Exhibit 15A-1

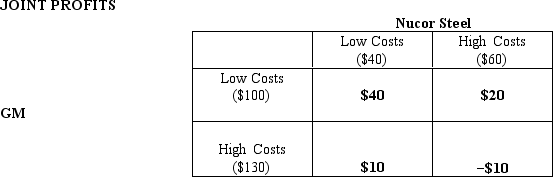

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the expected net profit under the simple profit sharing contract,and why would the partners adopt an incentive-compatible revelation mechanism (i.e. ,an optimal incentives contract)?

Correct Answer:

Verified

Q1: If two art dealers bidding for a

Q4: Sealed bids can be used in multiple

Q5: In comparing rules for serving a queue,last-come

Q6: Auctions are used in place of markets

Q7: An optimal incentives contract can induce the

Q8: Exhibit 15A-1

Suppose GM and Nucor Steel seek

Q9: Suppose that a private firm wants to

Q10: An incentive-compatible revelation mechanism is

A)self-enforcing

B)always multi-period

C)too complicated

Q11: Common value auctions with open bidding necessarily

Q23: Refer to Exhibit 15A-1.

Part B: What are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents