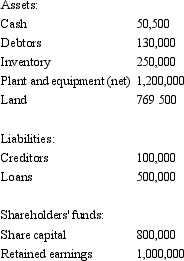

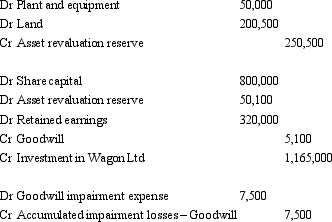

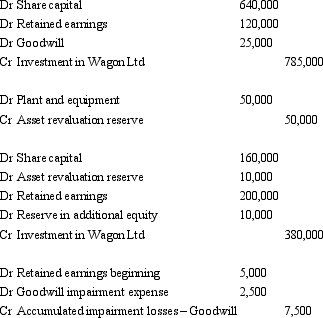

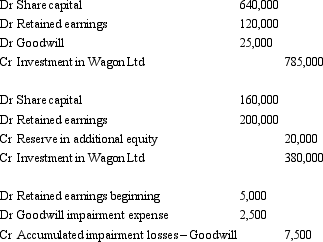

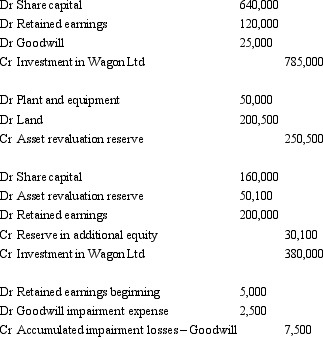

On 1 July 2004, Horse Ltd acquired 80 per cent of the issued capital of Wagon Ltd for $785,000 when the fair value of the net assets of Wagon Ltd was $950,000 (share capital $800,000 and retained earnings $150,000) . On 30 June 2007 Horse Ltd purchased the final 20 per cent of Wagon's issued capital for $380,000. The net assets of Wagon Ltd were not stated at fair value in the accounts, which are summarised as follows:

The fair value of the plant and equipment is $1,250,000 and the land was valued at $970,000 at year end. Impairment of goodwill was assessed at $7,500, the impairment having been incurred evenly across the last three years. There were no intragroup transactions during the period.

What are the consolidation journal entries required for the period ended 30 June 2007? (Ignore the tax effect of the revaluation)

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q5: Under the single-date method,goodwill would be recognised.

A)

Q9: The required method (according to AASB 3)of

Q10: The consolidated balance sheet at year-end,in a

Q15: Where a parent entity with a controlling

Q19: Once control over a subsidiary has been

Q22: Star Trek Ltd acquires shares in Vulcan

Q23: Fish Ltd acquired an 80 per cent

Q24: Fan Ltd acquired a 60 per cent

Q29: Which of the following statements is in

Q32: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents