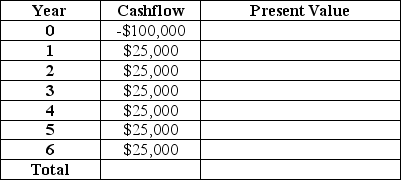

Ed's Electronic Devices has an asset beta of 0.6.The market rate of return is 12% and the risk-free rate of return is 2%.Ed is considering updating his production technology.If he does so,he expects the cash streams indicated in the table below.Given this information,should Ed update his production technology?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: You have won a contest and are

Q47: The Clemson Manufacturing Corp. engineers have estimated

Q51: The Vortex Corp. has an opportunity to

Q60: The Ampex Co. manufactures plastic fixtures for

Q104: Rita is considering purchasing a new or

Q105: Ed's Electronic Devices has an asset beta

Q124: Your aunt owns a gold mine. The

Q147: XYZ corporation will pay the $1,000 face

Q150: Samantha feels that XYZ corporation is currently

Q152: Your aunt has offered to give you

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents