Exhibit 15A-1

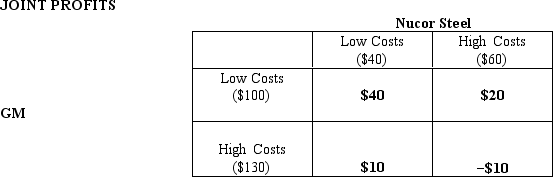

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the incentive-compatible revelation mechanism that will induce true revelation of the asymmetric cost information and maximize the value of the partnership?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: An incentive-compatible revelation mechanism is

A)self-enforcing

B)always multi-period

C)too complicated

Q11: Common value auctions with open bidding necessarily

Q12: Incentive-compatible revelation mechanisms attempt to

A)induce an employee

Q13: An incentive-compatible mechanism for revealing true willingness

Q14: The principal advantage of an open bidding

Q15: Revenue equivalence theorem refers to equal seller

Q16: Each partner in a simple profit-sharing contract

Q18: Research suggests that an auction for a

Q19: A Dutch auction implies all of the

Q20: In Dutch auctions,the bidding

A)starts low and rises

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents