Deck 20: Exchange Rate Crises: How Pegs Work and How They Break

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 20: Exchange Rate Crises: How Pegs Work and How They Break

1

Which of the following occurs during a banking crisis?

A) Banks close or declare bankruptcy.

B) A government is unable to pay principal or interest on debt owed to banks.

C) No one wants to borrow from banks.

D) A country's central bank runs out of reserve currencies.

A) Banks close or declare bankruptcy.

B) A government is unable to pay principal or interest on debt owed to banks.

C) No one wants to borrow from banks.

D) A country's central bank runs out of reserve currencies.

A

2

The depreciation in value of a nation's currency hits a crisis point when the decline in value exceeds:

A) 50% for all nations.

B) 10% for large nations and 20% for small nations.

C) 2% for all nations.

D) the rise in nominal prices and wages.

A) 50% for all nations.

B) 10% for large nations and 20% for small nations.

C) 2% for all nations.

D) the rise in nominal prices and wages.

B

3

The likelihood of an exchange rate crisis is more than ___ times higher during a default crisis.

A) 2

B) 3

C) 5

D) 10

A) 2

B) 3

C) 5

D) 10

C

4

Why might a default crisis be associated with an exchange rate crisis?

A) A large depreciation causes a sudden decrease in the local currency value of international debts denominated in other currencies.

B) A government is unable to pay principal or interest on debt owed to banks.

C) A large depreciation causes a sudden increase in the local currency value of international debts denominated in other currencies.

D) Banks close or declare bankruptcy.

A) A large depreciation causes a sudden decrease in the local currency value of international debts denominated in other currencies.

B) A government is unable to pay principal or interest on debt owed to banks.

C) A large depreciation causes a sudden increase in the local currency value of international debts denominated in other currencies.

D) Banks close or declare bankruptcy.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is correct?

A) The likelihood of an exchange rate crisis increases if a country is having a banking crisis.

B) The likelihood of an exchange rate crisis decreases if a country is having a banking and default crisis.

C) There is no relationship between an exchange rate crisis and banking or default crises.

D) When a banking or default crisis occurs, countries typically are forced to appreciate their currencies.

A) The likelihood of an exchange rate crisis increases if a country is having a banking crisis.

B) The likelihood of an exchange rate crisis decreases if a country is having a banking and default crisis.

C) There is no relationship between an exchange rate crisis and banking or default crises.

D) When a banking or default crisis occurs, countries typically are forced to appreciate their currencies.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

A banking crisis often threatens a fixed exchange rate (or peg). Why?

A) Banks have to provide funds to maintain the fixed exchange rate.

B) The central bank may have to bail out insolvent banks by inflating the currency, which could cause a loss of reserves.

C) The central bank has to close relationships with foreign banks, and there is no way to implement the fixed exchange rate system.

D) The banking crisis means that domestic banks hold onto foreign currency reserves rather than exchanging them with the central bank.

A) Banks have to provide funds to maintain the fixed exchange rate.

B) The central bank may have to bail out insolvent banks by inflating the currency, which could cause a loss of reserves.

C) The central bank has to close relationships with foreign banks, and there is no way to implement the fixed exchange rate system.

D) The banking crisis means that domestic banks hold onto foreign currency reserves rather than exchanging them with the central bank.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

As evident from EU nations pegging to the German mark (before currency union) and nations pegging to the U.S. dollar:

A) the mark was overvalued, while the dollar was undervalued.

B) when currency crises occur, they are more severe in emerging markets, yet they can affect both developing and emerging market economies.

C) nations pegging their currencies to the mark had lower rates of interest, yet domestic credit volume was lower in nations pegging to the dollar.

D) currency crises are very uncommon, yet when they occur, the media often makes too much of the issue in their reports.

A) the mark was overvalued, while the dollar was undervalued.

B) when currency crises occur, they are more severe in emerging markets, yet they can affect both developing and emerging market economies.

C) nations pegging their currencies to the mark had lower rates of interest, yet domestic credit volume was lower in nations pegging to the dollar.

D) currency crises are very uncommon, yet when they occur, the media often makes too much of the issue in their reports.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

The average duration for a pegged exchange rate is about:

A) 5 years.

B) 10 years.

C) 2 years.

D) It is indefinite.

A) 5 years.

B) 10 years.

C) 2 years.

D) It is indefinite.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

The sudden collapse of a fixed exchange rate system is known as:

A) an exchange rate crisis.

B) deflation.

C) an implosion.

D) a financial cave-in.

A) an exchange rate crisis.

B) deflation.

C) an implosion.

D) a financial cave-in.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

An exchange rate crisis is defined as:

A) a depreciation of 5% to 10% in a developing economy.

B) a depreciation of 10% to 15% in an advanced country.

C) a depreciation of 20% to 25% in an emerging economy.

D) a depreciation of 10% to 15% in an advanced country and a depreciation of 20% to 25% in an emerging economy.

A) a depreciation of 5% to 10% in a developing economy.

B) a depreciation of 10% to 15% in an advanced country.

C) a depreciation of 20% to 25% in an emerging economy.

D) a depreciation of 10% to 15% in an advanced country and a depreciation of 20% to 25% in an emerging economy.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

Although fixed exchange rates are desirable for many reasons, nations that adopt fixed exchange rates find that:

A) fixed exchange rates are difficult to abandon once they become established.

B) flexible exchange rates actually offer a nation more stability.

C) the rate is often only successful for a few years before the peg is broken.

D) intergovernmental agreements limit the fixed exchange rates to only a few products.

A) fixed exchange rates are difficult to abandon once they become established.

B) flexible exchange rates actually offer a nation more stability.

C) the rate is often only successful for a few years before the peg is broken.

D) intergovernmental agreements limit the fixed exchange rates to only a few products.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is correct?

A) Exchange rate crises typically impose larger costs on advanced countries than on emerging market countries.

B) Exchange rate crises typically impose larger costs on emerging market countries than on advanced countries.

C) Exchange rate crises typically impose the same costs on advanced countries and on emerging market countries.

D) Exchange rate crises typically do not impose any costs on advanced countries.

A) Exchange rate crises typically impose larger costs on advanced countries than on emerging market countries.

B) Exchange rate crises typically impose larger costs on emerging market countries than on advanced countries.

C) Exchange rate crises typically impose the same costs on advanced countries and on emerging market countries.

D) Exchange rate crises typically do not impose any costs on advanced countries.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following occurs during a default crisis?

A) Banks close or declare bankruptcy.

B) A government is unable to pay principal or interest on debt owed to banks.

C) No one wants to borrow from banks.

D) A country's central bank runs out of reserve currencies.

A) Banks close or declare bankruptcy.

B) A government is unable to pay principal or interest on debt owed to banks.

C) No one wants to borrow from banks.

D) A country's central bank runs out of reserve currencies.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

An exchange rate crisis causes all of the following, EXCEPT:

A) a large and sudden depreciation of the currency.

B) economic hardships.

C) political turmoil.

D) a sharp appreciation of the currency.

A) a large and sudden depreciation of the currency.

B) economic hardships.

C) political turmoil.

D) a sharp appreciation of the currency.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

In emerging markets, the reductions in growth of GDP as a result of exchange rate crises:

A) is never very much.

B) is not a problem because the IMF and World Bank make up the difference.

C) is more than 50% per year.

D) is about 10% of total GDP.

A) is never very much.

B) is not a problem because the IMF and World Bank make up the difference.

C) is more than 50% per year.

D) is about 10% of total GDP.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

Typically, an exchange rate crisis can be caused by:

A) a government default on debt.

B) a banking crisis, triggered by adverse shocks.

C) sudden infusion of credit into the economy.

D) a government default on debt and a banking crisis, triggered by adverse shocks.

A) a government default on debt.

B) a banking crisis, triggered by adverse shocks.

C) sudden infusion of credit into the economy.

D) a government default on debt and a banking crisis, triggered by adverse shocks.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

A nation experiencing financial difficulties often has simultaneous crises. Which of the following is NOT typically concurrent for such nations?

A) a banking crisis

B) a default crisis

C) an exchange rate crisis

D) a climate crisis

A) a banking crisis

B) a default crisis

C) an exchange rate crisis

D) a climate crisis

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

One economic cost of an exchange rate crisis is:

A) a decrease in the rate of inflation.

B) an increase in exports.

C) a slowing in a country's rate of economic growth.

D) an increase in employment.

A) a decrease in the rate of inflation.

B) an increase in exports.

C) a slowing in a country's rate of economic growth.

D) an increase in employment.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

The effect of an exchange crisis on large nations compared with small ones:

A) is less severe, with a better recovery in a shorter period.

B) is more severe, with a worse chance of full recovery in a shorter period.

C) is about the same in terms of recovery but not in terms of unemployment.

D) is more severe because the crisis affects interaction between a number of trading partners.

A) is less severe, with a better recovery in a shorter period.

B) is more severe, with a worse chance of full recovery in a shorter period.

C) is about the same in terms of recovery but not in terms of unemployment.

D) is more severe because the crisis affects interaction between a number of trading partners.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

The reason for the concurrence of exchange rate crises and other financial disruptions centers on:

A) the inherent instability of most banks in low-income nations.

B) the tendency of most elected officials to be susceptible to influence and corruption.

C) the fact that changes in exchange rates can raise debt burdens (denominated in other currencies) to intolerable levels.

D) the tendency of the current administration to react by nationalizing banks and implementing capital controls.

A) the inherent instability of most banks in low-income nations.

B) the tendency of most elected officials to be susceptible to influence and corruption.

C) the fact that changes in exchange rates can raise debt burdens (denominated in other currencies) to intolerable levels.

D) the tendency of the current administration to react by nationalizing banks and implementing capital controls.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

In the home economy, when "money" is a liability of the government, the supply of money is equal to:

A) gold reserves on a one-to-one basis.

B) the physical quantity of currency and coins in circulation.

C) the assets in a nation's account at the IMF.

D) the total of bonds (domestic credit) plus foreign currency and gold reserves held by the central bank.

A) gold reserves on a one-to-one basis.

B) the physical quantity of currency and coins in circulation.

C) the assets in a nation's account at the IMF.

D) the total of bonds (domestic credit) plus foreign currency and gold reserves held by the central bank.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

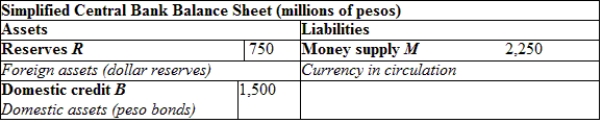

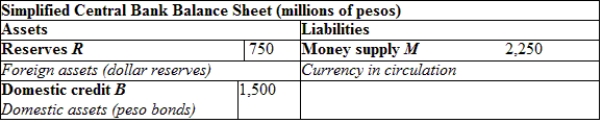

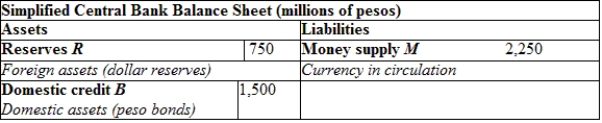

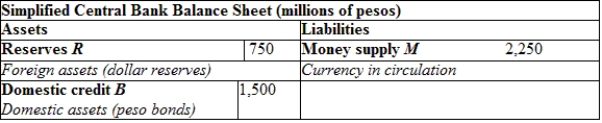

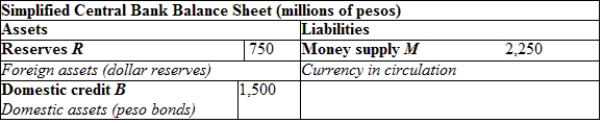

(Table: Mexico's Central Bank Balance Sheet) If the country sells 325 million pesos of foreign assets and reduces domestic credit by 425 million pesos, then:

A) the reserves will be 450 million pesos.

B) the domestic assets will be 1,125 million pesos.

C) the domestic assets will be 1,075 million pesos.

D) the reserves will be 1,075 million pesos.

A) the reserves will be 450 million pesos.

B) the domestic assets will be 1,125 million pesos.

C) the domestic assets will be 1,075 million pesos.

D) the reserves will be 1,075 million pesos.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

When analyzing problems in maintaining a fixed exchange rate system, simplifying assumptions must be made. Which of the following is NOT a simplifying assumption?

A) The domestic government issues no bonds.

B) The price level is stable and purchasing power parity (PPP) holds.

C) Output is exogenous.

D) Everyone believes the peg will hold, so there is uncovered interest parity (UIP).

A) The domestic government issues no bonds.

B) The price level is stable and purchasing power parity (PPP) holds.

C) Output is exogenous.

D) Everyone believes the peg will hold, so there is uncovered interest parity (UIP).

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is counted in the domestic assets of a central bank?

A) money that the central bank issues to pay for purchases of domestic bonds

B) domestic bonds that it purchases with money that it issues

C) reserve currencies that it purchases with money that it issues

D) money that it issues to purchase reserve currencies

A) money that the central bank issues to pay for purchases of domestic bonds

B) domestic bonds that it purchases with money that it issues

C) reserve currencies that it purchases with money that it issues

D) money that it issues to purchase reserve currencies

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

When a nation is maintaining an exchange rate peg, its money supply is typically backed by:

A) gold.

B) nothing.

C) domestic bonds and foreign exchange assets purchased with the national currency.

D) domestic credit only.

A) gold.

B) nothing.

C) domestic bonds and foreign exchange assets purchased with the national currency.

D) domestic credit only.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

What must a nation's central bank do to maintain a fixed exchange rate?

A) achieve a balanced budget

B) keep the level of foreign reserves above zero so that it can prevent a fall in value of its currency

C) keep the level of foreign reserves at zero

D) hold only foreign government bonds to back the currency 100%

A) achieve a balanced budget

B) keep the level of foreign reserves above zero so that it can prevent a fall in value of its currency

C) keep the level of foreign reserves at zero

D) hold only foreign government bonds to back the currency 100%

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

Saudi Arabia pegs its currency (the riyal, or SAR) to the U.S. dollar. Currently, the exchange rate is SAR3.75 = $US1. Suppose that the Saudi Arabian money multiplier is 1. By how much will the Saudi Arabian money supply change when the Saudi central bank makes loans of SAR 1 million?

A) +SAR 1 million

B) -SAR 1 million

C) +SAR 3.75 million

D) -SAR 3.75 million

A) +SAR 1 million

B) -SAR 1 million

C) +SAR 3.75 million

D) -SAR 3.75 million

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

(Table: Mexico's Central Bank Balance Sheet) If the country sells 325 million pesos of foreign assets and issues domestic credit worth 425 million pesos, what will be the money supply in the economy?

A) 750 million pesos

B) 1,500 million pesos

C) 2,350 million pesos

D) It will be unchanged.

A) 750 million pesos

B) 1,500 million pesos

C) 2,350 million pesos

D) It will be unchanged.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

Saudi Arabia pegs its currency (the riyal, or SAR) to the U.S. dollar. Currently, the exchange rate is SAR3.75 = $US1. Suppose that the Saudi Arabian money multiplier is 1. Which of the following is NOT included in the assets of the Saudi Arabian central bank?

A) reserves

B) domestic credit

C) the money supply

D) domestic credit and the money supply

A) reserves

B) domestic credit

C) the money supply

D) domestic credit and the money supply

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

A drawback to using changes in domestic credit to adjust the domestic money supply to maintain a peg:

A) is problems in emerging market economies as a result of bond market instability.

B) is the lack of expertise in financial matters in the central banks of emerging markets.

C) is the requirement that currencies flip flop from fixed to floating.

D) is that nations are ignoring a potentially more effective source of currency adjustment.

A) is problems in emerging market economies as a result of bond market instability.

B) is the lack of expertise in financial matters in the central banks of emerging markets.

C) is the requirement that currencies flip flop from fixed to floating.

D) is that nations are ignoring a potentially more effective source of currency adjustment.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

Saudi Arabia pegs its currency (the riyal, or SAR) to the U.S. dollar. Currently, the exchange rate is SAR3.75 = $US1. Suppose that the Saudi Arabian money multiplier is 1. By how much will the Saudi Arabian money supply change when the Saudi central bank buys $1 million of additional reserves?

A) +SAR 1 million

B) -SAR 1 million

C) +SAR 3.75 million

D) -SAR 3.75 million

A) +SAR 1 million

B) -SAR 1 million

C) +SAR 3.75 million

D) -SAR 3.75 million

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

Financial crises tend to happen in pairs or triplets because:

A) a democracy is good in some ways but puts too much financial power in the control of the people.

B) when financial fundamentals such as debt, real GDP, and fiscal discipline are weak, then trade, investment, consumers, business firms, and the financial sector are affected in a number of ways.

C) for there to be a currency crisis, consumer debt must be rising.

D) the central bank usually has everything under control, so crises are generally the fault of greedy firms.

A) a democracy is good in some ways but puts too much financial power in the control of the people.

B) when financial fundamentals such as debt, real GDP, and fiscal discipline are weak, then trade, investment, consumers, business firms, and the financial sector are affected in a number of ways.

C) for there to be a currency crisis, consumer debt must be rising.

D) the central bank usually has everything under control, so crises are generally the fault of greedy firms.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

What results in changes in the domestic money supply?

A) changes in the central bank's holding of domestic credit only

B) changes in the central bank's holding of foreign reserves only

C) some combination of changes in the central bank's holdings of domestic credit or foreign reserves

D) changes in the nation's stock of gold

A) changes in the central bank's holding of domestic credit only

B) changes in the central bank's holding of foreign reserves only

C) some combination of changes in the central bank's holdings of domestic credit or foreign reserves

D) changes in the nation's stock of gold

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

When maintaining a peg, if the central bank runs out of foreign currency reserves, then:

A) it can always print more of the domestic currency.

B) it can back the money supply by purchasing domestic assets.

C) it can sell its own currency and purchase foreign currency reserves.

D) it must allow the domestic currency to float.

A) it can always print more of the domestic currency.

B) it can back the money supply by purchasing domestic assets.

C) it can sell its own currency and purchase foreign currency reserves.

D) it must allow the domestic currency to float.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

(Table: Mexico's Central Bank Balance Sheet) To maintain a fixed exchange rate, which of the following will Mexico do?

A) always buy more government bonds

B) always sell more government bonds

C) buy and sell reserves

D) print more money

A) always buy more government bonds

B) always sell more government bonds

C) buy and sell reserves

D) print more money

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

Saudi Arabia pegs its currency (the riyal, or SAR) to the U.S. dollar. Currently, the exchange rate is SAR3.75 = $US1. Suppose that the Saudi Arabian money multiplier is 1. How does the Saudi Arabian central bank maintain the pegged exchange rate of SAR3.75 = $US1?

A) It sells dollars (for Saudi riyals) in foreign exchange markets whenever the SAR-$US rate falls below SAR3.75 = $US1.

B) It buys dollars (with Saudi riyals) in foreign exchange markets whenever the SAR-$US rate rises above SAR3.75 = $US1.

C) It sells Saudi riyals (for dollars) in foreign exchange markets whenever the SAR-/$US rate rises above SAR3.75 = $US1.

D) It buys Saudi riyals (with dollars) in foreign exchange markets whenever the SAR-$US rate rises above SAR3.75 = $US1.

A) It sells dollars (for Saudi riyals) in foreign exchange markets whenever the SAR-$US rate falls below SAR3.75 = $US1.

B) It buys dollars (with Saudi riyals) in foreign exchange markets whenever the SAR-$US rate rises above SAR3.75 = $US1.

C) It sells Saudi riyals (for dollars) in foreign exchange markets whenever the SAR-/$US rate rises above SAR3.75 = $US1.

D) It buys Saudi riyals (with dollars) in foreign exchange markets whenever the SAR-$US rate rises above SAR3.75 = $US1.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

If the central bank holds no foreign currency reserves, the nation's exchange rate is:

A) fixed.

B) pegged.

C) under the control of the IMF.

D) floating.

A) fixed.

B) pegged.

C) under the control of the IMF.

D) floating.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

A balance sheet for the central bank shows assets of _____ and liabilities of ______.

A) gold and silver; foreign obligations

B) reserves (foreign currency and foreign bonds); domestic currency (money supply)

C) private individuals; public entities

D) large money center banks; corporate borrowers

A) gold and silver; foreign obligations

B) reserves (foreign currency and foreign bonds); domestic currency (money supply)

C) private individuals; public entities

D) large money center banks; corporate borrowers

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

Which method would the central bank NOT use to keep the exchange value of its currency fixed?

A) It would purchase its own currency for foreign reserves when the domestic credit expanded.

B) It would ensure that the domestic money supply remained constant.

C) It would sell its own currency for foreign reserves when domestic credit contracted.

D) It would ensure that the domestic money supply increased to maintain uncovered interest and PPP.

A) It would purchase its own currency for foreign reserves when the domestic credit expanded.

B) It would ensure that the domestic money supply remained constant.

C) It would sell its own currency for foreign reserves when domestic credit contracted.

D) It would ensure that the domestic money supply increased to maintain uncovered interest and PPP.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

To maintain the peg, a nation must keep its money supply constant, which it does by:

A) buying and selling foreign reserves and domestic assets for its own currency.

B) requiring all banks to back deposits 100%.

C) backing the currency by foreign reserves 100%.

D) selling only foreign reserves for its own currency.

A) buying and selling foreign reserves and domestic assets for its own currency.

B) requiring all banks to back deposits 100%.

C) backing the currency by foreign reserves 100%.

D) selling only foreign reserves for its own currency.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

41

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Which of the following best describes the effect on Aruba's money supply from purchasing dollars?

A) The money supply will increase.

B) The money supply will decrease.

C) The money supply will not change.

D) The money supply will not change as the exchange rate appreciates.

A) The money supply will increase.

B) The money supply will decrease.

C) The money supply will not change.

D) The money supply will not change as the exchange rate appreciates.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

Assume the money supply is backed by bonds and reserves, and the exchange rate is pegged. If the domestic demand for money falls, what happens to the level of bonds and reserves?

A) The level of bonds and reserves both rise.

B) The level of bonds stays the same, while the level of reserves falls.

C) The level of bonds rises, while the level of reserves falls.

D) The level of bonds falls and the level of reserves rises.

A) The level of bonds and reserves both rise.

B) The level of bonds stays the same, while the level of reserves falls.

C) The level of bonds rises, while the level of reserves falls.

D) The level of bonds falls and the level of reserves rises.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following methods would the central bank NOT use to keep the exchange value of its currency fixed?

A) It would purchase its own currency for foreign reserves when the domestic credit expanded.

B) It would sell its own currency for foreign reserves when domestic credit contracted.

C) It would ensure that the domestic money supply stayed constant to maintain uncovered interest and PPP.

D) It would ensure that the domestic money supply increased to maintain PPP.

A) It would purchase its own currency for foreign reserves when the domestic credit expanded.

B) It would sell its own currency for foreign reserves when domestic credit contracted.

C) It would ensure that the domestic money supply stayed constant to maintain uncovered interest and PPP.

D) It would ensure that the domestic money supply increased to maintain PPP.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

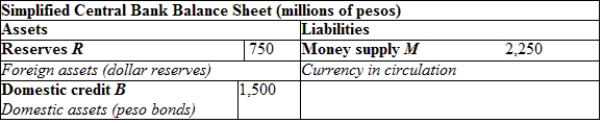

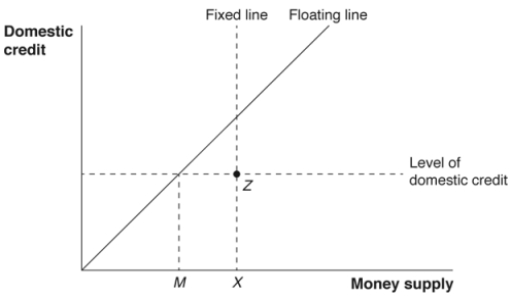

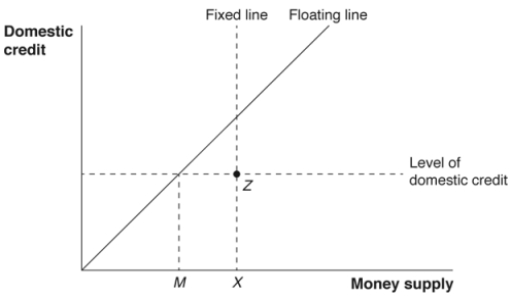

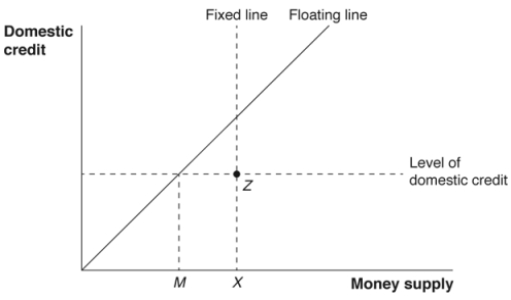

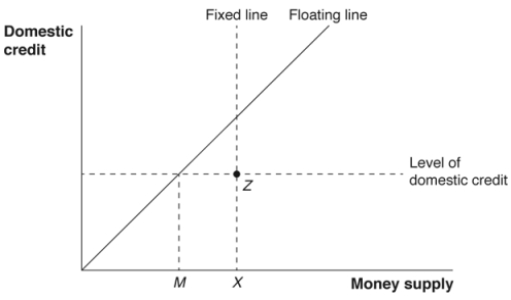

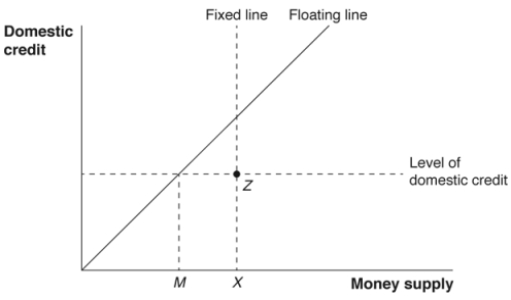

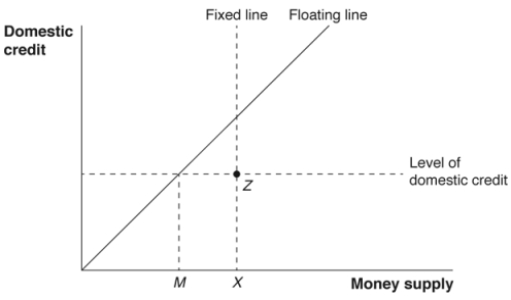

(Figure: Central Bank Balance Sheet) All points on the fixed line (XZ) are so named because:

A) at every point on the line, the supply of money is equal to bond holdings so that reserves are equal to zero.

B) at every point on the line, the supply of money is greater than domestic bond holdings so that reserves are greater than zero.

C) at every point to the right of the line, the money supply is backed 100% by reserves.

D) exchange rates will float unless the economy is "on" the fixed line.

A) at every point on the line, the supply of money is equal to bond holdings so that reserves are equal to zero.

B) at every point on the line, the supply of money is greater than domestic bond holdings so that reserves are greater than zero.

C) at every point to the right of the line, the money supply is backed 100% by reserves.

D) exchange rates will float unless the economy is "on" the fixed line.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

45

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Suppose that Aruba's money supply is Af 20 billion and Aruba's central bank holds $5 billion of dollar reserves and Af 10 billion of domestic bonds. What is the backing ratio for Aruban florins?

A) 10.5%

B) 21%

C) 50%

D) 89.5%

A) 10.5%

B) 21%

C) 50%

D) 89.5%

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

46

To maintain the peg, a nation must keep its circulating money supply constant. What factor(s) (in addition to its own actions) might result in a change in the money supply?

A) a change in the demand for money produced by an output shock or a change in foreign rates of interest

B) an increase in the trade gap

C) the issuance of new government bonds by the nation's government

D) a crackdown on money laundering activities by multinational corporations

A) a change in the demand for money produced by an output shock or a change in foreign rates of interest

B) an increase in the trade gap

C) the issuance of new government bonds by the nation's government

D) a crackdown on money laundering activities by multinational corporations

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

When output falls or the foreign rate of interest rises, what must the central bank do and why?

A) It must sell foreign currency reserves for its own currency to raise rates of interest and decrease the supply of money.

B) It must buy foreign currency reserves with its own currency to lower rates of interest and increase the supply of money.

C) It must resist the temptation to do something immediately and let the situation work itself out.

D) It must ask the domestic government to issue more bonds to raise domestic rates of interest.

A) It must sell foreign currency reserves for its own currency to raise rates of interest and decrease the supply of money.

B) It must buy foreign currency reserves with its own currency to lower rates of interest and increase the supply of money.

C) It must resist the temptation to do something immediately and let the situation work itself out.

D) It must ask the domestic government to issue more bonds to raise domestic rates of interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Now suppose that the Aruban central bank buys dollars. Which of the following describes the effect of this dollar purchase on Aruba's exchange rate?

A) upward pressure on the exchange rate (depreciation of florin)

B) downward pressure on the exchange rate (appreciation of florin)

C) no effect on the exchange rate

D) Not enough information is provided to answer.

A) upward pressure on the exchange rate (depreciation of florin)

B) downward pressure on the exchange rate (appreciation of florin)

C) no effect on the exchange rate

D) Not enough information is provided to answer.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

The degree of danger of breaking the peg focuses on:

A) how problematic defaults are for the domestic banking system.

B) the volatility of interest rates.

C) the ratio of domestic bonds to foreign currency reserves in backing the domestic money supply.

D) how difficult it is for the nation to maintain a current account surplus.

A) how problematic defaults are for the domestic banking system.

B) the volatility of interest rates.

C) the ratio of domestic bonds to foreign currency reserves in backing the domestic money supply.

D) how difficult it is for the nation to maintain a current account surplus.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

50

Consider an economy with a fixed exchange rate and money supply equal to 2 billion pesos. The country has 1 billion in reserves and 1 billion in domestic credit. If there is a sudden decline in the demand for money, then:

A) the country needs to reduce its reserves to maintain the exchange rate.

B) the country needs to increase its reserves to maintain the exchange rate.

C) the country will face rising interest rates and, thus, a sharp appreciation of the peso.

D) the country will see a sharp increase in the demand for loans.

A) the country needs to reduce its reserves to maintain the exchange rate.

B) the country needs to increase its reserves to maintain the exchange rate.

C) the country will face rising interest rates and, thus, a sharp appreciation of the peso.

D) the country will see a sharp increase in the demand for loans.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Now suppose that the Aruban central bank buys dollars. Which of the following describes what will happen to Aruba's exchange rate?

A) The exchange rate will appreciate.

B) The exchange rate will depreciate.

C) The exchange rate will not change.

D) Not enough information is provided to answer.

A) The exchange rate will appreciate.

B) The exchange rate will depreciate.

C) The exchange rate will not change.

D) Not enough information is provided to answer.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

(Figure: Central Bank Balance Sheet) When an economy with a pegged exchange rate operates with the money supply backed 100% by reserves, it is at point __________ on the diagram, and the situation is known as __________.

A) Z; complete sterilization

B) B; modified fixed/float

C) M; freely floating system

D) X; currency board system

A) Z; complete sterilization

B) B; modified fixed/float

C) M; freely floating system

D) X; currency board system

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

53

El Salvador has dollarized; that is, it uses the U.S. dollar as its currency. What is the backing ratio for El Salvador's currency?

A) 0%

B) 25%

C) 75%

D) 100%

A) 0%

B) 25%

C) 75%

D) 100%

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

If the price level is fixed, the demand for money depends on changes in which of the following?

A) the exchange rate with trading partners

B) government purchases of domestic bonds

C) GDP and/or the domestic rate of interest

D) the total value of assets held by the central bank

A) the exchange rate with trading partners

B) government purchases of domestic bonds

C) GDP and/or the domestic rate of interest

D) the total value of assets held by the central bank

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

With a credible peg, whenever there is a rise in the foreign interest rate:

A) there is a drop in the domestic interest rate.

B) the exchange rate changes.

C) there is an equal rise in the domestic interest rate.

D) there will be no change in the domestic interest rate.

A) there is a drop in the domestic interest rate.

B) the exchange rate changes.

C) there is an equal rise in the domestic interest rate.

D) there will be no change in the domestic interest rate.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

When a country adopts a currency board system:

A) it no longer needs to hold any reserves.

B) its reserves equal 100% of its money supply.

C) it can create money by lending to domestic borrowers.

D) its reserves must equal 50% of its money supply.

A) it no longer needs to hold any reserves.

B) its reserves equal 100% of its money supply.

C) it can create money by lending to domestic borrowers.

D) its reserves must equal 50% of its money supply.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Which of the following best describes the effect on Aruba's interest rates from purchasing dollars?

A) Interest rates will rise.

B) Interest rates will fall.

C) Interest rates will not change.

D) Interest rates will rise as the exchange rate depreciates.

A) Interest rates will rise.

B) Interest rates will fall.

C) Interest rates will not change.

D) Interest rates will rise as the exchange rate depreciates.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

To have adequate protection to cover a depreciation, the central bank must keep its foreign currency reserves at the level at which:

A) they are growing at the same rate as GDP.

B) they are equal to the demand for money minus the amount of domestic credit (held by the central bank).

C) they are greater than zero.

D) they are worth three months of import protection.

A) they are growing at the same rate as GDP.

B) they are equal to the demand for money minus the amount of domestic credit (held by the central bank).

C) they are greater than zero.

D) they are worth three months of import protection.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

Aruba pegs its currency (the Aruban florin) to the U.S. dollar at a rate of Af 2 = $US1. Suppose that the actual exchange rate is equal to this pegged rate. Suppose that Aruba's money supply is Af 20 billion and Aruba's central bank holds $5 billion of dollar reserves and Af 10 billion of domestic bonds. What will happen to Aruba's backing ratio if its central bank sells $2.5 billion of U.S. dollars to Aruban citizens?

A) It will not change.

B) It will fall to 33%.

C) It will fall to 2.6%.

D) It will fall to 81%.

A) It will not change.

B) It will fall to 33%.

C) It will fall to 2.6%.

D) It will fall to 81%.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

(Figure: Central Bank Balance Sheet) All points on the floating line are so named because:

A) at every point on the line, the supply of money is equal to bond holdings so that reserves are equal to zero.

B) at every point above the line, the exchange rate floats.

C) at every point below the line, the exchange rate is backed 100% by reserves.

D) exchange rates can only float if the economy is "on" the floating line.

A) at every point on the line, the supply of money is equal to bond holdings so that reserves are equal to zero.

B) at every point above the line, the exchange rate floats.

C) at every point below the line, the exchange rate is backed 100% by reserves.

D) exchange rates can only float if the economy is "on" the floating line.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

If domestic credit is constant, then any change in the demand for money will result in:

A) a change in foreign credit.

B) a change in the rate of interest.

C) an inverse change in the price level.

D) an equal change in foreign currency reserves.

A) a change in foreign credit.

B) a change in the rate of interest.

C) an inverse change in the price level.

D) an equal change in foreign currency reserves.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

Emerging markets and developing economies may have to raise domestic rates of interest suddenly if:

A) the supply of money unexpectedly drops.

B) the IMF calls in loans with no warning.

C) the risk premium for its currency rises dramatically.

D) domestic investors wish to repatriate their profits earned overseas.

A) the supply of money unexpectedly drops.

B) the IMF calls in loans with no warning.

C) the risk premium for its currency rises dramatically.

D) domestic investors wish to repatriate their profits earned overseas.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

When the backing ratio is higher, the peg is:

A) less stable.

B) higher.

C) safer.

D) less credible.

A) less stable.

B) higher.

C) safer.

D) less credible.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

An economy is better able to withstand a shock to the money demand if:

A) the backing ratio is lower.

B) the country holds more domestic assets.

C) the backing ratio is higher.

D) the country holds fewer reserves.

A) the backing ratio is lower.

B) the country holds more domestic assets.

C) the backing ratio is higher.

D) the country holds fewer reserves.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

When other emerging market nations experience an exchange rate crisis, it affects healthy emerging market economies (raises risk premiums) because of investor worry. This phenomenon is known as:

A) emerging market dysfunction.

B) the law of like outcomes.

C) experiential judgment.

D) contagion.

A) emerging market dysfunction.

B) the law of like outcomes.

C) experiential judgment.

D) contagion.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

Consider an economy with a fixed exchange rate and money supply equal to 2 billion pesos. The country has 1 billion in reserves and 1 billion in domestic credit. If the output in the country were to increase by 5%, then:

A) the money demand would increase by 10%.

B) the central bank would have to increase reserves by 5%.

C) the central bank would have to decrease reserves by 5%.

D) the central bank would have to decrease domestic credit.

A) the money demand would increase by 10%.

B) the central bank would have to increase reserves by 5%.

C) the central bank would have to decrease reserves by 5%.

D) the central bank would have to decrease domestic credit.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

Consider an economy with a fixed exchange rate and money supply equal to 2 billion pesos. The country has 1 billion in reserves and 1 billion in domestic credit. If as a result of some exogenous events, foreign interest rate increases, then the central bank in the home country:

A) will have to decrease the reserves to maintain the peg.

B) will have to decrease the domestic assets.

C) will have to increase the reserves to maintain the peg.

D) will do nothing.

A) will have to decrease the reserves to maintain the peg.

B) will have to decrease the domestic assets.

C) will have to increase the reserves to maintain the peg.

D) will do nothing.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is NOT likely to cause a money demand shock under a fixed exchange rate system?

A) a decline in foreign interest rates

B) a sudden decline in domestic output

C) a sudden increase in domestic output

D) a change in marginal tax rate in the foreign country

A) a decline in foreign interest rates

B) a sudden decline in domestic output

C) a sudden increase in domestic output

D) a change in marginal tax rate in the foreign country

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

Assume the money supply is backed by bonds and reserves, and the exchange rate is pegged. If the demand for money rises, how might the central bank maintain the peg?

A) by selling back domestic bonds and foreign currency reserves

B) by selling domestic bonds equal to the increase in demand

C) by purchasing reserves equal to the increase in demand

D) by selling reserves equal to the increase in demand

A) by selling back domestic bonds and foreign currency reserves

B) by selling domestic bonds equal to the increase in demand

C) by purchasing reserves equal to the increase in demand

D) by selling reserves equal to the increase in demand

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

If a nation's interest rate on foreign currency deposits is higher inside than outside the nation, which of the following is the cause?

A) a fall in the domestic money supply

B) a country premium, meaning investors are concerned about defaults or capital controls

C) a currency premium

D) an exchange rate premium

A) a fall in the domestic money supply

B) a country premium, meaning investors are concerned about defaults or capital controls

C) a currency premium

D) an exchange rate premium

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

Special situations in emerging markets and developing economies, such as volatile output and an export dependent economy, usually mean:

A) the prudent level of reserves is much higher than for higher-income nations.

B) there is no way they are able to maintain an exchange rate peg.

C) pegging exchange rates is even more important.

D) pegging exchange rates is much easier because the economies are smaller.

A) the prudent level of reserves is much higher than for higher-income nations.

B) there is no way they are able to maintain an exchange rate peg.

C) pegging exchange rates is even more important.

D) pegging exchange rates is much easier because the economies are smaller.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

If domestic credit is constant and the money supply changes, then:

A) reserves will remain constant.

B) foreign credit will remain constant.

C) reserves will change by a larger percentage than the change in the money supply.

D) foreign interest rates will begin to increase.

A) reserves will remain constant.

B) foreign credit will remain constant.

C) reserves will change by a larger percentage than the change in the money supply.

D) foreign interest rates will begin to increase.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

An example in the text of Argentina's convertibility plan during 1993-94 indicated that because of a growing economy, the central bank expanded the supply of money to maintain its U.S. dollar peg by:

A) acquiring foreign reserves.

B) buying domestic bonds.

C) issuing new government liabilities.

D) selling gold.

A) acquiring foreign reserves.

B) buying domestic bonds.

C) issuing new government liabilities.

D) selling gold.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

Uncovered interest parity may actually result in domestic interest rates being ____ than foreign rates because of investors' perceived risk of holding assets based in the domestic currency.

A) lower

B) more unstable

C) higher

D) more stable

A) lower

B) more unstable

C) higher

D) more stable

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

To what does global contagion refer?

A) an equalization of world interest rates

B) elimination of risk premiums between countries

C) adverse changes in market sentiment based on events in faraway places

D) switching to fixed exchange rates by emerging market economies

A) an equalization of world interest rates

B) elimination of risk premiums between countries

C) adverse changes in market sentiment based on events in faraway places

D) switching to fixed exchange rates by emerging market economies

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

The risk premium is the difference between foreign and domestic rates of interest under parity. This premium has three distinct parts. Which of the following is NOT a factor in the risk premium?

A) the currency premium

B) the country premium

C) the default risk premium

D) the floating risk premium

A) the currency premium

B) the country premium

C) the default risk premium

D) the floating risk premium

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

A ratio indicating how safe the peg is from breaking is calculated by _______ and is called ________.

A) foreign reserves as a percent of GDP; the safety margin

B) foreign reserves as a percent of the total money supply; the backing ratio

C) money demand as a percent of money supply; the financial adequacy quotient

D) foreign reserves as a percent of domestic credit; the marginal propensity to break

A) foreign reserves as a percent of GDP; the safety margin

B) foreign reserves as a percent of the total money supply; the backing ratio

C) money demand as a percent of money supply; the financial adequacy quotient

D) foreign reserves as a percent of domestic credit; the marginal propensity to break

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

What is a problem in emerging markets that affects a nation's ability to peg its currency?

A) The low level of GDP means the demand for money is always small.

B) The high level of GDP means the demand for money is always large.

C) As the nation develops, the ratio of the demand for money to GDP rises.

D) Because of the volatility of GDP, the demand for money is volatile and the nation must hold higher levels of reserves to peg.

A) The low level of GDP means the demand for money is always small.

B) The high level of GDP means the demand for money is always large.

C) As the nation develops, the ratio of the demand for money to GDP rises.

D) Because of the volatility of GDP, the demand for money is volatile and the nation must hold higher levels of reserves to peg.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

Whenever a nation opts to back its fixed exchange rate 100% with foreign currency reserves, it is known as:

A) a floating rate system.

B) a currency peg.

C) a currency board.

D) a full concentration ratio.

A) a floating rate system.

B) a currency peg.

C) a currency board.

D) a full concentration ratio.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

When the central bank adopts a currency board, it is considered ______, because a shock to money demand _______.

A) a hard peg; can be covered at any level without a change in domestic credit

B) a soft peg; can be absorbed by a change in domestic credit

C) a reversion to floating rates; is impossible

D) the reinstatement of a gold standard; cannot be covered any other way

A) a hard peg; can be covered at any level without a change in domestic credit

B) a soft peg; can be absorbed by a change in domestic credit

C) a reversion to floating rates; is impossible

D) the reinstatement of a gold standard; cannot be covered any other way

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck