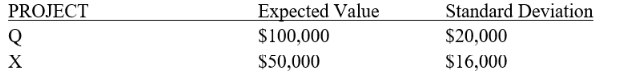

Two investments have the following expected returns (net present values) and standard deviations:

Based on the where the C.V.is the standard deviation dividend by the expected value.

A) All coefficients of variation are always the same.

B) Project Q is riskier than Project X

C) Project X is riskier than Project Q

D) Both projects have the same relative risk profile

E) There is not enough information to find the coefficient of variation.

Correct Answer:

Verified

Q1: The approximate probability of a value occurring

Q4: Based on risk-return tradeoffs observable in the

Q4: Complete the following table. Q5: A firm has decided to invest in Q6: Generally,investors expect that projects with high expected Q7: The standard deviation is appropriate to compare Q8: A change in the level of an Q8: Suppose that the firm's cost function is Q11: An closest example of a risk-free security Q17: Receiving $100 at the end of the

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents