Major Ltd has a weekly payroll of $30,000. Its employees work a 5-day week (Monday to Friday) and are paid on Thursdays in arrears (i.e., for the five days up to, and including, the Thursday) . Pay-as-you-go tax on the weekly payroll is $10,000 and this is paid to the Australian Tax Office on the following Monday. Deductions of $1,000 are also made on behalf of employees to pay into a medical benefits fund. The year ended 30 June 2004 falls on a Wednesday. What is the accounting entry to record accrued salaries and wages for this period?

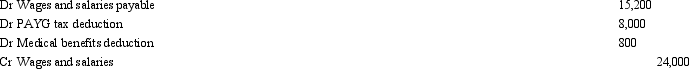

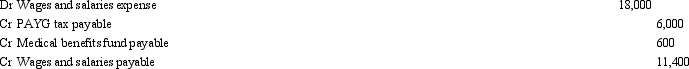

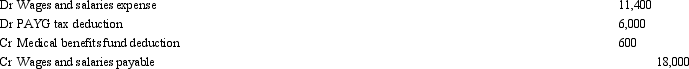

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q5: In a defined contribution plan,the employer effectively

Q11: Any employee benefits that have been earned

Q16: When determining accounting entries to be made

Q19: Non-vesting sick leave that has accumulated will

Q23: Danish Ltd has an average weekly payroll

Q25: Kerry Gill works for Kentucky Enterprises for

Q26: What discount rate does AASB 119 require

Q31: Short-term employee benefits are defined in AASB

Q33: According to the former Australian guidance section

Q34: 'On-costs' can be described as:

A) The additional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents