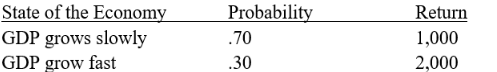

Consider an investment with the following payoffs and probabilities:

Let the expected value in this example be 1,300.How do we find the standard deviation of the investment?

A) = { (1000-1300) 2 + (2000-1300) 2 }

B) = { (1000-1300) + (2000-1300) }

C) = { (.5) (1000-1300) 2 + (.5) (2000-1300) 2 }

D) = { (.7) (1000-1300) + (.3) (2000-1300) }

E) = { (.7) (1000-1300) 2 + (.3) (2000-1300) 2 }

Correct Answer:

Verified

Q1: The approximate probability of a value occurring

Q3: The level of an economic activity should

Q6: Generally,investors expect that projects with high expected

Q7: Two investments have the following expected

Q8: Suppose that the firm's cost function is

Q9: The net present value of an investment

Q10: The primary difference(s)between the standard deviation and

Q11: An closest example of a risk-free security

Q14: The _ is the ratio of _

Q17: Receiving $100 at the end of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents