Deck 7: Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 7: Inventory

1

A company engaged in buying and selling equity securities should consider this asset as inventory and should be accounted for in accordance with AASB 102.

False

2

AASB 102 requires that fixed manufacturing costs be excluded from the cost of inventories, as they cannot be allocated accurately:

False

3

AASB 102 "Inventories" applies to biological assets related to agricultural activity.

False

4

Which of the following is not a definition in AASB 102 on inventories:

A) Assets in the form of materials or supplies to be consumed in the production process.

B) Assets in the process of production for sale.

C) Raw materials to be used in maintaining machines that prepare goods for sale.

D) Assets held for sale in the ordinary course of business.

E) All of the given answers.

A) Assets in the form of materials or supplies to be consumed in the production process.

B) Assets in the process of production for sale.

C) Raw materials to be used in maintaining machines that prepare goods for sale.

D) Assets held for sale in the ordinary course of business.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

Standard costs may be used to arrive at the cost of inventory only where standards are set at ideal levels and any costs arising from exceptional wastage are excluded from the cost of inventories:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

The first-in, first-out (FIFO) method assumes that items remaining in inventory at the end of the period are those most recently purchased or produced.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

FIFO method is an income decreasing inventory cost flow method in periods of rising prices.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

AASB 102 provides that inventories must be valued at the lower of cost and net realisable value for groups of homogeneous items where it is impracticable to measure them on an item-by-item basis:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Reversal of a previous inventory write down is not advocated in AASB 102.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

The cost-flow assumption selected for inventory costing purposes should always reflect the physical flow of goods out of inventory:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

The cost of sub-contracted work is not included in costs of conversion for the purposes of calculating the cost of inventory:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

The measurement of inventories is no different for not-for-profit entities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

The value of inventory reported in the financial statements under AASB 102 may be reported at an amount lower than its original cost:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

AASB 102 applies to all inventories including work in progress under construction contracts:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

In periods where production costs or purchase prices of inventory items do not change, it does not matter which inventory method is adopted as this would generate the same value for cost of goods sold and ending inventory.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

The only difference between the old AASB 1019 and the new AASB 102 is that the 'international' standards allow inventory to be valued using LIFO:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

AASB 102 on inventories does not apply to:

A) Trees held for sale as part of forestry operations.

B) Work-in-progress under construction contracts.

C) Agricultural produce of a biological asset.

D) All of the given answers.

E) None of the given answers.

A) Trees held for sale as part of forestry operations.

B) Work-in-progress under construction contracts.

C) Agricultural produce of a biological asset.

D) All of the given answers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Some biological assets may be covered by AASB 102 "Inventories":

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Upward revaluation of inventory is permitted for as long as all assets in same inventory class are revalued.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

The definition of inventories includes assets in the form of materials or supplies to be consumed in the production process or in rendering of services:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

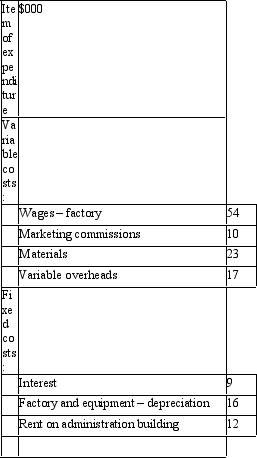

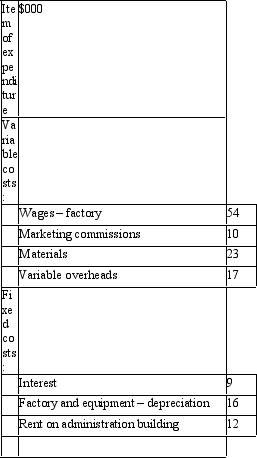

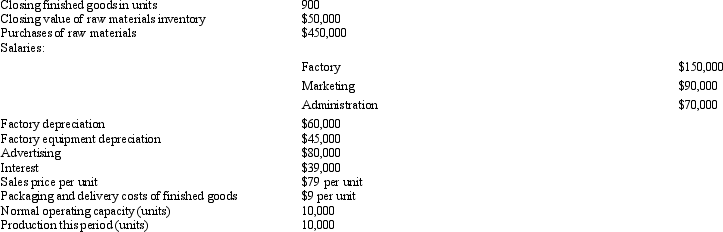

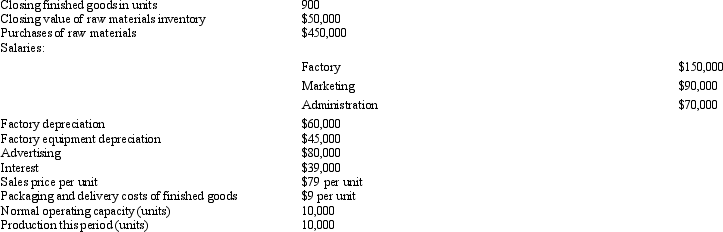

Digitoll Ltd produces a range of computer accessories. One product is a web-cam, a miniature digital camera with the capacity to be linked to a computer. The following are the summary costs for the web-cam for the period ended 31 December 2002:

The production level this period was normal at 10,000 units. What is the cost per unit (rounded to the nearest cent) in accordance with AASB 102 requirements?

A) $11.00

B) $10.40

C) $14.10

D) $11.90

E) None of the given answers.

The production level this period was normal at 10,000 units. What is the cost per unit (rounded to the nearest cent) in accordance with AASB 102 requirements?

A) $11.00

B) $10.40

C) $14.10

D) $11.90

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

According to AASB 102 inventories include assets:

A) Such as service contracts arising under construction contracts.

B) Such as assets held long-term for use in the production process.

C) Such as financial instruments.

D) Held in the process of production, preparation or conversion for sale.

E) None of the given answers.

A) Such as service contracts arising under construction contracts.

B) Such as assets held long-term for use in the production process.

C) Such as financial instruments.

D) Held in the process of production, preparation or conversion for sale.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

In times of rising prices for inventory, which of the following is true?

A*: LIFO adopters would report higher cost of goods sold and lower ending inventory than FIFO adopters.

B) FIFO adopters would report higher profits and lower ending inventory than LIFO adopters.

C) LIFO adopters would report higher profits and higher ending inventory than FIFO adopters.

D) FIFO adopters would report higher cost of goods sold and higher ending inventory than LIFO adopters.

E) None of the given answers.

A*: LIFO adopters would report higher cost of goods sold and lower ending inventory than FIFO adopters.

B) FIFO adopters would report higher profits and lower ending inventory than LIFO adopters.

C) LIFO adopters would report higher profits and higher ending inventory than FIFO adopters.

D) FIFO adopters would report higher cost of goods sold and higher ending inventory than LIFO adopters.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

The two main methods for dealing with fixed costs in relation to the production of inventory are:

A) Variable costing and incremental costing.

B) Absorption costing and direct costing.

C) Overhead costing and ABC costing.

D) Relevant costing and incremental costing.

E) None of the given answers.

A) Variable costing and incremental costing.

B) Absorption costing and direct costing.

C) Overhead costing and ABC costing.

D) Relevant costing and incremental costing.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Under AASB 102 revaluations are permitteD.

A) Only in the form of a write-down.

B) Only when an independent valuation is made by an external party.

C) Only if upward revaluations are credited to an Inventory Revaluation Reserve.

D) Only if the replacement cost of the asset is higher than the historical cost.

E) None of the given answers.

A) Only in the form of a write-down.

B) Only when an independent valuation is made by an external party.

C) Only if upward revaluations are credited to an Inventory Revaluation Reserve.

D) Only if the replacement cost of the asset is higher than the historical cost.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Fixed production costs are those that, within normal operating limits:

A) Vary in relation to production volume by a fixed amount.

B) Remain a constant per unit amount as volume changes.

C) Vary in relation to the levels of input but remain constant at varying levels of output.

D) Remain a constant amount at varying production volume levels.

E) None of the given answers.

A) Vary in relation to production volume by a fixed amount.

B) Remain a constant per unit amount as volume changes.

C) Vary in relation to the levels of input but remain constant at varying levels of output.

D) Remain a constant amount at varying production volume levels.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

In addition to the cost-flow assumption, the system used to record movements in inventory also affects the determination of the cost of inventory. What are the systems commonly in use for recording the movement of inventory?

A) Continuous and cyclic.

B) ABC costing and overhead allocation.

C) Positive and periodic.

D) Periodic and perpetual.

E) None of the given answers.

A) Continuous and cyclic.

B) ABC costing and overhead allocation.

C) Positive and periodic.

D) Periodic and perpetual.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

AASB 102 requires that the specific identification method of assigning cost to items of inventory be applieD.

A) Wherever possible in order to achieve the most accurate cost figure.

B) To items of inventory that are ordinarily interchangeable or identical and have significant individual dollar value.

C) Wherever items are separately identifiable and of significant individual dollar value.

D) To items of inventory that are not ordinarily interchangeable or are produced and segregated for specific projects.

E) None of the given answers.

A) Wherever possible in order to achieve the most accurate cost figure.

B) To items of inventory that are ordinarily interchangeable or identical and have significant individual dollar value.

C) Wherever items are separately identifiable and of significant individual dollar value.

D) To items of inventory that are not ordinarily interchangeable or are produced and segregated for specific projects.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Use of the LIFO method has been deemed unacceptable under AASB 102 because?

A) It presents too many options to report preparers and may confuse them.

B) This method allows profits to be manipulated by purchasing items at year's end even though they have not been sold.

C) It can result in higher cost of goods sold figures and therefore lower taxes.

D) This method did reflect the actual physical flow of inventories.

E) All of the given answers.

A) It presents too many options to report preparers and may confuse them.

B) This method allows profits to be manipulated by purchasing items at year's end even though they have not been sold.

C) It can result in higher cost of goods sold figures and therefore lower taxes.

D) This method did reflect the actual physical flow of inventories.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

AASB 102 requires that inventory is valued at:

A) The lower of cost and recoverable value, on an item-by-item basis where practicable.

B) Cost or fair value for classes of assets and services that are defined as inventories.

C) The lower of cost and net realisable value, on an item-by-item basis where practicable.

D) Cost or deprival value, whichever is the lower, for classes of inventories.

E) None of the given answers.

A) The lower of cost and recoverable value, on an item-by-item basis where practicable.

B) Cost or fair value for classes of assets and services that are defined as inventories.

C) The lower of cost and net realisable value, on an item-by-item basis where practicable.

D) Cost or deprival value, whichever is the lower, for classes of inventories.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is correct in relation to the costing of inventories?

A) Direct costing treats fixed production costs as an expense of the period and is not permitted as a method for valuing inventories under AASB 102.

B) Absorption costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method for valuing inventories under AASB 102.

C) Absorption costing treats fixed production costs as an expense of the period and is the required method for valuing inventories under AASB 102.

D) Direct costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method of valuing inventory under AASB 102.

E) None of the given answers.

A) Direct costing treats fixed production costs as an expense of the period and is not permitted as a method for valuing inventories under AASB 102.

B) Absorption costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method for valuing inventories under AASB 102.

C) Absorption costing treats fixed production costs as an expense of the period and is the required method for valuing inventories under AASB 102.

D) Direct costing treats fixed production costs as a product cost, allocating them to the goods produced, and is not permitted as a method of valuing inventory under AASB 102.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

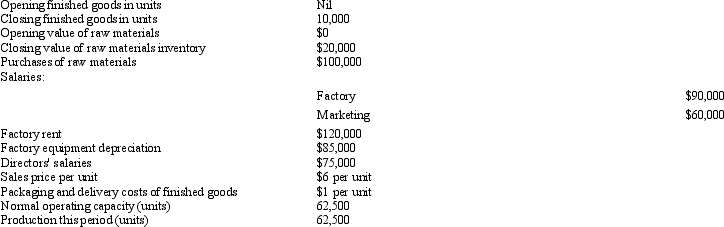

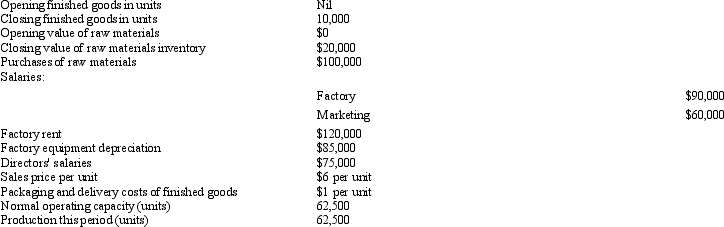

Video Productions Ltd commenced business manufacturing video tapes on 1 July 2002. Summary data for the first full year of production are:

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $66,400

B) $72,000

C) $46,400

D) $50,000

E) None of the given answers.

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $66,400

B) $72,000

C) $46,400

D) $50,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Standard costs are able to be used under AASB 102 where:

A) They have been properly set and maintained.

B) They are realistically attainable and are reviewed regularly.

C) They are assessed to be a sound basis for the purpose of inventory valuation.

D) They are revised in the light of current conditions as necessary.

E) None of the given answers.

A) They have been properly set and maintained.

B) They are realistically attainable and are reviewed regularly.

C) They are assessed to be a sound basis for the purpose of inventory valuation.

D) They are revised in the light of current conditions as necessary.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

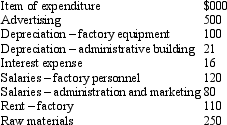

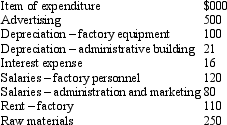

Handy Ltd produces a line of brooms. The summary cost information for brooms for the year ended 30 June 2002 is:

The level of output for the period was the normal level of production of 290,000 units. What is the cost per broom (rounded to the nearest cent) in accordance with AASB 102 requirements?

A) $4.13

B) $2.00

C) $0.13

D) $2.06

E) None of the given answers.

The level of output for the period was the normal level of production of 290,000 units. What is the cost per broom (rounded to the nearest cent) in accordance with AASB 102 requirements?

A) $4.13

B) $2.00

C) $0.13

D) $2.06

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

AASB 102 provides that not-for-profit entities:

A) Must value their assets at the lower of cost or net realisable value to allow reports to be compared.

B) Should only report inventories at cost for simplicity.

C) Should value their assets at either cost or current replacement cost, whichever is more beneficial.

D) Will record the inventories at the lower of cost or current replacement cost.

E) None of the given answers.

A) Must value their assets at the lower of cost or net realisable value to allow reports to be compared.

B) Should only report inventories at cost for simplicity.

C) Should value their assets at either cost or current replacement cost, whichever is more beneficial.

D) Will record the inventories at the lower of cost or current replacement cost.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Balmoral Ltd commenced business on 1 July 2003. The company manufactures bookcases. Summary data for Balmoral's first full year of operations are:

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $58,950

B) $63,000

C) $49,500

D) $69,660

E) None of the given answers.

Packaging and delivery are essential to be able to sell the product. What total value should be attributed to finished goods inventory in the financial statements in accordance with AASB 102?

A) $58,950

B) $63,000

C) $49,500

D) $69,660

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

According to AASB 102, one or more of which set of methods should be used to apply the costs of inventories to particular items of inventory?

A) Specific identification, LIFO or FIFO.

B) Absorption costing, weighted average costing or LIFO.

C) FIFO, specific identification or weighted average cost.

D) Weighted average costing, ABC costing or FIFO.

E) None of the given answers.

A) Specific identification, LIFO or FIFO.

B) Absorption costing, weighted average costing or LIFO.

C) FIFO, specific identification or weighted average cost.

D) Weighted average costing, ABC costing or FIFO.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

The cost of inventory is defined by AASB 102 as including:

A) The cost of purchase and conversion.

B) Duties and taxes on purchase of goods or services for sale.

C) The cost incurred in the normal course of operations to bring the inventories to their present location and condition.

D) The deduction of relevant rebates and subsidies.

E) All of the given answers.

A) The cost of purchase and conversion.

B) Duties and taxes on purchase of goods or services for sale.

C) The cost incurred in the normal course of operations to bring the inventories to their present location and condition.

D) The deduction of relevant rebates and subsidies.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

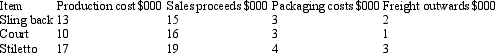

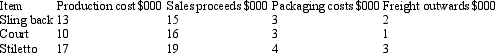

Toey Ltd has provided the following information about the total production cost and estimates of realisable value of three lines of shoes they produce within the same class of inventory:

Packaging and freight are necessary in order to be able to sell the shoes. What is the value of the inventory in accordance with AASB 102?

A) $34,000

B) $40,000

C) $32,000

D) $24,000

E) None of the given answers.

Packaging and freight are necessary in order to be able to sell the shoes. What is the value of the inventory in accordance with AASB 102?

A) $34,000

B) $40,000

C) $32,000

D) $24,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

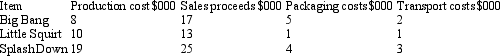

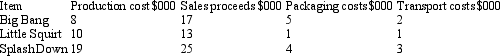

The following information relates to the total production costs and estimates of realisable value for a line of water pistols produced by Splash Happy Co LtD.

Packaging and transport costs are necessarily incurred in order to be able to sell the inventory. What is the value of the inventory in accordance with AASB 102?

A) $37,000

B) $21,000

C) $39,000

D) $36,000

E) None of the given answers.

Packaging and transport costs are necessarily incurred in order to be able to sell the inventory. What is the value of the inventory in accordance with AASB 102?

A) $37,000

B) $21,000

C) $39,000

D) $36,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is correct with respect to positive accounting theory?

A) Managers of firms with bonus based contracts prefer LIFO method of valuation basis, if permitted.

B) Managers of firms with bonus based contracts prefer FIFO method of valuation basis.

C) Managers prefer the FIFO method of valuation basis.

D) Managers with debt covenants prefer LIFO method, if permitted.

E) E: None of the given answers.

A) Managers of firms with bonus based contracts prefer LIFO method of valuation basis, if permitted.

B) Managers of firms with bonus based contracts prefer FIFO method of valuation basis.

C) Managers prefer the FIFO method of valuation basis.

D) Managers with debt covenants prefer LIFO method, if permitted.

E) E: None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Consistent with positive accounting theory, an entity close to breaching their debt covenant will:

A) prefer LIFO method over FIFO method.

B) prefer FIFO method over LIFO method.

C) prefer weighted average method over FIFO method.

D) prefer moving average method over FIFO method.

E) None of the given answers.

A) prefer LIFO method over FIFO method.

B) prefer FIFO method over LIFO method.

C) prefer weighted average method over FIFO method.

D) prefer moving average method over FIFO method.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

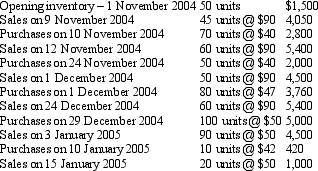

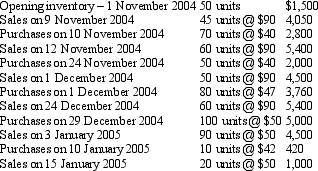

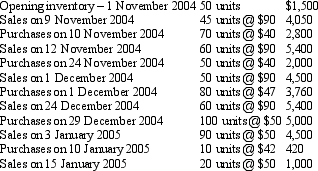

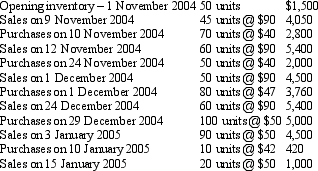

Big Games for Big Kids sell a variety of gaming consoles and games. It has presented you with the following information for the sales of a new product Angel's Hat 2 for the three months from November to January. They began November with 50 units on hand valued at $1,500. In the lead up to Christmas each unit sold for $90 but in the post Christmas sales in January this price was reduced to $50.

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the weighted average cost-flow assumption?

A) Cost of sales: $14,190 Ending inventory: $1,290

B) Cost of sales: $14,060 Ending inventory: $1,420

C) Cost of sales: $14,190 Ending inventory: $ 900

D) Cost of sales: $24,850 Ending inventory: $1,420

E) Cannot be determined from the above information.

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the weighted average cost-flow assumption?

A) Cost of sales: $14,190 Ending inventory: $1,290

B) Cost of sales: $14,060 Ending inventory: $1,420

C) Cost of sales: $14,190 Ending inventory: $ 900

D) Cost of sales: $24,850 Ending inventory: $1,420

E) Cannot be determined from the above information.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Big Games for Big Kids sell a variety of gaming consoles and games. It has presented you with the following information for the sales of a new product, Angel's Hat 2, for the three months from November to January. They began November with 50 units on hand valued at $1,500. In the lead up to Christmas each unit sold for $90 but in the post Christmas sales in January this price was reduced to $50.

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the FIFO cost-flow assumption?

A) Cost of sales: $14 190 Ending inventory: $1290

B) Cost of sales: $14 060 Ending inventory: $1420

C) Cost of sales: $14 060 Ending inventory: $1260

D) Cost of sales: $24 850 Ending inventory: $1420

E) Cannot be determined from the above information.

Big Games for Big Kids use the periodic system to record inventory. A physical stock take reveals 30 units on hand at the end of January. What is the cost of sales and value of ending inventory using the FIFO cost-flow assumption?

A) Cost of sales: $14 190 Ending inventory: $1290

B) Cost of sales: $14 060 Ending inventory: $1420

C) Cost of sales: $14 060 Ending inventory: $1260

D) Cost of sales: $24 850 Ending inventory: $1420

E) Cannot be determined from the above information.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Using the periodic system of inventory:

A) Gives the same results as a perpetual system when FIFO is applied but without some of the extra detail.

B) Is much more cost effective as a perpetual system requires a computer.

C) Does not require a stock take each year and is therefore more accurate.

D) Accurately reports all stock movements which assists with decision-making.

E) All of the given answers.

A) Gives the same results as a perpetual system when FIFO is applied but without some of the extra detail.

B) Is much more cost effective as a perpetual system requires a computer.

C) Does not require a stock take each year and is therefore more accurate.

D) Accurately reports all stock movements which assists with decision-making.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

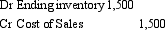

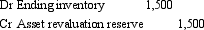

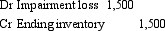

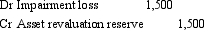

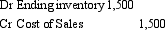

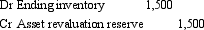

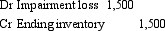

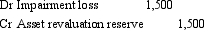

The inventory record of Palm Springs Ltd. shows 1,000 surf boards on stock that cost $50 each. During the last stock take, the accountant noted 100 old style surf boards with net realisable amount of $15. What journal entry would be required of Palm Springs to comply with AASB 102?

A)

B)

C)

D)

E) E: None of the given answers.

A)

B)

C)

D)

E) E: None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Paris Merchandising Ltd sells ladies skirts. The opening stock consisted of 300 skirts with purchase price of $50 each. Subsequent purchases during the period include: 400 at $60 each and another 200 for $70 each. A total of 700 skirts were sold during the period. What is ending inventory using FIFO method?

A) $10,000

B) $11,800

C) $12,000

D) $14,000

E) E: None of the given answers.

A) $10,000

B) $11,800

C) $12,000

D) $14,000

E) E: None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

AASB 102 requires among others disclosure of which information:

A) Accounting policy adopted for measuring inventories.

B) Carrying amount of inventories for each classification of inventory appropriate to the entity.

C) Amount of any write-down during the period.

D) All of the given answers.

E) Carrying amount of inventories pledged for liabilities.

A) Accounting policy adopted for measuring inventories.

B) Carrying amount of inventories for each classification of inventory appropriate to the entity.

C) Amount of any write-down during the period.

D) All of the given answers.

E) Carrying amount of inventories pledged for liabilities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

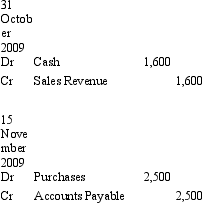

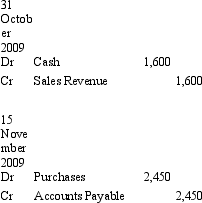

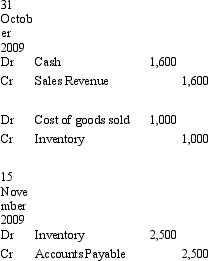

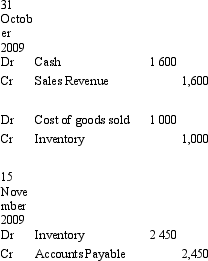

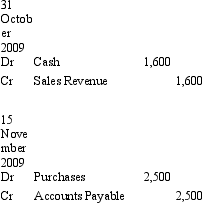

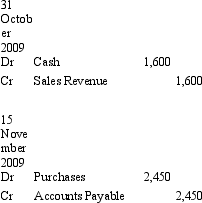

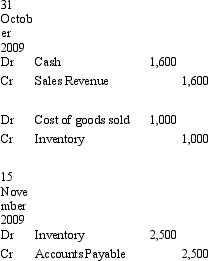

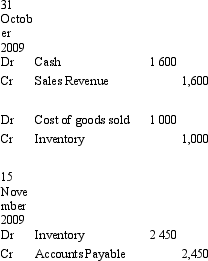

Bondi Ltd is a small sports shop. At the beginning of the period, Bondi Ltd had 30 tennis racquets on hand costing $50 each. On 31 October 2009, the shop sold 20 racquets to a tennis instructor for $80. A delivery of 50 racquets was received on 15 November 2009 at $50 but received 2% discount if the account is paid within 30 days. What are the appropriate journal entries to recognise above transactions using the periodic system?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

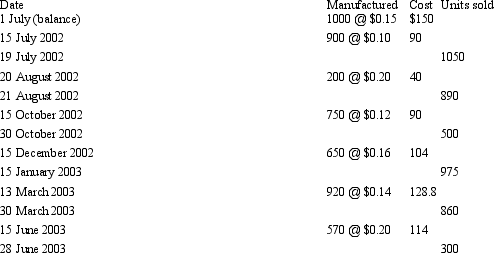

Circle Ltd manufactures polystyrene trays for a variety of purposes. The following information relates to the production of the medium trays used by meat packing companies for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $0.17 at the end of the period. What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

A) Cost of sales: $633.80 Ending inventory: $83

B) Cost of sales: $654.55 Ending inventory: $62.25

C) Cost of sales: $657.19 Ending inventory: $59.61

D) Cost of sales: $633.80 Ending inventory: $70.55

E) None of the given answers.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $0.17 at the end of the period. What are the costs of sales and the value of ending inventory for Rectangle Ltd assuming the FIFO cost-flow assumption is used?

A) Cost of sales: $633.80 Ending inventory: $83

B) Cost of sales: $654.55 Ending inventory: $62.25

C) Cost of sales: $657.19 Ending inventory: $59.61

D) Cost of sales: $633.80 Ending inventory: $70.55

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Which accounting policy for manufacturing fixed costs is likely to favour managers whose firms are subject to political scrutiny?

A) Direct costing;

B) Absorption costing;

C) LIFO assuming prices are falling;

D) FIFO assuming prices are rising;

E) E: None of the given answers.

A) Direct costing;

B) Absorption costing;

C) LIFO assuming prices are falling;

D) FIFO assuming prices are rising;

E) E: None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Kensington Ltd is an importer and retailer of European made glass crystals. For the year ended 30 June 2008, Kensington Ltd still holds 30 units of an item originally purchased for $10,000 each and a net realisable value of $8,000. On 1 June 2009 the TV show "Home Improvement" featured a similar item prompting an increase in demand for this glass crystal. Management believes that the net realisable value of this item is now $15,000. All 30 items remain unsold on 30 June 2009. What is the effect of holding this inventory on the income statement of Heffron Ltd for the years ended 30 June 2008 and 2009?

A) No effect on both years because the inventory items are still unsold.

B) Decrease profit by $60,000 in 2008; increase profit by $210,000 in 2009.

C) Decrease profit by $60,000 in 2008; no effect in 2009.

D) Decrease profit by $60,000 in 2008; increase profit by $60,000 in 2009.

E) None of the given answers.

A) No effect on both years because the inventory items are still unsold.

B) Decrease profit by $60,000 in 2008; increase profit by $210,000 in 2009.

C) Decrease profit by $60,000 in 2008; no effect in 2009.

D) Decrease profit by $60,000 in 2008; increase profit by $60,000 in 2009.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

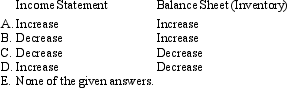

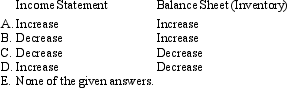

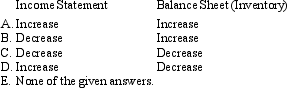

David Gordon is an accountant for Bronte Ltd. At the end of the year he realised that ending inventory was overstated but the purchases account was recorded correctly. What is the effect of above error in the income statement and balance sheet (inventory) accounts of Bronte Ltd?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

According to AASB 102 material information relating to which of the following must be disclosed?

A) The carrying amount of closing inventories included in equity accounted profits.

B) The carrying amount of inventories classified as non-current assets.

C) The aggregate amount of inventory recorded at recoverable amount.

D) The carrying amount of inventories revalued upwards as at the end of the period.

E) None of the given answers.

A) The carrying amount of closing inventories included in equity accounted profits.

B) The carrying amount of inventories classified as non-current assets.

C) The aggregate amount of inventory recorded at recoverable amount.

D) The carrying amount of inventories revalued upwards as at the end of the period.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

The periodic inventory system operates by:

A) Keeping track of inventory as it comes into the organisation and as it leaves.

B) Counting inventory at regular intervals to establish how much of each item is on hand.

C) Assuming that the inventory that came in first is the first to be sold.

D) Tracking the cost of specific items of inventory to the products sold by grouping items according to cost drivers.

E) None of the given answers.

A) Keeping track of inventory as it comes into the organisation and as it leaves.

B) Counting inventory at regular intervals to establish how much of each item is on hand.

C) Assuming that the inventory that came in first is the first to be sold.

D) Tracking the cost of specific items of inventory to the products sold by grouping items according to cost drivers.

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

The valuation of inventories may be on the basis of:

A) The lower of direct cost and recoverable amount.

B) Regular revaluations by classes of inventories undertaken at the end of the period.

C) The weighted average of market value and absorption cost over the period.

D) The lower of cost and net realisable value.

E) All of the given answers.

A) The lower of direct cost and recoverable amount.

B) Regular revaluations by classes of inventories undertaken at the end of the period.

C) The weighted average of market value and absorption cost over the period.

D) The lower of cost and net realisable value.

E) All of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

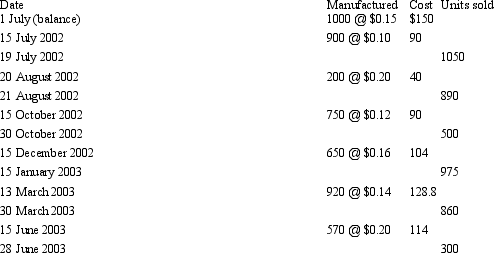

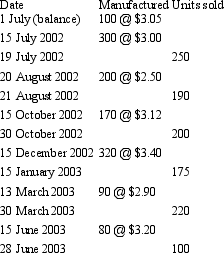

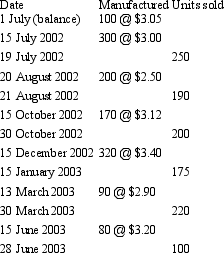

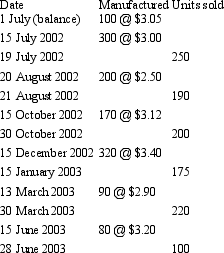

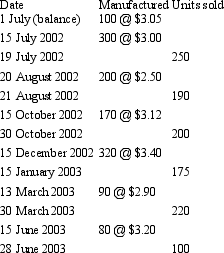

Oblong Ltd manufactures cardboard boxes for a variety of purposes. The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

A) Cost of sales: $3,460.40 Ending inventory: $380.00

B) Cost of sales: $3,453.90 Ending inventory: $386.50

C) Cost of sales: $3,459.41 Ending inventory: $380.99

D) Cost of sales: $3,453.90 Ending inventory: $393.75

E) None of the given answers.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

A) Cost of sales: $3,460.40 Ending inventory: $380.00

B) Cost of sales: $3,453.90 Ending inventory: $386.50

C) Cost of sales: $3,459.41 Ending inventory: $380.99

D) Cost of sales: $3,453.90 Ending inventory: $393.75

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

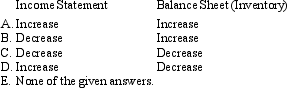

Randwick Ltd has a year-end of 30 June 2009. During the year the following errors were discovereD.

-Merchandise inventory at the factory had been understated by $44,000.

-Goods on consignment from a supplier for $13,000 were included in inventory at the shops.

-Physical inventory for one warehouse had a shortage of $58,000

What is the net effect of above errors in the income statement and balance sheet (inventory) accounts of Randwick Ltd?

-Merchandise inventory at the factory had been understated by $44,000.

-Goods on consignment from a supplier for $13,000 were included in inventory at the shops.

-Physical inventory for one warehouse had a shortage of $58,000

What is the net effect of above errors in the income statement and balance sheet (inventory) accounts of Randwick Ltd?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Las Vegas Ltd sells second hand luxury cars of various makes and models, and uses the FIFO cost flow assumption to ascertain the cost of ending inventory. This would be incorrect because:

A) this is not the practice used by other car dealerships.

B) this method will overstate profit.

C) this method will not capture unique characteristics of items held in inventory.

D) this method requires detailed bookkeeping.

E) E: None of the given answers.

A) this is not the practice used by other car dealerships.

B) this method will overstate profit.

C) this method will not capture unique characteristics of items held in inventory.

D) this method requires detailed bookkeeping.

E) E: None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Rectangle Ltd manufactures cardboard boxes for a variety of purposes. The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of goods sold and the value of ending inventory for Rectangle Ltd assuming the LIFO cost-flow assumption is used?

A) Cost of sales: $3,460.40 Ending inventory: $380.00

B) Cost of sales: $3,453.90 Ending inventory: $393.75

C) Cost of sales: $3,459.41 Ending inventory: $380.99

D) Cost of sales: $3,453.90 Ending inventory: $386.50

E) None of the given answers.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of goods sold and the value of ending inventory for Rectangle Ltd assuming the LIFO cost-flow assumption is used?

A) Cost of sales: $3,460.40 Ending inventory: $380.00

B) Cost of sales: $3,453.90 Ending inventory: $393.75

C) Cost of sales: $3,459.41 Ending inventory: $380.99

D) Cost of sales: $3,453.90 Ending inventory: $386.50

E) None of the given answers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck