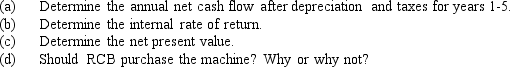

RCB Corporation is considering the purchase of a machine for which the initial cash outlay will be $100,000.Predicted net cash inflows before depreciation and taxes are $25,000 per year for the next five years.The machine will be depreciated (using the straight-line method)over the 5-year period with a zero estimated salvage value at the end of the period.The corporation's marginal tax rate is 40 percent and its cost of capital is 12 percent.

This problem requires the use of present value tables or a financial calculator.

This problem requires the use of present value tables or a financial calculator.

Correct Answer:

Verified

represents the present value...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: All of the following except _ are

Q13: The _ method assumes that the cash

Q24: In cost-effectiveness analysis,constant cost studies:

A) are rarely

Q25: The discount rate utilized in public sector

Q27: The production superintendent of the Holloway Company

Q31: Public sector investment projects are economically justifiable

Q31: The effect of changes in the level

Q33: In calculating the benefit-cost ratio,social benefits and

Q33: The social discount rate used in cost-benefit

Q34: Direct costs of a public sector investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents