Deck 12: Monopolistic Competition and Oligopoly

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 12: Monopolistic Competition and Oligopoly

1

Monopolistically competitive firms have monopoly power because they:

A) face downward sloping demand curves.

B) are great in number.

C) have freedom of entry.

D) are free to advertise.

A) face downward sloping demand curves.

B) are great in number.

C) have freedom of entry.

D) are free to advertise.

face downward sloping demand curves.

2

Why don't some firms in monopolistic competition earn losses in the long run?

A) The firms have enough monopoly power to ensure they always earn profits.

B) Free entry allows enough firms to remain in the market and maintain the critical mass of firms required to attract customers.

C) Free exit implies that any unprofitable firms leave the market in the long run.

D) In the long run, firms will build enough brand loyalty among customers to ensure a profitable level of sales.

A) The firms have enough monopoly power to ensure they always earn profits.

B) Free entry allows enough firms to remain in the market and maintain the critical mass of firms required to attract customers.

C) Free exit implies that any unprofitable firms leave the market in the long run.

D) In the long run, firms will build enough brand loyalty among customers to ensure a profitable level of sales.

Free exit implies that any unprofitable firms leave the market in the long run.

3

The authors cited statistical evidence that the price elasticity of demand for Royal Crown cola is -2.4, and the price elasticity of demand for Coke is roughly -5.5. Which firm likely has stronger brand loyalty among customers that provides greater potential for monopoly power in the cola market?

A) Coke

B) Royal Crown

C) Both firms should have identical monopoly power

D) We do not have enough information to answer this question.

A) Coke

B) Royal Crown

C) Both firms should have identical monopoly power

D) We do not have enough information to answer this question.

Royal Crown

4

Which of the following is true of the output level produced by a firm in long-run equilibrium in a monopolistically competitive industry?

A) It produces at minimum average cost.

B) It does not produce at minimum average cost, and average cost is increasing.

C) It does not produce at minimum average cost, and average cost is decreasing.

D) Either B or C could be true.

A) It produces at minimum average cost.

B) It does not produce at minimum average cost, and average cost is increasing.

C) It does not produce at minimum average cost, and average cost is decreasing.

D) Either B or C could be true.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

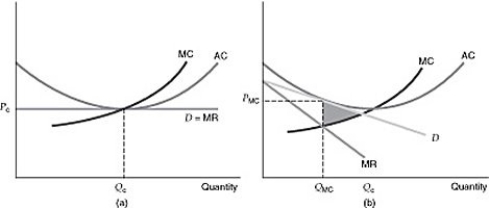

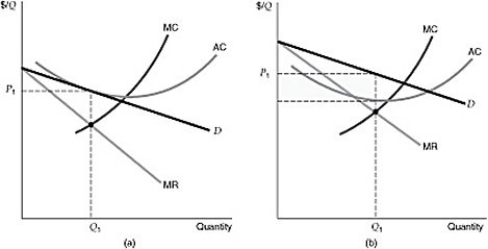

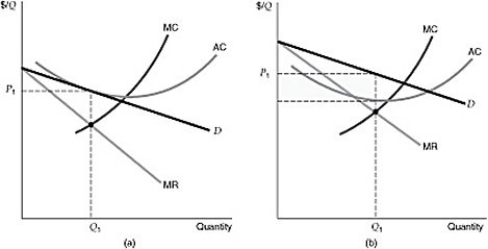

Figure 12.1.2

Figure 12.1.2Which of the following is true for both perfect and monopolistic competition?

A) Firms produce a differentiated product.

B) Firms face a downward sloping demand curve.

C) Firms produce a homogeneous product.

D) There is freedom of entry and exit in the long run.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

Excess capacity in monopolistically competitive industries results because in equilibrium:

A) each firm's output level is too great to minimize average cost.

B) each firm's output level is too small to minimize average cost.

C) firms make positive economic profit.

D) price equals marginal cost.

A) each firm's output level is too great to minimize average cost.

B) each firm's output level is too small to minimize average cost.

C) firms make positive economic profit.

D) price equals marginal cost.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

For which of the following market structures is it assumed that there are barriers to entry?

A) Perfect competition

B) Monopolistic competition

C) Monopoly

D) all of the above

E) B and C only

A) Perfect competition

B) Monopolistic competition

C) Monopoly

D) all of the above

E) B and C only

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

A market with few entry barriers and with many firms that sell differentiated products is:

A) purely competitive.

B) a monopoly.

C) monopolistically competitive.

D) oligopolistic.

A) purely competitive.

B) a monopoly.

C) monopolistically competitive.

D) oligopolistic.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

Figure 12.1.2

Figure 12.1.2Which of the following is true in long-run equilibrium for a firm in monopolistic competition?

A) MC = ATC.

B) MC > ATC.

C) MC < ATC.

D) Any of the above may be true.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

The most important factor in determining the long-run profit potential in monopolistic competition is:

A) free entry and exit.

B) the elasticity of the market demand curve.

C) the elasticity of the firm's demand curve.

D) the reaction of rival firms to a change in price.

A) free entry and exit.

B) the elasticity of the market demand curve.

C) the elasticity of the firm's demand curve.

D) the reaction of rival firms to a change in price.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

What happens to an incumbent firm's demand curve in monopolistic competition as new firms enter?

A) It shifts right.

B) It shifts left.

C) It becomes horizontal.

D) New entrants will not affect an incumbent firm's demand curve.

A) It shifts right.

B) It shifts left.

C) It becomes horizontal.

D) New entrants will not affect an incumbent firm's demand curve.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

Figure 12.1.2

Figure 12.1.2Refer to Figure 12.1.2 above. Which of the following best describes the reason for the shaded triangle in panel (b)?

A) The triangle shows the benefits of advertising and product differentiation, which do not exist in perfect competition.

B) The triangle describes the improvement in efficiency in monopolistic competition.

C) The triangle describes the deadweight loss associated with market power in monopolistic competition.

D) The gains in allocative efficiency under monopolistic competition, compared to a perfectly competitive market.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following two statements about monopolistic competition to answer this question. I. In the long run, the price of the good will equal the minimum of the average cost.

II) In the short run, firms may earn a profit.

A) I and II are true.

B) I is true, and II is false.

C) I is false, and II is true.

D) I and II are false.

II) In the short run, firms may earn a profit.

A) I and II are true.

B) I is true, and II is false.

C) I is false, and II is true.

D) I and II are false.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

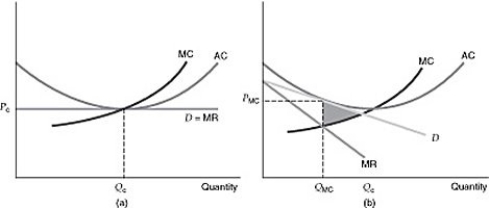

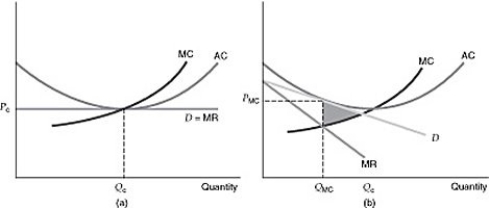

Figure 12.1.1

Figure 12.1.1Refer to Figure 12.1.1 above. Which of the figures describes the long run equilibrium in a monopolistically competitive market?

A) The figure in panel (a).

B) The figure in panel (b).

C) Both figures.

D) Neither figure.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

Although firms earn zero profits in the long run, why is the outcome from monopolistic competition considered to be inefficient?

A) Price exceeds marginal cost.

B) Quantity is lower than the perfectly competitive outcome.

C) Goods are not identical.

D) A and B are correct.

E) B and C are correct.

A) Price exceeds marginal cost.

B) Quantity is lower than the perfectly competitive outcome.

C) Goods are not identical.

D) A and B are correct.

E) B and C are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is NOT regarded as a source of inefficiency in monopolistic competition?

A) The fact that price exceeds marginal cost

B) Excess capacity

C) Product diversity

D) The fact that long-run average cost is not minimized

E) all of the above

A) The fact that price exceeds marginal cost

B) Excess capacity

C) Product diversity

D) The fact that long-run average cost is not minimized

E) all of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Figure 12.1.1

Figure 12.1.1A monopolistically competitive firm in long-run equilibrium:

A) will make negative profit.

B) will make zero profit.

C) will make positive profit.

D) Any of the above are possible.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

Figure 12.1.1

Figure 12.1.1A monopolistically competitive firm in short-run equilibrium:

A) will make negative profit (lose money).

B) will make zero profit (break-even).

C) will make positive profit.

D) Any of the above are possible.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is true in long-run equilibrium for a firm in a monopolistic competitive industry?

A) The demand curve is tangent to marginal cost curve.

B) The demand curve is tangent to average cost curve.

C) The marginal cost curve is tangent to average cost curve.

D) The demand curve is tangent to marginal revenue curve.

A) The demand curve is tangent to marginal cost curve.

B) The demand curve is tangent to average cost curve.

C) The marginal cost curve is tangent to average cost curve.

D) The demand curve is tangent to marginal revenue curve.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

Figure 12.1.2

Figure 12.1.2Which of the following is true for both perfectly competitive and monopolistically competitive firms in the long run?

A) P = MC.

B) MC = ATC.

C) P > MR.

D) Profit equals zero.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

Scenario 12.1:

Suppose mountain spring water can be produced at no cost and that the demand and marginal revenue curves for mountain spring water are given as follows:

Q = 6000 - 5P MR = 1200 - 0.4Q

Refer to Scenario 12.1. What will be the price in the long run if the industry is a Cournot duopoly?

A) $400

B) $600

C) $800

D) $900

E) Competition will drive the price to zero.

Suppose mountain spring water can be produced at no cost and that the demand and marginal revenue curves for mountain spring water are given as follows:

Q = 6000 - 5P MR = 1200 - 0.4Q

Refer to Scenario 12.1. What will be the price in the long run if the industry is a Cournot duopoly?

A) $400

B) $600

C) $800

D) $900

E) Competition will drive the price to zero.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

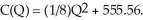

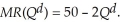

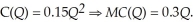

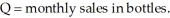

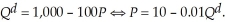

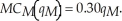

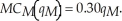

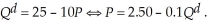

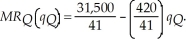

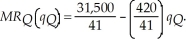

The market structure of Red Raider Gear is best characterized by monopolistic competition. Red Raider Gear is one of the producers in this market. The demand for Red Raider Gear is:  The resulting marginal revenue curve is

The resulting marginal revenue curve is  The Red Raider Gear cost function is

The Red Raider Gear cost function is  Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

The resulting marginal revenue curve is

The resulting marginal revenue curve is  The Red Raider Gear cost function is

The Red Raider Gear cost function is  Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

The market structure in which strategic considerations are most important is:

A) monopolistic competition.

B) oligopoly.

C) pure competition.

D) pure monopoly.

A) monopolistic competition.

B) oligopoly.

C) pure competition.

D) pure monopoly.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

The market structure of the local boat industry is best characterized by monopolistic competition. Homer's Boat Manufacturing is one of the producers in the local market. The demand for Homer's Boats is:  = 5000 - P ⇔ P = 5000 -

= 5000 - P ⇔ P = 5000 -  .

.

The resulting marginal revenue curve is

MR( ) = 5000 - 2

) = 5000 - 2  .

.

Homer's cost function is:

C(Q) = 3 ⇒ MC(Q) = 6Q.

⇒ MC(Q) = 6Q.

Determine Homer's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

= 5000 - P ⇔ P = 5000 -

= 5000 - P ⇔ P = 5000 -  .

.The resulting marginal revenue curve is

MR(

) = 5000 - 2

) = 5000 - 2  .

.Homer's cost function is:

C(Q) = 3

⇒ MC(Q) = 6Q.

⇒ MC(Q) = 6Q.Determine Homer's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

What condition may provide for a relatively small degree of inefficiency under monopolistic competition?

A) There is a single seller and no product differentiation.

B) The marginal cost of production is less than the market price.

C) The demand curve is relatively elastic so that the price is near the long-run minimum average cost.

D) There is only one buyer in the market.

A) There is a single seller and no product differentiation.

B) The marginal cost of production is less than the market price.

C) The demand curve is relatively elastic so that the price is near the long-run minimum average cost.

D) There is only one buyer in the market.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

The market structure in which there is interdependence among firms is:

A) monopolistic competition.

B) oligopoly.

C) perfect competition.

D) monopoly.

A) monopolistic competition.

B) oligopoly.

C) perfect competition.

D) monopoly.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

What characteristic of monopolistic competition may help to offset the inefficiency of this market structure?

A) Free entry and exit imply that firms produce at minimum long-run average cost.

B) Consumers may value the product diversity that allows them to choose from a wide variety of differentiated products.

C) Consumers may feel better about the inefficiency if they know that firms earn zero profits.

D) Consumers may prefer this outcome to monopoly or monopsony.

A) Free entry and exit imply that firms produce at minimum long-run average cost.

B) Consumers may value the product diversity that allows them to choose from a wide variety of differentiated products.

C) Consumers may feel better about the inefficiency if they know that firms earn zero profits.

D) Consumers may prefer this outcome to monopoly or monopsony.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following can be thought of as a barrier to entry?

A) scale economies.

B) patents.

C) strategic actions by incumbent firms.

D) all of the above

A) scale economies.

B) patents.

C) strategic actions by incumbent firms.

D) all of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

In the ________, each firm treats the output of its competitor as fixed and then decides how much to produce.

A) Cournot model

B) model of monopolistic competition

C) Stackelberg model

D) kinked-demand model

E) none of the above

A) Cournot model

B) model of monopolistic competition

C) Stackelberg model

D) kinked-demand model

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

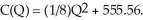

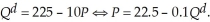

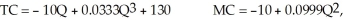

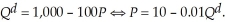

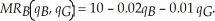

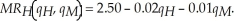

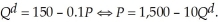

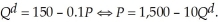

The market structure of the local pizza industry is best characterized by monopolistic competition. One Guy's Pizza is one of the producers in the local market. The demand for One Guy's Pizza is:  The resulting marginal revenue curve is

The resulting marginal revenue curve is  One Guy's cost function is:

One Guy's cost function is:  Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

The resulting marginal revenue curve is

The resulting marginal revenue curve is  One Guy's cost function is:

One Guy's cost function is:  Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

In the Cournot duopoly model, each firm assumes that:

A) rivals will match price cuts but will not match price increases.

B) rivals will match all reasonable price changes.

C) the price of its rival is fixed.

D) the output level of its rival is fixed.

A) rivals will match price cuts but will not match price increases.

B) rivals will match all reasonable price changes.

C) the price of its rival is fixed.

D) the output level of its rival is fixed.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

A ________ shows how much a firm will produce as a function of how much it thinks its competitors will produce.

A) contract curve

B) demand curve

C) reaction curve

D) Nash equilibrium curve

E) none of the above

A) contract curve

B) demand curve

C) reaction curve

D) Nash equilibrium curve

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

A situation in which each firm selects its best action, given what its rivals are doing, is called a:

A) Nash equilibrium.

B) Cooperative equilibrium.

C) Stackelberg equilibrium.

D) zero sum game.

A) Nash equilibrium.

B) Cooperative equilibrium.

C) Stackelberg equilibrium.

D) zero sum game.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

Scenario 12.1:

Suppose mountain spring water can be produced at no cost and that the demand and marginal revenue curves for mountain spring water are given as follows:

Q = 6000 - 5P MR = 1200 - 0.4Q

Refer to Scenario 12.1. What is the profit maximizing price of a monopolist?

A) $400

B) $600

C) $800

D) $900

E) none of the above

Suppose mountain spring water can be produced at no cost and that the demand and marginal revenue curves for mountain spring water are given as follows:

Q = 6000 - 5P MR = 1200 - 0.4Q

Refer to Scenario 12.1. What is the profit maximizing price of a monopolist?

A) $400

B) $600

C) $800

D) $900

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

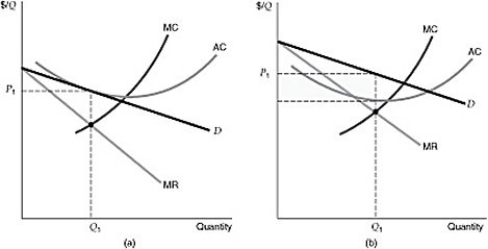

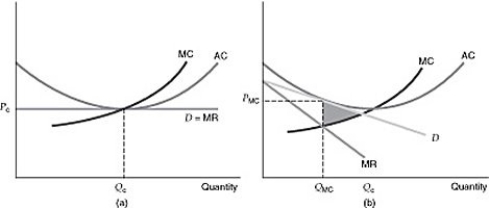

Figure 12.2.1

Figure 12.2.1In comparing the Cournot equilibrium with the competitive equilibrium,

A) both profit and output level are higher in Cournot.

B) both profit and output level are higher in the competitive equilibrium.

C) profit is higher, and output level is lower in the competitive equilibrium.

D) profit is higher, and output level is lower in Cournot.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following markets is most likely to be oligopolistic?

A) The market for corn

B) The market for aluminum

C) The market for colas

D) The market for ground coffees

A) The market for corn

B) The market for aluminum

C) The market for colas

D) The market for ground coffees

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

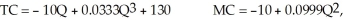

A firm operating in a monopolistically competitive market faces demand and marginal revenue curves as given below:

P = 10 - 0.1Q MR = 10 - 0.2Q

The firm's total and marginal cost curves are: where P is in dollars per unit, output rate Q is in units per time period, and total cost C is in dollars.

where P is in dollars per unit, output rate Q is in units per time period, and total cost C is in dollars.

a. Determine the price and output rate that will allow the firm to maximize profit or minimize losses.

b. Compute a Lerner index.

P = 10 - 0.1Q MR = 10 - 0.2Q

The firm's total and marginal cost curves are:

where P is in dollars per unit, output rate Q is in units per time period, and total cost C is in dollars.

where P is in dollars per unit, output rate Q is in units per time period, and total cost C is in dollars.a. Determine the price and output rate that will allow the firm to maximize profit or minimize losses.

b. Compute a Lerner index.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Figure 12.2.1

Figure 12.2.1Refer to Figure 12.2.1 above. The points A, B and C in the figure correspond, in that order, to:

A) competitive, collusion, and Cournot equilibrium.

B) competitive, Cournot, and collusion equilibrium.

C) collusion, Cournot, and competitive equilibrium.

D) Cournot, collusion, and competitive equilibrium.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

The market structure of home video gaming systems is best characterized by monopolistic competition. Quasar Entertainment is one of the producers in this market. The inverse demand for Quasar systems is:

P = 500 - 9.75Qd

The resulting marginal revenue curve is

MR( ) = 500 - 19.5

) = 500 - 19.5  .

.

Quasar's cost function is:

C(Q) = 0.25 + 6,250 ⇒ MC(Q) = 0.5Q.

+ 6,250 ⇒ MC(Q) = 0.5Q.

Determine Quasar's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

P = 500 - 9.75Qd

The resulting marginal revenue curve is

MR(

) = 500 - 19.5

) = 500 - 19.5  .

.Quasar's cost function is:

C(Q) = 0.25

+ 6,250 ⇒ MC(Q) = 0.5Q.

+ 6,250 ⇒ MC(Q) = 0.5Q.Determine Quasar's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

The Cournot equilibrium can be found by treating ________ as a pair of simultaneous equations and by finding the combination of Q1 and Q2 that satisfy both equations.

A) the reaction curves for firms 1 and 2

B) the market supply curve and the market demand curve

C) the contract curve and the market demand curve

D) the contract curve and the market supply curve

E) the firm's supply curve and the firm's demand curve

A) the reaction curves for firms 1 and 2

B) the market supply curve and the market demand curve

C) the contract curve and the market demand curve

D) the contract curve and the market supply curve

E) the firm's supply curve and the firm's demand curve

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

Lambert-Rogers Company is a manufacturer of petrochemical products. The firm's research efforts have resulted in the development of a new auto fuel injector cleaner that is considerably more effective than other products on the market. Another firm, G.H. Squires Company, independently developed a very similar product that is as effective as the Lambert-Rogers formula. To avoid a lengthy court battle over conflicting patent claims, the two firms have decided to cross-license each other's patents and proceed with production. It is unlikely that other petrochemical companies will be able to duplicate the product, making the market a duopoly for the foreseeable future. Lambert-Rogers estimates the demand curve given below for the new cleaner. Marginal cost is estimated to be a constant $2 per bottle.

Q = 300,000 - 25,000P.

where P = dollars per bottle and a. Lambert-Rogers and G.H. Squires have very similar operating strategies. Consequently, the management of Lambert-Rogers believes that the Cournot model is appropriate for analyzing the market, provided that both firms enter at the same time. Calculate Lambert-Rogers's profit-maximizing output and price according to this model.

a. Lambert-Rogers and G.H. Squires have very similar operating strategies. Consequently, the management of Lambert-Rogers believes that the Cournot model is appropriate for analyzing the market, provided that both firms enter at the same time. Calculate Lambert-Rogers's profit-maximizing output and price according to this model.

b. Lambert-Rogers's productive capacity and technical expertise could allow them to enter the market several months before Squires's. Choose an appropriate model and analyze the impact of Lambert Rogers being first into the market. Should Lambert-Rogers hurry to enter first?

Q = 300,000 - 25,000P.

where P = dollars per bottle and

a. Lambert-Rogers and G.H. Squires have very similar operating strategies. Consequently, the management of Lambert-Rogers believes that the Cournot model is appropriate for analyzing the market, provided that both firms enter at the same time. Calculate Lambert-Rogers's profit-maximizing output and price according to this model.

a. Lambert-Rogers and G.H. Squires have very similar operating strategies. Consequently, the management of Lambert-Rogers believes that the Cournot model is appropriate for analyzing the market, provided that both firms enter at the same time. Calculate Lambert-Rogers's profit-maximizing output and price according to this model.b. Lambert-Rogers's productive capacity and technical expertise could allow them to enter the market several months before Squires's. Choose an appropriate model and analyze the impact of Lambert Rogers being first into the market. Should Lambert-Rogers hurry to enter first?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Two large diversified consumer products firms are about to enter the market for a new pain reliever. The two firms are very similar in terms of their costs, strategic approach, and market outlook. Moreover, the firms have very similar individual demand curves so that each firm expects to sell one-half of the total market output at any given price. The market demand curve for the pain reliever is given as:

Q = 2600 - 400P.

Both firms have constant long-run average costs of $2.00 per bottle. Patent protection insures that the two firms will operate as a duopoly for the foreseeable future. Price and quantity values are stated in per-bottle terms. If the firms act as Cournot duopolists, solve for the firm and market outputs and equilibrium prices.

Q = 2600 - 400P.

Both firms have constant long-run average costs of $2.00 per bottle. Patent protection insures that the two firms will operate as a duopoly for the foreseeable future. Price and quantity values are stated in per-bottle terms. If the firms act as Cournot duopolists, solve for the firm and market outputs and equilibrium prices.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

In the Stackelberg model, there is an advantage:

A) to waiting until your competitor has committed herself to a particular output level before deciding on your output level.

B) to being the first competitor to commit to an output level.

C) to the firm with a dominant strategy.

D) to producing an output level which is identical to a monopolist's output level.

A) to waiting until your competitor has committed herself to a particular output level before deciding on your output level.

B) to being the first competitor to commit to an output level.

C) to the firm with a dominant strategy.

D) to producing an output level which is identical to a monopolist's output level.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

In a Cournot duopoly, we find that Firm 1's reaction function is Q1 = 50 - 0.5Q2, and Firm 2's reaction function is Q2 = 75 - 0.75Q1. What is the Cournot equilibrium outcome in this market?

A) Q1 = 20 and Q2 = 60

B) Q1 = 20 and Q2 = 20

C) Q1 = 60 and Q2 = 60

D) Q1 = 60 and Q2 = 20

A) Q1 = 20 and Q2 = 60

B) Q1 = 20 and Q2 = 20

C) Q1 = 60 and Q2 = 60

D) Q1 = 60 and Q2 = 20

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

Under a Cournot duopoly, the collusion curve represents:

A) all possible allocations of the pure monopoly quantity among the two firms in the duopoly.

B) all possible allocations of the pure monopoly quantity that would be possible if the two firms in the duopoly did not cooperate.

C) all optimal price-quantity outcomes for a cartel rather than a Cournot duopoly.

D) the potential profits to be earned by firms in a collusive cartel.

A) all possible allocations of the pure monopoly quantity among the two firms in the duopoly.

B) all possible allocations of the pure monopoly quantity that would be possible if the two firms in the duopoly did not cooperate.

C) all optimal price-quantity outcomes for a cartel rather than a Cournot duopoly.

D) the potential profits to be earned by firms in a collusive cartel.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Cournot duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Cournot duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

For a market with a linear demand curve and constant marginal cost of production, why are the reaction functions for the Cournot duopoly sellers also straight lines?

A) The reaction functions do not have to be straight lines, and they are only drawn this way in the book to keep the figures simple.

B) Cournot thought the lines would be straight, but this was proven wrong by other economists.

C) Marginal revenue is always linear when marginal costs are constant.

D) We know that the marginal revenue curves for linear demand curves are also straight lines.

A) The reaction functions do not have to be straight lines, and they are only drawn this way in the book to keep the figures simple.

B) Cournot thought the lines would be straight, but this was proven wrong by other economists.

C) Marginal revenue is always linear when marginal costs are constant.

D) We know that the marginal revenue curves for linear demand curves are also straight lines.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

Consider two identical firms (no. 1 and no. 2) that face a linear market demand curve. Each firm has a marginal cost of zero and the two firms together face demand:

P = 50 - 0.5Q, where Q = Q1 + Q2.

a. Find the Cournot equilibrium Q and P for each firm.

b. Find the equilibrium Q and P for each firm assuming that the firms collude and share the profit equally.

c. Contrast the efficiencies of the markets in (a) and (b) above.

P = 50 - 0.5Q, where Q = Q1 + Q2.

a. Find the Cournot equilibrium Q and P for each firm.

b. Find the equilibrium Q and P for each firm assuming that the firms collude and share the profit equally.

c. Contrast the efficiencies of the markets in (a) and (b) above.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

In the Stackelberg model, suppose the first-mover has MR = 15 - Q1, the second firm has reaction function Q2 = 15 - Q1/2, and production occurs at zero marginal cost. Why doesn't the first-mover announce that its production is Q1 = 30 in order to exclude the second firm from the market (i.e., Q2 = 0 in this case)?

A) In this case, MR is negative and is less than MC, so the first-mover would be producing less than the optimal quantity.

B) In this case, MR is negative and is less than MC, so the first-mover would be producing too much output.

C) This is a possible outcome from the Stackelberg duopoly under these conditions.

D) We do not have enough information to determine if this is an optimal outcome for this case.

A) In this case, MR is negative and is less than MC, so the first-mover would be producing less than the optimal quantity.

B) In this case, MR is negative and is less than MC, so the first-mover would be producing too much output.

C) This is a possible outcome from the Stackelberg duopoly under these conditions.

D) We do not have enough information to determine if this is an optimal outcome for this case.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose the market demand curve is P = 40 - 2Q and the constant marginal cost of production is MC = 20. Which of the following is a valid expression for the collusion curve?

A) Q = 5

B) Q1 = 5 - Q2

C) Q1 = Q2 = 5

D) Q1 = 40 - Q2

A) Q = 5

B) Q1 = 5 - Q2

C) Q1 = Q2 = 5

D) Q1 = 40 - Q2

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

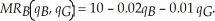

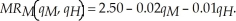

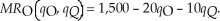

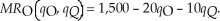

The Grand River Brick Corporation uses Business-to-Business internet technology to set output before Bernard's Bricks. This gives the Grand River Brick Corporation "first-move" ability. The market demand for bricks is:  Bernard Brick's marginal revenue curve is:

Bernard Brick's marginal revenue curve is:  The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:

The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:  Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Bernard Brick's marginal revenue curve is:

Bernard Brick's marginal revenue curve is:  The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:

The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:  Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose that the market demand for mountain spring water is given as follows:

P = 1200 - Q

Mountain spring water can be produced at no cost.

a. What is the profit maximizing level of output and price of a monopolist?

b. What level of output would be produced by each firm in a Cournot duopoly

in the long run? What will the price be?

c. What will be the level of output and price in the long run if this industry were

perfectly competitive?

P = 1200 - Q

Mountain spring water can be produced at no cost.

a. What is the profit maximizing level of output and price of a monopolist?

b. What level of output would be produced by each firm in a Cournot duopoly

in the long run? What will the price be?

c. What will be the level of output and price in the long run if this industry were

perfectly competitive?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What is the monopoly price of this new drink?

A) 0

B) $3

C) $13.50

D) $16.50

E) $27

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What is the monopoly price of this new drink?

A) 0

B) $3

C) $13.50

D) $16.50

E) $27

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

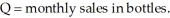

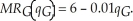

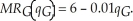

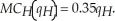

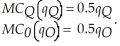

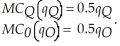

Hale's One Stop Gas and Auto Service competes with Murray's Gas and Service Mart. The local demand is given by:  Hale's marginal cost function is:

Hale's marginal cost function is:  Murray's marginal cost function is:

Murray's marginal cost function is:  Given the demand relationship above, Hale's marginal revenue function is:

Given the demand relationship above, Hale's marginal revenue function is:  Determine Hale's reaction function. Murray's marginal revenue function is:

Determine Hale's reaction function. Murray's marginal revenue function is:  Determine Murray's reaction function. What is the Cournot solution?

Determine Murray's reaction function. What is the Cournot solution?

Hale's marginal cost function is:

Hale's marginal cost function is:  Murray's marginal cost function is:

Murray's marginal cost function is:  Given the demand relationship above, Hale's marginal revenue function is:

Given the demand relationship above, Hale's marginal revenue function is:  Determine Hale's reaction function. Murray's marginal revenue function is:

Determine Hale's reaction function. Murray's marginal revenue function is:  Determine Murray's reaction function. What is the Cournot solution?

Determine Murray's reaction function. What is the Cournot solution?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

The oligopoly model that is most appropriate when one large firm usually takes the lead in setting price is the ________ model.

A) Cournot

B) Stackelberg

C) game theory

D) Prisoners' Dilemma

A) Cournot

B) Stackelberg

C) game theory

D) Prisoners' Dilemma

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What price would this new drink sell for if it sold in a competitive market?

A) 0

B) $3

C) $13.50

D) $16.50

E) $27

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What price would this new drink sell for if it sold in a competitive market?

A) 0

B) $3

C) $13.50

D) $16.50

E) $27

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

Bartels and Jaymes are two individuals who one day discover a stream that flows wine cooler instead of water. Bartels and Jaymes decide to bottle the wine cooler and sell it. The marginal cost of bottling wine cooler and the fixed cost to bottle wine cooler are both zero. The market demand for bottled wine cooler is given as:

P = 90 - 0.25Q

where Q is the total quantity of bottled wine cooler produced and P is the market price of bottled wine cooler.

a. What is the economically efficient price of bottled wine cooler?

b. What is the economically efficient quantity of bottled wine cooler produced?

c. If Bartels and Jaymes were to collude with one another and produce the profit-maximizing monopoly quantity of bottled wine cooler, how much bottled wine cooler will they produce?

d. Given the output level in (c), what price will Bartels and Jaymes charge for bottled wine cooler?

e. At the output level in (c), what is the welfare loss?

f. Suppose that Bartels and Jaymes act as Cournot duopolists, what are the reaction functions for Bartels and for Jaymes?

g. In the long run, what level of output will Bartels produce if Bartels and Jaymes act as Cournot duopolists?

h. In the long run, what will be the price of wine coolers be if Bartels and Jaymes act as Cournot duopolists?

i. Suppose that after Bartels and Jaymes have arrived at their long run equilibrium as Cournot duopolists, another individual, Paul Mason, discovers the streams. Paul Mason, who will sell no wine cooler before its time, decides to bottle wine coolers. There are now three Cournot firms producing at once. In the long run, what level of output will Bartels produce?

P = 90 - 0.25Q

where Q is the total quantity of bottled wine cooler produced and P is the market price of bottled wine cooler.

a. What is the economically efficient price of bottled wine cooler?

b. What is the economically efficient quantity of bottled wine cooler produced?

c. If Bartels and Jaymes were to collude with one another and produce the profit-maximizing monopoly quantity of bottled wine cooler, how much bottled wine cooler will they produce?

d. Given the output level in (c), what price will Bartels and Jaymes charge for bottled wine cooler?

e. At the output level in (c), what is the welfare loss?

f. Suppose that Bartels and Jaymes act as Cournot duopolists, what are the reaction functions for Bartels and for Jaymes?

g. In the long run, what level of output will Bartels produce if Bartels and Jaymes act as Cournot duopolists?

h. In the long run, what will be the price of wine coolers be if Bartels and Jaymes act as Cournot duopolists?

i. Suppose that after Bartels and Jaymes have arrived at their long run equilibrium as Cournot duopolists, another individual, Paul Mason, discovers the streams. Paul Mason, who will sell no wine cooler before its time, decides to bottle wine coolers. There are now three Cournot firms producing at once. In the long run, what level of output will Bartels produce?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Stackelberg duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Stackelberg duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is true in the Stackelberg model?

A) The first firm produces less than its rival.

B) The first firm produces more than its rival.

C) Both firms produce the same quantity.

D) Both firms have a reaction curve.

A) The first firm produces less than its rival.

B) The first firm produces more than its rival.

C) Both firms produce the same quantity.

D) Both firms have a reaction curve.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

What is one difference between the Cournot and Stackelberg models?

A) In Cournot, both firms make output decisions simultaneously, and in Stackelberg, one firm sets its output level first.

B) In Stackelberg, both firms make output decisions simultaneously, and in Cournot, one firm sets its output level first.

C) In Cournot, a firm has the opportunity to react to its rival.

D) Profits are zero in Cournot and positive in Stackelberg.

A) In Cournot, both firms make output decisions simultaneously, and in Stackelberg, one firm sets its output level first.

B) In Stackelberg, both firms make output decisions simultaneously, and in Cournot, one firm sets its output level first.

C) In Cournot, a firm has the opportunity to react to its rival.

D) Profits are zero in Cournot and positive in Stackelberg.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

Which oligopoly model(s) have the same results as the competitive model?

A) Cournot

B) Bertrand

C) Stackelberg

D) Both Cournot and Stackelberg

A) Cournot

B) Bertrand

C) Stackelberg

D) Both Cournot and Stackelberg

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

The Prisoners' Dilemma is a particular type of game in which negotiation and enforcement of binding contracts is not possible, and such games are known as:

A) cooperative games.

B) noncooperative games.

C) collusive games.

D) Cournot games.

A) cooperative games.

B) noncooperative games.

C) collusive games.

D) Cournot games.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

In the ________, one firm sets its output first, and then a second firm, after observing the first firm's output, makes its output decision.

A) Cournot model

B) model of monopolistic competition

C) Bertrand model

D) kinked-demand model

E) none of the above

A) Cournot model

B) model of monopolistic competition

C) Bertrand model

D) kinked-demand model

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

In the ________, two duopolists compete by simultaneously selecting price.

A) Cournot model

B) Nash model

C) Bertrand model

D) kinked-demand model

E) none of the above

A) Cournot model

B) Nash model

C) Bertrand model

D) kinked-demand model

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

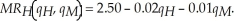

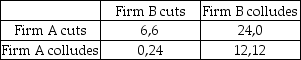

Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:  Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

A) Both firms cut prices.

B) A cuts and B colludes.

C) B cuts and A colludes.

D) Both firms collude.

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?A) Both firms cut prices.

B) A cuts and B colludes.

C) B cuts and A colludes.

D) Both firms collude.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

In which oligopoly model(s) do firms earn zero profit?

A) Cournot

B) Bertrand

C) Stackelberg

D) Oligopoly firms always earn positive economic profits.

A) Cournot

B) Bertrand

C) Stackelberg

D) Oligopoly firms always earn positive economic profits.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

In the Bertrand model with homogeneous products,

A) the firm that sets the lower price will capture all of the market.

B) the Nash equilibrium is the competitive outcome.

C) both firms set price equal to marginal cost.

D) all of the above

E) the outcome is inconclusive.

A) the firm that sets the lower price will capture all of the market.

B) the Nash equilibrium is the competitive outcome.

C) both firms set price equal to marginal cost.

D) all of the above

E) the outcome is inconclusive.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

Is there a first-mover advantage in the Bertrand duopoly model with homogenous products?

A) Yes, first-movers always hold the advantage over other firms.

B) Yes, first-movers may have an advantage, but it depends on the model assumptions.

C) No, first-movers cannot choose a profit maximizing quantity because the second-mover can always produce a bit less and earn higher profits.

D) No, the second-mover would be able to set a slightly lower price and capture the full market share.

A) Yes, first-movers always hold the advantage over other firms.

B) Yes, first-movers may have an advantage, but it depends on the model assumptions.

C) No, first-movers cannot choose a profit maximizing quantity because the second-mover can always produce a bit less and earn higher profits.

D) No, the second-mover would be able to set a slightly lower price and capture the full market share.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Bertrand duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the industry is a Bertrand duopoly?

A) $3

B) $9

C) $12

D) $13.50

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

Which one of the following statements is a common criticism of the original Bertrand duopoly model?

A) Firms never choose optimal prices as strategic variables.

B) Firms would more naturally choose quantities if goods are homogenous.

C) The assumption that market share is split evenly between the firms is unrealistic.

D) A and B are correct.

E) B and C are correct.

A) Firms never choose optimal prices as strategic variables.

B) Firms would more naturally choose quantities if goods are homogenous.

C) The assumption that market share is split evenly between the firms is unrealistic.

D) A and B are correct.

E) B and C are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

Which statement most nearly describes a Nash equilibrium applied to price competition?

A) Two firms cooperate and set the price that maximizes joint profits.

B) Each firm automatically moves to the purely competitive equilibrium because it knows the other firm will eventually move to that price anyway.

C) Given the prices chosen by its competitors, no firm has an incentive to change their prices from the equilibrium level.

D) One dominant firm sets the price, and the other firms take that price as if it were given by the market.

A) Two firms cooperate and set the price that maximizes joint profits.

B) Each firm automatically moves to the purely competitive equilibrium because it knows the other firm will eventually move to that price anyway.

C) Given the prices chosen by its competitors, no firm has an incentive to change their prices from the equilibrium level.

D) One dominant firm sets the price, and the other firms take that price as if it were given by the market.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose the market demand curve for a Bertrand duopoly is downward sloping. What happens to the Nash equilibrium price and market quantity if the constant marginal cost declines?

A) Price and quantity decline.

B) Price increases and quantity declines.

C) Price decreases and quantity increases.

D) Price and quantity increase.

A) Price and quantity decline.

B) Price increases and quantity declines.

C) Price decreases and quantity increases.

D) Price and quantity increase.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

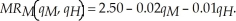

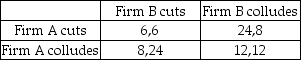

Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:  Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

A) Both firms cut prices.

B) Both firms collude.

C) There are two Nash equilibria: A cuts and B colludes, and A colludes and B cuts.

D) There are no Nash equilibria in this game.

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?

Here, the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut). The payoffs are stated in terms of millions of dollars of profits earned per year. What is the Nash equilibrium for this game?A) Both firms cut prices.

B) Both firms collude.

C) There are two Nash equilibria: A cuts and B colludes, and A colludes and B cuts.

D) There are no Nash equilibria in this game.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

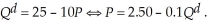

74

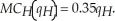

Hale's One Stop and Auto Service competes with Murray's Gas Mart. The local demand is:  Both firms sell exactly the same quality of gasoline. Thus, if the firms charge a different price, the lower price firm will capture the entire market share. If the firms charge the same price, they will split the market share. The marginal cost functions are both constant at $1.25. If the firms compete by setting price, what is the market output level? What is the market price level?

Both firms sell exactly the same quality of gasoline. Thus, if the firms charge a different price, the lower price firm will capture the entire market share. If the firms charge the same price, they will split the market share. The marginal cost functions are both constant at $1.25. If the firms compete by setting price, what is the market output level? What is the market price level?

Both firms sell exactly the same quality of gasoline. Thus, if the firms charge a different price, the lower price firm will capture the entire market share. If the firms charge the same price, they will split the market share. The marginal cost functions are both constant at $1.25. If the firms compete by setting price, what is the market output level? What is the market price level?

Both firms sell exactly the same quality of gasoline. Thus, if the firms charge a different price, the lower price firm will capture the entire market share. If the firms charge the same price, they will split the market share. The marginal cost functions are both constant at $1.25. If the firms compete by setting price, what is the market output level? What is the market price level?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

Quasar Corporation is set to release its latest video game system which utilizes the newest game technology. In fact, the release date is sooner than that of its only rival Orion. This gives Quasar Corporation "first-move" ability. The demand for video game systems is:  Orion's marginal revenue curve is:

Orion's marginal revenue curve is:  The marginal cost functions are:

The marginal cost functions are:  Determine Orion's reaction function. Given that Quasar Corporation has this information and moves first, Quasar's marginal revenue function is:

Determine Orion's reaction function. Given that Quasar Corporation has this information and moves first, Quasar's marginal revenue function is:  Calculate Quasar Corporation's optimal output level. Does the "first-move" ability of Quasar Corporation allow it to capture a larger market share?

Calculate Quasar Corporation's optimal output level. Does the "first-move" ability of Quasar Corporation allow it to capture a larger market share?

Orion's marginal revenue curve is:

Orion's marginal revenue curve is:  The marginal cost functions are:

The marginal cost functions are:  Determine Orion's reaction function. Given that Quasar Corporation has this information and moves first, Quasar's marginal revenue function is:

Determine Orion's reaction function. Given that Quasar Corporation has this information and moves first, Quasar's marginal revenue function is:  Calculate Quasar Corporation's optimal output level. Does the "first-move" ability of Quasar Corporation allow it to capture a larger market share?

Calculate Quasar Corporation's optimal output level. Does the "first-move" ability of Quasar Corporation allow it to capture a larger market share?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

Suppose two firms with differentiated products are competing on price. The reaction curve for Firm 1 is P1 = 4 + 0.5 P2, and the reaction curve for Firm 2 is P2 = 4 + 0.5P1. What is the equilibrium price outcome in this market?

A) P1 = P2 = 4

B) P1 = P2 = 6

C) P1 = P2 = 8

D) P1 = 6 and P2 = 8

A) P1 = P2 = 4

B) P1 = P2 = 6

C) P1 = P2 = 8

D) P1 = 6 and P2 = 8

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

Collusion can earn higher prices and higher profits under the Bertrand model, but why is this an unlikely outcome in practice?

A) Firms prefer to remain independent of other firms so that their pricing plans can be more flexible over time.

B) The collusive firms have an incentive to gain market share at the expense of the other firms by cutting prices.

C) The federal antitrust authorities have an easier time catching firms that collude on price rather than quantity.

D) none of the above

A) Firms prefer to remain independent of other firms so that their pricing plans can be more flexible over time.

B) The collusive firms have an incentive to gain market share at the expense of the other firms by cutting prices.

C) The federal antitrust authorities have an easier time catching firms that collude on price rather than quantity.

D) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

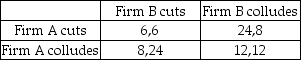

78

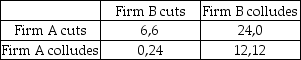

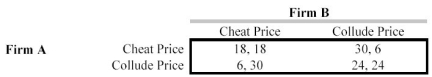

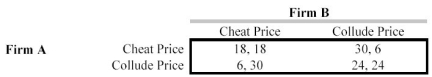

Two firms operating in the same market must choose between a collude price and a cheat price. Firm A's profit is listed before the comma, B's outcome after the comma.  If each firm tries to choose a price that is best for it, regardless of the other firm's price, which of these statements is correct?

If each firm tries to choose a price that is best for it, regardless of the other firm's price, which of these statements is correct?

A) Firm A should charge the collude price, Firm B should charge a cheat price.

B) Firm A should charge a cheat price, Firm B should charge a collude price.

C) Both firms should charge a collude price.

D) Both firms should charge a cheat price.

If each firm tries to choose a price that is best for it, regardless of the other firm's price, which of these statements is correct?

If each firm tries to choose a price that is best for it, regardless of the other firm's price, which of these statements is correct?A) Firm A should charge the collude price, Firm B should charge a cheat price.

B) Firm A should charge a cheat price, Firm B should charge a collude price.

C) Both firms should charge a collude price.

D) Both firms should charge a cheat price.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

Relative to the Nash equilibrium in the Cournot model, the Nash equilibrium in the Bertrand model with homogeneous products

A) results in the same output but a higher price.

B) results in the same output but a lower price.

C) results in a larger output at a lower price.

D) results in a smaller output at a higher price.

E) any of the above may result.

A) results in the same output but a higher price.

B) results in the same output but a lower price.

C) results in a larger output at a lower price.

D) results in a smaller output at a higher price.

E) any of the above may result.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the firms in the industry collude with one another to maximize joint profit?

A) $3

B) $9

C) $12

D) $16.50

E) none of the above

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

Refer to Scenario 12.2. What will be the price of this new drink in the long run if the firms in the industry collude with one another to maximize joint profit?

A) $3

B) $9

C) $12

D) $16.50

E) none of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck