoring §179 and bonus depreciation) :

A)$857

B)$3,357

C)$5,429

D)$6,000

E)None of these

A)$857

B)$3,357

C)$5,429

D)$6,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

48

How is the recovery period of an asset determined?

A)Estimated useful life

B)Treasury regulation

C)Revenue Procedure 87-56

D)Revenue Ruling 87-56

E)None of these

A)Estimated useful life

B)Treasury regulation

C)Revenue Procedure 87-56

D)Revenue Ruling 87-56

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

49

Lenter LLC placed in service on April 29,2013 machinery and equipment (7-year property) with a basis of $600,000.Assume that Lenter has sufficient income to avoid any limitations.Calculate the maximum depreciation expense including section 179 expensing (but ignoring bonus expensing) :

A)$85,740

B)$120,000

C)$514,290

D)$585,740

E)None of these

A)$85,740

B)$120,000

C)$514,290

D)$585,740

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

Which depreciation convention is the general rule for tangible personal property?

A)Full-month

B)Half-year

C)Mid-month

D)Mid-quarter

E)None of these are conventions for tangible personal property

A)Full-month

B)Half-year

C)Mid-month

D)Mid-quarter

E)None of these are conventions for tangible personal property

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

Tom Tom LLC purchased a rental house and land during the current year for $150,000.The purchase price was allocated as follows: $100,000 to the building and $50,000 to the land.The property was placed in service on May 22.Calculate Tom Tom's maximum depreciation for this first year:

A)$1,605

B)$2,273

C)$2,408

D)$3,410

E)None of these

A)$1,605

B)$2,273

C)$2,408

D)$3,410

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

Poplock LLC purchased a warehouse and land during the current year for $350,000.The purchase price was allocated as follows: $275,000 to the building and $75,000 to the land.The property was placed in service on August 12.Calculate Poplock's maximum depreciation for this first year,rounded to the nearest whole number:

A)$2,648

B)$3,371

C)$3,751

D)$4,774

E)None of these

A)$2,648

B)$3,371

C)$3,751

D)$4,774

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

Sairra,LLC purchased only one asset during the current year.It placed in service furniture (7-year property) on April 16 with a basis of $25,000.Calculate the maximum depreciation expense for the current year,rounding to a whole number (ignoring §179 and bonus depreciation) :

A)$1,786

B)$3,573

C)$4,463

D)$5,000

E)None of these

A)$1,786

B)$3,573

C)$4,463

D)$5,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

Tasha LLC purchased furniture (7-year property) on April 20 with a basis of $20,000 and used the mid-quarter convention.During the current year,which is the fourth year Tasha LLC owned the property,the property was disposed of on December 15.Calculate the maximum depreciation expense,rounding to a whole number:

A)$898

B)$2,095

C)$2,461

D)$2,394

E)None of these

A)$898

B)$2,095

C)$2,461

D)$2,394

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following depreciation conventions are not used under MACRS?

A)Full-month

B)Half-year

C)Mid-month

D)Mid-quarter

E)All of these are used under MACRS

A)Full-month

B)Half-year

C)Mid-month

D)Mid-quarter

E)All of these are used under MACRS

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

Crouch LLC placed in service on May 19,2013 machinery and equipment (7-year property) with a basis of $2,200,000.Assume that Crouch has sufficient income to avoid any limitations.Calculate the maximum depreciation expense including §179 expensing (but ignoring bonus expensing) :

A)$314,380.

B)$440,000.

C)$571,510.

D)$742,930.

E)None of thesE.The $500,000 §179 expense is reduced to $300,000 because of the property placed in service limitation ($2,200,000 - $2,000,000 threshold) .The half year convention applies.The expense is $571,510 which is depreciation of $1,900,000 × .1429 = $271,510 plus $300,000 of §179 expense.

A)$314,380.

B)$440,000.

C)$571,510.

D)$742,930.

E)None of thesE.The $500,000 §179 expense is reduced to $300,000 because of the property placed in service limitation ($2,200,000 - $2,000,000 threshold) .The half year convention applies.The expense is $571,510 which is depreciation of $1,900,000 × .1429 = $271,510 plus $300,000 of §179 expense.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

Simmons LLC purchased an office building and land several years ago for $250,000.The purchase price was allocated as follows: $200,000 to the building and $50,000 to the land.The property was placed in service on October 2.If the property is disposed of on February 27 during the 10th year,calculate Simmons' maximum depreciation in the 10th year:

A)$641

B)$909

C)$5,128

D)$7,346

E)None of these

A)$641

B)$909

C)$5,128

D)$7,346

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

Beth's business purchased only one asset during the current year.It placed in service machinery (7-year property) on December 1 with a basis of $50,000.Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation) :

A)$1,785

B)$2,500

C)$7,145

D)$10,000

E)None of these

A)$1,785

B)$2,500

C)$7,145

D)$10,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

Lax,LLC purchased only one asset during the current year.It placed in service computer equipment (5-year property) on August 26 with a basis of $20,000.Calculate the maximum depreciation expense for the current year (ignoring §179 and bonus depreciation) :

A)$2,000

B)$2,858

C)$3,000

D)$4,000

E)None of these

A)$2,000

B)$2,858

C)$3,000

D)$4,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

Wheeler LLC purchased two assets during the current year.It placed in service computer equipment (5-year property) on November 16 with a basis of $15,000 and furniture (7-year property) on April 20 with a basis of $11,000.Calculate the maximum depreciation expense,rounding to a whole number (ignoring §179 and bonus depreciation) :

A)$1,285

B)$2,714

C)$4,572

D)$5,200

E)None of these

A)$1,285

B)$2,714

C)$4,572

D)$5,200

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

Jasmine started a new business in the current year.She incurred $10,000 of start-up costs.How much of the start-up costs can be immediately expensed for the year?

A)$0

B)$2,500

C)$5,000

D)$10,000

E)None of these

A)$0

B)$2,500

C)$5,000

D)$10,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

Racine started a new business in the current year.She incurred $52,000 of start-up costs.If her business started on November 23rd of the current year,what is the total expense she may deduct with respect to the start-up costs for her initial year,rounded to the nearest whole number?

A)$2,555

B)$3,544

C)$5,522.

D)$52,000

E)None of these

A)$2,555

B)$3,544

C)$5,522.

D)$52,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

Sequoia purchased the rights to cut timber on several tracts of land over a fifteen year period.It paid $500,000 for cutting rights.A timber engineer estimates that 500,000 board feet of timber will be cut.During the current year,Sequoia cut 45,000 board feet of timber,which it sold for $900,000.What is Sequoia's cost depletion expense for the current year?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

Santa Fe purchased the rights to extract turquoise on a tract of land over a five-year period.Santa Fe paid $300,000 for extraction rights.A geologist estimates that Santa Fe will recover 5,000 pounds of turquoise.During the current year,Santa Fe extracted 1,500 pounds of turquoise,which it sold for $200,000.What is Santa Fe's cost depletion expense for the current year?

A)$60,000

B)$90,000

C)$110,000

D)$300,000

E)None of these

A)$60,000

B)$90,000

C)$110,000

D)$300,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

Geithner LLC patented a process it developed in the current year.The patent is expected to create benefits for Geithner over a 10 year period.The patent was issued on April 15th and the legal costs associated with the patent were $43,000.In addition,Geithner had unamortized research expenditures of $15,000 related to the process.What is the total amortization expense Geithner may deduct during the current year?

A)$2,417

B)$2,559

C)$4,108

D)$4,350

E)None of these

A)$2,417

B)$2,559

C)$4,108

D)$4,350

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

Santa Fe purchased the rights to extract turquoise on a tract of land over a five-year period.Santa Fe paid $300,000 for extraction rights.A geologist estimated that Santa Fe will recover 5,000 pounds of turquoise.During the past several years,4,000 pounds were extracted.During the current year,Santa Fe extracted 1,500 pounds of turquoise,which it sold for $250,000.What is Santa Fe's cost depletion expense for the current year?

A)$60,000

B)$90,000

C)$190,000

D)$160,000

E)None of these

A)$60,000

B)$90,000

C)$190,000

D)$160,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

Billie Bob purchased a used computer (5-year property) for use in his sole proprietorship in the prior year.The basis of the computer was $2,400.Billie Bob used the computer in his business 60 percent of the time during the first year.During the second year,Billie Bob used the computer 40 percent for business use.Calculate Billie Bob's depreciation expense during the second year assuming the sole proprietorship had a loss during the year (Billie Bob did not place the asset in service in the last quarter) :

A)$0

B)$48

C)$192

D)$336

E)None of these

A)$0

B)$48

C)$192

D)$336

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

PC Mine purchased a platinum deposit for $3,500,000.It estimated it would extract 17,000 ounces of platinum from the deposit.PC mined the platinum and sold it reporting gross receipts of $500,000 and $8 million for years 1 and 2,respectively.During years 1 and 2,PC reported net income (loss) from the platinum deposit activity in the amount of ($100,000) and $3,800,000,respectively.In years 1 and 2,PC actually extracted 2,000 and 8,000 ounces of platinum.What is PC's depletion expense for years 1 and 2 if the applicable percentage depletion for platinum is 22 percent,rounded to the nearest whole number?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

Potomac LLC purchased an automobile for $30,000 on August 5,2012.What is Potomac's depreciation expense for 2012 (ignore any possible bonus depreciation) ?

A)$3,160

B)$4,287

C)$6,000

D)$30,000

E)None of these

A)$3,160

B)$4,287

C)$6,000

D)$30,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

Jorge purchased a copyright for use in his business in the current year.The purchase occurred on July 15th and the purchase price was $75,000.If the patent has a remaining life of 75 months,what is the total amortization expense Jorge may deduct during the current year?

A)$0

B)$5,500

C)$6,000

D)$12,000

E)None of these

A)$0

B)$5,500

C)$6,000

D)$12,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

Daschle LLC completed some research and development during June of the current year.The related costs were $60,000.If Daschle wants to capitalize and amortize the costs as quickly as possible,what is the total amortization expense Daschle may deduct during the current year?

A)$0

B)$6,500

C)$7,000

D)$12,000

E)None of these

A)$0

B)$6,500

C)$7,000

D)$12,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

Assume that Brittany acquires a competitor's assets on September 30th of year 1 for $350,000.Of that amount,$300,000 is allocated to tangible assets and $50,000 is allocated equally to two §197 intangible assets (goodwill and a 1-year non-compete agreement) .Given,that the non-compete agreement expires on September 30th of year 2,what is Brittany's amortization expense for the second year,rounded to the nearest whole number?

A)$0

B)$1,667

C)$2,917

D)$3,333

E)None of these

A)$0

B)$1,667

C)$2,917

D)$3,333

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

Phyllis purchased $8,000 of specialized audio equipment that she uses in her business regularly.Occasionally,she uses the equipment for personal use.During the first year,Phyllis used the equipment for business use 70 percent of the time;however,during the current (second) year the business use fell to 40 percent.Assume that the equipment is seven-year MACRS property and is under the half-year convention.Assume the ADS recovery period is 10 years.What is the depreciation allowance for the current year,rounded to the nearest whole number?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

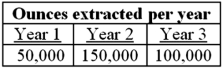

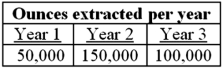

Lucky Strike Mine (LLC) purchased a silver deposit for $1,500,000.It estimated it would extract 500,000 ounces of silver from the deposit.Lucky Strike mined the silver and sold it reporting gross receipts of $1.8 million,$2.5 million,and $2 million for years 1 through 3,respectively.During years 1 - 3,Lucky Strike reported net income (loss) from the silver deposit activity in the amount of ($100,000) ,$400,000,and $100,000,respectively.In years 1 - 3,Lucky Strike actually extracted 300,000 ounces of silver as follows:  What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?

A)$200,000

B)$375,000

C)$400,000

D)$450,000

E)None of these

What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?

What is Lucky Strike's depletion expense for year 2 if the applicable percentage depletion for silver is 15 percent?A)$200,000

B)$375,000

C)$400,000

D)$450,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

Assume that Bethany acquires a competitor's assets on March 31st.The purchase price was $150,000.Of that amount,$125,000 is allocated to tangible assets and $25,000 is allocated to goodwill (a §197 intangible asset) .What is Bethany's amortization expense for the current year,rounded to the nearest whole number?

A)$0

B)$1,250

C)$1,319

D)$1,389

E)None of these

A)$0

B)$1,250

C)$1,319

D)$1,389

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

Arlington LLC purchased an automobile for $40,000 on July 5,2012.What is Arlington's depreciation expense for 2012 if its business use percentage is 75 percent (ignore any possible bonus depreciation) ?

A)$2,370

B)$3,160

C)$6,000

D)$8,000

E)None of these

A)$2,370

B)$3,160

C)$6,000

D)$8,000

E)None of these

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck