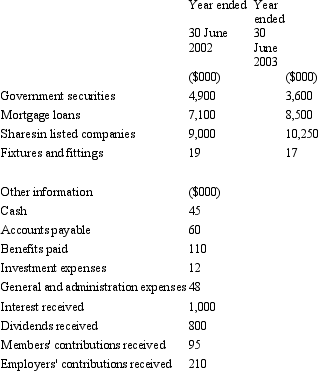

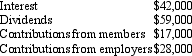

The following information relates to the Montigo Superannuation Plan, which is a defined benefit scheme. Amounts given for all assets are at net market value.

At balance date the scheme is owed from the current period.

During the period shares in listed companies that had a net realisable value of $7 million at the beginning of the period were sold for $8.5 million. Shares were purchased during the period for $3 million.

The fund has not had an actuarial review undertaken as at balance date. What are the net assets available to pay benefits at 30 June 2003?

A) $22,290,000

B) $22,498,000

C) $22,453,000

D) $26,998,000

E) None of the given answers.

Correct Answer:

Verified

Q42: Revenues of superannuation plans include:

A) Investment revenue.

B)

Q45: The accounting treatment for the sale of

Q48: Maestro Superannuation Plan provides the following information

Q48: The assets of a superannuation fund include:

A)

Q49: Which of the following items is not

Q51: Which of the following statement(s)is/are correct?

A) AAS

Q52: AAS 25 requires a defined benefit plan

Q53: For a defined contribution plan to satisfy

Q55: The following information relates to the Old

Q56: The required disclosures for a defined benefit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents