Longreach Ltd grants 100 options to each of its 50 employees on 1 July 2009. Each grant is conditional on the employee working for the company for 3 years. The fair value of each option at grant date is $15.

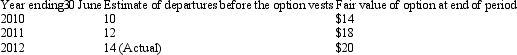

The following information is available:

What is the employee benefits expense of Longreach Ltd related to this share option for the year ended 30 June 2010?

A) $18 667;

B) 20 000;

C) $26 667;

D) $56 000;

E) $60 000

Correct Answer:

Verified

Q46: What is the Employee benefits expense of

Q49: What is the Employee benefits expense of

Q51: On 1 July 2009 Chester Ltd granted

Q52: On 1 July 2009 York Ltd (a

Q53: In accordance with AASB 2,how much Employee

Q55: North Terraces Ltd issued share options to

Q55: What is the journal entry to recognise

Q57: Winton Ltd grants 100 options to each

Q58: What is/are the journal entry/ies to recognise

Q59: What action must Wigan Ltd take that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents