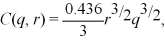

The squishy industry is competitive and the market price is $0.80.Apu's long-run cost function is:  where r is the price Apu pays to lease a squishy machine and q is squishy output.The long-run marginal cost curve is:

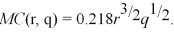

where r is the price Apu pays to lease a squishy machine and q is squishy output.The long-run marginal cost curve is:  What is Apu's optimal output if the price Apu pays to lease a squishy machine is $1.10? Suppose the lease price of squishy machines falls by $0.55.What happens to Apu's optimal output if the market price for a squishy remains at $0.80? Did profits increase for Apu when the lease rate of squishy machines fell?

What is Apu's optimal output if the price Apu pays to lease a squishy machine is $1.10? Suppose the lease price of squishy machines falls by $0.55.What happens to Apu's optimal output if the market price for a squishy remains at $0.80? Did profits increase for Apu when the lease rate of squishy machines fell?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q109: Assume the market for tortillas is perfectly

Q121: The demand for pizzas in the local

Q122: In the long-run equilibrium of a competitive

Q127: The manufacturing of paper products causes damage

Q128: In the robotics industry there are 100

Q129: The long-run cost function for Jeremy's Jetski

Q130: The long-run cost function for LeAnn's telecommunication

Q144: Consider a competitive market in which the

Q146: The demand curve and long-run supply curve

Q152: Bud Owen operates Bud's Package Store in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents