Deck 17: Long-Term Investment Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 17: Long-Term Investment Analysis

1

In order to help assure that all relevant factors will be considered,the capital-expenditure selection process should include the following steps except:

A)generating alternative capital-investment project proposals

B)estimating cash flows for the project proposals

C)reviewing the investment projects after they have been implemented

D)allocate manpower to the various divisions within the firm

E)a and d

A)generating alternative capital-investment project proposals

B)estimating cash flows for the project proposals

C)reviewing the investment projects after they have been implemented

D)allocate manpower to the various divisions within the firm

E)a and d

D

2

The ____ depicts the risk-return relationship in the market for all securities:

A)characteristic line

B)security market line

C)investment opportunity curve

D)marginal cost of capital schedule

E)none of the above

A)characteristic line

B)security market line

C)investment opportunity curve

D)marginal cost of capital schedule

E)none of the above

B

3

The relationship between NPV and IRR is such that :

A)both approaches always provide the same ranking of alternatives

B)the IRR of a project is equal to the firm's cost of capital when the NPV of a project is $0

C)if the NPV of a project is negative,then the IRR must be greater than the cost of capital

D)all of the above

E)none of the above

A)both approaches always provide the same ranking of alternatives

B)the IRR of a project is equal to the firm's cost of capital when the NPV of a project is $0

C)if the NPV of a project is negative,then the IRR must be greater than the cost of capital

D)all of the above

E)none of the above

B

4

Beta in the CAPM is ____.

A)one measure of the systematic risk of a stock

B)estimated as the slope of a regression line between an individual security's returns and returns for the market index.

C)useful in estimating the firm's cost of debt capital

D)a and b only

E)a,b,and c

A)one measure of the systematic risk of a stock

B)estimated as the slope of a regression line between an individual security's returns and returns for the market index.

C)useful in estimating the firm's cost of debt capital

D)a and b only

E)a,b,and c

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

The decision by the Municipal Transit Authority to either refurbish existing buses,buy new large buses,or to supplement the existing fleet with mini-buses is an example of:

A)independent projects

B)mutually exclusive projects

C)contingent projects

D)separable projects

E)none of the above

A)independent projects

B)mutually exclusive projects

C)contingent projects

D)separable projects

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

GE Appliance Division believes which of the following warrants shifting assembly of appliances back from Shanghai to Louisville,KY:.

A)The negotiation of a two-tiered wage structure for union labor,

B)Faster innovations when product design engineers and assembly line team leaders are located in the same place,

C)quicker delivery to retail dealers reduce inventory storage

D)none of the above,

E)all of the above.

A)The negotiation of a two-tiered wage structure for union labor,

B)Faster innovations when product design engineers and assembly line team leaders are located in the same place,

C)quicker delivery to retail dealers reduce inventory storage

D)none of the above,

E)all of the above.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following would not be classified as a capital expenditure for decision-making purposes?

A)purchase of a building

B)investment in a new milling machine

C)purchase of 90-day Treasury Bills

D)investment in a management training program

E)all of the above are capital expenditures

A)purchase of a building

B)investment in a new milling machine

C)purchase of 90-day Treasury Bills

D)investment in a management training program

E)all of the above are capital expenditures

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is (are)a guideline(s)to be used in the estimation of cash flows?

A)cash flows should be measured on an incremental basis

B)cash flows should be measured on an after-tax basis

C)all the indirect effects of the project should be included

D)all of the above

E)none of the above

A)cash flows should be measured on an incremental basis

B)cash flows should be measured on an after-tax basis

C)all the indirect effects of the project should be included

D)all of the above

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

The cost of capital can be thought of as the rate of return required by investors in the firm's securities.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

If the acceptance of Project A makes it impossible to accept Project B,these projects are:

A)contingent projects

B)complementary projects

C)mutually inclusive projects

D)mutually exclusive projects

E)none of the above

A)contingent projects

B)complementary projects

C)mutually inclusive projects

D)mutually exclusive projects

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

Capital expenditures:

A)are easily reversible

B)are forms of operating expenditures

C)Affect long-run future profitability

D)Involve only money,not machinery

E)none of the above

A)are easily reversible

B)are forms of operating expenditures

C)Affect long-run future profitability

D)Involve only money,not machinery

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

The expected rate of return from a share of stock consists of:

A)a dividend return

B)capital appreciation (or depreciation)

C)interest

D)a and b only

E)a,b,and c

A)a dividend return

B)capital appreciation (or depreciation)

C)interest

D)a and b only

E)a,b,and c

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

In determining the optimal capital budget,one should choose those project's whose ____ exceeds the firm's ____ cost of capital.

A)internal rate of return,average

B)internal rate of return,marginal

C)internal rate of return,historic

D)average rate of return,marginal

E)none of the above

A)internal rate of return,average

B)internal rate of return,marginal

C)internal rate of return,historic

D)average rate of return,marginal

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

Any current outlay that is expected to yield a flow of benefits beyond one year in the future is:

A)a capital gain

B)a wealth maximizing factor

C)a capital expenditure

D)a cost of capital

E)a dividend reinvestment

A)a capital gain

B)a wealth maximizing factor

C)a capital expenditure

D)a cost of capital

E)a dividend reinvestment

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is (are)a basic principle(s)when estimating a project's cash flows?

A)cash flows should be measured on a pre-tax basis

B)cash flows should ignore depreciation since it is a non-cash charge

C)only direct effects of a project should be included in the cash flow calculations

D)cash flows should be measured on an incremental basis

E)all of the above

A)cash flows should be measured on a pre-tax basis

B)cash flows should ignore depreciation since it is a non-cash charge

C)only direct effects of a project should be included in the cash flow calculations

D)cash flows should be measured on an incremental basis

E)all of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

In cost of capital calculations,the flotation cost on new debt is usually ignored because the flotation cost percentage for large debt issues is relatively low.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following items is (are) considered as part of the net investment calculation?

A)installation and shipping charges

B)acquisition cost of new asset

C)salvage value of old equipment that is being replaced

D)first year's net cash flow

E)c and d

A)installation and shipping charges

B)acquisition cost of new asset

C)salvage value of old equipment that is being replaced

D)first year's net cash flow

E)c and d

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

The weights used in calculating the firm's weighted-average cost of capital are equal to the proportion of debt and equity ____.

A)used to finance the project

B)used to finance the projects undertaken last year

C)in the industry average capital structure

D)in the firm's target capital structure

E)none of the above

A)used to finance the project

B)used to finance the projects undertaken last year

C)in the industry average capital structure

D)in the firm's target capital structure

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

In the constant-growth dividend valuation model,the required rate of return on common stock (i.e. ,cost of equity capital)can be shown to be equal to the sum of the dividend yield plus the ____.

A)yield-to-maturity

B)present value yield

C)risk-free rate

D)dividend growth rate

E)none of the above

A)yield-to-maturity

B)present value yield

C)risk-free rate

D)dividend growth rate

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

The cost of internal equity (retained earnings)is ____ the cost of external equity (new common stock).

A)greater than

B)equal to

C)less than

A)greater than

B)equal to

C)less than

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

Aspen Industries currently pays an annual common stock dividend of $5.00 per share.The company's dividend has grown steadily over the past 10 years at a 7 percent rate and this rate is expected to continue for the foreseeable future.The company's stock currently sells for $70 per share.The company can issue new common stock at a net price of $65 per share.

(a) Determine the firm's cost of equity capital using the dividend capitalization (constant-growth) model.

(b) Determine the firm's cost of equity capital using the dividend capitalization (constant-growth) model.

(a) Determine the firm's cost of equity capital using the dividend capitalization (constant-growth) model.

(b) Determine the firm's cost of equity capital using the dividend capitalization (constant-growth) model.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

The capital structure of Wildcat Wells,an independent petroleum exploration and drilling company,consists of 40 percent debt and 60 percent equity capital.Debt capital consists of a bond (which matures in 10 years)issued five years ago at an interest rate of 10 percent.Since then market interest rates have risen substantially.The firm has been advised by its investment banker that additional debt financing (bonds)could be obtained at a rate of 12 percent.In the last six years of operations,Wildcat Wells has averaged a 12 percent compound rate of growth in earnings and dividends.This rate is expected to continue for the foreseeable future.Next year's dividend is projected to be $.75 per share.The firm's stock is currently selling for $25 per share.Wildcat Wells has a 40 percent marginal income tax rate.

(a) What is the firm's after-tax cost of debt financing?

(b) What is the firm's after-tax cost of internal equity capital?

(c) Assuming that Wildcat Wells plans to maintain its present capital structure, what is the firm's weighted cost of capital?

(a) What is the firm's after-tax cost of debt financing?

(b) What is the firm's after-tax cost of internal equity capital?

(c) Assuming that Wildcat Wells plans to maintain its present capital structure, what is the firm's weighted cost of capital?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

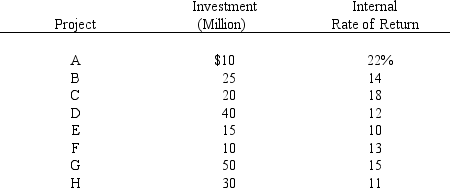

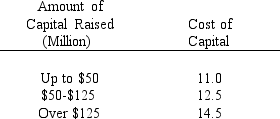

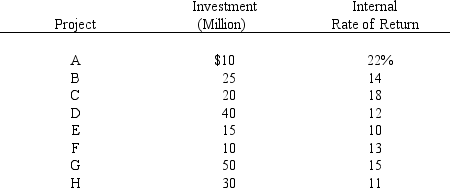

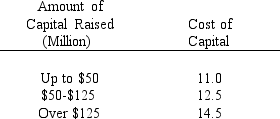

The Jackson Company has the following capital expenditure projects available for possible investment next year:

The company has developed the following costs of various increments of capital needed to finance its capital budget for next year:

The company has developed the following costs of various increments of capital needed to finance its capital budget for next year:

Determine the optimal capital budget for the company.

Determine the optimal capital budget for the company.

The company has developed the following costs of various increments of capital needed to finance its capital budget for next year:

The company has developed the following costs of various increments of capital needed to finance its capital budget for next year: Determine the optimal capital budget for the company.

Determine the optimal capital budget for the company.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

In cost-effectiveness analysis,constant cost studies:

A)are rarely used

B)attempt to specify the output which may be achieved from a number of alternative programs,assuming all are funded at the same level

C)are useless because they fail to adequately evaluate program benefits

D)try to find the least expensive way of achieving a certain objective

E)none of the above

A)are rarely used

B)attempt to specify the output which may be achieved from a number of alternative programs,assuming all are funded at the same level

C)are useless because they fail to adequately evaluate program benefits

D)try to find the least expensive way of achieving a certain objective

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

Public sector investment projects are economically justifiable only when:

A)the discounted social benefits exceed the discounted social costs

B)the internal rate of return exceeds the social discount rate

C)the benefit-cost ratio exceeds zero

D)a and b only

E)a,b,and c

A)the discounted social benefits exceed the discounted social costs

B)the internal rate of return exceeds the social discount rate

C)the benefit-cost ratio exceeds zero

D)a and b only

E)a,b,and c

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

The discount rate utilized in public sector budgeting performs the functions of:

A)allocating funds between the public and private sectors

B)allocating funds between present consumption and investment (i.e. ,future consumption)

C)allocating funds between debt and equity securities

D)a and b only

E)none of the above

A)allocating funds between the public and private sectors

B)allocating funds between present consumption and investment (i.e. ,future consumption)

C)allocating funds between debt and equity securities

D)a and b only

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

The production superintendent of the Holloway Company has proposed that the firm purchase a new $40,000 grinding machine for use in the plant.The machine is expected to generate $10,000 per year in pre-tax cash savings (labor and spoilage)for the next 10 years.At the end of 10 years the salvage value of the machine is estimated to be $5,000.Holloway uses straight-line depreciation and its marginal income tax rate is 40 percent.The firm's cost of capital is 12 percent.

(a) What are the net cash inflows after depreciation and taxes for the machine in years 1-10?

(b) What is the net present value for the machine?

(c) What is the internal rate of return for the machine?

(d) Would you recommend purchasing the machine? Why or why not?

NOTE: This problem requires the use of present value tables or a financial calculator.

(a) What are the net cash inflows after depreciation and taxes for the machine in years 1-10?

(b) What is the net present value for the machine?

(c) What is the internal rate of return for the machine?

(d) Would you recommend purchasing the machine? Why or why not?

NOTE: This problem requires the use of present value tables or a financial calculator.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

All of the following ____ are shortcomings of cost-benefit analysis.

A)difficulty in measuring third-party costs

B)difficulty in measuring third-party benefits

C)failure to consider the time value of benefits and costs

D)difficulty of accounting for program interactions

E)a and b

A)difficulty in measuring third-party costs

B)difficulty in measuring third-party benefits

C)failure to consider the time value of benefits and costs

D)difficulty of accounting for program interactions

E)a and b

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

RCB Corporation is considering the purchase of a machine for which the initial cash outlay will be $100,000.Predicted net cash inflows before depreciation and taxes are $25,000 per year for the next five years.The machine will be depreciated (using the straight-line method)over the 5-year period with a zero estimated salvage value at the end of the period.The corporation's marginal tax rate is 40 percent and its cost of capital is 12 percent.

This problem requires the use of present value tables or a financial calculator.

This problem requires the use of present value tables or a financial calculator.

This problem requires the use of present value tables or a financial calculator.

This problem requires the use of present value tables or a financial calculator.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

The ____ method assumes that the cash flows over the life of the project are reinvested at the ____.

A)net present value;computed internal rate of return

B)internal rate of return;firm's cost of capital

C)net present value;firm's cost of capital

D)net present value;risk-free rate of return

E)none of the above

A)net present value;computed internal rate of return

B)internal rate of return;firm's cost of capital

C)net present value;firm's cost of capital

D)net present value;risk-free rate of return

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

The effect of changes in the level of interest rates on security returns is an example of ____.

A)systematic risk

B)unsystematic risk

C)nondiversifiable risk

D)a and c only

E)b and c only

A)systematic risk

B)unsystematic risk

C)nondiversifiable risk

D)a and c only

E)b and c only

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

In calculating the benefit-cost ratio,social benefits and costs are discounted at the

A)internal rate of return

B)federal funds rate

C)Treasury Bill rate

D)long-term government bond rate

E)none of the above

A)internal rate of return

B)federal funds rate

C)Treasury Bill rate

D)long-term government bond rate

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

The social discount rate used in cost-benefit analysis is equal to a weighted average of the Treasury Bill rate and the long-term government borrowing rate.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

Direct costs of a public sector investment project are generally easier to measure than the direct benefits.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following should be counted in a cost-benefit analysis?

A)direct benefits and costs

B)real secondary benefits

C)technological secondary costs

D)pecuniary benefits

E)intangibles

A)direct benefits and costs

B)real secondary benefits

C)technological secondary costs

D)pecuniary benefits

E)intangibles

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

In cost-benefit analysis,intangibles include such factors as:

A)quality of life considerations

B)changes in land values resulting from a project

C)aesthetic contributions

D)a and b only

E)a and c only

A)quality of life considerations

B)changes in land values resulting from a project

C)aesthetic contributions

D)a and b only

E)a and c only

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

The social rate of discount is best approximated by:

A)the cost of government borrowing

B)the opportunity cost of resources taken from the private sector

C)3 percent

D)30 percent

E)none of the above

A)the cost of government borrowing

B)the opportunity cost of resources taken from the private sector

C)3 percent

D)30 percent

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

In cost-benefit analysis,a low discount rate tends to favor projects with relatively ____ lives.

A)short

B)long

A)short

B)long

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

Cost-benefit analysis is the public sector counterpart to ____ used in private,profit-oriented firms.

A)ratio analysis

B)break-even analysis

C)capital budgeting techniques

D)economic forecasting

E)none of the above

A)ratio analysis

B)break-even analysis

C)capital budgeting techniques

D)economic forecasting

E)none of the above

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

Piedmont Power Company's common stock has a beta,ß,estimated to be .85.The risk-free rate is 8 percent and the expected market return is 14 percent.Compute Peidmont's cost of equity capital.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

The Ministry of Recreation has decided to consider a proposal to build a new regional park.A piece of land is available which can be purchased,after condemnation proceedings,for $1,000,000.A private developer has offered the owner of the land $2 million.The value of direct recreational benefits from the park is estimated at $175,000 per year for 25 years.In addition,indirect benefits of $12,500 per year for 25 years have been projected.Increased values in land surrounding the project will provide immediate,one-time pecuniary benefits to the land-owners of $1,000,000.

The direct cost to operate and maintain the park is estimated at $50,000 per year.The Ministry believes a 10% discount rate is appropriate to evaluate projects of this sort.Should the park be built? Justify your answer using cost benefit analysis.

The direct cost to operate and maintain the park is estimated at $50,000 per year.The Ministry believes a 10% discount rate is appropriate to evaluate projects of this sort.Should the park be built? Justify your answer using cost benefit analysis.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck