Lesser Ltd is wholly owned by Moore Ltd. In the current year Lesser Ltd has made a tax loss of $200,000 and Moore Ltd has made a profit of $300,000. It is expected that Lesser Ltd will make sufficient profits in the future to utilise the benefits of the tax loss, so Lesser has recorded a deferral for the loss. Moore pays Lesser $10,000 consideration for the transfer of the tax loss. Neither Moore nor Lesser have elected to be part of a tax consolidated group. The taxation rate is 30 per cent. What are the appropriate entries to record the transfer (only) ?

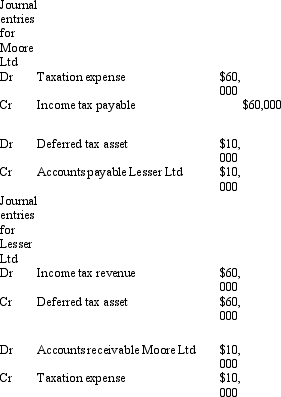

A)

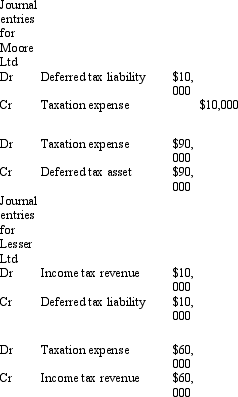

B)

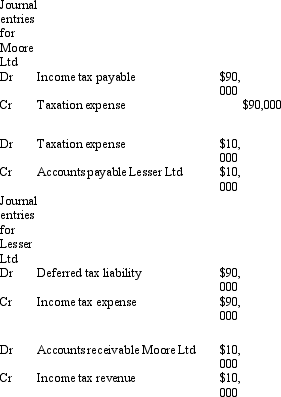

C)

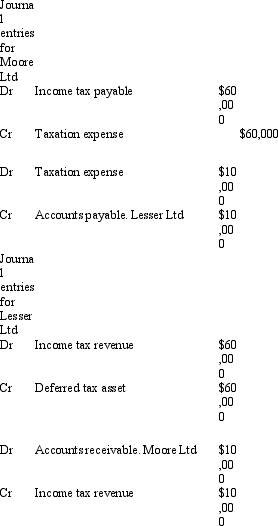

D)

E) None of the given answers.

Correct Answer:

Verified

Q30: The criteria for recognising a deferred tax

Q43: Shopping Malls Ltd has some land it

Q44: As at 30 June 2007, Net Accounts

Q46: The transfer of tax losses to other

Q50: The balance sheet approach adopted in AASB

Q51: Spring Day Ltd has a piece of

Q52: Which of the following statements is not

Q52: Casper Ltd incurred a loss of $500,000

Q53: Bogart Ltd has the following tax balances

Q55: To be a member of a "tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents