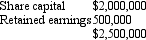

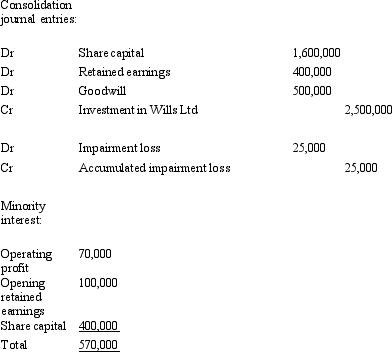

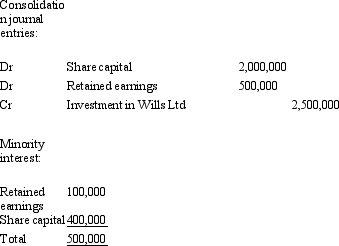

On 1 July 2005 Harry Ltd purchased 80 per cent of the issued share capital of Wills Ltd and has control of Wills. The fair value of the net assets of Wills Ltd on that date was represented as follows:

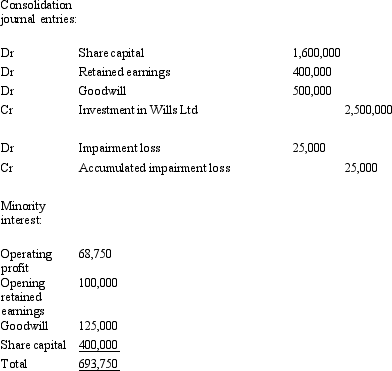

Harry Ltd paid cash consideration of $2,500,000 for Wills. Wills Ltd made an operating profit of $350,000, there were no intragroup transactions during the period ended 30 June 2006. Goodwill had been determined to have been impaired during the year by $25,000. What consolidation journal entries are required for the period and what is the minority interest in equity as at 30 June 2006?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q2: AASB 127 "Consolidated and Separate Financial Statements"

Q3: Minority interests are 'identified' and eliminated as

Q5: Where the parent entity holds less than

Q8: AASB 101 Presentation of Financial Statements requires

Q11: Minority interests are shown as equity: that

Q12: When a subsidiary company that has a

Q13: Minority interests arise when:

A) The parent entity

Q15: AASB 101 "Presentation of Financial Statements" requires

Q16: Minority interests are allocated on a 'line-by-line'

Q19: Using full goodwill method,share of goodwill attributable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents