Deck 17: The Statement of Comprehensive Income and Statement of Changes in E

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 17: The Statement of Comprehensive Income and Statement of Changes in E

1

All expenses from operating activities must be classified according to either their nature or function:

False

2

Comprehensive income includes dividend payments to shareholders.

False

3

By focusing only on the income statement, we do not obtain a full picture of all the gains and losses that may have occurred for an entity during the perioD.

True

4

As part of the process of international harmonisation, standard setters have removed the need for professional judgement to be exercised in respect of expenses; all discretion that once existed has been removed.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

According to AASB 101, the income statement provides a total profit figure to which opening retained earnings is added and from which dividends are deducteD.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

If the exercise (strike) price of a call option is greater than the current share price, the option is said to be 'in-the-money':

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

The income statement under AASB 101 is designed to report all revenues and expenses to determine profit or loss.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

All disclosure requirements that relate to an entity's profit or loss are included in AASB 101:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

Profit is a measure of financial performance and therefore may not truly reflect the success or otherwise of an organisation:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

The choice between reporting expenses by nature or by function is extremely important, as different net profit figures are derived depending upon the choice made:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Total comprehensive income for the year is profit for the year plus comprehensive income.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

All adjustments to equity other than those related to transactions with owners in their capacity as owners are disclosed in the Statement of Comprehensive Income (AASB 101):

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

An item must be outside the ordinary operations of the business or be of a non-recurring nature to be classified as an extraordinary item under AASB 101:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 101 permits entities to present the components of other comprehensive income either before tax effects (gross presentation) or after their related tax effects (net presentation).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

Discovery of an error from a prior period corrected retrospectively is an example of an item reportable under other comprehensive income.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

In establishing the classification of items in the income statement, the size of an item is an appropriate basis for establishing a separate classification (by nature or function) for it:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

The income statement satisfies the requirements of the Corporations Act 2001 for a 'profit and loss statement':

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 101 requires profit or loss and the total comprehensive income for the period reported on the face of the statement of comprehensive income to be disaggregated between the non-controlling interest and the owners of the parent.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

AASB 101 permits an entity to present all items of income and expense recognised in a period to be presented in either the statement of comprehensive income or the income statement.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

AASB 2 requires that the fair value of the option issued as a share-based payment to an employee, be determined and this value be deemed to be the cost of the options:

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

'Comprehensive income' refers to:

A) The statement of total recognised income and expense.

B) The statement of changes in equity.

C) The net profit figure shown at the bottom of the income statement.

D) All of the given answers.

E) None of the given answers.

A) The statement of total recognised income and expense.

B) The statement of changes in equity.

C) The net profit figure shown at the bottom of the income statement.

D) All of the given answers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

Examples of classification of expenses by their nature are:

A) Employee expenses and distribution expenses.

B) Depreciation and marketing expenses.

C) Borrowing costs and distribution expenses.

D) Employee expenses and depreciation expenses.

E) None of the given answers.

A) Employee expenses and distribution expenses.

B) Depreciation and marketing expenses.

C) Borrowing costs and distribution expenses.

D) Employee expenses and depreciation expenses.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Estimations are frequently made in the income statement in relation to items such as bad debts, inventory obsolescence, an asset's useful life, and the expected pattern of consumption of economic benefits of depreciable assets. The effect of these estimations on the income statement is to:

A) Increase the variability of profits.

B) Make the statement unreliable.

C) Reduce the relevance of the profit figures reported.

D) All of the given answers.

E) None of the given answers.

A) Increase the variability of profits.

B) Make the statement unreliable.

C) Reduce the relevance of the profit figures reported.

D) All of the given answers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

The effect of a revision of an accounting estimate must be recognised in profit and loss in which reporting periods?

A) In the present, prior (by adjusting retained earnings) and future periods affected.

B) In the present and future periods affected.

C) In the present and prior reporting periods (by adjusting retained earnings).

D) Revisions to accounting estimates should not be recognised in any period.

E) None of the given answers.

A) In the present, prior (by adjusting retained earnings) and future periods affected.

B) In the present and future periods affected.

C) In the present and prior reporting periods (by adjusting retained earnings).

D) Revisions to accounting estimates should not be recognised in any period.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

Traditional financial accounting calculations of profit ignore the cost of externalities. One reason for this is:

A) Negative impacts on environmental resources not controlled by an entity (e.g. air and oceans) are not considered impacts on assets of the entity.

B) Negative impacts on environmental resources not controlled by an entity do not fall into the definition of extraordinary items.

C) Negative impacts on environmental resources not controlled by an entity may cover more than one future accounting period.

D) Negative impacts on environmental resources not controlled by an entity are by-products of ordinary activities and are not therefore disclosed in the income statement.

E) None of the given answers.

A) Negative impacts on environmental resources not controlled by an entity (e.g. air and oceans) are not considered impacts on assets of the entity.

B) Negative impacts on environmental resources not controlled by an entity do not fall into the definition of extraordinary items.

C) Negative impacts on environmental resources not controlled by an entity may cover more than one future accounting period.

D) Negative impacts on environmental resources not controlled by an entity are by-products of ordinary activities and are not therefore disclosed in the income statement.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

A statement displaying components of profit or loss is referred to in AASB 101 as a(n):

A) Profit and loss statement.

B) Statement of income.

C) Statement of financial performance.

D) Income statement.

E) None of the given answers.

A) Profit and loss statement.

B) Statement of income.

C) Statement of financial performance.

D) Income statement.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

Extraordinary items will be included in the income statement:

A) When they are material and need to be disclosed separately.

B) When an item of revenue or expense is attributable to an event outside the ordinary course of business.

C) When an expense or a revenue is of a non-recurring nature.

D) When an item of revenue or expense is attributable to an event outside the ordinary course of business and when an expense or a revenue is of a non-recurring nature.

E) None of the given answers.

A) When they are material and need to be disclosed separately.

B) When an item of revenue or expense is attributable to an event outside the ordinary course of business.

C) When an expense or a revenue is of a non-recurring nature.

D) When an item of revenue or expense is attributable to an event outside the ordinary course of business and when an expense or a revenue is of a non-recurring nature.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Where a change in accounting estimates occurs, the following should be disclosed.

A) The fact that the amount of the effect on future periods will not be disclosed because estimating that amount is impracticable.

B) The reason for the change and comparative data to show the impact with and without the change.

C) The nature of the change and the impact on previous income statements.

D) The fact that the amount of the effect on future periods will not be disclosed because estimating that amount is impracticable and the reason for the change and comparative data to show the impact with and without the change.

E) None of the given answers.

A) The fact that the amount of the effect on future periods will not be disclosed because estimating that amount is impracticable.

B) The reason for the change and comparative data to show the impact with and without the change.

C) The nature of the change and the impact on previous income statements.

D) The fact that the amount of the effect on future periods will not be disclosed because estimating that amount is impracticable and the reason for the change and comparative data to show the impact with and without the change.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

Under AASB 101 additional line items, headings and subtotals:

A) Are precluded as they provide unnecessary information that may confuse the user.

B) Shall be presented on the face of the statement when such presentation is relevant to an understanding of the entity's financial performance.

C) Shall be presented on the face of the statement when such items can be measured reliably and it is probable these events will occur.

D) Will only be included in the notes to the income statement if they are relevant to an understanding of the entity's financial performance.

E) None of the given answers.

A) Are precluded as they provide unnecessary information that may confuse the user.

B) Shall be presented on the face of the statement when such presentation is relevant to an understanding of the entity's financial performance.

C) Shall be presented on the face of the statement when such items can be measured reliably and it is probable these events will occur.

D) Will only be included in the notes to the income statement if they are relevant to an understanding of the entity's financial performance.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

The statement of changes in equity is required.

A) Because AASB 101 deals with income and does not define profit.

B) To show profit and loss for the period.

C) To summarise the large number of transactions that take place on the income statement.

D) To show each item of income and expense for the period that is recognised directly in equity as required by other AASB standards.

E) To provide a reconciliation of opening and closing equity, and also to provide details of the various equity accounts that are impacted by the period's total comprehensive income.

A) Because AASB 101 deals with income and does not define profit.

B) To show profit and loss for the period.

C) To summarise the large number of transactions that take place on the income statement.

D) To show each item of income and expense for the period that is recognised directly in equity as required by other AASB standards.

E) To provide a reconciliation of opening and closing equity, and also to provide details of the various equity accounts that are impacted by the period's total comprehensive income.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

The choice of classification between nature and function of expenses from ordinary activities depends on:

A) The size of the items that would be reported under the possible classifications.

B) The historical evidence about the probability of the items recurring.

C) The nature of the entity and historical and industry factors.

D) The classification that best reflects the way expenses vary directly or indirectly with the entity's level of activity.

E) None of the given answers.

A) The size of the items that would be reported under the possible classifications.

B) The historical evidence about the probability of the items recurring.

C) The nature of the entity and historical and industry factors.

D) The classification that best reflects the way expenses vary directly or indirectly with the entity's level of activity.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

An entity is required in AASB 101 to produce:

A) A statement of changes in equity.

B) A balance sheet.

C) An income statement.

D) A statement beginning with profit or loss and displaying components of other comprehensive income.

E) All of the given answers.

A) A statement of changes in equity.

B) A balance sheet.

C) An income statement.

D) A statement beginning with profit or loss and displaying components of other comprehensive income.

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

The notes to the accounts that relate to income and expense should include:

A) Only commentary on issues covered by AASB 101.

B) A variety of information that incorporates the disclosures required in all standards related to income and expenses.

C) Only information that would have resulted in a different profit or loss figure if it had been included on the face of the statement.

D) Only items that were deemed non-material when selecting items to place on the face of the accounts.

E) None of the given answers.

A) Only commentary on issues covered by AASB 101.

B) A variety of information that incorporates the disclosures required in all standards related to income and expenses.

C) Only information that would have resulted in a different profit or loss figure if it had been included on the face of the statement.

D) Only items that were deemed non-material when selecting items to place on the face of the accounts.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

Profit is not defined in the AASB Framework:

A) Because it is simply the difference between income and expenses, both of which are defined.

B) As it is an intangible item and therefore cannot be properly defined.

C) Because different measurement methods will give different profits, therefore there cannot be one definition.

D) As it is clearly defined under AASB 101.

E) None of the given answers.

A) Because it is simply the difference between income and expenses, both of which are defined.

B) As it is an intangible item and therefore cannot be properly defined.

C) Because different measurement methods will give different profits, therefore there cannot be one definition.

D) As it is clearly defined under AASB 101.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

Profit is:

A) An ideal measure of the 'well-offness' of a firm because income and expenses are clearly defined.

B) Only a measure of financial performance and therefore not useful in decision-making.

C) Directly affected by the accounting policy choices implemented by management.

D) Comparable across all firms as it is simply calculated by subtracting expense from revenues.

E) None of the given answers.

A) An ideal measure of the 'well-offness' of a firm because income and expenses are clearly defined.

B) Only a measure of financial performance and therefore not useful in decision-making.

C) Directly affected by the accounting policy choices implemented by management.

D) Comparable across all firms as it is simply calculated by subtracting expense from revenues.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

If it is found that an error had been made in a prior period.

A) The error should be rectified by including the item of income or expense in the period in which the error was discovered.

B) AASB 101 does not cover this concept and so no entry is required.

C) AASB 108 requires that errors are corrected via an adjustment to opening retained earnings.

D) Material errors discovered in the current reporting period must be included in that period's income statement, while non-material errors may be corrected with an adjustment to opening retained earnings.

E) None of the given answers.

A) The error should be rectified by including the item of income or expense in the period in which the error was discovered.

B) AASB 101 does not cover this concept and so no entry is required.

C) AASB 108 requires that errors are corrected via an adjustment to opening retained earnings.

D) Material errors discovered in the current reporting period must be included in that period's income statement, while non-material errors may be corrected with an adjustment to opening retained earnings.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

AASB 118 'Revenue' requires a number of disclosures, including information about:

A) Rents, interest, royalties and dividends.

B) Accounting policies adopted for the recognition of revenues.

C) Methods adopted to determine the stage of completion of contracts involving the rendering of services.

D) All of the given answers.

E) None of the given answers.

A) Rents, interest, royalties and dividends.

B) Accounting policies adopted for the recognition of revenues.

C) Methods adopted to determine the stage of completion of contracts involving the rendering of services.

D) All of the given answers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

Different measurement models affect the determination of income and expenses. The different measurement models include:

A) Historical cost, market value, present value.

B) Historical cost, direct costs, indirect costs.

C) Current cost, historical cost, overhead cost.

D) Market value, opportunity cost, historical cost.

E) None of the given answers.

A) Historical cost, market value, present value.

B) Historical cost, direct costs, indirect costs.

C) Current cost, historical cost, overhead cost.

D) Market value, opportunity cost, historical cost.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

Government departments are now required to report in accordance with AAS 29 'Financial reporting by government departments'. Opponents of this requirement suggest that:

A) it is not a good move as it makes managers to be more accountable for their department's performance.

B) it is not a good move, as it emphasises the use of cash accounting by government departments.

C) it is not a good move, as it distracts managers from pursuing their proper goals: the provision of social services.

D) it is not a good move as it introduces value added reporting.

E) All of the given answers.

A) it is not a good move as it makes managers to be more accountable for their department's performance.

B) it is not a good move, as it emphasises the use of cash accounting by government departments.

C) it is not a good move, as it distracts managers from pursuing their proper goals: the provision of social services.

D) it is not a good move as it introduces value added reporting.

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

Government departments are now required to report in accordance with AAS 29 'Financial reporting by government departments'. The broad effect of the requirements of this standard is to:

A) Emphasise the reporting of the service role of government departments.

B) Emphasise the use of cash accounting by government departments.

C) Introduce accrual accounting and an emphasis on profit.

D) Introduce value added reporting.

E) None of the given answers.

A) Emphasise the reporting of the service role of government departments.

B) Emphasise the use of cash accounting by government departments.

C) Introduce accrual accounting and an emphasis on profit.

D) Introduce value added reporting.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would not be considered a 'prior period error' for the purposes of AASB 108?

A) Mathematical mistakes.

B) Fraud.

C) Misinterpretations of fact.

D) Human error.

E) None of the given answers.

A) Mathematical mistakes.

B) Fraud.

C) Misinterpretations of fact.

D) Human error.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Paragraph 87 of AASB 101 lists some circumstances that may give rise to separate disclosure of items of income and expense. They include:

A) Reversals of inventory write-downs.

B) Extraordinary items.

C) Finance costs.

D) Distribution costs.

E) All of the given answers.

A) Reversals of inventory write-downs.

B) Extraordinary items.

C) Finance costs.

D) Distribution costs.

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not required to be shown on the face of the income statement?

A) Tax Expense.

B) Revenue.

C) Share of profit or loss of joint ventures using the equity method.

D) Profit or loss attributable to minority interests.

E) Share of profit or loss of joint ventures using the proportional consolidation method.

A) Tax Expense.

B) Revenue.

C) Share of profit or loss of joint ventures using the equity method.

D) Profit or loss attributable to minority interests.

E) Share of profit or loss of joint ventures using the proportional consolidation method.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

When selecting a presentation format management must select the one that is:

A) The most relevant.

B) The most reliable.

C) The most consistent.

D) The most useful to management.

E) The most relevant and the most reliable.

A) The most relevant.

B) The most reliable.

C) The most consistent.

D) The most useful to management.

E) The most relevant and the most reliable.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

The problem with a "blanket rule" requiring all expenditure of a particular type to be written off as incurred (e.g., expenditure on research), is:

A) that it is too much like US GAAP.

B) it does not enable readers of financial reports to differentiate between entities that have generated future economic benefits from particular activities and those who have not.

C) it does not enable readers of financial reports to differentiate between entities that have managed their earnings and those who have not.

D) it does not enable readers of financial reports to differentiate between entities that are going to continue to be successful and those who are not.

E) it does not enable readers of financial reports to make their own judgements about the future worth of the entity.

A) that it is too much like US GAAP.

B) it does not enable readers of financial reports to differentiate between entities that have generated future economic benefits from particular activities and those who have not.

C) it does not enable readers of financial reports to differentiate between entities that have managed their earnings and those who have not.

D) it does not enable readers of financial reports to differentiate between entities that are going to continue to be successful and those who are not.

E) it does not enable readers of financial reports to make their own judgements about the future worth of the entity.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

An income statement that includes the following items:

Revenue

Cost of Sales

Selling Expenses

Financial Expenses

Would have been prepared using the:

A) Nature of expense method.

B) Narrative method.

C) Revenues and gains approach.

D) The function of expense approach.

E) None of the given answers.

Revenue

Cost of Sales

Selling Expenses

Financial Expenses

Would have been prepared using the:

A) Nature of expense method.

B) Narrative method.

C) Revenues and gains approach.

D) The function of expense approach.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

AASB 2 lists a number of factors that need to be considered when valuing an executive share option. They include:

A) The expected volatility of the share price.

B) The exercise price of the share.

C) The life of the underlying share.

D) The expected volatility of the share price and the exercise price of the share.

E) The expected volatility of the share price, the exercise price of the share and the life of the underlying share

A) The expected volatility of the share price.

B) The exercise price of the share.

C) The life of the underlying share.

D) The expected volatility of the share price and the exercise price of the share.

E) The expected volatility of the share price, the exercise price of the share and the life of the underlying share

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

An implication of the fact that traditional financial accounting is based on a model that emphasises property rights is:

A) fair values become of critical importance.

B) that such rights are recognised as intangible assets.

C) many social costs are ignored.

D) that these financial reports are always prepared on a 'true and fair' basis.

E) that auditors have an easier job in verifying financial statements.

A) fair values become of critical importance.

B) that such rights are recognised as intangible assets.

C) many social costs are ignored.

D) that these financial reports are always prepared on a 'true and fair' basis.

E) that auditors have an easier job in verifying financial statements.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following items is not an example of items reportable under other comprehensive income?

A) Changes in revaluation surplus;

B) Actuarial gains and losses on defined contribution plans;

C) Gains and losses arising from translating the financial statements of a foreign operation;

D) The effective portion of gains and losses on hedging instruments in a cash flow hedge;

E) All of the given answers.

A) Changes in revaluation surplus;

B) Actuarial gains and losses on defined contribution plans;

C) Gains and losses arising from translating the financial statements of a foreign operation;

D) The effective portion of gains and losses on hedging instruments in a cash flow hedge;

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

When there is a change made to the useful life of an asset:

A) it must be recognised as a change in an accounting estimate and the impact of the reported change must be disclosed in the notes to the accounts.

B) it must be recognised as an error and all previous financial statements must be restated.

C) it must be recognised as an error and opening retained earnings and opening balances of the asset must be restated.

D) it is recognised as a change in an accounting estimate and the opening retained earnings and opening balances of the asset must be restated.

E) it is ignored.

A) it must be recognised as a change in an accounting estimate and the impact of the reported change must be disclosed in the notes to the accounts.

B) it must be recognised as an error and all previous financial statements must be restated.

C) it must be recognised as an error and opening retained earnings and opening balances of the asset must be restated.

D) it is recognised as a change in an accounting estimate and the opening retained earnings and opening balances of the asset must be restated.

E) it is ignored.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

Reports in the financial press that a particular company reported healthy profits despite increased wage costs are indicative of:

A) The negative impact of reporting payments to employees as expenses while payments to owners are treated as distributions of profits.

B) The implied emphasis on the returns to owners being good and returns to other stakeholders such as employees as being bad.

C) The effect of reporting employees as expenses and not reporting the social costs of unemployment on decisions to restructure companies to reduce the work force.

D) The way accounting reflects and helps to re-create widely held views about the roles of various stakeholders in the entity.

E) All of the given answers.

A) The negative impact of reporting payments to employees as expenses while payments to owners are treated as distributions of profits.

B) The implied emphasis on the returns to owners being good and returns to other stakeholders such as employees as being bad.

C) The effect of reporting employees as expenses and not reporting the social costs of unemployment on decisions to restructure companies to reduce the work force.

D) The way accounting reflects and helps to re-create widely held views about the roles of various stakeholders in the entity.

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

Hicks' notion of income is that:

A) An individual's income is what they consume.

B) An individual's income is the minimum value that they can consume during a period and still be as well off at the end as they were in the beginning.

C) An individual's income is the difference between their revenues and expenses.

D) An individual's income is the maximum value that they can consume during a period and still be as well off at the end as they were in the beginning.

E) None of the given answers.

A) An individual's income is what they consume.

B) An individual's income is the minimum value that they can consume during a period and still be as well off at the end as they were in the beginning.

C) An individual's income is the difference between their revenues and expenses.

D) An individual's income is the maximum value that they can consume during a period and still be as well off at the end as they were in the beginning.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Total recognised income and expense is also defined as:

A) Net profit reported in the income statement.

B) Net operating cash flows reported on the cash flow statement.

C) Net profit reported on the income statement, plus total of all income and expenses recognised directly in equity.

D) Net operating cash flows reported on the cash flow statement, plus total of all income and expenses recognised directly in equity.

E) Net operating cash flows reported on the cash flow statement, plus net profit reported in the income statement.

A) Net profit reported in the income statement.

B) Net operating cash flows reported on the cash flow statement.

C) Net profit reported on the income statement, plus total of all income and expenses recognised directly in equity.

D) Net operating cash flows reported on the cash flow statement, plus total of all income and expenses recognised directly in equity.

E) Net operating cash flows reported on the cash flow statement, plus net profit reported in the income statement.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is not in accordance with AASB 101 "Presentation of Financial Statements" with respect to the statement of comprehensive income?

A) All items of income and expense recognised in a period are to be presented in a single statement of comprehensive income;

B) All items of income and expense recognised in a period are permitted to be presented in two statements: 1) a separate income statement and 2) a statement beginning with profit or loss and displaying components of other comprehensive income;

C) An entity shall present an analysis of expenses in profit or loss using a classification based on either the nature of expenses or their function within the entity, whichever provides information that is reliable and more relevant;

D) Components of other comprehensive income include gain on sale of property plant and equipment;

E) All of the given answers.

A) All items of income and expense recognised in a period are to be presented in a single statement of comprehensive income;

B) All items of income and expense recognised in a period are permitted to be presented in two statements: 1) a separate income statement and 2) a statement beginning with profit or loss and displaying components of other comprehensive income;

C) An entity shall present an analysis of expenses in profit or loss using a classification based on either the nature of expenses or their function within the entity, whichever provides information that is reliable and more relevant;

D) Components of other comprehensive income include gain on sale of property plant and equipment;

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is not in accordance with AASB 101 "Presentation of Financial Statements" with respect to the statement of comprehensive income?

A) An entity shall not present any items of income or expense as extraordinary items, in the statement of comprehensive income or the separate income statement (if presented), or in the notes.

B) An entity shall disclose the amount of income tax relating to each component of other comprehensive income, including reclassification adjustments, either in the statement of comprehensive income or in the notes.

C) As a minimum, the statement of comprehensive income shall include line items of each component of other comprehensive income classified by nature.

D) An entity shall recognise all items of income and expense in a period in profit or loss unless an Australian Accounting Standard requires or permits otherwise. For example, the financial effect of changes in accounting estimates.

E) All of the given answers.

A) An entity shall not present any items of income or expense as extraordinary items, in the statement of comprehensive income or the separate income statement (if presented), or in the notes.

B) An entity shall disclose the amount of income tax relating to each component of other comprehensive income, including reclassification adjustments, either in the statement of comprehensive income or in the notes.

C) As a minimum, the statement of comprehensive income shall include line items of each component of other comprehensive income classified by nature.

D) An entity shall recognise all items of income and expense in a period in profit or loss unless an Australian Accounting Standard requires or permits otherwise. For example, the financial effect of changes in accounting estimates.

E) All of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not a required disclosure pertaining to payments made to auditors?

A) The amounts paid to an auditor for an audit of financial reports.

B) The amounts payable to an auditor for a review of financial reports.

C) The amounts paid to assurors of corporate sustainability reports.

D) The nature of each of the non-audit services provided by the auditor.

E) The amount of each of the non-audit services provided by the auditor.

A) The amounts paid to an auditor for an audit of financial reports.

B) The amounts payable to an auditor for a review of financial reports.

C) The amounts paid to assurors of corporate sustainability reports.

D) The nature of each of the non-audit services provided by the auditor.

E) The amount of each of the non-audit services provided by the auditor.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

When items of income and expense are material, and their nature and amount are separately disclosed, this could indicate the existence of:

A) An extraordinary item.

B) An abnormal item.

C) An adjusting item.

D) An unusual item.

E) A major item.

A) An extraordinary item.

B) An abnormal item.

C) An adjusting item.

D) An unusual item.

E) A major item.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

An income statement that includes the following items:

Revenue

Other Income

Employee Benefits and Costs

Motor Vehicle Expenses

Would have been prepared using the:

A) Nature of expense method.

B) Narrative method.

C) Revenues and gains approach.

D) The function of expense approach.

E) None of the given answers.

Revenue

Other Income

Employee Benefits and Costs

Motor Vehicle Expenses

Would have been prepared using the:

A) Nature of expense method.

B) Narrative method.

C) Revenues and gains approach.

D) The function of expense approach.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

Profit is calculated as the difference between income and expenses as defined by the AASB Framework. As a result:

A) The matching principle is of prime importance in calculating profit.

B) Profit is influenced directly by the definitions and measurement rules for assets and liabilities.

C) There is no need for separate recognition criteria for profit.

D) Profit is influenced directly by the definitions and measurement rules for assets and liabilities and there is no need for separate recognition criteria for profit.

E) None of the given answers.

A) The matching principle is of prime importance in calculating profit.

B) Profit is influenced directly by the definitions and measurement rules for assets and liabilities.

C) There is no need for separate recognition criteria for profit.

D) Profit is influenced directly by the definitions and measurement rules for assets and liabilities and there is no need for separate recognition criteria for profit.

E) None of the given answers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

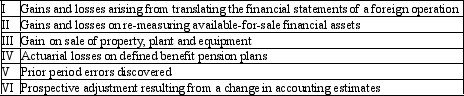

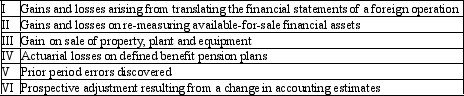

Following are the items of income and expense recognised during the period by Gordon Field LtD.

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

A) I, II, IV, V and VI;

B) I, II, IV, and V;

C) II, III, V and VI;

D) II, V and VI;

E) III, V and VI;

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

A) I, II, IV, V and VI;

B) I, II, IV, and V;

C) II, III, V and VI;

D) II, V and VI;

E) III, V and VI;

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following items does not give rise to a reclassification adjustment from components of other comprehensive income to profit and loss?

A) Disposal of a foreign operation;

B) De-recognition of revalued assets;

C) Sale of a foreign subsidiary;

D) De-recognition of available-for sale financial assets;

E) Cash flow hedge forecast transaction that affects profit or loss.

A) Disposal of a foreign operation;

B) De-recognition of revalued assets;

C) Sale of a foreign subsidiary;

D) De-recognition of available-for sale financial assets;

E) Cash flow hedge forecast transaction that affects profit or loss.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

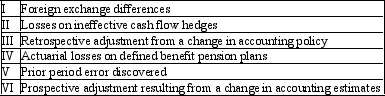

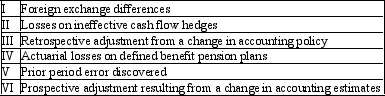

Following are the items of income and expense recognised during the period by Murray LtD.

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

A) I, II, V and VI;

B) II, III, VI and V;

C) I, III, and VI;

D) II, IV and VI

E) III, IV and V;

Which of the following combinations identify all items permitted in AASB 101 "Presentation of Financial Statements" to be presented under other comprehensive income?

A) I, II, V and VI;

B) II, III, VI and V;

C) I, III, and VI;

D) II, IV and VI

E) III, IV and V;

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck