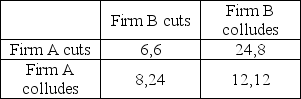

Consider the following payoff matrix for a game in which two firms attempt to collude under the Bertrand model:  Here,the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut) .The payoffs are stated in terms of millions of dollars of profits earned per year.What is the Nash equilibrium for this game?

Here,the possible options are to retain the collusive price (collude) or to lower the price in attempt to increase the firm's market share (cut) .The payoffs are stated in terms of millions of dollars of profits earned per year.What is the Nash equilibrium for this game?

A) Both firms cut prices.

B) Both firms collude.

C) There are two Nash equilibria: A cuts and B colludes,and A colludes and B cuts.

D) There are no Nash equilibria in this game.

Correct Answer:

Verified

Q42: Two large diversified consumer products firms are

Q62: The Prisoners' Dilemma is a particular type

Q63: The two leading U.S.manufacturers of high performance

Q64: In the _, two duopolists compete by

Q64: Lambert-Rogers Company is a manufacturer of petrochemical

Q71: Which statement most nearly describes a Nash

Q79: Relative to the Nash equilibrium in the

Q83: Which of the following is true about

Q88: Suppose that three oligopolistic firms are currently

Q116: Cartels can more easily detect cheating by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents