On 1 July 2012, Felix Ltd acquires all shares in Oscar Ltd for $800 000. The fair value of net assets acquired is $620 000 comprised of $400,000 in share capital and $220 000 in retained earnings. What is the appropriate elimination entry for this investment that is in accordance with AASB 3 "Business Combinations" and AASB 127 "Consolidated and Separate Financial Statements"?

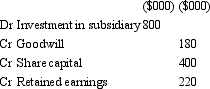

A)

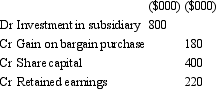

B)

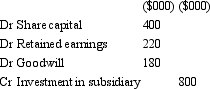

C)

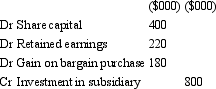

D)

E) None of the given answers.

Correct Answer:

Verified

Q45: The lack of a direct link between

Q49: After initial recognition,goodwill is measured in which

Q52: A former loophole (now closed)that existed under

Q53: 'Control' exists when the parent owns less

Q59: Gingimup Ltd purchased all the equity of

Q63: Which of the following statements is not

Q64: On 1 July 2012, Goliath Ltd acquires

Q64: Which of the following statements about post-acquisition

Q65: On 1 July 2012, Carol Ltd acquires

Q66: On consolidation,the investment in subsidiary,shown in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents