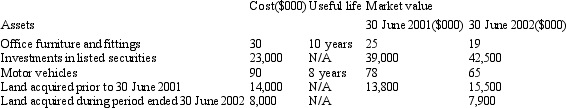

Happy Days Superannuation Plan provides the following information regarding its assets and receipts for the year ended 30 June 2002:

During the period land acquired before 30 June 2001 was sold. The land had a cost of $4 million, a market value at 30 June 2001 of $4.5 million, and was sold for $6 million. What is the revenue of the superannuation plan for the period in accordance with AAS 25?

A) $12,600,000

B) $6,585,750

C) $11,081,000

D) $6,581,000

E) None of the given answers.

Correct Answer:

Verified

Q22: According to AAS 25,superannuation plans must provide

Q25: According to AAS 25,beneficiaries of a defined

Q26: The discount rate that AAS 25 recommends

Q28: A defined benefit plan is one in

Q30: In the case of a defined benefit

Q31: A defined contribution plan is one in

Q33: The measurement of the accrued benefits of

Q34: What is the key distinction between a

Q35: AAS 25's argument in support of its

Q40: How are the accrued benefits of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents