G.C. Donovan Company is a large pharmaceutical company located in the U.S., but with worldwide sales. Donovan has recently developed two new medications that have been licensed for sale in European Union countries. One medication is an over-the-counter cold preparation that effectively eliminates all cold symptoms, while the other is an antibiotic that is effective against drug resistant bacteria. A European firm, Demtech Limited, has developed drugs that are similar to Donovan's and will be ready for the European market at approximately the same time. Liability concerns make it unlikely that either firm will choose to market both new drugs at this time. Both firms do plan to market one of the drugs this year.

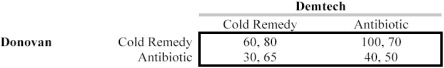

Donovan's managers consider their own lack of reputation among European physicians to be an important obstacle in the antibiotic market. Consequently, Donovan feels more comfortable marketing the cold preparation. Demtech, on the other hand, has an excellent reputation among physicians but little experience in over-the-counter drugs so that Demtech's competitive advantage is with the antibiotic. Should Demtech choose to market the cold remedy, it believes that its sales will increase if Donovan also enters the cold remedy market and advertises heavily. Similarly, Donovan anticipates that its sales in the antibiotic market would be enhanced if Demtech produces antibiotics, given Demtech's excellent reputation among physicians. In short, each firm believes that there are circumstances under which participation by the other firm will complement rather than compete with the firm's own sales. Profits in millions of dollars are given in the payoff matrix below.

a. Given the table above, does either firm have a dominant strategy? Is there a Nash equilibrium? (Explain the difference between a Nash equilibrium and a dominant strategy.)

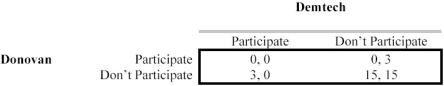

b. Pharmaceutical firms within the EU are attempting to organize a risk pool that would share liability risks for new drugs. Since Donovan and Demtech are among the largest pharmaceutical companies operating in Europe, the benefits of the risk pool depend upon the participation of the other firm. Increased profits achieved through reduced risk liability (measured in millions of dollars) are shown in the payoff matrix below.

Does either firm have an incentive to use participation in the risk pool as a bargaining device in the drug-marketing decision? If so, what would be the nature of the bargain? How credible is the firm's bargaining position? What could be done to make the bargaining position more credible?

Correct Answer:

Verified

Demtech has a dominant strategy in th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: In the sequential version of a game

Q62: Which of the following situations is likely

Q64: A "Credible Threat"

A) is also called a

Q65: Two firms at the St. Louis airport

Q67: An oligopolistic situation involving the possible creation

Q68: Consider two firms, X and Y, that

Q72: Why does cooperative behavior break down in

Q73: For infinitely repeated games in which the

Q77: The strategy that worked best in Axelrod's

Q80: Scenario 13.11

Consider the game below:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents