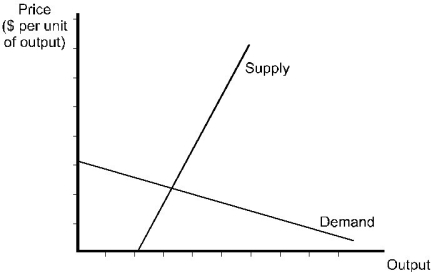

A specific tax will be imposed on a good. The supply and demand curves for the good are shown in the diagram below. Given this information, the burden of the tax:

A) is shared about evenly between consumers and producers.

B) falls mostly on consumers.

C) falls mostly on producers.

D) cannot be determined without more information on the price elasticities of supply and demand.

Correct Answer:

Verified

Q173: The market demand and supply functions for

Q174: The price elasticity of demand is -1.5.

Q175: Use the following statements to answer this

Q176: Consider a good whose own price elasticity

Q177: The deadweight loss of a specific tax

Q178: A few years ago, the city of

Q180: The world price for oil is $31

Q181: The market demand and supply functions for

Q182: The market demand and supply functions for

Q183: The market demand and supply functions for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents