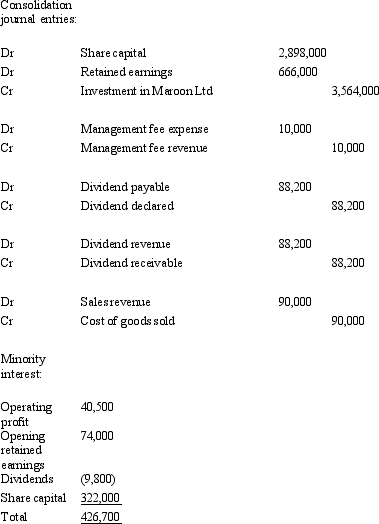

Green Ltd purchased 90 per cent of the issued capital and in the process gained control over Maroon Ltd on 1 July 2005. The fair value of the net assets of Maroon Ltd at purchase was represented by:

Green Ltd paid cash consideration of $3,700,000 for Maroon Ltd. During the period ended 30 June 2007, Maroon Ltd paid management fees of $100,000 to Green Ltd and Maroon had an operating profit of $405,000. Maroon Ltd declared a dividend of $98,000 during the period. Green purchased inventory from Maroon during the period ended 30 June 2007 for $100,000. The inventory cost Maroon Ltd $85,000 and at the end of the period Green had 35 per cent of that inventory still on hand. Maroon's opening retained earnings for the period ended 30 June 2007 was $810,000. Goodwill has been determined to have been impaired by $13,600. Companies in the group use perpetual inventory systems and accrue dividends when they are declared by subsidiaries. There were no other inter-company transactions. Ignore tax implications.

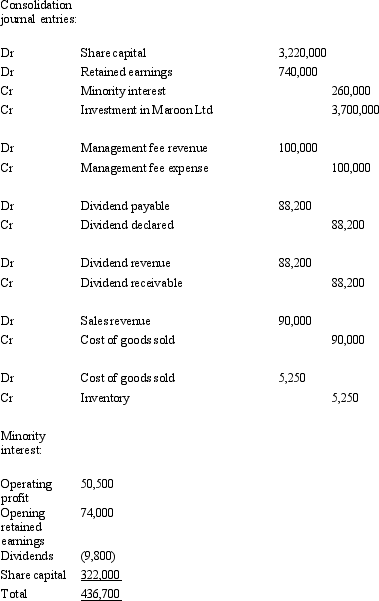

For the period ended 30 June 2007, what consolidation journal entries are required and what is the outside equity interest?

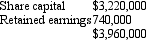

A)

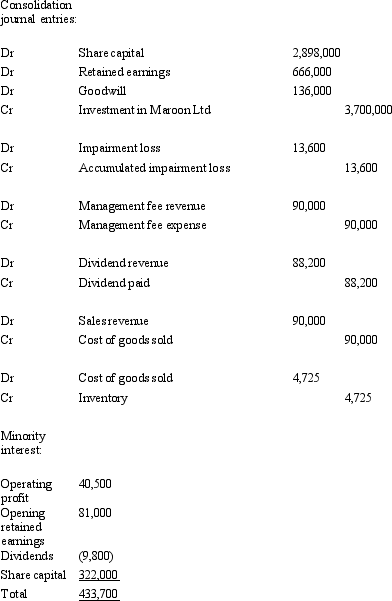

B)

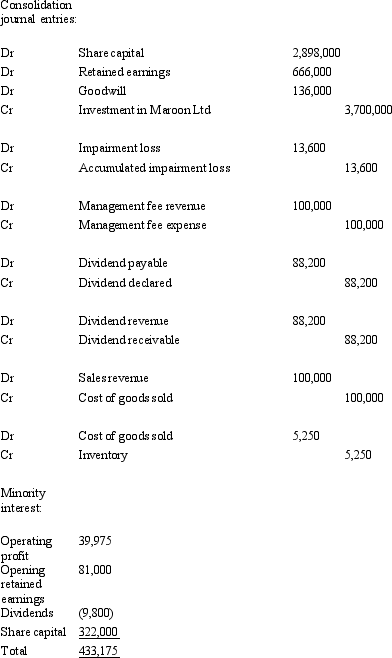

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q21: On 1 July 2012,Han Solo Ltd acquired

Q22: Which of the following is not one

Q23: Which of the following statements is incorrect

Q26: The disclosure of minority interests in thE.(a)income

Q27: Which of the following situations,involving eliminations as

Q30: As prescribed in AASB 127,which of the

Q31: Groucho Ltd purchased 60 per cent of

Q32: There is no adjustment for things such

Q33: Which of the following statements is incorrect

Q34: Calculating the minority interest (MI)in the operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents