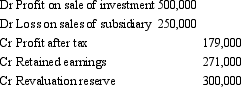

The following consolidation adjusting journal entries appeared at the end of a period in which the parent sold all of its shareholding in a subsidiary. It received $1,200,000 for the shares.

The 'Cr Profit after tax' entry above represents:

A) the profit made by the parent on the sale of the shares.

B) the profit made by the economic entity on the sale of the shares.

C) the amount accruing to the minority interest of the subsidiary.

D) the share of profits derived by the subsidiary for the entire current period.

E) the share of profits derived by the subsidiary in the current period, up to the time of divestment.

Correct Answer:

Verified

Q1: When a parent sells its interest in

Q2: The profit or loss on the sale

Q3: When shares in a subsidiary are sold

Q3: Under the step-by-step method,the need to revalue

Q6: The following consolidation adjusting journal entries appeared

Q6: Under the step-by-step method,the aggregate costs of

Q9: In calculating the profit or loss on

Q10: The following consolidation adjusting journal entries appeared

Q12: In a business combination achieved in stages,the

Q13: Two common approaches to accounting for acquisition

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents