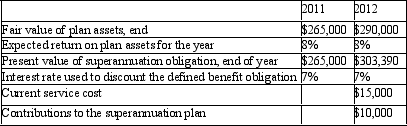

Whitsunday Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement. The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:

In accordance with AASB 119 "Employee Benefits", what is the expected return and actuarial gain (loss) for the plan assets for the year ending 2012, respectively?

A) $21 200; $6 200

B) $21 200; ($6 200)

C) $23 200; $8 200

D) $23 200; ($8 200)

E) None of the given answers

Correct Answer:

Verified

Q50: A non-contributory superannuation fund means:

A) No contributions

Q53: Junior Ltd employs three workers to develop

Q56: Junior Ltd employs three workers to develop

Q60: The following journal entry shows: Q61: Great Keppel Ltd provides defined superannuation benefits Q63: Annette French joined Paris Ltd on 1 Q65: Which of the following is ?not considered Q66: Entity A contributes to a defined benefit Q67: Entity A contributes to a defined benefit Q67: Mackay Ltd provides defined superannuation benefits to![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents