Deck 20: Cash-Flow Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 20: Cash-Flow Statements

1

Survey research by Jones and Ratnatunga (1997) undertaken in Australia found that respondents indicated that, on average, the statement of cash flows:

A) Provides greater comparability between companies.

B) Was considered to be more understandable to users.

C) Is a better indicator of the company's future operating performance.

D) Provides greater comparability between companies and was considered to be more understandable to users.

E) All of the given answers.

A) Provides greater comparability between companies.

B) Was considered to be more understandable to users.

C) Is a better indicator of the company's future operating performance.

D) Provides greater comparability between companies and was considered to be more understandable to users.

E) All of the given answers.

E

2

AASB 107 requires disclosures about non-cash financing and investing activities:

True

3

Sharma (1996) argues that cash flows from operating activities divided by current debt should replace the current ratio as a measure of liquidity:

False

4

While the statement of cash flows is presently required along with the accrual statements, taking a balanced view, it would be sufficient to meet the accountability needs of general-purpose financial statement users on its own:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The statement of cash flows may assist in determining the ability of an entity to:

A) Generate cash flows.

B) Obtain internal finance.

C) Meet its financial commitments to customers.

D) Generate cash flows and meet its financial commitments to customers.

E) All of the given answers.

A) Generate cash flows.

B) Obtain internal finance.

C) Meet its financial commitments to customers.

D) Generate cash flows and meet its financial commitments to customers.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Cash-flow statements should be subdivided into selling, financing and investing categories:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

In accordance with AASB 107 "Cash Flow Statements", dividends paid may be classified as an investing or a financing cash flow.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

If a business consistently has positive cash flows from financing and negative cash flows from investing and operating activities, this is a positive sign for the business:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

In accordance with AASB 107, non-cash investing and financing transactions are required to be included in the cash flow statement.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

In accordance with AASB 107 "Cash Flow Statements", cash payments to suppliers for goods and services are classified as cash flows from operating activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

To calculate the cash flow associated with an accrued expense, any increase in the associated liability should be added to the expense:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

In accordance with AASB 107 "Cash Flow Statements", a bonus share issue is to be classified under financing activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

The cash-flow statement is argued by researchers to be a more reliable statement than accrual statements:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

To calculate the cash flow from the issue of debentures, the face value of the debentures would have to be adjusted by deducting any premium or adding any discount on issue:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

A cash flow statement is a forecast of net cash flows from operating, investing and financing activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

The cash-flow statement effectively provides a reconciliation of the opening and closing cash balances in the balance sheet:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

A reporting entity is required to prepare a cash flow statement that is in accordance with the requirements of AASB 107 and shall be presented as an integral part of the notes to the accounts.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

In accordance with AASB 107 "Cash Flow Statements", cash receipts from sales of property, plant and equipment are classified as cash flows from operating activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

All cash flows from investing and financing activities are required to be reported on a gross basis.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

AASB 107 requires ledger accounts to be reconstructed in order to calculate cash flows from operating activities:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

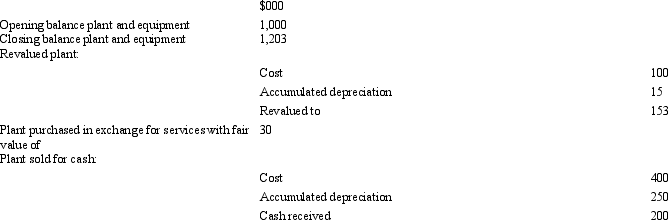

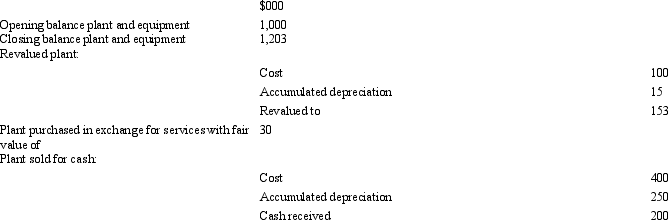

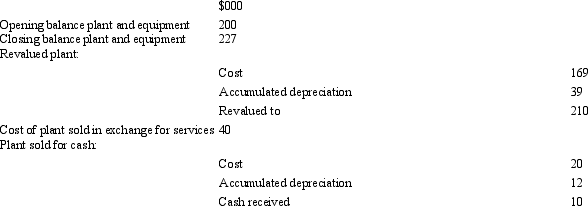

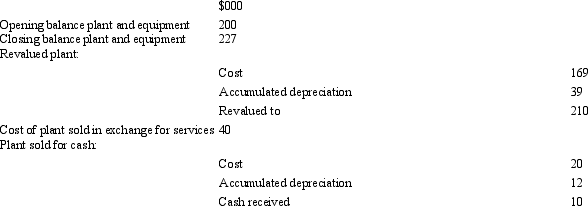

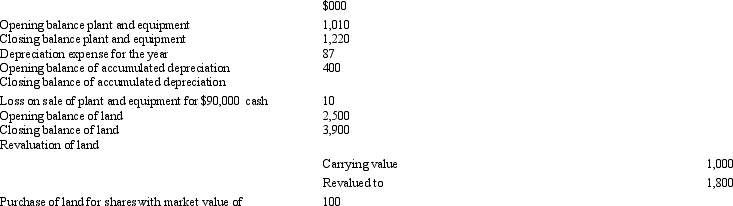

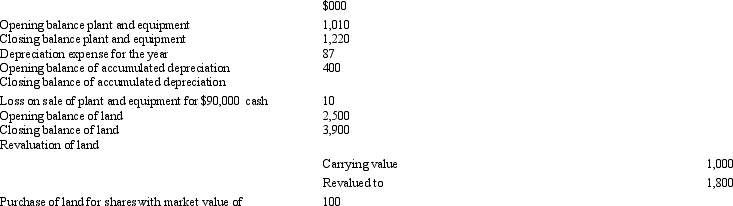

Hybrid Ltd provides the following information for the period ended 30 June 2005:

What was the amount of cash used to acquire plant and equipment?

A) $626,000

B) $114,000

C) $520,000

D) $270,000

E) None of the given answers.

What was the amount of cash used to acquire plant and equipment?

A) $626,000

B) $114,000

C) $520,000

D) $270,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

A note to the accounts reconciling cash flows from operating activities to net profit is required because:

A) Complex calculations are required to convert cash based revenues.

B) Items such as depreciation are only recorded in a cash system and not an accrual system.

C) There is likely to be a disparity between cash from operations under AASB 107 and the profits reported in the income statement.

D) The direct method is required under AASB 107.

E) None of the given answers.

A) Complex calculations are required to convert cash based revenues.

B) Items such as depreciation are only recorded in a cash system and not an accrual system.

C) There is likely to be a disparity between cash from operations under AASB 107 and the profits reported in the income statement.

D) The direct method is required under AASB 107.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

An item considered to be a cash equivalent in one company may not be considered as such in another. This is because:

A) The operating cycle varies between companies.

B) Companies have different balance dates and this will affect the measurement of the term to maturity.

C) Companies use highly liquid items for purposes other than as part of their cash-management function.

D) The working capital management policies of companies vary so an item may be considered very liquid in one company and not in another.

E) None of the given answers.

A) The operating cycle varies between companies.

B) Companies have different balance dates and this will affect the measurement of the term to maturity.

C) Companies use highly liquid items for purposes other than as part of their cash-management function.

D) The working capital management policies of companies vary so an item may be considered very liquid in one company and not in another.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

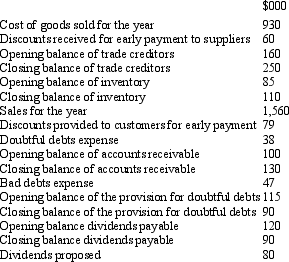

Joplyn Ltd provides the following information for the period ended 30 June 2005:

All transactions are in cash unless otherwise indicated. What is the net cash flow from investing activities?

A) Cash inflow $80,000

B) Cash inflow $30,000

C) Cash outflow $100,000

D) $0

E) None of the given answers.

All transactions are in cash unless otherwise indicated. What is the net cash flow from investing activities?

A) Cash inflow $80,000

B) Cash inflow $30,000

C) Cash outflow $100,000

D) $0

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

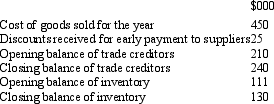

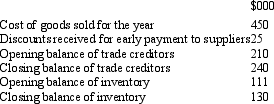

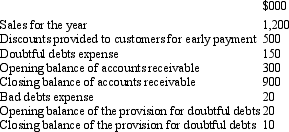

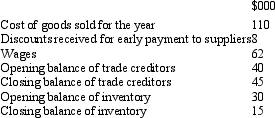

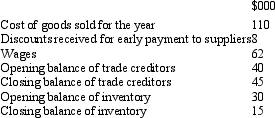

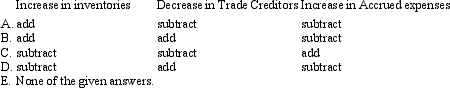

Up and Away Unlimited provides the following information for the period ended 30 June 2004:

What is the cash paid to suppliers for the period?

A) $376,000

B) $415,000

C) $474,000

D) $426,000

E) None of the given answers.

What is the cash paid to suppliers for the period?

A) $376,000

B) $415,000

C) $474,000

D) $426,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

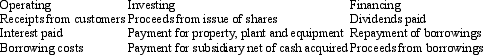

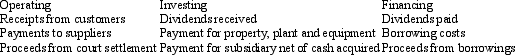

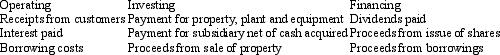

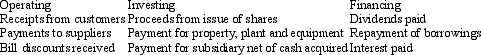

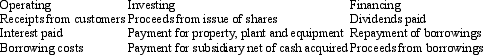

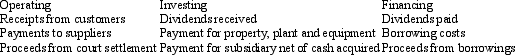

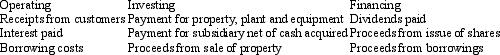

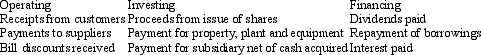

Which of the following tables provides an appropriate classification for the items listed for the statement of cash flows for a retailing business?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

AASB 107 requires that a note to the accounts shall disclose a reconciliation of cash flows from operating activities to operating profit or loss after income tax as reported in the income statement. The correct adjustments to the operating profit/loss after tax include:

A) AdD. depreciation expense, gain on sale of plant and equipment, increase in interest payable, increase in inventories.

B) Subtract: increase in future income tax benefit, increase in accounts receivable, loss on sale of plant and equipment.

C) AdD. increase in accounts payable, increase in income taxes payable, increase in deferred taxes payable.

D) Subtract: amortisation expense, increase in future income benefit, increase in interest payable.

E) None of the given answers.

A) AdD. depreciation expense, gain on sale of plant and equipment, increase in interest payable, increase in inventories.

B) Subtract: increase in future income tax benefit, increase in accounts receivable, loss on sale of plant and equipment.

C) AdD. increase in accounts payable, increase in income taxes payable, increase in deferred taxes payable.

D) Subtract: amortisation expense, increase in future income benefit, increase in interest payable.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

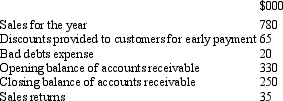

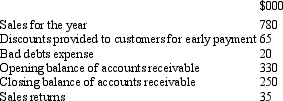

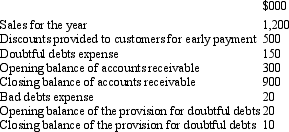

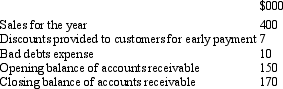

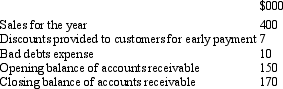

DryGrass Ltd provides the following information that relates to the period ended 30 June 2005:

What amount of cash was received from customers during the year?

A) $775,000

B) $580,000

C) $740,000

D) $615,000

E) None of the given answers.

What amount of cash was received from customers during the year?

A) $775,000

B) $580,000

C) $740,000

D) $615,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

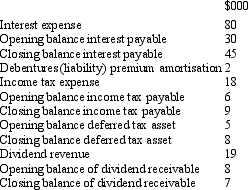

Mogull Ltd provides the following information for the period ended 30 June 2005:

What are the cash flows from interest, dividends and tax for the period?

A) Cash outflow from interest: $97,000; Cash inflow from dividends: $18,000; Cash outflow tax: $24,000

B) Cash outflow from interest: $67,000; Cash inflow from dividends: $20,000; Cash outflow tax: $12,000

C) Cash outflow from interest: $63,000; Cash inflow from dividends: $4,000; Cash outflow tax: $18,000

D) Cash outflow from interest: $7,000; Cash inflow from dividends: $20,000; Cash outflow tax: $16,000

E) None of the given answers.

What are the cash flows from interest, dividends and tax for the period?

A) Cash outflow from interest: $97,000; Cash inflow from dividends: $18,000; Cash outflow tax: $24,000

B) Cash outflow from interest: $67,000; Cash inflow from dividends: $20,000; Cash outflow tax: $12,000

C) Cash outflow from interest: $63,000; Cash inflow from dividends: $4,000; Cash outflow tax: $18,000

D) Cash outflow from interest: $7,000; Cash inflow from dividends: $20,000; Cash outflow tax: $16,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

AASB 107 defines cash equivalents to include:

A) Highly liquid investments with short periods to maturity which are readily convertible to cash on hand at the investor's option and are subject to an insignificant risk of changes in value.

B) Term borrowing.

C) Working capital items such as prepayments and accruals.

D) Highly liquid investments with short periods to maturity which are readily convertible to cash on hand at the investor's option and are subject to an insignificant risk of changes in value and term borrowing.

E) All of the given answers.

A) Highly liquid investments with short periods to maturity which are readily convertible to cash on hand at the investor's option and are subject to an insignificant risk of changes in value.

B) Term borrowing.

C) Working capital items such as prepayments and accruals.

D) Highly liquid investments with short periods to maturity which are readily convertible to cash on hand at the investor's option and are subject to an insignificant risk of changes in value and term borrowing.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Mopoke Ltd provides the following information that relates to the period ended 30 June 2004:

What amount of cash was received from customers during the year?

A) $1,780,000

B) $930,000

C) $1,720,000

D) $920,000

E) None of the given answers.

What amount of cash was received from customers during the year?

A) $1,780,000

B) $930,000

C) $1,720,000

D) $920,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

What method does AASB 107 require for the reporting of cash flows from operating activities and what does it mean for the presentation of this category in the statement of cash flows?

A) The derivative method is required. This means that the amounts are presented as increases or decreases in balance sheet working capital accounts.

B) The indirect method is required. This means that the cash flows are presented as accrual amounts from the operating section of the income statement adjusted for non-cash effects.

C) The direct method is required. This means that the gross cash flows from operating items are presented.

D) Either the derivative method is required. This means that the amounts are presented as increases or decreases in balance sheet working capital accounts or the direct method is required. This means that the gross cash flows from operating items are presented is permitted.

E) None of the given answers.

A) The derivative method is required. This means that the amounts are presented as increases or decreases in balance sheet working capital accounts.

B) The indirect method is required. This means that the cash flows are presented as accrual amounts from the operating section of the income statement adjusted for non-cash effects.

C) The direct method is required. This means that the gross cash flows from operating items are presented.

D) Either the derivative method is required. This means that the amounts are presented as increases or decreases in balance sheet working capital accounts or the direct method is required. This means that the gross cash flows from operating items are presented is permitted.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Railway Corporation provides the following information that relates to the period ended 30 June 2005:

What amount of cash was received from customers during the year?

A) $383,000

B) $363,000

C) $403,000

D) $397,000

E) None of the given answers.

What amount of cash was received from customers during the year?

A) $383,000

B) $363,000

C) $403,000

D) $397,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

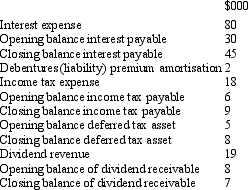

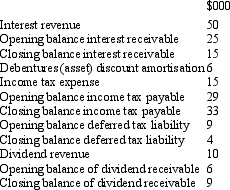

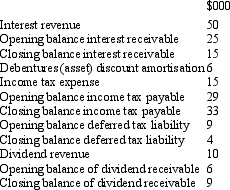

Mistril Ltd provides the following information for the period ended 30 June 2005:

What are the cash flows from interest, dividends and tax for the period?

A) Cash inflow from interest: $34,000; Cash inflow from dividends: $13,000; Cash outflow tax: $14,000

B) Cash inflow from interest: $54,000; Cash inflow from dividends: $7,000; Cash outflow tax: $16,000

C) Cash inflow from interest: $66,000; Cash inflow from dividends: $7,000; Cash outflow tax: $6,000

D) Cash inflow from interest: $84,000; Cash inflow from dividends: $25,000; Cash outflow tax: $82,000

E) None of the given answers.

What are the cash flows from interest, dividends and tax for the period?

A) Cash inflow from interest: $34,000; Cash inflow from dividends: $13,000; Cash outflow tax: $14,000

B) Cash inflow from interest: $54,000; Cash inflow from dividends: $7,000; Cash outflow tax: $16,000

C) Cash inflow from interest: $66,000; Cash inflow from dividends: $7,000; Cash outflow tax: $6,000

D) Cash inflow from interest: $84,000; Cash inflow from dividends: $25,000; Cash outflow tax: $82,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

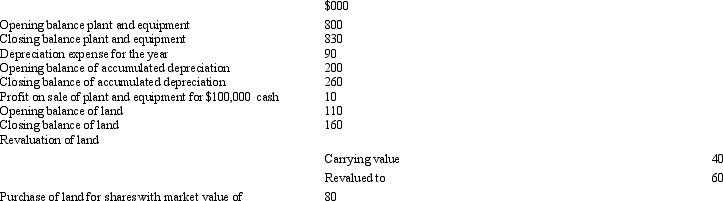

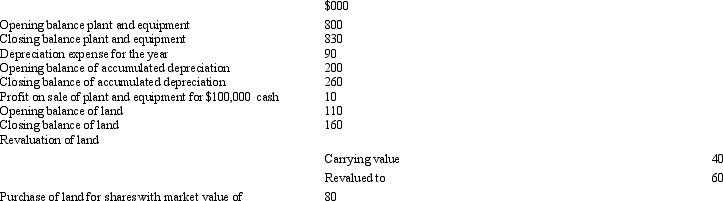

Hansard Ltd provides the following information for the period ended 30 June 2005:

What was the amount of cash used to acquire plant and equipment?

A) $55,000

B) $16,000

C) $23,000

D) $18,000

E) None of the given answers.

What was the amount of cash used to acquire plant and equipment?

A) $55,000

B) $16,000

C) $23,000

D) $18,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Accounts that represent cash or cash equivalents include:

A) Bank overdrafts.

B) Accounts receivable.

C) Short-term money market deposits.

D) Bank overdrafts and short-term money market deposits.

E) All of the given answers.

A) Bank overdrafts.

B) Accounts receivable.

C) Short-term money market deposits.

D) Bank overdrafts and short-term money market deposits.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Investing activities are defined by AASB 107 as those that:

A) Relate to the changing size or composition of the capital management structure of the entity.

B) Relate to the acquisition or disposal of inventory.

C) Relate to the acquisition and/or disposal of non-current assets and investments not falling into the definition of cash.

D) Relate to changes in capital or liabilities used to fund long-term assets.

E) None of the given answers.

A) Relate to the changing size or composition of the capital management structure of the entity.

B) Relate to the acquisition or disposal of inventory.

C) Relate to the acquisition and/or disposal of non-current assets and investments not falling into the definition of cash.

D) Relate to changes in capital or liabilities used to fund long-term assets.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

AASB 107 states that for a money market deposit to be classified as cash:

A) It must normally have a maturity of 3 months or less from the date of acquisition.

B) It must be scheduled to mature within the operating cycle of the entity.

C) It must normally mature 3 months or less from balance date.

D) It must be within 1 month of maturing at balance date.

E) None of the given answers.

A) It must normally have a maturity of 3 months or less from the date of acquisition.

B) It must be scheduled to mature within the operating cycle of the entity.

C) It must normally mature 3 months or less from balance date.

D) It must be within 1 month of maturing at balance date.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

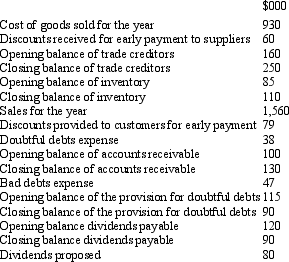

Cod Ltd provides the following information for the period ended 30 June 2004:

What is the cash paid to suppliers for the period?

A) $82,000

B) $144,000

C) $184,000

D) $122,000

E) None of the given answers.

What is the cash paid to suppliers for the period?

A) $82,000

B) $144,000

C) $184,000

D) $122,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

AASB 107 requires disclosure of information about transactions and events that do not result in cash flows during the financial year, including:

A) A commitment under an operating lease.

B) The use of forward exchange contracts to hedge purchases.

C) Acquisition of assets by entering into finance leases.

D) Liquidation of investments.

E) None of the given answers.

A) A commitment under an operating lease.

B) The use of forward exchange contracts to hedge purchases.

C) Acquisition of assets by entering into finance leases.

D) Liquidation of investments.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

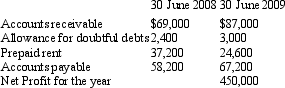

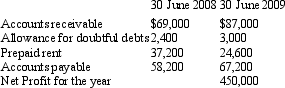

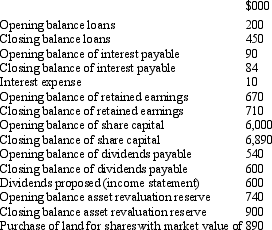

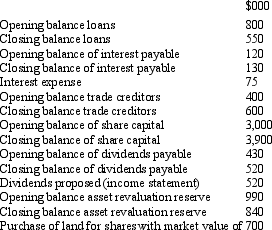

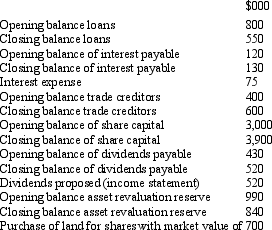

Crows Ltd's books show the following information for the preparation of its cash flow statement for the year ended 30 June 2009:

What is the amount of net cash from operating activities for the year ended 30 June 2009?

A) $445,800;

B) $453,600;

C) $454,200;

D) $489,000;

E) None of the given answers.

What is the amount of net cash from operating activities for the year ended 30 June 2009?

A) $445,800;

B) $453,600;

C) $454,200;

D) $489,000;

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Sharma (1996) suggests that a cash-flow based measure of retained cash flows from operations (RCFFO) may be an important indicator of financial flexibility. How is RCFFO measured?

A) The level of cash retained, calculated by deducting net cash flows from investing from the net cash flows from operations.

B) The level of cash retained after meeting all operating costs and priority payments such as interest costs and dividends.

C) The level of cash retained after meeting all operating costs and deducting or adding as appropriate the cash flows from financing and investing activities.

D) The level of cash retained, calculated by deducting net cash flows from financing from the net cash flows from operations.

E) None of the given answers.

A) The level of cash retained, calculated by deducting net cash flows from investing from the net cash flows from operations.

B) The level of cash retained after meeting all operating costs and priority payments such as interest costs and dividends.

C) The level of cash retained after meeting all operating costs and deducting or adding as appropriate the cash flows from financing and investing activities.

D) The level of cash retained, calculated by deducting net cash flows from financing from the net cash flows from operations.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

The following information is provided for Identikit Ltd for the period ended 30 June 2005:

All transactions are in cash unless otherwise indicated. What is the net cash flow from operating activities for the period?

A) Cash inflow $371,000

B) Cash inflow $298,000

C) Cash outflow $554,000

D) Cash inflow $530,000

E) None of the given answers.

All transactions are in cash unless otherwise indicated. What is the net cash flow from operating activities for the period?

A) Cash inflow $371,000

B) Cash inflow $298,000

C) Cash outflow $554,000

D) Cash inflow $530,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

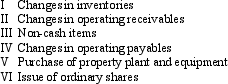

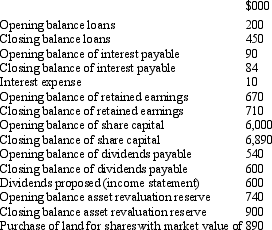

The following are cash flow transactions for Mungo LtD.

Which of the following combinations include all of the given answers transactions that will determine cash flows from operating activities of Mungo Ltd that is in accordance with AASB 107 "Cash Flow Statements"?

A) I, II, III, IV and V;

B) I, II, III, IV and VI;

C) I, II, III and IV;

D) I, II and III;

E) I, II and IV;

Which of the following combinations include all of the given answers transactions that will determine cash flows from operating activities of Mungo Ltd that is in accordance with AASB 107 "Cash Flow Statements"?

A) I, II, III, IV and V;

B) I, II, III, IV and VI;

C) I, II, III and IV;

D) I, II and III;

E) I, II and IV;

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

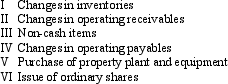

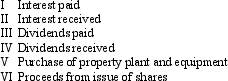

The following are cash flow transactions for Greenfell Ltd.

Which of the following combinations include all the non-cash investing and financing transactions of Greenfell Ltd that is required to be disclosed in the notes to the accounts in AASB 107 "Cash Flow Statements"?

A) I and II;

B) I, II and VI;

C) III, IV and V;

D) III, IV and VI;

E) IV, V and VI.

Which of the following combinations include all the non-cash investing and financing transactions of Greenfell Ltd that is required to be disclosed in the notes to the accounts in AASB 107 "Cash Flow Statements"?

A) I and II;

B) I, II and VI;

C) III, IV and V;

D) III, IV and VI;

E) IV, V and VI.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

The following information is provided for Unique Ltd for the period ended 30 June 2005:

All transactions are in cash unless otherwise indicated. What is the net cash flow from operating activities for the period?

A) Net cash inflow $596 00

B) Net cash inflow $426,000

C) Net cash inflow $536,000

D) Net cash inflow $486,000

E) None of the given answers.

All transactions are in cash unless otherwise indicated. What is the net cash flow from operating activities for the period?

A) Net cash inflow $596 00

B) Net cash inflow $426,000

C) Net cash inflow $536,000

D) Net cash inflow $486,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is not in accordance with AASB 107 "Cash Flow Statements"?

A) The cash flow statement shall report cash flows during the period classified by operating, investing and financing activities.

B) Investing and financing transactions that do not require the use of cash or cash equivalents shall be excluded from a cash flow statement.

C) Investing and financing activities that do not have a direct impact on current cash flows but affect the capital and asset structure of an entity should be included in the cash flow statement.

D) An entity shall disclose the components of cash and cash equivalents and shall present a reconciliation of the amounts in its cash flow statement with the equivalent items reported in the balance sheet.

E) Cash flows arising from taxes on income shall be separately disclosed and shall be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities.

A) The cash flow statement shall report cash flows during the period classified by operating, investing and financing activities.

B) Investing and financing transactions that do not require the use of cash or cash equivalents shall be excluded from a cash flow statement.

C) Investing and financing activities that do not have a direct impact on current cash flows but affect the capital and asset structure of an entity should be included in the cash flow statement.

D) An entity shall disclose the components of cash and cash equivalents and shall present a reconciliation of the amounts in its cash flow statement with the equivalent items reported in the balance sheet.

E) Cash flows arising from taxes on income shall be separately disclosed and shall be classified as cash flows from operating activities unless they can be specifically identified with financing and investing activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

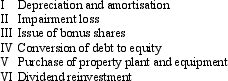

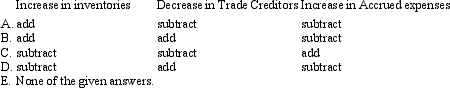

48

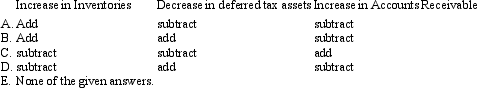

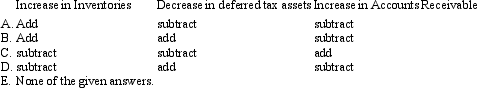

Which combination is the appropriate operation to perform to the following accounts to reconcile net profit with net cash flows from operating activities?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Jaunty Ltd provides the following information for the period ended 30 June 2005:

All transactions are in cash unless otherwise indicated. What is the net cash flow from investing activities?

A) Net cash outflow $770,000

B) $0

C) Net cash inflow $230,000

D) Net cash outflow $860,000

E) None of the given answers.

All transactions are in cash unless otherwise indicated. What is the net cash flow from investing activities?

A) Net cash outflow $770,000

B) $0

C) Net cash inflow $230,000

D) Net cash outflow $860,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

When creating a cash-flow statement certain items must be disclosed separately because of their significance, including:

A) Discounts received from suppliers.

B) Interest, both received and paid.

C) Discounts received from suppliers, and interest both received and paid.

D) Dividends paid.

E) Discounts received from suppliers and dividends paid.

A) Discounts received from suppliers.

B) Interest, both received and paid.

C) Discounts received from suppliers, and interest both received and paid.

D) Dividends paid.

E) Discounts received from suppliers and dividends paid.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

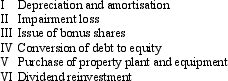

51

Which combination is the appropriate operation to perform to the following accounts to reconcile net profit with net cash flows from operating activities?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

What is net cash used in financing activities for the year ended 30 June 2009?

A) ($1,017,000)

B) ($1,032,000)

C) ($1,125,000)

D) ($1,218,000)

E) None of the given answers

A) ($1,017,000)

B) ($1,032,000)

C) ($1,125,000)

D) ($1,218,000)

E) None of the given answers

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

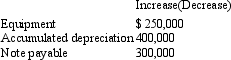

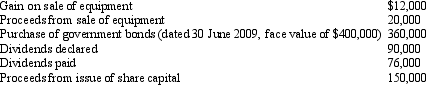

Swans Machinery Ltd reported a net profit of $3,000,000 for the year ended 30 June 2009. The following changes occurred in the balance sheet:

Additional information:

During the year Swans Ltd sold equipment with a cost of $250,000 and had accumulated depreciation of $120,000 for a gain of $50,000.

On 30 June 2009 Swans Ltd purchased equipment costing $500,000 with $200,000 in cash and a note payable for $300,000.

Depreciation expense for the year was $520,000

What is the amount of net cash from operating activities and net cash used in investing activities, respectively for the year ended 30 June 2009?

A) $3,470,000; ($20,000);

B) $3,520,000; ($20,000);

C) $3,470,000; (200,000);

D) $3,520,000; ($500,000);

E) None of the given answers.

Additional information:

During the year Swans Ltd sold equipment with a cost of $250,000 and had accumulated depreciation of $120,000 for a gain of $50,000.

On 30 June 2009 Swans Ltd purchased equipment costing $500,000 with $200,000 in cash and a note payable for $300,000.

Depreciation expense for the year was $520,000

What is the amount of net cash from operating activities and net cash used in investing activities, respectively for the year ended 30 June 2009?

A) $3,470,000; ($20,000);

B) $3,520,000; ($20,000);

C) $3,470,000; (200,000);

D) $3,520,000; ($500,000);

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is correct in accordance with AASB 107 "Cash Flow Statements"??

A) Cash repayments of amounts borrowed are classified under financing activities.

B) Cash proceeds from issuing equity instruments are classified under financing activities.

C) Cash payments to acquire property, plant and equipment are classified under investing activities.

D) Cash advances and loans made to other parties are classified under investing activities.

E) Conversion from debt to equity is classified under operating activities.

A) Cash repayments of amounts borrowed are classified under financing activities.

B) Cash proceeds from issuing equity instruments are classified under financing activities.

C) Cash payments to acquire property, plant and equipment are classified under investing activities.

D) Cash advances and loans made to other parties are classified under investing activities.

E) Conversion from debt to equity is classified under operating activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

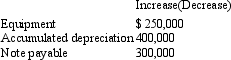

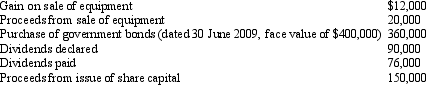

Saints Ltd is preparing a statement of cash flows for the year ended 30 June 2009. You are the accountant of the entity and have collected the following data.

What is the amount of net cash used in investing and financing activities, respectively?

A) $20,000; ($286,000);

B) $(340,000); $74,000;

C) $(348,000); ($22,000);

D) $(380,000); $74,000;

E) None of the given answers

What is the amount of net cash used in investing and financing activities, respectively?

A) $20,000; ($286,000);

B) $(340,000); $74,000;

C) $(348,000); ($22,000);

D) $(380,000); $74,000;

E) None of the given answers

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Lions Ltd engaged in the following activities for the year ended 30 June 2009:

Sold shares in Kangaroo Ltd for $70,000. The investment had a carrying amount of $66,000.

Purchased shares in Cats Ltd for $52,000.

Purchased government bonds for $100,000

Issued Lions Ltd shares for $100,000

What is the net cash flow used in investing activities?

A) $18,000;

B) ($18,000);

C) ($148,000)

D) ($82,000)

E) None of the given answers.

Sold shares in Kangaroo Ltd for $70,000. The investment had a carrying amount of $66,000.

Purchased shares in Cats Ltd for $52,000.

Purchased government bonds for $100,000

Issued Lions Ltd shares for $100,000

What is the net cash flow used in investing activities?

A) $18,000;

B) ($18,000);

C) ($148,000)

D) ($82,000)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Heady Ltd provides the following information for the period ended 30 June 2004:

During the period Sonic Co Ltd issued debentures with a face value of $2,000,000 at a discount of $260,000. All transactions are in cash unless otherwise indicated. What is the net cash flow from financing activities for the period?

A) Net cash outflow $1 450,000

B) Net cash outflow $6,000

C) Net cash inflow $1,154,000

D) Net cash inflow $1,390,000

E) None of the given answers.

During the period Sonic Co Ltd issued debentures with a face value of $2,000,000 at a discount of $260,000. All transactions are in cash unless otherwise indicated. What is the net cash flow from financing activities for the period?

A) Net cash outflow $1 450,000

B) Net cash outflow $6,000

C) Net cash inflow $1,154,000

D) Net cash inflow $1,390,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

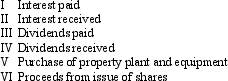

Following are cash flow transactions for Cootamundra Ltd.

Which of the following combinations include all transactions that may by classified under investing activities of Cootamundra Ltd that is in accordance with AASB 107 "Cash Flow Statements"?

A) I, II, III, IV, V and VI;

B) I, II, IV and V;

C) III, IV and VI;

D) I, II and V;

E) II, IV and V.

Which of the following combinations include all transactions that may by classified under investing activities of Cootamundra Ltd that is in accordance with AASB 107 "Cash Flow Statements"?

A) I, II, III, IV, V and VI;

B) I, II, IV and V;

C) III, IV and VI;

D) I, II and V;

E) II, IV and V.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Sonic Co Ltd provides the following information for the period ended 30 June 2005:

During the period Sonic Co Ltd issued debentures with a face value of $1,000,000 at a premium of $560,000. All transactions are in cash unless otherwise indicated. What is the net cash flow from financing activities for the period?

A) Net cash outflow $480,000

B) Net cash outflow $290,000

C) Net cash inflow $270,000

D) Net cash inflow $1,080,000

E) None of the given answers.

During the period Sonic Co Ltd issued debentures with a face value of $1,000,000 at a premium of $560,000. All transactions are in cash unless otherwise indicated. What is the net cash flow from financing activities for the period?

A) Net cash outflow $480,000

B) Net cash outflow $290,000

C) Net cash inflow $270,000

D) Net cash inflow $1,080,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

In accordance with AASB 107, what is the appropriate classification for the conversion of preference shares to ordinary shares?

A) inflow in investing activity

B) inflow in financing activity

C) non-cash investing item

D) non-cash financing item

E) None of the given answers

A) inflow in investing activity

B) inflow in financing activity

C) non-cash investing item

D) non-cash financing item

E) None of the given answers

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck