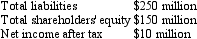

Nogales Ltd is planning to raise $100 million to finance its research and development program in the lucrative biotechnology division of the company. The company's internal forecasts for the year ended 30 June 2009 for selected accounts follow:

There are 10,000,000 ordinary shares on issue. The entity has a debt covenant that debt to equity ratio be kept at less than two.

Three alternatives for funding the projects were considered by the board of directors:

Issue of ordinary shares equivalent to $100 million (equivalent to 5 million ordinary shares)

Issue of 10%, 10-year non-convertible notes

Issue of 6%, preference shares (redeemable on 30 June 2019)

Which of the following statement made by a director is correct with respect to the three funding alternatives?

A) The 10-year non-convertible notes issue will have no dilution effect and no impact on the company's debt covenant.

B) Earnings per share will decline by one third with the issue of ordinary shares.

C) The issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

D) Earnings per share will decline by one third with the issue of ordinary shares and the issue of preference shares will have no dilution effect and no impact on the company's debt covenant.

E) None of the given answers

Correct Answer:

Verified

Q3: Gaslight Ltd has earnings after tax of

Q4: Benjy Ltd has 8,000,000 ordinary shares on

Q7: Cavendish Ltd has 2,000,000 ordinary shares on

Q20: According to AASB 133 the number of

Q25: In order to determine whether or not

Q28: Dormant Ltd has a net income after

Q34: In accordance with AASB 133,which of the

Q38: In relation to Option 1 issued on

Q39: Pilbarra Ltd has a profit after tax

Q43: Sedona Ltd historically makes a profit and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents