Gingimup Ltd purchased all the equity of Kindawansa Ltd on 30 June 2005. At that time the carrying value of the net assets of Kindawansa was $1,200,000. This amount was made up in equity as follows: share capital $1,000,000; retained earnings $200,000. Kindawansa has held some valuable land for a long time (purchased at $ 1,200,000) , but has not revalued it. Its fair value at 30 June 2005 was $2,800,000 (all other non-current assets are recorded at fair value) . Gingimup Ltd paid cash consideration of $3,000,000 for Kindawansa Ltd. Assuming that the land has not been revalued in the controlled entity's books, what are the elimination entries required to reflect the purchase of Kindawansa Ltd?

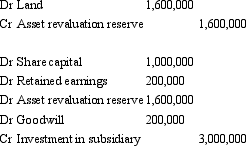

A)

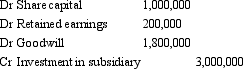

B)

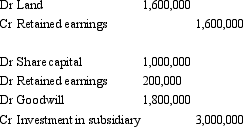

C)

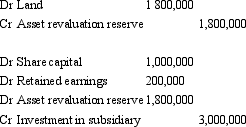

D)

E) None of the given answers.

Correct Answer:

Verified

Q44: The preparation of consolidated financial statements:

A) obviates

Q45: The lack of a direct link between

Q49: After initial recognition,goodwill is measured in which

Q52: A former loophole (now closed)that existed under

Q53: 'Control' exists when the parent owns less

Q55: Sigmund Ltd acquires all the issued capital

Q61: On 1 July 2012, Felix Ltd acquires

Q63: Which of the following statements is not

Q64: On 1 July 2012, Goliath Ltd acquires

Q66: On consolidation,the investment in subsidiary,shown in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents