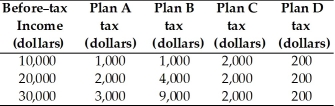

Use the table below to answer the following questions.

Table 18.4.1

-In Table 18.4.1,which tax plan is progressive?

A) Plan A

B) Plan B

C) Plan C

D) Plan D

E) impossible to calculate without additional information

Correct Answer:

Verified

Q105: Joe earns $100,000 per year.He pays a

Q106: In the absence of government policies to

Q107: If the average tax rate increases as

Q108: Policies that result in a redistribution of

Q109: The redistribution of income creates the big

Q111: If the average tax rate decreases as

Q112: Use the table below to answer the

Q113: Economic efficiency and economic equity have what

Q114: Last year you earned $45,000 and paid

Q115: Redistribution of income from the rich to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents