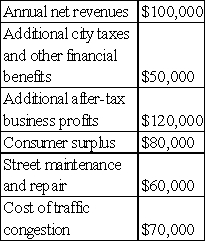

The following table gives the estimated costs and benefits of a proposed public convention center.

Table 11-1

-Two mutually exclusive projects,expected to last indefinitely,are being compared.Program A has annual profits and consumer surplus of $10 million and a one-time capital expenditure of $50 million.Program B has consumer surplus of $15 million and a one-time capital expenditure of $100 million.Using net present value as a criterion,which alternative should be selected?

A) If the discount rate is 12%,Program B should be selected.

B) If the discount rate is less than 10%,Program B should be selected.

C) If the discount rate is 22%,neither program should be selected.

D) The programs have the same net present value regardless of the discount rate used.

E) Answers b and c are both correct.

Correct Answer:

Verified

Q3: Figure 11-1 shows the marginal internal cost

Q12: When consumers possess imperfect information or misinformation:

A)

Q16: What is meant by predatory pricing?

A)It occurs

Q18: In the absence of regulation,which of the

Q19: The production of a good with positive

Q22: A port authority is in the process

Q23: How does decision making under profit-maximization compare

Q24: Suppose the yearly interest rate is given

Q25: Suppose the government plans to build a

Q34: Explain why a private golf club might

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents