Deck 14: Accounting for Not-for-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 14: Accounting for Not-for-Profit Organizations

1

Similarity in the characteristics of nongovernmental not-for-profit (NFP) organizations and governmental NFP organizations can make it difficult to determine whether the NFP is nongovernmental or governmental in nature.

True

2

Under current accounting and reporting standards, nongovernmental not-for-profit organizations must utilize the fund accounting structure set forth in the AICPA Audit and Accounting Guide Not-for-Profit Entities.

False

3

GAAP for nongovernmental not-for-profit organizations is set by the FASB and the AICPA.

False

4

The FASB requires not-for-profit organizations to report expenses by nature and function in the notes to the financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

Examples of organizations that can be either governmental or nongovernmental include colleges and universities, hospitals, and museums.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

Under FASB standards, expenses of a not-for-profit organization can only be shown as reductions of net assets without donor restrictions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

The FASB requires that support from special events, if related to the central ongoing and major activities of the organization, and related direct costs, be reported at their gross amounts in the statement of activities.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

The FASB requires that the purchase of equity securities be initially recorded at the acquisition price and the purchase of debt securities be initially recorded at fair value.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

The FASB generally requires that not-for-profit organizations record unconditional pledges as support (contributions) only when received in cash.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

The FASB requires not-for-profit to prepare a statement of cash flow.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

Donor-imposed restrictions must be clearly reflected in financial statements of not-for-profit organizations reporting under the FASB.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

Board-designated net assets are net assets with donor restrictions the board sets aide for a specific purpose.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

Not-for-profits are required to report expense amounts by natural classification and functional classification.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

Cash received by a nongovernmental not-for-profit organization in year 1 that the donor stipulates is to cover operating expenses of the following year should be recognized as an increase in net assets with donor restrictions in year 1 and as net assets released from restrictions in year 2.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

Supporting services expenses include fund-raising and management and general expenses that are not directly attributable to specific programs.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

Contributions received in a prior period and restricted by the donor for construction of a building were reported as increases to net assets with donor restrictions in the period received. When the building is constructed in a subsequent period a not-for-profit would report contributions for the amount released from restrictions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

According to the FASB Codification, donated materials are generally not recognized as contributions by a not-for-profit organization.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

The FASB states that donated services should be recorded as contributions by a not-for-profit organization if they meet the recognition criteria and are material.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

Museums and religious organizations reporting in accordance with FASB must capitalize and report assets such as works of art, historical treasures, and similar collectible items if they are held for public inspection.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

Under FASB standards the statement of activities for a not-for-profit organization is required to be separated into operating and nonoperating activity.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

Under the FASB Codification a $5 million endowment that cannot be spent for 50 years should be classified as net assets with donor restrictions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

According to the FASB Codification, which of the following is a condition that must be met for contributed services to a not-for-profit organization (NFP) to be recorded as both a contribution and as an expense?

A) The service creates or enhances nonfinancial assets, such as a carpenter renovating a building.

B) The service requires a specialized skill and is provided by someone who possesses the specialized skill, such as a lawyer preparing contracts.

C) The service supplements the management function, such as an auditor preparing a program audit, which is not normally done.

D) All of the given conditions must be met for contributed services to be recognized as a contribution and an expense.

A) The service creates or enhances nonfinancial assets, such as a carpenter renovating a building.

B) The service requires a specialized skill and is provided by someone who possesses the specialized skill, such as a lawyer preparing contracts.

C) The service supplements the management function, such as an auditor preparing a program audit, which is not normally done.

D) All of the given conditions must be met for contributed services to be recognized as a contribution and an expense.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

Under FASB standards how would a not-for-profit organization recognize a conditional pledge?

A) Debit Pledges Receivable and credit Contributions-With Donor Restrictions.

B) Debit Pledges Receivable and credit Deferred Contributions.

C) Debit Conditional Pledges Receivable and Credit Deferred Contributions.

D) It would not recognize the conditional pledge until pledge conditions are substantially met.

A) Debit Pledges Receivable and credit Contributions-With Donor Restrictions.

B) Debit Pledges Receivable and credit Deferred Contributions.

C) Debit Conditional Pledges Receivable and Credit Deferred Contributions.

D) It would not recognize the conditional pledge until pledge conditions are substantially met.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

An organization that can directly issue debt paying interest exempt from federal taxation may be a governmental not-for-profit or a nongovernmental not-for-profit.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

The FASB requires investments in equity securities that have a readily determinable market value of a not-for-profit organization be reported at:

A) Lower of cost or market.

B) Amortized cost.

C) Fair value.

D) Cost.

A) Lower of cost or market.

B) Amortized cost.

C) Fair value.

D) Cost.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

The FASB requires that if a financial intermediary has variance power it recognize a donation as a contribution payable on its financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

The FASB requires the statement of financial position prepared by a not-for-profit organization to report net assets in three categories: net assets without donor restrictions, net investment in capital assets, and net assets with donor restrictions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

The GASB provides guidance on generally accepted accounting principles for governmental not-for-profit organizations.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following characteristics of not-for-profit organizations (NFPs) can be used to distinguish a nongovernmental from a governmental NFP?

A) Contributions by resource providers who do not expect a return on investment.

B) Ability to impose taxes on citizens.

C) Absence of ownership interests.

D) All of the given characteristics are generally different for nongovernmental versus governmental NFPs.

A) Contributions by resource providers who do not expect a return on investment.

B) Ability to impose taxes on citizens.

C) Absence of ownership interests.

D) All of the given characteristics are generally different for nongovernmental versus governmental NFPs.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

An example of an increase in net assets for a not-for-profit organization that would be labeled revenue rather than support is:

A) An unconditional promise to give.

B) Investment income.

C) A restricted gift.

D) An allocation of funds from the local United Way organization.

A) An unconditional promise to give.

B) Investment income.

C) A restricted gift.

D) An allocation of funds from the local United Way organization.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

31

Organizations that have the power to enact and enforce a tax levy are nongovernmental not-for-profits.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

Fixed-term endowments and board-designated endowments are classified as net assets with donor restrictions according to the FASB.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

Goodwill created because a not-for-profit organization obtains control of another organization is always recorded as an asset.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

The FASB states that if a not-for-profit has a controlling financial interest in a for-profit it should consolidate the for-profit over which it has a controlling financial interest into its financial statements.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

Under the FASB Codification the costs incurred for a joint activity may be allocated between fund-raising expenses and program expenses if the criteria of purpose, audience, and content are met.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

Long-term unconditional pledges (those that will not be collected within a year) are generally reported at fair value.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

Responsibility for establishing generally accepted accounting principles (GAAP) for nongovernmental, not-for-profit organizations rests with the FASB and was most clearly established:

A) By the FASB Codification.

B) When the FASB was created in 1974.

C) When the GASB was created in 1984.

D) In the AICPA's Statement of Auditing Standards No. 69 (hierarchy of GAAP).

A) By the FASB Codification.

B) When the FASB was created in 1974.

C) When the GASB was created in 1984.

D) In the AICPA's Statement of Auditing Standards No. 69 (hierarchy of GAAP).

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

Similar to the GASB, the FASB requires not-for-profit entities to prepare the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

The FASB Codification requires the following financial statements for all not-for-profit organizations:

A) Statement of financial position, statement of activities, and statement of cash flows.

B) Statement of financial position, statement of operations, and statement of cash flows.

C) Statement of financial position, statement of activities, and statement of net assets.

D) Statement of financial position, statement of revenues and expenses, and statement of cash flows.

A) Statement of financial position, statement of activities, and statement of cash flows.

B) Statement of financial position, statement of operations, and statement of cash flows.

C) Statement of financial position, statement of activities, and statement of net assets.

D) Statement of financial position, statement of revenues and expenses, and statement of cash flows.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is True regarding fund accounting for not-for-profit organizations (NFPs)?

A) Fund accounting can be used by NFPs for external purposes, but not internal purposes.

B) Fund accounting can provide a good mechanism for facilitating reporting to donors.

C) Fund accounting is not allowed.

D) Fund accounting for internal and external reporting purposes has been replaced by FASB with the two classes of net assets (without donor restrictions, and net investment in restricted assets).

A) Fund accounting can be used by NFPs for external purposes, but not internal purposes.

B) Fund accounting can provide a good mechanism for facilitating reporting to donors.

C) Fund accounting is not allowed.

D) Fund accounting for internal and external reporting purposes has been replaced by FASB with the two classes of net assets (without donor restrictions, and net investment in restricted assets).

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

41

The FASB states that depreciation expense in a not-for-profit organization should be:

A) Assigned to or allocated to the functions to which it relates.

B) Reported under the management and general function.

C) Disclosed in the notes to the financial statements.

D) Allocated to program but not support functions.

A) Assigned to or allocated to the functions to which it relates.

B) Reported under the management and general function.

C) Disclosed in the notes to the financial statements.

D) Allocated to program but not support functions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would be considered "contribution revenue or support" of a not-for-profit organization under FASB standards?

A) Gain on disposal of capital assets.

B) Money received from a fund-raising campaign.

C) Money received from rental of surplus office space.

D) Investment earnings.

A) Gain on disposal of capital assets.

B) Money received from a fund-raising campaign.

C) Money received from rental of surplus office space.

D) Investment earnings.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

A local philanthropist made an unconditional pledge to donate $100,000 to a not-for-profit organization to be paid in five equal installments of $20,000 beginning in two years. Under FASB standards the pledge would be recognized as:

A) A contribution of $20,000 in each of the five years a contribution is made.

B) A contribution of $100,000 in the year the pledge is made, adjusted for the estimated uncollectible amount.

C) Deferred support of $100,000 in the year the pledge was made.

D) A contribution of $100,000 in the year the pledge was made, discounted for the difference between the pledge and its present value.

A) A contribution of $20,000 in each of the five years a contribution is made.

B) A contribution of $100,000 in the year the pledge is made, adjusted for the estimated uncollectible amount.

C) Deferred support of $100,000 in the year the pledge was made.

D) A contribution of $100,000 in the year the pledge was made, discounted for the difference between the pledge and its present value.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

A not-for-profit (NFP) organization acting as a financial intermediary receives a contribution. Under the FASB Codification the NFP would be most likely to recognize the contribution as a liability under which of the following situations?

A) The NFP has variance power.

B) The NFP is acting as an agent, receiving the contribution on behalf of another organization.

C) The NFP is financially interrelated with the organization on whose behalf it received the contribution.

D) The NFP has a 51 percent interest in the organization on whose behalf it received the contribution.

A) The NFP has variance power.

B) The NFP is acting as an agent, receiving the contribution on behalf of another organization.

C) The NFP is financially interrelated with the organization on whose behalf it received the contribution.

D) The NFP has a 51 percent interest in the organization on whose behalf it received the contribution.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

In the current year, the not-for-profit organization (NFP) How to Read Government Financial Reports received both cash of $1,000 and pledges of $2,000 to be used for teaching citizens how to read government financial reports. During the year the organization spent $1,500 teaching citizens to read financial statements. Assuming the NFP has a policy of spending its restricted resources first, in the current year what amount of contributions can be reclassified as without donor restrictions?

A) $1,000.

B) $1,500.

C) $2,000.

D) $3,000.

A) $1,000.

B) $1,500.

C) $2,000.

D) $3,000.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

A not-for-profit organization incurred $10,000 in management and general expenses in the current fiscal year. In the organization's statement of activities prepared in conformity with FASB standards, the $10,000 would be reported as:

A) A deduction from program revenue.

B) Fund-raising expense.

C) Program services expenses.

D) Supporting services expenses.

A) A deduction from program revenue.

B) Fund-raising expense.

C) Program services expenses.

D) Supporting services expenses.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is correct regarding reporting of special events and related direct costs under current FASB standards?

A) Special events and related direct costs must be reported separately at their gross amounts if they relate to the ongoing major operations of a not-for-profit.

B) Special events revenues are to be reported at gross amounts, even if direct costs are of a peripheral or incidental nature.

C) With few exceptions special events revenues are reported net of related direct costs.

D) Expenses of promoting and conducting special events should be netted directly against special events revenue.

A) Special events and related direct costs must be reported separately at their gross amounts if they relate to the ongoing major operations of a not-for-profit.

B) Special events revenues are to be reported at gross amounts, even if direct costs are of a peripheral or incidental nature.

C) With few exceptions special events revenues are reported net of related direct costs.

D) Expenses of promoting and conducting special events should be netted directly against special events revenue.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

A not-for-profit organization that follows FASB standards must display the changes in all classes of net assets on which of the following statements?

A) Statement of activities.

B) Statement of financial position.

C) Statement of cash flows.

D) Statement of functional expenses.

A) Statement of activities.

B) Statement of financial position.

C) Statement of cash flows.

D) Statement of functional expenses.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

Under FASB standards, which of the following contributions would not have to be reported as an asset on the statement of financial position of a not-for-profit organization?

A) Land was donated to the Friends of the Forest Society for conversion into a nature trail.

B) The original courthouse was donated to the Historical Preservation Society for conversion into a museum.

C) An art collector donated a famous oil painting to a local art museum for display in its exhibit hall.

D) A valuable coin collection was donated to the Youth for Conservation organization, which the organization plans to sell at current market prices.

A) Land was donated to the Friends of the Forest Society for conversion into a nature trail.

B) The original courthouse was donated to the Historical Preservation Society for conversion into a museum.

C) An art collector donated a famous oil painting to a local art museum for display in its exhibit hall.

D) A valuable coin collection was donated to the Youth for Conservation organization, which the organization plans to sell at current market prices.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

In accordance with FASB standards, securities donated to a not-for-profit organization should be recorded at the:

A) Donor's recorded amount.

B) Fair market value at the date of the gift, or the donor's recorded amount, whichever is lower.

C) Fair market value at the date of the gift, or the donor's recorded amount, whichever is higher.

D) Fair market value at the date of the gift.

A) Donor's recorded amount.

B) Fair market value at the date of the gift, or the donor's recorded amount, whichever is lower.

C) Fair market value at the date of the gift, or the donor's recorded amount, whichever is higher.

D) Fair market value at the date of the gift.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following terms is used to indicate that a donor provided a gift with explicit instructions that the gift is to be used for a specific purpose by the not-for-profit but the entire amount may be spent right away?

A) Board-designated net assets.

B) Net assets without donor restrictions.

C) Endowment assets.

D) Net assets with donor restrictions.

A) Board-designated net assets.

B) Net assets without donor restrictions.

C) Endowment assets.

D) Net assets with donor restrictions.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

According to the FASB, net assets with donor restrictions are released from restrictions:

A) At the end of each fiscal year.

B) As assets are spent for the purposes intended by the donor.

C) When funds are returned to the donor.

D) When all donor conditions have been met.

A) At the end of each fiscal year.

B) As assets are spent for the purposes intended by the donor.

C) When funds are returned to the donor.

D) When all donor conditions have been met.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

Not-for-profits can report expenses by nature and function:

A) In the notes to the financial statements.

B) As a separate financial statement.

C) In the statement of activities.

D) All of the options are correct.

A) In the notes to the financial statements.

B) As a separate financial statement.

C) In the statement of activities.

D) All of the options are correct.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following would be reported as an Asset with Restrictions on Use?

A) A cash contribution for a program activity, such as diabetes research.

B) A cash contribution for a new building.

C) Cash restricted by debt covenants with lenders.

D) Cash restricted by the board for purchase of new computer equipment.

A) A cash contribution for a program activity, such as diabetes research.

B) A cash contribution for a new building.

C) Cash restricted by debt covenants with lenders.

D) Cash restricted by the board for purchase of new computer equipment.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

According to the FASB, how should unrealized gains on the investment portfolio of a not-for-profit organization be recognized?

A) Not recognized.

B) Reported in the net asset section of the balance sheet.

C) Reported according to whether the gains relate to trading, or held-to-maturity assets.

D) Reported on the statement of activities.

A) Not recognized.

B) Reported in the net asset section of the balance sheet.

C) Reported according to whether the gains relate to trading, or held-to-maturity assets.

D) Reported on the statement of activities.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

In the current year, the not-for-profit organization Save the Butterflies Foundation received cash of $500 to be used as the Foundation wishes and $1,000 to be used for butterfly research. Save the Butterflies also received pledges of $700 that it can use as it wishes and $600 for its building fund. All pledges are expected to be received next year. How much would Save the Butterflies report as contributions with donor restrictions in the current year?

A) $1,000.

B) $1,600.

C) $1,300.

D) $2,300.

A) $1,000.

B) $1,600.

C) $1,300.

D) $2,300.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

According to the FASB, a not-for-profit arts organization would report the account Provision for Uncollectible Pledges as which of the following?

A) Expense.

B) Contra revenue.

C) Contra asset.

D) FASB allows management to determine its policy for reporting the Provision for Uncollectible Pledges.

A) Expense.

B) Contra revenue.

C) Contra asset.

D) FASB allows management to determine its policy for reporting the Provision for Uncollectible Pledges.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

A donor provides a large cash contribution that is to be used for acquisition of a new building. Under FASB standards, how would this contribution be reported by a not-for-profit organization on its statement of cash flows?

A) Operating activity.

B) Investing activity.

C) Financing activity.

D) Capital and related financing activity.

A) Operating activity.

B) Investing activity.

C) Financing activity.

D) Capital and related financing activity.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not one of the criteria specified in the FASB Codification for determining whether joint costs with a fund-raising appeal can be reported with program expenses rather than as fund-raising expenses?

A) Purpose.

B) Audience.

C) Time period.

D) Content.

A) Purpose.

B) Audience.

C) Time period.

D) Content.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

When a nongovernmental not-for-profit organization spends money for the purpose for which an external donor intended, the expense is reported as a:

A) Decrease in net assets with donor restrictions.

B) Decrease in net assets without donor restrictions.

C) Decrease in current-restricted fund balance.

D) Decrease in committed fund balance.

A) Decrease in net assets with donor restrictions.

B) Decrease in net assets without donor restrictions.

C) Decrease in current-restricted fund balance.

D) Decrease in committed fund balance.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

Would a not-for-profit library that receives the majority of its resources from a specific tax levy on local citizens remitted to the city follow the same financial reporting principles as would a library that operates without a dedicated tax and instead relies on contributions from individuals and grants from foundations and governments? Explain.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

62

Explain the purpose of FASB ASC 958-720-45 on joint-cost accounting as it relates to reporting fund-raising and program expenses of a not-for-profit organization. How is this standard applied?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

How does the FASB require not-for-profit organizations to report expenses?

A) Natural classification, such as salaries, rent, and supplies.

B) Functional classification, such as program and support.

C) Management has the option of reporting using natural classification or functional classification.

D) Both natural classification and functional classification must be reported.

A) Natural classification, such as salaries, rent, and supplies.

B) Functional classification, such as program and support.

C) Management has the option of reporting using natural classification or functional classification.

D) Both natural classification and functional classification must be reported.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

A local CPA volunteered his time to prepare the Form 990 for an after-school development organization that serves disadvantaged children. If the services had not been donated the organization would have had to hire a CPA to prepare the return. In accordance with the FASB Codification, the value of the CPA's time devoted to helping the organization should be recorded as:

A) Contribution-With Donor Restrictions.

B) Support Expense.

C) Machinery & Equipment.

D) It would not be recorded.

A) Contribution-With Donor Restrictions.

B) Support Expense.

C) Machinery & Equipment.

D) It would not be recorded.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

Record the journal entry that would be made by a nongovernmental, not-for-profit organization involved in medical research. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

1. The entity received $1,500 in cash contributions. Of that amount, $1,000 is to be used for medical research.

2. The entity received pledges of $700,000 for its endowment fund. All pledges will be collected next year.

3. The entity received donated services of $1,200 from medical researchers who helped with the entity's on-going drug development research. It also received $300 in donated services from students, who helped clean the research facilities.

4. The entity paid medical research operating expenses of $5,000 that were related to restricted net assets it had received in prior years.

1. The entity received $1,500 in cash contributions. Of that amount, $1,000 is to be used for medical research.

2. The entity received pledges of $700,000 for its endowment fund. All pledges will be collected next year.

3. The entity received donated services of $1,200 from medical researchers who helped with the entity's on-going drug development research. It also received $300 in donated services from students, who helped clean the research facilities.

4. The entity paid medical research operating expenses of $5,000 that were related to restricted net assets it had received in prior years.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

66

For financial reasons, two not-for-profit hospice organizations (hospices A and B) decided to combine. As a result of the combination, the assets and liabilities of the combined hospice were reported at the amounts that had been previously reported by A and B on their financial statements. Under the FASB, the combining of hospices A and B would be classified as which of the following?

A) Merger.

B) Consolidation.

C) Acquisition.

D) Component unit.

A) Merger.

B) Consolidation.

C) Acquisition.

D) Component unit.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

The mission of the not-for-profit organization, Save Our Butterflies Foundation, is to provide research and education concerning the conservation of butterflies. Which of the following expenses would be reported as a support expense by the Foundation?

A) The costs of exhibiting at the local Nature Conservancy annual fair held for the general public.

B) The costs of depreciation on it butterfly facility.

C) The cost of printed materials distributed to the local elementary schools on how to start butterfly gardens.

D) The cost of printing and distributing its annual report.

A) The costs of exhibiting at the local Nature Conservancy annual fair held for the general public.

B) The costs of depreciation on it butterfly facility.

C) The cost of printed materials distributed to the local elementary schools on how to start butterfly gardens.

D) The cost of printing and distributing its annual report.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

For each of the following definitions, indicate the key term from the list that best matches by placing the appropriate terms.

A. Nonexchange transactions

B. Net assets with donor restrictions

C. Collections

D. Variance power

E. Exchange transactions

F. Board-designated net assets

G. Endowment

H. Promise to give

________ 1. Unrestricted net assets that the governing body decides to set aside for specific purposes

________ 2. The unilateral power of an organization to redirect donated assets to a different beneficiary than initially indicated by the donor

________ 3. Net assets for which the donor has indicated use in a future period or for a particular purpose

________ 4. Transactions in which the donor derives no direct tangible benefits

________ 5. Works or art, historical treasures, or similar assets held and protected for public exhibition, and, if sold, proceeds would be used to acquire similar assets

A. Nonexchange transactions

B. Net assets with donor restrictions

C. Collections

D. Variance power

E. Exchange transactions

F. Board-designated net assets

G. Endowment

H. Promise to give

________ 1. Unrestricted net assets that the governing body decides to set aside for specific purposes

________ 2. The unilateral power of an organization to redirect donated assets to a different beneficiary than initially indicated by the donor

________ 3. Net assets for which the donor has indicated use in a future period or for a particular purpose

________ 4. Transactions in which the donor derives no direct tangible benefits

________ 5. Works or art, historical treasures, or similar assets held and protected for public exhibition, and, if sold, proceeds would be used to acquire similar assets

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

Explain the accounting for contributions received by a financial intermediary under the FASB Codification.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

The board of directors for a nongovernmental not-for-profit organization decided to designate $20,000 each year for the next three years to fund a special research project it was planning to conduct at the end of the three-year period. How would these board-designated resources be reported on the statement of financial position?

A) Net assets with donor restrictions.

B) Net assets without donor restrictions.

C) Internal payable.

D) The resources would not be reported on the statement of financial position.

A) Net assets with donor restrictions.

B) Net assets without donor restrictions.

C) Internal payable.

D) The resources would not be reported on the statement of financial position.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

During the year a donor pledged $1,000,000 in funds to a not-for-profit private charter school. The school will receive the pledge if it is able to raise $500,000 in funds over the next year. According to the FASB, how would this pledge be recorded?

A) Contribution-With Donor Restrictions.

B) Contribution-Without Donor Restrictions.

C) Deferred Revenue.

D) It would not be recorded.

A) Contribution-With Donor Restrictions.

B) Contribution-Without Donor Restrictions.

C) Deferred Revenue.

D) It would not be recorded.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

72

Distinguish not-for-profit organizations from entities in the government and commercial sectors of the U.S. economy.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

In accordance with the FASB Codification, which of the following would not be classified as a support expense by the not-for-profit organization Save Our Lakes?

A) The cost of printing and distributing the annual report.

B) The cost of a mailing to past contributors requesting donations for lakeshore cleanup.

C) The cost of the annual lakeshore cleanup activities.

D) The cost to have an attorney review the organization's by-laws.

A) The cost of printing and distributing the annual report.

B) The cost of a mailing to past contributors requesting donations for lakeshore cleanup.

C) The cost of the annual lakeshore cleanup activities.

D) The cost to have an attorney review the organization's by-laws.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

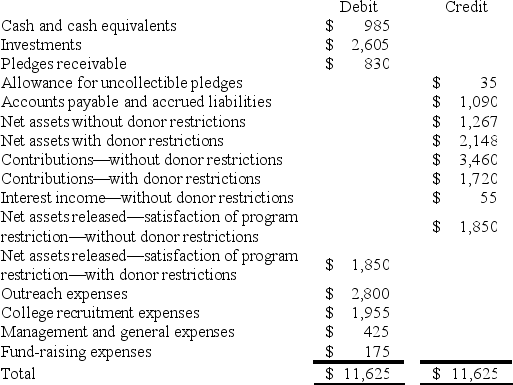

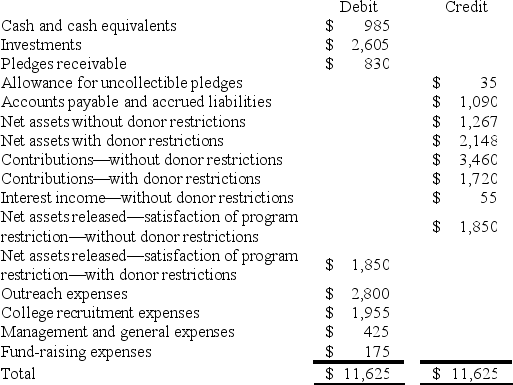

The not-for-profit organization Accountants Rule has a mission to promote the accounting profession in the local community. It is heavily supported by local accounting firms and businesses seeking to increase the number of individuals entering the profession. Following is the pre-closing trial balance for the organization.

Prepare a statement of activities for the organization for the year ended December 31, 2020. (Negative amounts should be indicated by a minus sign.)

Prepare a statement of activities for the organization for the year ended December 31, 2020. (Negative amounts should be indicated by a minus sign.)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

If the program services expenses category includes both directly related costs and indirect costs allocated to it, why is it necessary to have a separate category of "supporting services expenses"?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

76

Distinguish between "support" and "revenues from exchange transactions."

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

77

Explain when donated materials should be recognized as a contribution and as an expense by a nongovernmental not-for-profit organization.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck