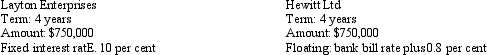

Layton Enterprises and Hewitt Ltd agree to swap their loans. The terms of the loans are:

Under the swap agreement Layton will make floating rate payments to Hewitt Ltd at the bank bill rate plus 0.8 per cent and Hewitt will make fixed rate payments to Layton Enterprises at 12 per cent.

Layton Enterprises' alternative to the fixed interest loan was to pay the bank bill rate (a floating rate). Hewitt's alternative was to pay a fixed interest rate of 13.5 per cent.

Is each company better off under the swap agreement than if it had taken up the alternatives offered by the bank? What is the net difference in the interest rate paid under the swap and the alternative for each company?

A. Layton Enterprises is better off but Hewitt Ltd may not be. Layton pays 2 per cent less but Hewitt Ltd's position will depend on the level of the bank bill rate in each period.

B. Each company is better off. Layton Enterprises pays 1.2 per cent less and Hewitt Ltd pays 1.5 per cent less.

C. Hewitt Ltd is better off but Layton Enterprises may not be. Hewitt Ltd pays 0.2 per cent less and Layton Enterprises' position will depend on the level of the bank bill rate in each period.

D. Each company's position will depend on the level of bank bill rate in each period. In entering the agreement they are anticipating that it will not go over 13.5 per cent.

E. None of the given answers.

Correct Answer:

Verified

Q44: The classification of a preference share as

Q52: A convertible note may be accurately described

Q57: For a financial instrument to be classified

Q59: Two companies enter into loan agreements on

Q59: What is the appropriate accounting treatment for

Q61: Which of the following items is not

Q62: On 31 October 2012 Gordon Investment Ltd

Q64: Identify which of the following financial instruments

Q65: Documentation that constitutes a financial instrument as

Q69: The risks arising from financial instruments are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents