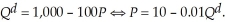

The Grand River Brick Corporation uses Business-to-Business internet technology to set output before Bernard's Bricks. This gives the Grand River Brick Corporation "first-move" ability. The market demand for bricks is:  Bernard Brick's marginal revenue curve is:

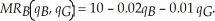

Bernard Brick's marginal revenue curve is:  The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:

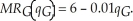

The marginal cost of producing an additional unit of bricks is constant at $2.00 for each firm. Determine Bernard's reaction function. Given that the Grand River Brick Corporation has this information and moves first, Grand River's marginal revenue curve is:  Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Calculate Grand River Brick Corporations optimal output level. Does the "first-move" ability of the Grand River Brick Corporation allow them to capture a larger market share (note that the marginal revenue curves would be symmetric if Grand River did not have first-move ability)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Scenario 12.2:

Suppose a stream is discovered whose

Q47: For a market with a linear demand

Q48: Consider two identical firms (no. 1 and

Q49: In the Stackelberg model, suppose the first-mover

Q50: Suppose the market demand curve is P

Q52: Suppose that the market demand for mountain

Q53: Scenario 12.2:

Suppose a stream is discovered whose

Q54: Hale's One Stop Gas and Auto Service

Q55: The oligopoly model that is most appropriate

Q56: Scenario 12.2:

Suppose a stream is discovered whose

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents