Deck 12: Set-Off and Extinguishment of Debt

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 12: Set-Off and Extinguishment of Debt

1

AASB 132 only allows assets and liabilities to be offset against one another if a legally recognised right to set-off exists for these items:

True

2

A right of set-off is a debtor's legal right, by contract or otherwise, to settle or otherwise eliminate all or a portion of an amount due to a creditor by applying against that amount an amount due from the creditor.

True

3

A right of set-off may still be applied in the case of Insubstance Debt Defeasance (ISDD) if the entity intends to settle on a net basis, or to realise the asset and settle the liability simultaneously.

False

4

In a set-off, the gearing ratio of the entity is usually increased.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

Legal defeasance is not addressed in AASB 132 and will no longer be used in Australia.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

The definition of a set-off is that an asset is reduced by the amount of a liability and a net liability remains:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

Release from the primary obligation for a debt may be achieved by replacement by another debt:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

The existence of a right to set off:

A) Is sufficient to allow set off of a financial asset and financial liability.

B) Does not have to be enforceable at law to allow set off of a financial asset and financial liability.

C) Is not sufficient to allow set off of a financial asset and financial liability, without the intention to set off and legal enforceability of the right to set off.

D) Is not discussed in AASB 132.

E) None of the given answers.

A) Is sufficient to allow set off of a financial asset and financial liability.

B) Does not have to be enforceable at law to allow set off of a financial asset and financial liability.

C) Is not sufficient to allow set off of a financial asset and financial liability, without the intention to set off and legal enforceability of the right to set off.

D) Is not discussed in AASB 132.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

One of the requirements for setting off in AASB 132 is the intention to offset. Which of the following statements about the "intention to set off" is correct?

A) The intention to offset is only required where the legal right to set-off is disputed.

B) Without the intention to offset the past cash flows of the entity will not be affected.

C) The intention of both parties to settle is insufficient unless a legal right exists.

D) Must be stipulated in writing for it to apply under ASB 132.

E) None of the given answers.

A) The intention to offset is only required where the legal right to set-off is disputed.

B) Without the intention to offset the past cash flows of the entity will not be affected.

C) The intention of both parties to settle is insufficient unless a legal right exists.

D) Must be stipulated in writing for it to apply under ASB 132.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

Debt extinguishment occurs when a liability can no longer be considered a primary obligation for an entity:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

Under the old AASB 1014 the debt-holder(s) may not be aware that a debt defeasance scheme is in place:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

Insubstance debt defeasance refers to an arrangement where assets are placed in trust, meaning that the creditor has now been paid in full:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

The changes under AASB 132 have removed the need for creditors to be involved in the defeasance process:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

The "Offsetting" in AASB 132 "Financial Instruments: Presentation" is similar to "derecognition" in AASB 139.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

Reasons provided in AASB 132 for the required treatment of the set-off of assets and liabilities include:

A) The gross basis is generally preferred, except in the situation outlined because the parties to the arrangement have a legal obligation that takes precedence over reporting form.

B) Setting off an obligation against an asset in the circumstances described allows the entity to manage its risk exposure and should be encouraged by reporting requirements.

C) While the gross basis shows more accurately the detailed transaction, the effect on ratios that may be used to analyse the financial statements of the reporting entity means that they will no longer reflect the economic substance of the arrangement.

D) The presentation of the asset and the liability on a net basis reflects more appropriately the amounts and timing of future cash flows.

E) None of the given answers.

A) The gross basis is generally preferred, except in the situation outlined because the parties to the arrangement have a legal obligation that takes precedence over reporting form.

B) Setting off an obligation against an asset in the circumstances described allows the entity to manage its risk exposure and should be encouraged by reporting requirements.

C) While the gross basis shows more accurately the detailed transaction, the effect on ratios that may be used to analyse the financial statements of the reporting entity means that they will no longer reflect the economic substance of the arrangement.

D) The presentation of the asset and the liability on a net basis reflects more appropriately the amounts and timing of future cash flows.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

AASB 132 "Financial Instruments: Presentation" supports a substance over from approach in the accounting treatment for Insubstance Debt Defeasance (ISDD).

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

The term defeasance means the setting off of one thing against another:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

AASB 132 allows for all types of assets and liabilities to be offset as long as the entity intends to settle on a net basis:

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

What is the AASB 132 requirement in relation to debt set-off?

A) That assets and liabilities may only be set-off against each other for balance sheet purposes if the asset and liability are classified as current and there is agreement with the other party to the liability, either legal or constructive, that the asset and liability are to be set-off.

B) That assets and liabilities be set-off against each other for balance sheet purposes when a legally recognised right of set-off for these items exists and the reporting entity intends to settle on that basis, or to realise the asset and settle the liability simultaneously.

C) That assets and liabilities be set-off against each other for balance sheet purposes when the reporting entity intends to realise an asset and settle a related liability simultaneously.

D) That assets and liabilities may only be set-off against each other for balance sheet purposes when there is a legal arrangement to set-off a financial asset and a financial liability and the other party to the liability agrees to the right to set-off.

E) None of the given answers.

A) That assets and liabilities may only be set-off against each other for balance sheet purposes if the asset and liability are classified as current and there is agreement with the other party to the liability, either legal or constructive, that the asset and liability are to be set-off.

B) That assets and liabilities be set-off against each other for balance sheet purposes when a legally recognised right of set-off for these items exists and the reporting entity intends to settle on that basis, or to realise the asset and settle the liability simultaneously.

C) That assets and liabilities be set-off against each other for balance sheet purposes when the reporting entity intends to realise an asset and settle a related liability simultaneously.

D) That assets and liabilities may only be set-off against each other for balance sheet purposes when there is a legal arrangement to set-off a financial asset and a financial liability and the other party to the liability agrees to the right to set-off.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

A futures contract is an example of a financial instrument where the net amount of a financial asset and a financial liability may be presented in the statement of financial position.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

When a debt is forgiven the accounting treatment is to:

A) Debit the liability; credit a deferred benefit account.

B) Credit a gain on release account; debit the liability.

C) Debit the gain on release account; credit the liability.

D) Debit a deferred benefit account; credit a debt defeasance account.

E) None of the given answers.

A) Debit the liability; credit a deferred benefit account.

B) Credit a gain on release account; debit the liability.

C) Debit the gain on release account; credit the liability.

D) Debit a deferred benefit account; credit a debt defeasance account.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

In relation to applying an amount due from a third party in a "set-off" situation, AASB 132 notes:

A) That it is never permitted.

B) That it is permitted only where the third party is a subsidiary of one of the other two parties.

C) That it is permitted where there exists an agreement between the three parties that clearly establishes the right to set off.

D) That it is only permitted where all three parties are part of the same consolidated group.

E) That it is permitted only under circumstances where the third party is in administration and it is part of a debt forgiveness program.

A) That it is never permitted.

B) That it is permitted only where the third party is a subsidiary of one of the other two parties.

C) That it is permitted where there exists an agreement between the three parties that clearly establishes the right to set off.

D) That it is only permitted where all three parties are part of the same consolidated group.

E) That it is permitted only under circumstances where the third party is in administration and it is part of a debt forgiveness program.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

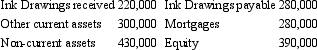

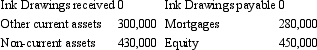

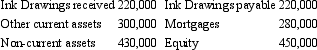

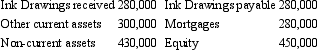

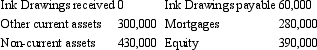

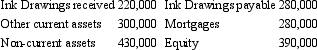

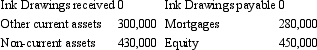

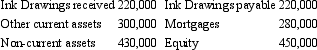

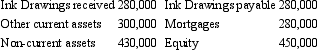

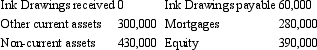

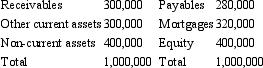

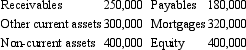

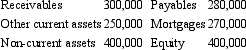

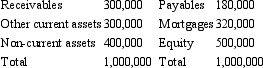

Cartoons and Co's balance sheet is shown below.

Assuming a right to set-off exist with Ink Drawings Ltd, the balance sheet after set-off will be:

A)

B)

C)

D)

E) None of the given answers.

Assuming a right to set-off exist with Ink Drawings Ltd, the balance sheet after set-off will be:

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

If the conditions for set off were initially met, and in a later period cease to be met, the debt remaining is to be:

A) Reinstated in the balance sheet.

B) Grossed up to the original amounts, and reported in the balance sheet pre-tax.

C) Written off immediately as an expense in the income statement.

D) Subject to ongoing review by the firm.

E) Transferred to the Australian Taxation Office, who will determine the fate of the debt.

A) Reinstated in the balance sheet.

B) Grossed up to the original amounts, and reported in the balance sheet pre-tax.

C) Written off immediately as an expense in the income statement.

D) Subject to ongoing review by the firm.

E) Transferred to the Australian Taxation Office, who will determine the fate of the debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not one of the advantages that were previously available when the insubstance defeasance of debt was allowable?

A) It provided a tool to 'manage' company earnings.

B) Restrictive limitations imposed by the trustee for debenture holders can be relaxed by reducing the amount of debt.

C) It allowed debt to be retired with reference to specific individual debt-holders.

D) It allowed strategic rethinking of business policies.

E) The effect of forcing up the market price of desired securities, when a company attempts to buy back debt, can be reduced.

A) It provided a tool to 'manage' company earnings.

B) Restrictive limitations imposed by the trustee for debenture holders can be relaxed by reducing the amount of debt.

C) It allowed debt to be retired with reference to specific individual debt-holders.

D) It allowed strategic rethinking of business policies.

E) The effect of forcing up the market price of desired securities, when a company attempts to buy back debt, can be reduced.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

A legal defeasance may occur as a result of:

A) Legal judgement, assumption of the debt by a third party or forgiveness of the debt.

B) The issuance of a guarantee by the debtor, the assumption of the debt by the lender, legal judgement or the repayment of the debt.

C) The issuance of an indemnity by a related company, or the forgiveness of the debt by the borrower.

D) The assumption of the debt by a related company, legal judgement, or the forgiveness of the debt by the borrower.

E) None of the given answers.

A) Legal judgement, assumption of the debt by a third party or forgiveness of the debt.

B) The issuance of a guarantee by the debtor, the assumption of the debt by the lender, legal judgement or the repayment of the debt.

C) The issuance of an indemnity by a related company, or the forgiveness of the debt by the borrower.

D) The assumption of the debt by a related company, legal judgement, or the forgiveness of the debt by the borrower.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

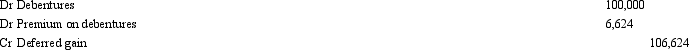

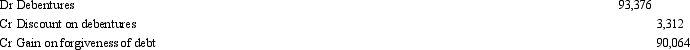

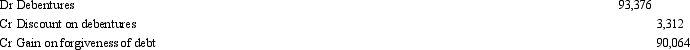

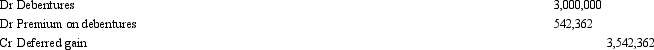

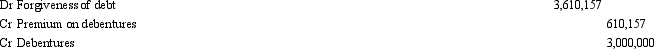

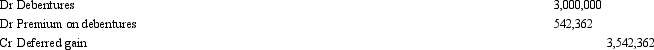

Practical Ltd issued $100,000 in 4-year, 6 per cent annual debentures for Theoretical Ltd on 1 July 2002. The market required rate of return on the debentures at the time of issue was 8 per cent. Theoretical Ltd decides to forgive the debt on 1 July 2004. Any premium or discount is amortised straight-line. What is the entry in the books of Theoretical Ltd to record the forgiveness of the debt?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

The effect of setting off on the gearing ratio of the reporting entity is to:

A) Increase it if the net amount is a liability.

B) Increase it if the net amount is an asset.

C) Decrease it.

D) Leave it unchanged.

E) None of the given answers.

A) Increase it if the net amount is a liability.

B) Increase it if the net amount is an asset.

C) Decrease it.

D) Leave it unchanged.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

Insubstance debt defeasance was defined in the former AASB 1014 as:

A) A type of legal defeasance in which a designated third entity assumes responsibility for the debt or a suitable legal arrangement is created to ensure that the debt is serviced and this is guaranteed by the debtor entity.

B) A defeasance, other than a legal defeasance, in which the debtor effectively achieves release from the primary obligation for a debt by placing in trust assets that are adequate to meet the servicing requirements (both interest and principal) of the debt or by having a suitable entity assume responsibility for those servicing requirements.

C) A defeasance, including a legal defeasance, in which the debtor effectively achieves release from the requirement to meet the interest and principal repayments on a debt by arranging for a suitable entity to assume the debt.

D) A defeasance where the substance of the arrangement is equivalent to a legal defeasance in that the primary obligation for the debt is assumed by a designated third party with the knowledge and permission of the lender.

E) None of the given answers.

A) A type of legal defeasance in which a designated third entity assumes responsibility for the debt or a suitable legal arrangement is created to ensure that the debt is serviced and this is guaranteed by the debtor entity.

B) A defeasance, other than a legal defeasance, in which the debtor effectively achieves release from the primary obligation for a debt by placing in trust assets that are adequate to meet the servicing requirements (both interest and principal) of the debt or by having a suitable entity assume responsibility for those servicing requirements.

C) A defeasance, including a legal defeasance, in which the debtor effectively achieves release from the requirement to meet the interest and principal repayments on a debt by arranging for a suitable entity to assume the debt.

D) A defeasance where the substance of the arrangement is equivalent to a legal defeasance in that the primary obligation for the debt is assumed by a designated third party with the knowledge and permission of the lender.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

Insubstance debt defeasance is no longer allowed under AASB 132:

A) Because this form of defeasance is no longer used in Australia.

B) Because the new standard takes a form over substance approach.

C) Because it is inappropriate to extinguish a debt where the discharge of the obligation has been accepted by the creditor.

D) Because this type of action requires the offsetting of financial assets and liabilities in circumstances not allowed under AASB 1014.

E) None of the given answers.

A) Because this form of defeasance is no longer used in Australia.

B) Because the new standard takes a form over substance approach.

C) Because it is inappropriate to extinguish a debt where the discharge of the obligation has been accepted by the creditor.

D) Because this type of action requires the offsetting of financial assets and liabilities in circumstances not allowed under AASB 1014.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

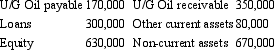

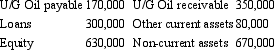

Pump It Up Ltd owes Under Ground Oil $170 000 and Under Ground Oil owes Pump It Up Ltd $350 000. Pump It Up Ltd's financial position before these amounts are set-off is:

What is the debt/equity ratio for Pump It Up Ltd before and after set-off?

A) Before set-off: 75 per cent; after set-off: 47 per cent

B) Before set-off: 43 per cent; after set-off: 27 per cent

C) Before set-off: 134 per cent; after set-off: 210 per cent

D) Before set-off: 43 per cent; after set-off: 32 per cent

E) None of the given answers.

What is the debt/equity ratio for Pump It Up Ltd before and after set-off?

A) Before set-off: 75 per cent; after set-off: 47 per cent

B) Before set-off: 43 per cent; after set-off: 27 per cent

C) Before set-off: 134 per cent; after set-off: 210 per cent

D) Before set-off: 43 per cent; after set-off: 32 per cent

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

"Legal defeasance":

A) Is not permitted under AASB 132.

B) Is a term explicitly used in AASB 132.

C) Is still acceptable under AASB 132.

D) Is not defined in the former AASB 1014.

E) All of the given answers.

A) Is not permitted under AASB 132.

B) Is a term explicitly used in AASB 132.

C) Is still acceptable under AASB 132.

D) Is not defined in the former AASB 1014.

E) All of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

There were two methods of achieving an insubstance debt defeasance in accordance with the former AASB 1014's requirements:

A) Having a risk-free entity assume responsibility for the debt or placing in trust assets adequate to meet the principal and interest servicing requirements of the debt.

B) Obtaining forgiveness of the debt or having a related entity assume the responsibility for the debt.

C) Having a related entity assume the debt or obtaining a legal judgement to extinguish the debt.

D) Placing sufficient assets in a secure offshore entity such that it is virtually certain that the responsibility for the debt will not revert to the reporting entity, or having a suitable entity assume responsibility for the debt.

E) None of the given answers.

A) Having a risk-free entity assume responsibility for the debt or placing in trust assets adequate to meet the principal and interest servicing requirements of the debt.

B) Obtaining forgiveness of the debt or having a related entity assume the responsibility for the debt.

C) Having a related entity assume the debt or obtaining a legal judgement to extinguish the debt.

D) Placing sufficient assets in a secure offshore entity such that it is virtually certain that the responsibility for the debt will not revert to the reporting entity, or having a suitable entity assume responsibility for the debt.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

A financial asset is:

A) Cash.

B) A contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially favourable to the entity.

C) A contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially unfavourable to the entity.

D) Cash and a contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially favourable to the entity.

E) Cash and a contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially unfavourable to the entity.

A) Cash.

B) A contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially favourable to the entity.

C) A contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially unfavourable to the entity.

D) Cash and a contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially favourable to the entity.

E) Cash and a contractual right to exchange financial assets and financial liabilities with another entity under conditions that are potentially unfavourable to the entity.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

The former AASB 1014 required that if a trust was established to assume the responsibility for a debt in an insubstance debt defeasance, that trust must:

A) Be under the control of the debtor entity and have enough securities issued by a credit-worthy government to ensure that there is a very low probability that the debtor entity will have any further obligation in relation to the debt.

B) Be a company set up under the relevant state and federal statutes to administer the risk-free assets that are to be used to release the debtor entity from the primary obligation for the debt.

C) Have risk-free assets irrevocably transferred to it, which are of a type suited to the amount and timing so as to meet the servicing requirements of the debt..

D) Be a government-guaranteed financial institution that is required to report annually to the Australian Securities and Investments Commission.

E) None of the given answers.

A) Be under the control of the debtor entity and have enough securities issued by a credit-worthy government to ensure that there is a very low probability that the debtor entity will have any further obligation in relation to the debt.

B) Be a company set up under the relevant state and federal statutes to administer the risk-free assets that are to be used to release the debtor entity from the primary obligation for the debt.

C) Have risk-free assets irrevocably transferred to it, which are of a type suited to the amount and timing so as to meet the servicing requirements of the debt..

D) Be a government-guaranteed financial institution that is required to report annually to the Australian Securities and Investments Commission.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

Release from the primary obligation of a debt may theoretically be achieved by:

A) Settlement of the debt.

B) Forgiveness of the debt.

C) Insubstance defeasance.

D) Assumption by a third party.

E) All of the given answers.

A) Settlement of the debt.

B) Forgiveness of the debt.

C) Insubstance defeasance.

D) Assumption by a third party.

E) All of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

The conditions that were required by the former AASB 1014 to be satisfied in order to achieve an insubstance debt defeasance using a trust include:

A) Irrevocably transfer risk-free assets to a trust, the trustees of which are independent, and remain independent, of the entity, and which is solely used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

B) The assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements.

C) Irrevocably transfer risk-free assets to a trust, the trustees of which are controlled by the entity, and which is mainly used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

D) Irrevocably transfer risk-free assets to a trust, the trustees of which are independent, and remain independent, of the entity, and which is solely used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt and the assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements.

E) The assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements and irrevocably transfer risk-free assets to a trust, the trustees of which are controlled by the entity, and which is mainly used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

A) Irrevocably transfer risk-free assets to a trust, the trustees of which are independent, and remain independent, of the entity, and which is solely used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

B) The assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements.

C) Irrevocably transfer risk-free assets to a trust, the trustees of which are controlled by the entity, and which is mainly used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

D) Irrevocably transfer risk-free assets to a trust, the trustees of which are independent, and remain independent, of the entity, and which is solely used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt and the assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements.

E) The assets transferred to the trust must be of an amount and type suited to the amount and timing of both the principal and interest servicing requirements and irrevocably transfer risk-free assets to a trust, the trustees of which are controlled by the entity, and which is mainly used for administering those assets so as to meet the servicing requirements (both interest and principal) of the debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

In AASB 132, the ability to set off makes reference to:

A) All assets and liabilities.

B) Financial assets and financial liabilities.

C) Current assets and current liabilities.

D) Preference shares and convertible notes.

E) Assets and liabilities of an amount above the materiality threshold.

A) All assets and liabilities.

B) Financial assets and financial liabilities.

C) Current assets and current liabilities.

D) Preference shares and convertible notes.

E) Assets and liabilities of an amount above the materiality threshold.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

A debt cannot be considered extinguished, and therefore removed from the balance sheet, unless:

A) It is not likely that the reporting entity will be required to assume the debt-servicing requirements of the loan and it has not otherwise guaranteed the servicing of the debt.

B) The probability that the reporting entity will be required to repay the principal and interest remaining under the conditions of the debt is so low as to be considered virtually impossible.

C) It is highly improbable that the reporting entity will be required to assume again the primary obligation for the debt-servicing requirements or to satisfy any guarantee, indemnity or similar relating to such requirements.

D) The possibility of the reporting entity being required to assume responsibility for the debt is considered remote.

E) None of the given answers.

A) It is not likely that the reporting entity will be required to assume the debt-servicing requirements of the loan and it has not otherwise guaranteed the servicing of the debt.

B) The probability that the reporting entity will be required to repay the principal and interest remaining under the conditions of the debt is so low as to be considered virtually impossible.

C) It is highly improbable that the reporting entity will be required to assume again the primary obligation for the debt-servicing requirements or to satisfy any guarantee, indemnity or similar relating to such requirements.

D) The possibility of the reporting entity being required to assume responsibility for the debt is considered remote.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

Businesses may be prepared to incur a loss on the defeasance of debt because:

A) It increases the certainty that the debt will be paid.

B) It is a means of eliminating the restrictive effects of any associated debt covenants.

C) It provides future reserves of assets that may be drawn upon when needed.

D) It increases the certainty that the debt will be paid and it provides future reserves of assets that may be drawn upon when needed.

E) None of the given answers.

A) It increases the certainty that the debt will be paid.

B) It is a means of eliminating the restrictive effects of any associated debt covenants.

C) It provides future reserves of assets that may be drawn upon when needed.

D) It increases the certainty that the debt will be paid and it provides future reserves of assets that may be drawn upon when needed.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is correct with respect to set-off of assets and liabilities?

A) If a right of set-off exists, an entity shall disclose the net amount of the financial assets and the financial liability in the notes to the accounts.

B) If a right of set-off exists, an entity shall disclose the net amount of the financial assets and the financial liability in income statement.

C) If a right of set-off exists, an entity shall present the net amount of the financial assets and the financial liability in the statement of financial position.

D) If a right of set-off exists, an entity shall present the net amount of the financial assets and the financial liability in income statement.

E) None of the given answers.

A) If a right of set-off exists, an entity shall disclose the net amount of the financial assets and the financial liability in the notes to the accounts.

B) If a right of set-off exists, an entity shall disclose the net amount of the financial assets and the financial liability in income statement.

C) If a right of set-off exists, an entity shall present the net amount of the financial assets and the financial liability in the statement of financial position.

D) If a right of set-off exists, an entity shall present the net amount of the financial assets and the financial liability in income statement.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

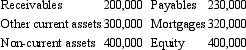

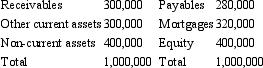

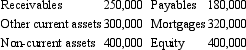

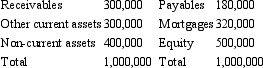

Lynne and Tom Ltd's statement of financial position is shown below.

The above balances include a receivable from Melinda Ltd for an amount of $100,000 and a payable to Melinda Ltd for $50,000.

Assuming a right to set-off exists with Melinda Ltd the balances on the statement of financial position of Lynne and Tom Ltd after set-off will be:

A)

B)

C)

D)

E) None of the given answers.

The above balances include a receivable from Melinda Ltd for an amount of $100,000 and a payable to Melinda Ltd for $50,000.

Assuming a right to set-off exists with Melinda Ltd the balances on the statement of financial position of Lynne and Tom Ltd after set-off will be:

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

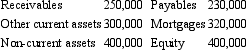

43

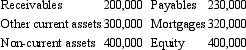

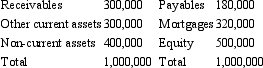

Claudia Ltd's statement of financial position is shown below.

The above balances include a receivable from Jeremy Ltd for an amount of $100,000 and a payable to Jeremy Ltd for $50,000. A debt contract with ABC Bank signed by Claudia Ltd requires a debt equity ratio of no more than 50%.

Assuming a right to set-off exists with Jeremy Ltd, what is the debt to equity ratio of Claudia Ltd?

A) 13%

B) 40%

C) 45%

D) 50%

E) All of the given answers.

The above balances include a receivable from Jeremy Ltd for an amount of $100,000 and a payable to Jeremy Ltd for $50,000. A debt contract with ABC Bank signed by Claudia Ltd requires a debt equity ratio of no more than 50%.

Assuming a right to set-off exists with Jeremy Ltd, what is the debt to equity ratio of Claudia Ltd?

A) 13%

B) 40%

C) 45%

D) 50%

E) All of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

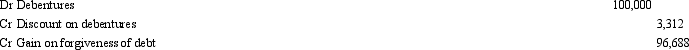

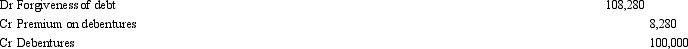

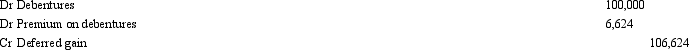

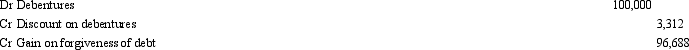

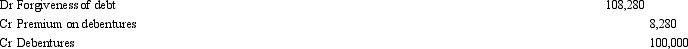

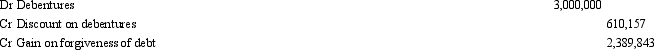

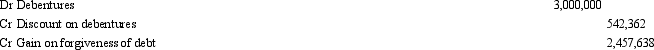

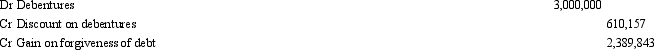

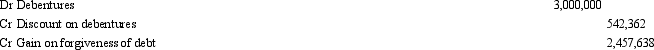

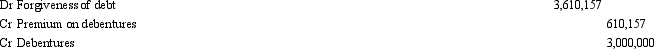

On 1 July 2008, Roos Limited issues $3 million in ten year, 8 per cent annual debentures to Hall Limited. The market required rate of return on the debentures at the time is 12 per cent. On 1 July 2010, Hall Limited decided to forgive the debt owed by Roos Limited, and so cancels the debt. Assuming Roos Limited uses the straight-line method to amortise the debenture discount, what is the journal entry passed in the books of Roos Limited at 1 July 2010?:

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is correct with respect to set-off of assets and liabilities?

A) An entity will apply set-off to reduce the number of elements reported in the financial statements.

B) An entity will apply set-off to avoid violation of debt covenants in debt contracts.

C) Positive accounting theory predicts the likelihood that managers will apply set-off to increase profits.

D) Positive accounting theory predicts the likelihood that managers will apply set-off to reduce political costs.

E) None of the given answers.

A) An entity will apply set-off to reduce the number of elements reported in the financial statements.

B) An entity will apply set-off to avoid violation of debt covenants in debt contracts.

C) Positive accounting theory predicts the likelihood that managers will apply set-off to increase profits.

D) Positive accounting theory predicts the likelihood that managers will apply set-off to reduce political costs.

E) None of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

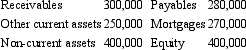

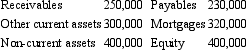

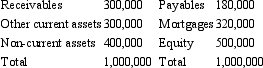

Pete Ltd's statement of financial position is shown below.

The above balances include a receivable from Patricia Ltd for an amount of $100,000 and a payable to Patricia Ltd for $50,000. A debt contract with ABC Bank signed by Pete Ltd requires a debt equity ratio of no more than 50%.

Based on the above information, which course of action will be consistent with positive accounting theory?

A) Pete Ltd will re-negotiate the debt contract with ABC Bank to increase the required debt equity ratio.

B) Pete Ltd will offset the receivable from Patricia Ltd with the payable to Patricia Ltd.

C) Pete Ltd will offset the payable to Patricia Ltd with the receivable from Patricia Ltd.

D) Pete Ltd need not do anything as the entity is not in violation of a debt covenant.

E) All of the given answers.

The above balances include a receivable from Patricia Ltd for an amount of $100,000 and a payable to Patricia Ltd for $50,000. A debt contract with ABC Bank signed by Pete Ltd requires a debt equity ratio of no more than 50%.

Based on the above information, which course of action will be consistent with positive accounting theory?

A) Pete Ltd will re-negotiate the debt contract with ABC Bank to increase the required debt equity ratio.

B) Pete Ltd will offset the receivable from Patricia Ltd with the payable to Patricia Ltd.

C) Pete Ltd will offset the payable to Patricia Ltd with the receivable from Patricia Ltd.

D) Pete Ltd need not do anything as the entity is not in violation of a debt covenant.

E) All of the given answers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following instruments satisfy the conditions to offset a financial asset and a financial liability?

A) Several financial instruments that are passed as a single financial instrument, for example, a synthetic instrument

B) Futures contract

C) Financial assets that are pledged as collateral for a non-recourse liability

D) Financial assets that are set aside in trust by a debtor for the purpose of discharging an obligation without these assets being accepted by the creditor in settlement of the obligation.

E) None of the given answers

A) Several financial instruments that are passed as a single financial instrument, for example, a synthetic instrument

B) Futures contract

C) Financial assets that are pledged as collateral for a non-recourse liability

D) Financial assets that are set aside in trust by a debtor for the purpose of discharging an obligation without these assets being accepted by the creditor in settlement of the obligation.

E) None of the given answers

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck