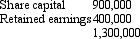

Hill Ltd acquired an 80 per cent interest in Dale Ltd on 1 July 2004 for a cash consideration of $1,200,000. At that date the shareholders' funds of Dale Ltd were:

The assets of Dale Ltd were recorded at fair value at the time of the purchase.

On 1 July 2005 Hill Ltd purchased the remaining 20 per cent of the issued capital of Dale Ltd for a cash consideration of $336,000. At this date the fair value of the net assets of Dale Ltd were represented by:

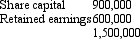

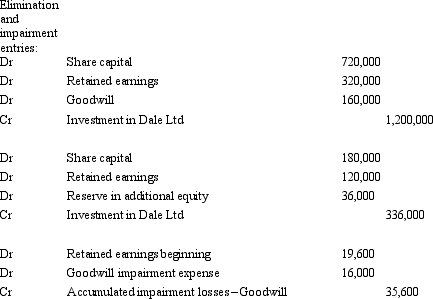

Impairment of goodwill amounted to $35,600; $16,000 of which related to the year ended 30 June 2006. There were no inter-company transactions. What are the consolidation entries to eliminate the investment in the subsidiary and account for goodwill for the period ended 30 June 2006?

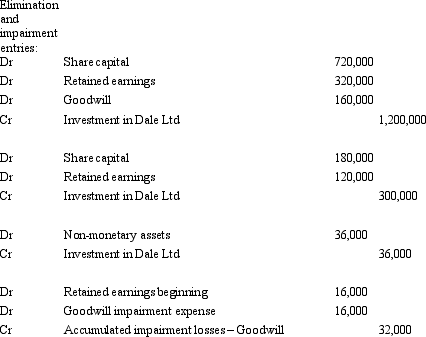

A)

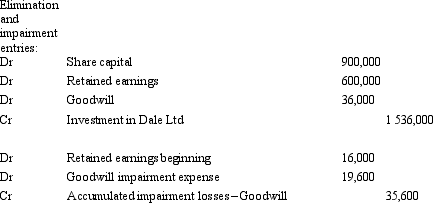

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q22: AASB 3 specifies that where a parent

Q28: An immediate parent entity may purchase shares

Q29: Mickey Ltd acquired a 70 per cent

Q30: Window Ltd acquired a 70 per cent

Q32: Dolly Ltd acquired a 60 per cent

Q33: Spock Ltd acquired a 10 per cent

Q35: The profit or loss on the sale

Q37: The profit or loss on the sale

Q38: Which of the following is not a

Q39: Spock Ltd acquired a 10 per cent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents