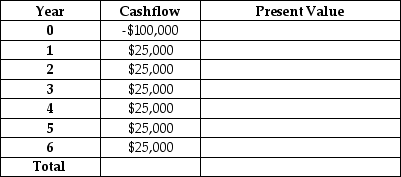

Ed's Electronic Devices has an asset beta of 0.6. The market rate of return is 12% and the risk-free rate of return is 2%. Ed is considering updating his production technology. If he does so, he expects the cash streams indicated in the table below. Given this information, should Ed update his production technology?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Another name for diversifiable risk is:

A) systematic

Q80: An asset's beta can be used to

Q81: In the consumer's NPV decision, the correct

Q82: Scenario 15.5:

Consider the following information based on

Q83: Scenario 15.4:

Consider the following information:

You are considering

Q85: The opportunity cost of capital for a

Q86: For an investment in a hybrid auto

Q87: Scenario 15.5:

Consider the following information based on

Q88: Scenario 15.5:

Consider the following information based on

Q89: Scenario 15.6:

Consider the following decision that Eileen

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents